How to Look at Financial Statements to Invest in Stocks

- Balance Sheet. The balance sheet summarizes a company's assets, liabilities and shareholders' equity, which is the...

- Income Statement. The two key lines on an income statement are the top and bottom lines. The top line is the revenue and...

- Statement of Cash Flows. The statement of cash flows summarizes the cash...

How to read financial statements for beginners?

What to Look for on the Balance Sheet

- Assets. The assets section covers all economic resources owned by a company. ...

- Liabilities. The liabilities section summarizes all of the financial obligations a company has to outside parties.

- Shareholders’ Equity. The shareholders’ equity section represents the total value of the company that is available to shareholders after all debts have been paid.

Why do shareholders need financial statements?

Why Do Shareholders Need Financial Statements?

- Understanding the Need for Financial Statements. Financial statements are the financial records that show a company’s business activity and financial performance.

- Profitability Ratios. ...

- Liquidity Ratios. ...

- Debt Ratios. ...

- Efficiency Ratios. ...

- The Bottom Line. ...

How to analyze financial statements with example?

With examples

- Profit and Loss Statement. Every business either manufactures a product or provides a service. ...

- Balance Sheet. To understand what a balance sheet is, let’s think of a company that manufactures automobiles. ...

- Assets = Liabilities + Shareholders’ Equity. ...

- Cash Flow Statement. ...

- Cash Flow = Net Profit + Non-Cash Expenses. ...

- The Author. ...

How to interpret a financial statement?

Look at the cash flow statement.

- Read about the operating activities first. This section analyzes how the company's cash was used in order to reach its net profit or loss.

- Check the investment activities. This part of the cash flow statement shows any income from investments or assets that were sold.

- Look at the financing activities. ...

What financial statements should I look for when buying stocks?

What Investors Want to See in Financial StatementsNet Profit. Financial statements will reveal a company's net profit, The net profit is the money that a business has left over after paying all expenses. ... Sales. ... Margins. ... Cash Flow. ... Customer Acquisition Cost. ... Customer Churn Rates. ... Debt. ... Accounts Receivable Turnover.More items...•

How do you read financial statements like Warren Buffett?

Warren's rule of thumb:If the net earnings demonstrate a consistently upward trend on a long-term scale, then the company is worth investing.A company with a net earning of more than 20% on total revenues has long-term competitive advantage.The more a company earns per share, the higher its stock price is.

How do you read financials for beginners?

3:4911:07How To Read And Understand Financial Statements As A Small ...YouTubeStart of suggested clipEnd of suggested clipIt has six main sections revenue cost of revenue gross profit which is revenue minus cost of revenueMoreIt has six main sections revenue cost of revenue gross profit which is revenue minus cost of revenue operating expenses operating income or loss taxes and other non-operating expenses. And net income.

Does Warren Buffett read balance sheet?

As with the income statement, Buffett can learn a lot about a company's durable competitive advantage, or moat, by studying its balance sheet.

How does Warren Buffett evaluate stocks?

Buffett uses the average rate of return on equity and average retention ratio (1 - average payout ratio) to calculate the sustainable growth rate [ ROE * ( 1 - payout ratio)]. The sustainable growth rate is used to calculate the book value per share in year 10 [BVPS ((1 + sustainable growth rate )^10)].

Which financial statement is most important to investors?

income statementA company's income statement is the most important financial statement to provide when applying for funding because it reveals whether your business can generate profits.

What do investors look for in annual reports?

Look for companies with positive trends in sales, costs, earnings and cash flow. Warning signs include a high proportion of liabilities to assets, shrinking profit margins and declining cash balances.

What are the three financial statements?

There are three main financial statements investors should be aware of: the income statement, the balance sheet, and the cash flow statement. In this article, we'll look at what each one is and the key information investors should pay attention to.

What is an income statement?

An income statement starts with the company's sales and shows step by step how it turns them into profit. It's also worth mentioning that there are typically several columns of numbers on an income statement to show how the current period compares to the same period last year.

What are the sections of a balance sheet?

There are three sections on a balance sheet: 1 Assets: What the company owns. This is further broken down into current and noncurrent assets. Current assets include liquid assets and assets that can be expected to become liquid within a year. Examples include cash, short-term Treasuries, accounts receivable, and inventory. Noncurrent assets include long-term investments, real estate, and equipment used in manufacturing, just to name a few. 2 Liabilities: What the company owes. These are also divided into current and noncurrent. Current liabilities include payments a company will have to make within a year, such as accounts payable and short-term debt. Noncurrent liabilities include things like long-term debts. 3 Shareholder's equity: Think of shareholder's equity as what the company would have if it shut down, sold all of its assets, and paid all of its debts. Shareholder’s equity is the difference between assets and liabilities and is the company's net worth.

What is the bottom line of a publicly traded company?

