Which president had the best stock market performance?

Overall, President Bill Clinton had the best stock market performance based on the S&P 500 and the Dow Jones Industrial Average (DHIA). The DJIA increased 15.94% under President Clinton, and the S&P 500 increased 15.18%. President Barack Obama had the second-best performance.

Does the stock market perform better under a different president?

Although volatility is often heightened during an election year, historically, returns tend to be higher as well. And over the long-term, the stock market has performed well under all types of presidential administrations.

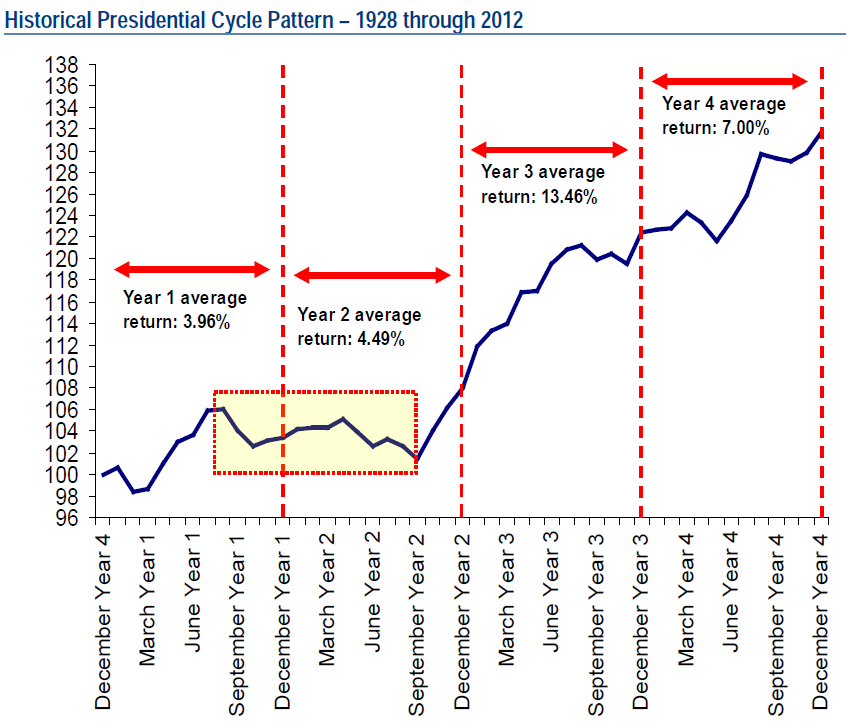

What happens to the stock market in a President’s third year?

The equity party continues well into a president’s third year in office when there’s a push to stimulate the economy ahead of the next election. It’s no coincidence that the best market returns come during that period; the S&P 500 rises an average 16% in that third year.

What does a presidential election mean for the stock market?

A presidential election means the possibility for significant change. Historically, Republicans have valued lower taxes and less regulation (both of which the market likes), but as evidenced in earlier charts, that doesn’t necessarily translate to higher returns during an administration.

Does the President affect stock market?

But over the past century, the stock market has mostly run briskly across most of the presidential cycle before losing momentum during election years. Since 1930, the Dow Jones Industrial Average has gained an average of 10.0% in a president's first year and 7.9% in the second, according to YCharts data.

Is the US stock market rigged?

So investors rightfully wonder whether the stock market is rigged. Technically, the answer is of course, no, the stock market is not rigged but there are some real disadvantages that you will need to overcome to be successful small investors.

Who will control the stock market?

The Securities and Exchange Board of India (SEBI) is the regulatory authority established under the SEBI Act 1992 and is the principal regulator for Stock Exchanges in India.

Can the President own stocks?

Responding to a growing controversy over investing practices, the Federal Reserve on Thursday announced a ban on officials owning individual stocks and limits on other activities as well. The ban includes top policymakers such as those who sit on the Federal Open Market Committee, along with senior staff.

How the big players manipulate the stock market?

Market manipulation schemes use social media, telemarketing, high-speed trading, and other tactics to intentionally drive a stock price dramatically up or down. The manipulators then profit from the price movement.

