Step 1: What is Correlation

- A positive correlation means, when stock x goes up, we expect stock y to go up, and opposite.

- A negative correlation means, when stock x goes up, we expect stock y to go down, and opposite.

- A zero correlation, we cannot say anything in relation to each other.

How to calculate correlation between stocks?

Step 1: What is Correlation

- A positive correlation means, when stock x goes up, we expect stock y to go up, and opposite.

- A negative correlation means, when stock x goes up, we expect stock y to go down, and opposite.

- A zero correlation, we cannot say anything in relation to each other.

How do you calculate the correlation between two stocks?

- Obtain a data sample with the values of x-variable and y-variable.

- Calculate the means (averages) x̅ for the x-variable and ȳ for the y-variable.

- For the x-variable, subtract the mean from each value of the x-variable (let’s call this new variable “a”). ...

How to find the correlation of two stocks?

Correlation Formula

- Examples of Correlation Formula (With Excel Template) Let’s take an example to understand the calculation of Correlation formula in a better manner. ...

- Explanation. Correlation is used in the measure of the standard deviation. ...

- Relevance and Uses of Correlation. ...

- Correlation Formula Calculator

- Recommended Articles. ...

How to calculate stock correlation coefficient?

The options in the dialogue box are pretty easy to understand:

- ‘Input’: Contains all the options related to the input

- ‘Input Range’: The cell ranges with the data values on it including the labels in the first row

- ‘Grouped By’: Choose if the values are grouped in columns or in rows

- ‘Labels in First Row’: Check this if you included the labels in the first row on the ‘Input Range’

How do you find the correlation of a stock?

To find the correlation between two stocks, you'll start by finding the average price for each one. Choose a time period, then add up each stock's daily price for that time period and divide by the number of days in the period. That's the average price. Next, you'll calculate a daily deviation for each stock.

What is a high stock correlation?

Correlation is the degree to which the prices of different assets move together. If the prices move in a similar proportion and in the same direction, they have a high correlation. If they move in opposite directions, they have a high negative correlation.

What is good correlation stock?

A correlation coefficient of 1 indicates a perfect positive correlation between the prices of two stocks, meaning the stocks always move in the same direction by the same amount.

Are stock markets correlated?

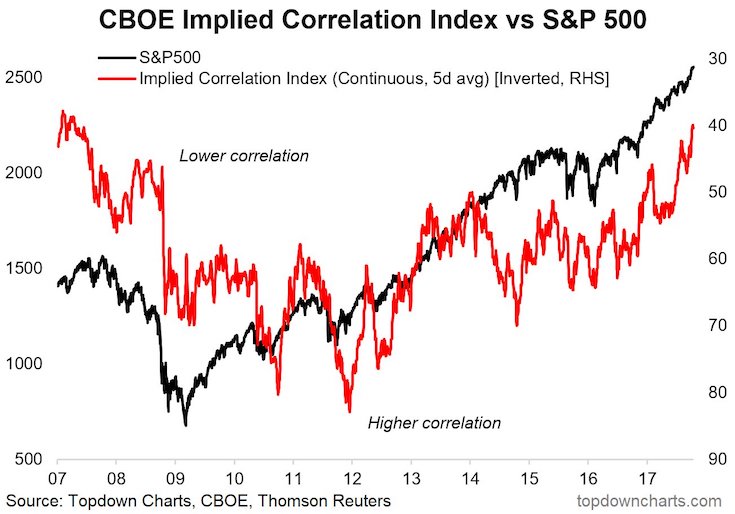

CORRELATION OF STOCK MARKETS The correlations are surprisingly low, but equally important, are currently not at a peak level. We observe a moderate but steady increase in the correlation of international to US stock markets from the 1990s to the global financial crisis in 2008, but no significant changes thereafter.

What is price correlation?

In investing, correlation is a measure that indicates the degree to which the prices of two assets move together relative to their means. The correlation between two stocks is 1.0 when the prices of the two stocks move completely in tandem to their average prices.

Why is correlation between stocks important?

Correlation can be used to gain perspective on the overall nature of the larger market or to measure the amount of diversification among the assets in a portfolio. Choosing assets with low correlation with each other can help to reduce the risk of a portfolio.

Does high correlation mean high risk?

Quite simply, using correlation information is a way to help you diversify and de-risk your portfolio. A highly correlated portfolio is a riskier portfolio. It means that when one of your stocks falls, it's likely that all of them will fall by a similar amount.

What should correlation be in a portfolio?

A correlation of 1.00 indicates perfect correlation, while lower numbers indicate that the asset classes are not correlated and generally do not move in tandem with each other—or, when the market moves down, these asset classes may not fall as much as the market in general, which could mitigate risk in your portfolio.

What is negatively correlated to stocks?

A negative correlation is observed when one variable moves in the opposite direction as another. In investing, owning negatively correlated securities ensures that losses are limited as when prices fall in one asset, they will rise to some degree in another.

