Key Takeaways

- Stock index futures are legal agreements to buy or sell stocks on a future date and at a specific price.

- They can allow investors to speculate on future prices, but are also risky if prices change too quickly.

- ETFs are one way to invest in stock index futures.

- It's advisable to consult with a professional first.

Full Answer

What are stock futures and how do they work?

- These contracts ensure that the commodity producer receives a fixed sales price, come harvest or selling time.

- In a price drop, the producer does not lose money. He gets the agreed-upon price.

- Producers can limit their risk, in case of a price drop.

- Producers or companies can make better production plans.

What are the advantages of trading futures vs stocks?

U.S. equity futures traded lower Thursday morning after ... the Labor Department will release new claims for unemployment benefits for last week. Expectations are for 219,000, down from 223,000 ...

How to buy and sell stock futures?

- Find the local minima and store it as starting index. If not exists, return.

- Find the local maxima. and store it as ending index. If we reach the end, set the end as ending index.

- Update the solution (Increment count of buy sell pairs)

- Repeat the above steps if end is not reached.

How to start trading futures?

How to Trade Futures

- Understanding the basics. A futures contract is quite literally how it sounds. ...

- Trading futures. Leverage : Control a large investment with a relatively small amount of money. ...

- Setting up an account. ...

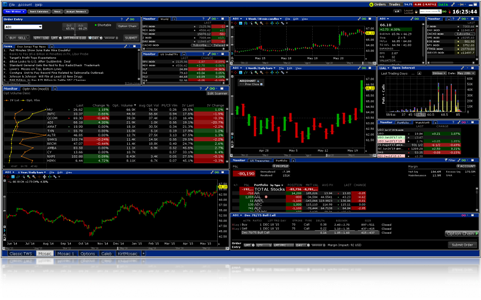

- Choosing a trading platform. ...

- Developing a trading strategy. ...

- Building your skills. ...

/GettyImages-598776121-59bf3ad6af5d3a0010321ef6.jpg)

What do stock futures mean?

Futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set future date for a set price. Futures contracts, or simply "futures," are traded on futures exchanges like the CME Group and require a brokerage account that's approved to trade futures.

What are stock futures example?

Definitions and Examples of Futures Futures trading is common with commodities. For example, if someone buys a July crude oil futures contract (CL), they are saying they will buy 1,000 barrels of oil from the agreed price upon the July expiration, no matter what the market price is at that time.

What is the difference between stocks and stock futures?

Futures are contracts with expiration dates, while stocks represent ownership in a company.

What do stock index futures tell you?

Index Futures Predict the Opening Direction The local equity markets will probably rise, and investors may anticipate a stronger U.S. market, too. If they buy index futures, the price will go up.

Why futures are better than stocks?

Futures and derivatives help increase the efficiency of the underlying market because they lower unforeseen costs of purchasing an asset outright. For example, it is much cheaper and more efficient to go long in S&P 500 futures than to replicate the index by purchasing every stock.

When should you buy futures?

This usually happens on the date of the contract's expiry. However, many traders also choose to settle before the expiry of the contract. In this case, the futures contract (purchase or sale) is settled at the closing price of the underlying asset as on the expiry date of the contract.

How do you make money on futures?

Futures contracts apply to agricultural commodities, rising and falling as the supply and demand of items such as corn, steel, cotton and oil change. You can make money trading futures if you follow trends, cut your losses and watch your expenses.

Are futures riskier than stocks?

Futures, in and of themselves, are not any riskier than other types of investments, such as owning equities, bonds, or currencies. That is because futures prices depend on the prices of those underlying assets, whether it is futures on stocks, bonds, or currencies.

Can futures trading make you rich?

You indeed can become rich from futures trading. The great liquidity in most futures markets, the ease of access, great short-selling opportunities, and high leverage, all make futures some of the most flexible and useful securities out there.

Do futures predict stock market?

However, futures aren't always a reliable indicator of which way stocks will actually move. They represent more of a bet that a stock or index will move in a particular direction. Sometimes traders will accurately predict the direction, but sometimes they won't.

How do you read futures?

Reading a Futures Quote It trades on the CBOT. 9 Also near the top is the current price, and how much the price has moved up or down during the day. The quote also shows the trading volume, the low and high price of the day—1 day range—open interest, and high and low prices for last 52 weeks.

How do you know if a stock will go up the next day?

The closing price on a stock can tell you much about the near future. If a stock closes near the top of its range, this indicates that momentum could be upward for the next day.

Why do companies use futures?

Futures can be used to hedge the price movement of the underlying asset. Here, the goal is to prevent losses from potentially unfavorable price changes rather than to speculate. Many companies that enter hedges are using—or in many cases producing—the underlying asset.

Why do investors use futures contracts?

Investors can use futures contracts to speculate on the direction in the price of an underlying asset. Companies can hedge the price of their raw materials or products they sell to protect from adverse price movements. Futures contracts may only require a deposit of a fraction of the contract amount with a broker. Cons.

What is leverage in futures?

Leverage means that the trader does not need to put up 100% of the contract's value amount when entering into a trade. Instead, the broker would require an initial margin amount, which consists of a fraction of the total contract value.

What is an underlying asset?

Underlying assets include physical commodities or other financial instruments. Futures contracts detail the quantity of the underlying asset and are standardized to facilitate trading on a futures exchange. Futures can be used for hedging or trade speculation.

What is futures contract?

Futures contracts are an investment vehicle that allows the buyer to bet on the future price of a commodity or other security. There are many types of futures contracts available, on assets such as oil, stock market indices, currencies, and agricultural products.