Why do CEOS buy their own stock?

Insiders sell for all kinds of reasons. They might want to diversify their holdings, distribute stock to investors, pay for a divorce or take a well-earned trip. Another big problem with using insider data on specific companies is that executives sometimes misread company prospects.

Is someone controlling the stock market?

The stock market is regulated by the U.S. Securities and Exchange Commission, and the SEC's mission is to “protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation."

When should you sell a stock?

Investors might sell a stock if it's determined that other opportunities can earn a greater return. If an investor holds onto an underperforming stock or is lagging the overall market, it may be time to sell that stock and put the money to work in another investment.

Should I invest in the stock market?

So, if you're asking yourself if now is a good time to buy stocks, advisors say the answer is simple, no matter what's happening in the markets: Yes, as long as you're planning to invest for the long-term, are starting with small amounts invested through dollar-cost averaging and you're investing in highly diversified ...

Can the government take your stocks?

Your assets can also be garnished if you are sued and a judgment is rendered against you and you do not pay the judgment. The government can also garnish assets if you owe back taxes or child support payments.

Do presidents get paid for life?

Former presidents receive a pension equal to the salary of a Cabinet secretary (Executive Level I); as of 2020, it is $219,200 per year. The pension begins immediately after a president's departure from office.

What stocks does Warren Buffett Own?

Top stock holdings in Buffett's portfolioApple (AAPL) – $159.1 billion.Bank of America (BAC) – $42.6 billion.American Express (AXP) – $28.4 billion.Chevron (CVX) – $25.9 billion.

What are some examples of factors that affect stock market performance?

For example, the September 11th terrorist attacks and the 2008 Great Financial Crisis occurred under President G.W. Bush. President Obama’s term, starting in 2009, ...

What was the S&P 500 down in 2000?

Between the election on November 7th, 2000 and end of the month, the S&P 500 was down about -8% and the NASDAQ -24%.

When did Obama start his term?

President Obama’s term, starting in 2009, began when stock market valuations were near the bottom and as is well documented now, the stock market went on to its longest bull market in history.

Is the stock market the only game in town?

The U.S. stock market isn’t the only game in town. In fact, the United States is roughly half of the global stock market. Investors who understand the value of diversifying in different asset classes may want to know the stock market performance by president for international developed markets, too.

Does the President control the bond market?

Since 1977, no president has had negative annualized fixed income returns over the course of their administration. Just like the stock market, the president does not control the bond market, either. Monetary policy, interest rates, and inflation are key factors in driving bond returns.

Is the stock market an economy?

The stock market is not the economy. Like the current climate, the performance of the stock market isn’t always aligned with broad economic conditions. And it’s important to note, the President of the United States and their political affiliation doesn’t make – or break – either.

How does the stock market react to elections?

In the past, the election season has meant volatility for the stock market. This is true in the months leading up to a presidential election, during the election itself, and the months following the election.

How did the market react to the 2016 election?

Before the results came in, stock market analysts predicted that a Trump victory in the 2016 election would make the stock market plummet and ultimately lead to an economic recession. While the S&P 500 did fall a staggering five percent in pre-market trading on election night, it recovered quickly and so did the rest of the market.

Stock market futures and the election

Based on the markets' performance, Wall Street claims a Biden win for the 2020 presidential election. The last week of October saw the most volatility since March when the COVID-19 pandemic bludgeoned the market. However, the numbers are up in the morning on Monday, Nov. 2.

Recent Election Examples

- Recent history has particularly challenged these patterns. During the presidencies of Barack Obama and Donald Trump, these stock market theories did not hold up. In each of Obama's terms, the first two years were more profitable than the third. For Trump, the first year was more profita…

Numerous Factors Affect The Market

- The problem with investing based on such data patterns is that it’s not a sound way to make investment decisions. It sounds exciting, and it fulfills a belief that many people have that there's a way to “beat the market." But there's no guarantee. There are too many other forces at work that affect market conditions. Furthermore, the underlying assumptions informing these theories mig…

Frequently Asked Questions

- The Balance does not provide tax or investment advice or financial services. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible los…