How to calculate dividend yield on cost of stock?

You just divide the annual dividends paid per share by the price per share. Yield on cost is more complicated and it changes in time. It simply means dividing current dividend yield by the original price you bought stock for and not by the current price. Even low-yield stock can become the high-yielding stock in a few years.

Is there a stock return calculator for dividends?

Below is a stock return calculator which automatically factors and calculates dividend reinvestment (DRIP). Additionally, you can simulate daily, weekly, monthly, or annual periodic investments into any stock and see your total estimated portfolio value on every date. There are over 5,000 American stocks in the database.

How does this stock price calculator work?

This stock price calculator approximates an acceptable purchase price of a stock by considering dividends per share, your desired rate of return and a stock growth rate. There is in depth information on this topic below the tool.

How does reinvesting dividends work in calculator?

If you enable reinvesting option in the calculator, we will automatically reinvest dividends from purchased stocks to buy a new one. During this simulation, our algorithm will rebalance the portfolio to keep original diversification for the whole investing period. How calculate dividend increases?

How do you find the non constant growth dividend?

17:5924:53Non-Constant Growth Dividends | EXAMPLES - YouTubeYouTubeStart of suggested clipEnd of suggested clipOkay so with a formula here's our formula again p 0 equals 2t 1 divided by K a minus G and do youMoreOkay so with a formula here's our formula again p 0 equals 2t 1 divided by K a minus G and do you want we get it by taking D 0. Times 1 plus G.

How do you calculate current stock price with dividend?

That formula is:Rate of Return = (Dividend Payment / Stock Price) + Dividend Growth Rate.($1.56/45) + .05 = .0846, or 8.46%Stock value = Dividend per share / (Required Rate of Return – Dividend Growth Rate)$1.56 / (0.0846 – 0.05) = $45.$1.56 / (0.10 – 0.05) = $31.20.

How do you calculate stock growth with dividend reinvestment?

The total value with dividend reinvestment equals the final stock price multiplied by the sum of the initial number of shares plus all dividend reinvestment shares. The number of shares is the initial number of shares plus all the shares purchased with reinvested dividends.

What three models are used to value stocks based on different dividend patterns?

Stock valuation based on the dividend discount model typically takes one of three forms depending on what pattern we expect the dividends to follow. These three model variations are (1) the no-growth case, (2) the constant-growth case, and (3) the non-constant-growth (or supernormal-growth) case.

What is the formula for calculating current stock price?

Use a simple formula to determine the present value of the stock price. The formula is D+E/(1+R)^Y where D is any dividends expected to be paid during the period, E is the expected stock price, Y is the number of years down the line, and R is the real rate of return you estimated.

How do you calculate the actual value of a stock?

The most common way to value a stock is to compute the company's price-to-earnings (P/E) ratio. The P/E ratio equals the company's stock price divided by its most recently reported earnings per share (EPS). A low P/E ratio implies that an investor buying the stock is receiving an attractive amount of value.

Does Warren Buffett reinvest dividends?

While Berkshire Hathaway itself does not pay a dividend because it prefers to reinvest all of its earnings for growth, Warren Buffett has certainly not been shy about owning shares of dividend-paying stocks.

Can you live off dividends?

Over time, the cash flow generated by those dividend payments can supplement your Social Security and pension income. Perhaps, it can even provide all the money you need to maintain your preretirement lifestyle. It is possible to live off dividends if you do a little planning.

Is it better to reinvest dividends?

The primary reason to reinvest your dividends is that doing so allows you to buy more shares and build wealth over time. If you examine your returns 10 or 20 years later, reinvesting is more likely to increase the value of your investment than simply taking the cash.

What are the 5 methods of valuation?

There are five main methods used when conducting a property evaluation; the comparison, profits, residual, contractors and that of the investment. A property valuer can use one of more of these methods when calculating the market or rental value of a property.

Which method is best for valuation of shares?

Following are generally accepted methodologies for valuation of shares / business:Net Asset Method.Discounted Cash Flow Method.Earnings Capitalisation Method.EV/EBIDTA Multiple Method.Comparable Transaction Method.Market Price Method.

How do you value stocks not paying dividends with negative earnings?

The P/E Ratio The price-to-earnings ratio or P/E ratio is a popular metric for valuing stocks that works even when they have no dividends. Regardless of dividends, a company with high earnings and a low price will have a low P/E ratio. Value investors see such stocks as undervalued.