How much is the December crude oil futures contract?

The December crude oil futures contract is trading at $50 and the trader locks in the contract.

Do futures contracts settle in cash?

Oftentimes, traders who hold futures contracts until expiration will settle their position in cash. In other words, the trader will simply pay or receive a cash settlement depending on whether the underlying asset increased or decreased during the investment holding period.

Why do investors look at futures?

Some investors look at futures for clues about what direction a stock index might move in when the market opens on a particular day. Futures track stock prices around the clock , while stocks only trade and track prices during the hours of operation of the exchange they trade on.

How do futures differ from options?

Futures differ from trading options because the buyer and seller are contractually obligated to complete the specified transaction. With options, the owner of the option has the right to exercise their option, but is not required to.

What happens if the price of futures increases before the expiration date?

On the other hand, if the futures price increases before the expiration date, the seller will lose out, since they previously agreed to sell the futures at a lower price as struck at the time the contract was entered. Buyers make money when the price increases before the expiration date.

What happens to the buyer of a futures contract?

The buyer of that futures contract will still have to pay the price stipulated in the contract to settle it. If the futures price has dropped in value, the buyer will essentially pay above the market price to settle the contract they entered into.

What is margin in trading?

The margin serves as collateral in case the market moves in the opposite direction of the position. Traders who sell a futures contract earn profit if the futures price drops before the expiration date. The buyer of that futures contract will still have to pay the price stipulated in the contract to settle it.

How to calculate futures?

To calculate futures, you multiply the stock price by the number of units in the contract. To trade futures, investors must pay in a margin, usually 10% of the value of the contract, although it can be as high as 20%. The margin serves as collateral in case the market moves in the opposite direction of the position.

Do futures trades have commissions?

Commissions on futures trades are quite low and only charged when the contract is completed. However, many online brokerages offer free stock trading, making futures trades a little less attractive comparatively than they once were in terms of fees.

What is stock futures?

What Are Stock Index Futures? The crystal ball of the financial markets, stock index futures are bets on the direction the equities will take that track with key stock market indexes . Stock index futures trade at different times of the day, even after the traditional markets have closed.

How do stock futures work?

How Stock Index Futures Work. Typically, stock index futures are traded with the help of a futures broker, who facilitates the trade on both buy and sell orders. Just like traditional stock market securities trading, "buy" positions let investors profit from a rising stock market while "sell" orders enable investors to benefit from ...

What are the disadvantages of trading in futures?

The disadvantages of trading in futures are all about high risk and the necessity of holding cash: Leverage risks: One downside of index futures investing is the high level of risk inherent in buying and selling such contracts.

Can ETFs be used to invest in futures?

They can allow investors to speculate on future prices, but are also risky if prices change too quickly. ETFs are one way to invest in stock index futures. It's advisable to consult with a professional first. The Balance does not provide tax, investment, or financial services and advice.

When did futures trading start?

Futures trading In the United States dates back to the 1800s in the form of commodities futures where regional farmers convened in Chicago to sell wheat to dealers. That scenario evolved to include trades for future bushels of wheat, livestock, and butter, among other items. Sellers could lock in prices ahead of time, while buyers knew the costs they would eventually pay. 1

Can investors speculate on future stock price performance?

Speculation possibilities: Investors can speculate on future stock price performance, giving them more leverage, plus access to 24/7 securities trading in highly regulated markets—without actually owning the stock market index that the futures contract covers.

What does futures mean in stock market?

What Does Futures Mean in Relation to the Stock Market? The stock market news networks and financial websites often discuss the futures prices of the stock market, especially early in the day before the market opens. Futures trading takes place on different markets from the stock exchanges, and can provide an indication of the future direction ...

What is futures trading?

Futures trading allows traders to make bets on moves in either direction of the stock market, up or down. Futures are well suited to day or swing trading. The commodity and futures markets have developed e-mini contracts on the Dow, S&P 500 and NASDAQ 100 for use by individual traders. U.S. Congress.

What happens to the stock market when the stock market is closed?

When the stock market is closed, the futures contracts change in value if there is breaking news or in response to the Asian and European stock markets.

How long is the futures market open?

Electronic trading for futures is open 23 1/2 hours per day. These extended trading hours means the futures on stocks are reacting to market news when the stock market is closed.

What is futures contract?

Futures contracts are derivative securities that trade on the commodities and futures exchanges. Historically, futures contracts were for the future delivery of commodities like corn, coffee and pork bellies -- bacon. The selection of futures contracts has expanded significantly, and includes a range of futures on financial products including ...

Do the Dow and S&P 500 follow the futures?

At the open of the stock market, the major indexes of the Dow, S&P 500 and NASDAQ do not have to follow the lead of the futures prices, but often the futures are a good forecast of the opening moves of the stock market.

Can you track futures before the stock market opens?

Potential. Stock market investors can track the value of the futures contracts before the stock market opens to get a forecast of the market day. The major financial websites have a web page dedicated to the value of the stock index futures. Futures trading allows traders to make bets on moves in either direction of the stock market, up or down.

What is the difference between index futures and index funds?

But one huge difference between stock index futures and such index funds is that the former don’t take dividends into account. An index fund, by virtue of actually holding positions in the various stocks that comprise the index, is eligible for whatever dividends those stocks’ companies’ managers decide to pay out to shareholders.

What is index in stock market?

A stock market index is, at its essence, just a number that represents a collection of stock prices manipulated arithmetically. The index is a quantity, but not really “of” anything you can taste or touch. Yet we can add another level of abstraction and create a futures contract for a stock index, the result of which is speculators taking positions ...