The bottom line is that for all publicly traded companies listed on major U.S. exchanges, financial statements are full of information, updated quarterly, and readily available to help investors like you make informed decisions.

What does a positive number mean in a cash flow?

A positive number indicates that the company's cash increased during the period, while a negative number shows that the cash decreased. Just under the cash flow number will be a total of the cash and cash equivalents the company currently has. Learn which investments can help grow your money over time.

What are current assets?

Current assets include liquid assets and assets that can be expected to become liquid within a year. Examples include cash, short-term Treasuries, accounts receivable, and inventory. Noncurrent assets include long-term investments, real estate, and equipment used in manufacturing, just to name a few. Liabilities: What the company owes.

What is balance sheet?

Balance sheet. A balance sheet gives you a snapshot of a company's financial condition at a given time (typically the end of a quarter). And as with the income statement, the data is typically presented as a comparison between the current period and the same time a year prior. There are three sections on a balance sheet:

What to look for in an annual report?

Key Things to Look at in an Annual Report When It Comes to Investing. Financial statements include the income statement, balance sheet and statement of cash flow. They contain current and prior-period results, as well as supplementary notes and management's analysis of current and future business conditions.

What are the two key lines on an income statement?

Income Statement. The two key lines on an income statement are the top and bottom lines. The top line is the revenue and the bottom line is the net income. You subtract cost of goods sold, administrative, marketing and other expenses from revenue to calculate net income.

What is balance sheet?

Balance Sheet. The balance sheet summarizes a company's assets, liabilities and shareholders' equity, which is the difference between assets and liabilities. Determine if short-term liquid assets, such as cash and accounts receivables, are sufficient to cover current liabilities, such as bills payable and short-term loans.

What is the entry point of a stock?

A possible entry point for a stock is when its PE ratio is at or below the industry or market average. Some companies distribute part of their profits as dividends to shareholders. The stocks of these companies are attractive investments because investors receive regular income and participate in capital gains.

Why read management discussion and analysis?

Read the section titled "management discussion and analysis" in quarterly and annual reports because it contains detailed explanation of the recent results and expectations for the future. Review the reasons cited for changes in quarterly and annual results. For example, a company's revenues might fall short of expectations because some of its customers have delayed placing orders. This would not necessarily be a cause for concern. However, if the company is about to lose a major customer to a competitor, that could mean declining revenues and profits for the near future.

Why do companies fall short of expectations?

For example, a company's revenues might fall short of expectations because some of its customers have delayed placing orders. This would not necessarily be a cause for concern. However, if the company is about to lose a major customer to a competitor, that could mean declining revenues and profits for the near future.

Where are financial statements found?

Financial statements are assembled by a company’s accounting and/or finance department. Each transaction throughout the month is recorded in the company’s accounting books, which makes creating such reports possible. Financial statements are typically found in one of the following three intervals: Monthly. Quarterly.

Why do companies use financial statements?

Financial statements are the lifeblood of a company. External investors use financial statements to determine the financial position of a company before making their investments. The internal management team of a company will use the financial statements to benchmark performance, set goals, and create accountability and action plans ...

What is the balance sheet of a company?

Balance Sheets. If you ever want to see what a company owns (also known as assets), or what the company owes (also known as liabilities), you’ll need to view the company’s balance sheet. The balance sheet will cover assets, liabilities, and shareholders equity. There are many important financial metrics and ratios one will pull from ...

What is the difference between income statement and balance sheet?

The income statement – highlights how much income and profit a company generated for a specific period of time . The income statement is also known as the profit and loss report, or P&I. The balance sheet – highlights what the company owns (assets) and what the company owes (liabilities). The statement of cash flows – highlights how much cash came ...

What is the health report of a company?

The Health Report of a Company. The three financial statements make up the health report of a company. Outside investors will want to be aware of the financial performance of a company before investing their own cash into the company. A management team will want to know how their ideas and performance is impacting the company, ...

What is cash flow statement?

The cash flow statement shows how much cash came into the company and how much cash left the company for a specific period of time. If a company is spending more money than taking in, that would be reason for an initial concern.

What are the three financial statements?

Financial statements are typically found in one of the following three intervals: Monthly. Quarterly. Yearly. Each interval has its own benefit and consequence. Investors and management teams will typically leverage numerous time periods to get a broader understanding of the business and plot a proper trend.

What are the financial statements used in investment analysis?

The financial statements used in investment analysis are the balance sheet, the income statement, and the cash flow statement with additional analysis of a company's shareholders' equity and retained earnings. Although the income statement and the balance sheet typically receive the majority of the attention from investors and analysts, ...

Why is it important to understand notes to financial statements?

Analysts and investors alike universally agree that a thorough understanding of the notes to financial statements is essential to properly evaluate a company's financial condition and performance. As noted by auditors on financial statements "the accompanying notes are an integral part of these financial statements.".