How do you read a stock correlation matrix?

How to Read a Correlation Matrix-1 indicates a perfectly negative linear correlation between two variables.0 indicates no linear correlation between two variables.1 indicates a perfectly positive linear correlation between two variables.

Which stock sectors are negatively correlated?

Some sectors that are negatively correlated with the oil sector are aerospace, airlines, and casino gaming. The portfolio manager may look to sell a portion of his investments in the oil sector and buy stocks that are associated with the negatively correlated sectors.

Is positive correlation risky?

A positive correlation exists between risk and return: the greater the risk, the higher the potential for profit or loss. Using the risk-reward tradeoff principle, low levels of uncertainty (risk) are associated with low returns and high levels of uncertainty with high returns.

How do you read a stock correlation matrix?

How to Read a Correlation Matrix-1 indicates a perfectly negative linear correlation between two variables.0 indicates no linear correlation between two variables.1 indicates a perfectly positive linear correlation between two variables.

What is negatively correlated to S&P 500?

Wine, gold, crude oil, and platinum all were moderately correlated with the S&P 500. Bonds and fine art were shown to be negatively correlated to the S&P 500.

Does positive correlation reduce risk?

Including securities that are not perfectly positively correlated with each other will reduce the SD of the portfolio. The lower the correlations between two returns of assets in the portfolio, the lower the portfolio risk, and thus the higher the diversification benefits and vice versa.

Why do we use stock correlation?

Using stock correlation can help you determine the amount of risk you might be taking on and balance those risks.

What is correlation in portfolio management?

Correlation is used in portfolio management as a tool to measure the amount of correlation that exists between the assets in the portfolio.

What Are the Five Types of Correlation?

Correlation refers to the method of determining the relationship between two variables. There are multiple methods of determining the correlation between those variables.

What does it mean when a coefficient is closer to a negative?

A coefficient closer to a negative one indicates a negative correlation between the securities, with the increase in one stock tying to the other stock’s decrease. There are three types of correlation related to our interests: Positive correlation – when the equity value of one security increases with respect to the other security.

What does it mean when a stock is close to zero?

A stock correlation closer to zero, either positive or negative, implies little or no correlation between them . The coefficients move closer to a positive one, the closer the correlation to the securities.

What is correlation in statistics?

Correlation, in statistics, shows the strength of the relationship between two variables. And the correlation is expressed as a statistical coefficient.

Which portfolio will perform better over time?

According to the theory, a portfolio full of assets that have less correlation to each other will perform better over time.

What does it mean when a stock has a correlation of -1?

A correlation of -1 is a "perfect" negative correlation, meaning that when one stock goes up five points, the other loses five points.

Why is correlation important in the stock market?

Correlation, by itself, cannot affect the stock market because it is simply the degree to which two things behave in the same way. However, the correlation between the activity of two stocks, or between a stock and the performance of a given index, sector or industry, can be a very important factor in developing a prudent investing strategy.

How and Why Do Stocks Correlate?

This is because the businesses have very different operations, and the products and services of the auto shop are not things that can be provided virtually.

What is the correlation coefficient used to predict a stock's performance?

Stock analysts use a measure called the correlation coefficient to make predictions about how a stock will behave based on past performance and the activity of another security with which the stock in question has been shown to correlate.

What is the correlation coefficient of a stock?

The correlation coefficient is used to measure both the degree and direction of the correlation between any two stocks. It can be anywhere between -1 and 1, though it is almost always in between. Any two securities that have a coefficient of 1 are said to be "perfectly" correlated. This means when one stock moves up five points, the other does exactly the same thing, at the same time. A correlation of -1 is a "perfect" negative correlation, meaning that when one stock goes up five points, the other loses five points. This kind of behavior is incredibly rare in the stock market, so perfect correlations are almost entirely theoretical.

Does Investopedia include all offers?

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

What is the correlation between stocks?

The correlation of stocks is bounded between and , meaning we have a definitive range for the relationship between any two securities.

How to calculate stock correlation?

We can calculate stock correlation by scaling the covariance by the product of the standard deviations.

What is the measure of the covariance of two variables?

The covariance is a fundamental measure of the relationship – or strictly, the co- variability – of 2 variables.

What happens if the correlation is zero?

Finally, if the correlation is equal to zero, then we can say that the securities are completely uncorrelated; or perfectly uncorrelated.

What is correlation coefficient?

Fundamentally, the correlation (aka correlation coefficient, Pearson Correlation Coefficient) is just an alternative measure of the relationship between securities.

What is the biggest limitation of covariance?

Perhaps the biggest limitation of the covariance is the fact that it’s really hard to interpret.

Is the correlation between stocks and securities negative?

If on the other hand, the correlation of stocks between the two securities is equal to , then we say that the stocks are perfectly negatively correlated.