What is the share price after the dividend is paid?

After the declaration of a stock dividend, the stock's price often increases. However, because a stock dividend increases the number of shares outstanding while the value of the company remains stable, it dilutes the book value per common share, and the stock price is reduced accordingly.

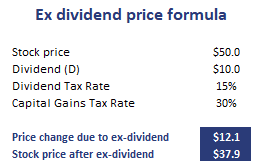

What happens to stock price on dividend pay date?

Stock market specialists will mark down the price of a stock on its ex-dividend date by the amount of the dividend. For example, if a stock trades at $50 per share and pays out a $0.25 quarterly dividend, the stock will be marked down to open at $49.75 per share.

How does this stock price calculator work?

This investment calculator can help in estimating an acceptable purchase price of a stock by taking account of the following variables:

Example of a calculation

Let’s assume an individual analyses the posibility to buy a stock that within the last period paid an average dividend of $15/share, while the stock growth rate is considered to increase by an average of 5% year per year, and the expected rate of return is 10%. What will the results be if 1,000 shares will be purchased?

What is dividend in stocks?

A dividend is a portion of a company’s profit that is paid back to shareholders. In most cases, companies that issue a dividend are financially stable. Many of these companies are in mature industries and have stable, predictable revenue and earnings. Utility stocks and consumer discretionary stocks are good examples of companies ...

What does it mean when a company projects a dividend increase?

If the company is expecting growth in earnings and revenue, they may project a dividend increase. If the company is expecting slowing and/or declining earnings and revenue, they may project keeping the dividend the same.

What is the dividend yield of Company B?

However, Company B was able to increase its annual dividend from $1.50 to $1.75. Now its dividend yield is 3.5%. This means investors will have to look at other factors to decide which company’s stock is better to own. For example, maybe analysts are projecting that Company A will raise its dividend later in the year.

Why is dividend yield a trap?

A dividend yield trap occurs when the stock of a company falls faster than its earnings. This will make its yield look more attractive than it really is. Here’s why it’s a trap. Let’s say you buy the stock at its low price and then the company cuts its dividend. Now, investors may start to sell off even more, lowering the share price which means you’ve lost capital growth and are looking at a lower yield.

What is dividend payout ratio?

The payout ratio is the amount of a company’s net income that goes towards dividends.

How often do companies pay dividends?

Companies typically pay dividends quarterly (i.e. four times per year) or annually (once a year). When a company delivers its earnings report to shareholders, it usually provides guidance about the direction of the dividend. If the company is expecting growth in earnings and revenue, they may project a dividend increase.

Can dividend stocks grow in a bull market?

However, although dividend stocks are traditionally lumped into the “value” category, many of these companies can generate significant capital growth, particularly in a bull market. One of the distinctions, however, is the ability of these companies to pay a dividend in a bear market.

What is dividend discount model?

The dividend discount model valuation calculator allows customization with a few advanced options. It uses Dividends per Share to run valuations and allows you to change options around perpetual modelling.

Is dividend discount more real than cash flow?

Working off the theory that stock value is based on the sum of future cash flows, there is no cash flow more real than dividends.

How to use the calculator

The calculator comes with prefilled input parameters. Change the parameters to see the calculated results. After changing a parameter, the results are automatically calculated.

Assumptions

Contributions are done at the beginning on each period (month, quarter etc.).

What is DRIP

According to Investopedia, The word "DRIP" is an acronym for dividend reinvestment plan, but DRIP also happens to describe the way the plan works. With DRIPs, the cash dividends that an investor receives from a company are reinvested to purchase more stock, making the investment in the company grow little by little.

What is preferred equity?

Preferred equity will usually pay the stockholder a fixed dividend, unlike common shares. If you take this payment and find the present value of the perpetuity, you will find the implied value of the stock.

Why is supernormal growth so difficult?

Calculations using the supernormal growth model are difficult because of the assumptions involved, such as the required rate of return, growth or length of higher returns. If this is off it could drastically change the value of the shares. In most cases, such as tests or homework, these numbers will be given. But in the real world, we are left to calculate and estimate each of the metrics and evaluate the current asking price for shares. Supernormal growth is based on a simple idea, but can even give veteran investors trouble.

Can you use a constant growth rate?

Sometimes when you're presented with a growth company, you can't use a constant growth rate. In these cases, you need to know how to calculate value through both the company's early, high growth years, and its later, lower constant growth years. It can mean the difference between getting the right value or losing your shirt .