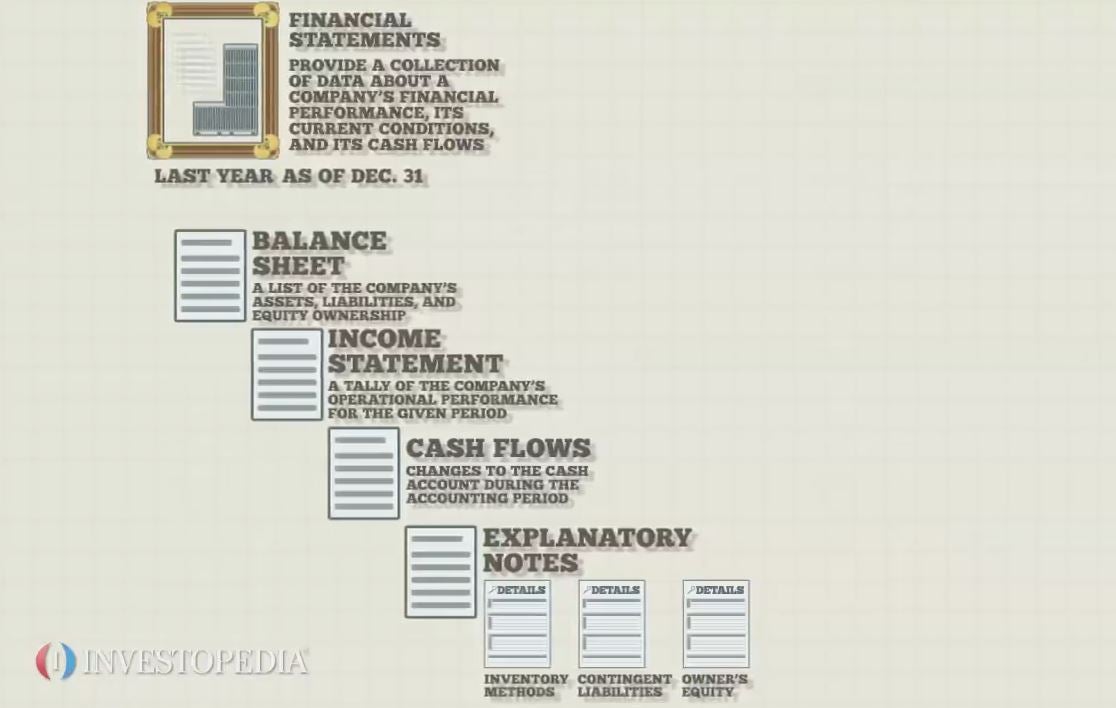

What are the sections of a company's financial statement?

There are four sections to a company's financial statements: the balance sheet, the income statement, the cash flow statement, and the explanatory notes. Prudent investors might also want to review a company's 10-K, which is the detailed financial report the company files with the U.S. Securities and Exchange Commission (SEC).

What information should an investor review?

An investor should also review non-financial information that could impact a company's return, such as the state of the economy, the quality of the company's management, and the company's competitors . 1. Financial Statement = Scorecard.

What does the number in a financial statement mean?

The numbers in a company's financial statements reflect the company's business, products, services, and macro-fundamental events. These numbers and the financial ratios or indicators derived from them are easier to understand if you can visualize the underlying realities of the fundamentals driving the quantitative information. For example, before you start crunching numbers, it's critical to develop an understanding of what the company does, its products and/or services, and the industry in which it operates.

Why are absolute numbers important in financial statements?

The absolute numbers in financial statements are of little value for investment analysis unless these numbers are transformed into meaningful relationships to judge a company's financial performance and gauge its financial health. The resulting ratios and indicators must be viewed over extended periods to spot trends.

What is the presentation of a company's financial position?

The presentation of a company's financial position, as portrayed in its financial statements, is influenced by management's estimates and judgments. In the best of circumstances, management is scrupulously honest and candid, while the outside auditors are demanding, strict, and uncompromising.

What publications recommend stocks to invest in each month?

Publications like U.S. News, Forbes, and Investopedia recommend stocks to invest in each month. But while you should definitely take professional stock recommendations into account, it's best to read a company's financial documents yourself before putting any money into their business.

What is income statement?

Income statements (profit and loss statements) An income statement showcases a business's profitability over a specific time period, usually over the course of a fiscal year. You might also hear income statements referred to as profit and loss (P&L) statements, statements of earnings, or statements of operations.

What are the sections of a cash flow statement?

Cash flow statements include three main sections: 1 Cash flow from operating activities. This section of the statement compares the income statement's net profit to the amount of cash you put into (and get out of) daily operations, such as sales and wages. 2 Cash flow from investing activities. This section includes cash earned from a company's investment portfolio as well as long-term investments in a business's future, such as cash payments for property or new equipment. These types of investments are also called capital expenditures, or the money businesses reinvest in their own physical assets. 3 Cash flow from financing activities. Shareholders' equity is listed in this section, as are payments a company makes to a financial institution like a bank.

What are the liabilities of a company?

A company's liabilities include whatever it owes to non-shareholders. The amount could include loans, unpaid wages, income taxes, rent, and interest payments. A company's shareholder equity refers to what its shareholders would earn after the company liquidated its assets and paid all its bills.

What is the liability side of a balance sheet?

The liability side of the sheet lists liabilities by how soon each payment is due, starting with current liabilities that are due within a year. Long-term liabilities, which come due more than a year after the balance sheet is created, are listed next.

What is gross profit?

A company's gross profit shows, in dollar amount, how much a company earns from product sales after accounting for the direct costs of product production. The gross profit margin isn't usually listed on the statement itself, so you'll likely need to calculate the percentage yourself.

Which side of the balance sheet is the assets?

A balance sheet lists the company's assets on one side (usually the left half) and its liabilities and equity on the other (usually the right half). The two halves of the sheet must equal each other for the sheet to be balanced.

What are the four main financial statements?

There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders’ equity. Balance sheets show what a company owns and what it owes at a fixed point in time. Income statements show how much money a company made and spent over a period of time.

What is income statement?

An income statement is a report that shows how much revenue a company earned over a specific time period (usually for a year or some portion of a year). An income statement also shows the costs and expenses associated with earning that revenue.

What is the first part of a cash flow statement?

The first part of a cash flow statement analyzes a company’s cash flow from net income or losses. For most companies, this section of the cash flow statement reconciles the net income (as shown on the income statement) to the actual cash the company received from or used in its operating activities. To do this, it adjusts net income for any non-cash items (such as adding back depreciation expenses) and adjusts for any cash that was used or provided by other operating assets and liabilities.

What is current asset?

Current assets are things a company expects to convert to cash within one year. A good example is inventory. Most companies expect to sell their inventory for cash within one year. Noncurrent assets are things a company does not expect to convert to cash within one year or that would take longer than one year to sell.

Why is cash flow important?

This is important because a company needs to have enough cash on hand to pay its expenses and purchase assets. While an income statement can tell you whether a company made a profit, a cash flow statement can tell you whether the company generated cash.

What is the equation for assets?

ASSETS = LIABILITIES + SHAREHOLDERS' EQUITY. A company's assets have to equal, or "balance," the sum of its liabilities and shareholders' equity. A company’s balance sheet is set up like the basic accounting equation shown above. On the left side of the balance sheet, companies list their assets.

What is balance sheet?

A balance sheet provides detailed information about a company’s assets, liabilities and shareholders’ equity. Assets are things that a company owns that have value. This typically means they can either be sold or used by the company to make products or provide services that can be sold.

What are the three basic financial statements?

If a C-level executive starts trying to talk to you about your company’s financial statements, don’t stress. Chances are, they’ll be referencing one of three main types of financial statements. Those three are your balance sheet, income statement, and cash flow statement.

What do you look at in financial statements?

Balance sheets, income statements, and cash flow statements all have unique data sets and important information that you’ve got to consider when reading them.

What are the three main ways to analyze financial statements?

There are three ways that most organizations will analyze financial statements. They’ll either choose horizontal analysis, vertical analysis, ratio analysis, or a combination of the three.

Conclusion

No matter how you look at your financial statements, it’s important to consider different angles that will help you develop a holistic picture of your company’s financial statements.

What is the income statement?

The income statement is sometimes called the profit and loss statement or may be enumerated as part of a statement of comprehensive income. The balance sheet is sometimes called the statement of financial position. The cash flow statement is also sometimes called a statement of cash flows. A fourth financial statement is called the statement ...

What is the fourth financial statement?

A fourth financial statement is called the statement of retained earnings or statement of changes in equity. .

Can you use unsustainable sources to make future cash flow projections?

Unsustainable sources and uses of cash should not be used to make future cash flow projections. Calculate free cash flow to investors by summing cash flows from operations and capital expenditures (an item in investing cash flows).

What is a Form 10-K?

This official form, filed to the SEC, will include On its face of the 10-K a statement to this effect:

What is a Form 10-Q?

This is the quarterly and slimmed-down version of the 10-K. It typically only includes unaudited financial statements, notes to the financial statements and a management discussion.

What is an Annual Report?

This publication is sent to all shareholders and is available from the company for prospective investors. The annual report varies from company to company. Netflix, for example, links to an annual report via their Investor Relations page, but it's just their 10-K report again with no additional frills.

Step by Step for Reading Financial Statements

Now that you know what reports to obtain, let's walk through what you should do with them -- before you even get to analyzing the financials.