Is Sprague resources (SRLP) a great dividend stock?

Sprague Resources pays an annual dividend of $1.74 per share and currently has a dividend yield of 10.41%. SRLP has a dividend yield higher than 75% of all dividend-paying stocks, making it a leading dividend payer.

Is Sprague resources'stock overvalued or undervalued?

The P/E ratio of Sprague Resources is -6.82, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings. Sprague Resources has a P/B Ratio of 6.53. P/B Ratios above 3 indicate that a company could be overvalued with respect to its assets and liabilities.

Is Sprague resources's PE ratio good or bad?

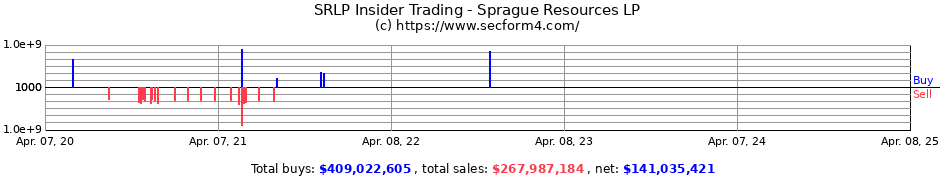

In the past three months, Sprague Resources insiders have not sold or bought any company stock. The P/E ratio of Sprague Resources is -6.82, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings.

What is Sprague resources lpsprague resources LP?

About Sprague Resources LPSprague Resources LP is engaged in the purchase, storage, distribution and sale of refined petroleum products and natural gas. The company also provides storage and handling services for a broad range of materials.

Is Sprague Resources a buy?

Sprague Resources LP (NYSE:SRLP) The 1 analysts offering 12-month price forecasts for Sprague Resources LP have a median target of 19.00, with a high estimate of 19.00 and a low estimate of 19.00. The median estimate represents a -0.31% decrease from the last price of 19.06.

Is SRLP a good stock to buy?

Is Sprague Resources Stock a good buy in 2022, according to Wall Street analysts? The consensus among 1 Wall Street analyst covering (NYSE: SRLP) stock is to Hold SRLP stock.

What does Sprague Resources do?

Sprague (NYSE SRLP) is one of the largest independent suppliers of energy and materials handling services in the Northeast with products including home heating oil, diesel and fuels, gasoline and natural gas.

Who bought Sprague Energy?

Hartree Partners, LPPORTSMOUTH, N.H. , May 28, 2021 (GLOBE NEWSWIRE) -- Sprague Resources LP (SRLP) (“Sprague”) and Hartree Partners, LP (“Hartree”) announced today that affiliates of Hartree have closed the purchase of the general partner interest, the incentive distribution rights and all of the common units representing limited partner ...

Does SRLP pay a dividend?

SRLP pays a dividend of $1.97 per share. SRLP's annual dividend yield is 10.34%. Sprague Resources's dividend is higher than the US industry average of 6.01%, and it is higher than the US market average of 3.87%.

What is Sprague Energy mission statement?

Our goal is to consistently exceed your expectations and earn your business with every interaction. We work tirelessly to provide you with the knowledge and tools to administer your energy buying and reporting needs—all to help your business thrive.

How has Sprague Resources' stock price performed in 2022?

Sprague Resources' stock was trading at $13.55 on January 1st, 2022. Since then, SRLP stock has increased by 40.3% and is now trading at $19.01. V...

Are investors shorting Sprague Resources?

Sprague Resources saw a drop in short interest in the month of May. As of May 31st, there was short interest totaling 8,300 shares, a drop of 16.2%...

When is Sprague Resources' next earnings date?

Sprague Resources is scheduled to release its next quarterly earnings announcement on Thursday, August 4th 2022. View our earnings forecast for Sp...

How were Sprague Resources' earnings last quarter?

Sprague Resources LP (NYSE:SRLP) issued its quarterly earnings data on Thursday, May, 5th. The oil and gas company reported $0.68 earnings per shar...

How often does Sprague Resources pay dividends? What is the dividend yield for Sprague Resources?

Sprague Resources declared a quarterly dividend on Monday, April 25th. Stockholders of record on Friday, May 6th will be given a dividend of $0.434...

Is Sprague Resources a good dividend stock?

Sprague Resources(NYSE:SRLP) pays an annual dividend of $1.74 per share and currently has a dividend yield of 9.13%. SRLP has a dividend yield high...

Who are Sprague Resources' key executives?

Sprague Resources' management team includes the following people: Mr. David C. Glendon , Pres, CEO & Director of Sprague Resources GP LLC (Age 5...

What is Dave Glendon's approval rating as Sprague Resources' CEO?

18 employees have rated Sprague Resources CEO Dave Glendon on Glassdoor.com . Dave Glendon has an approval rating of 92% among Sprague Resources'...

Who are some of Sprague Resources' key competitors?

Some companies that are related to Sprague Resources include Canadian Solar (CSIQ) , Montauk Renewables (MNTK) , Talos Energy (TALO) , Laredo P...

When will Sprague Resources release its earnings?

Sprague Resources is scheduled to release its next quarterly earnings announcement on Thursday, August 5th 2021. View our earnings forecast for Sprague Resources.

How much does Sprague Resources make?

Sprague Resources has a market capitalization of $656.94 million and generates $2.34 billion in revenue each year. The oil and gas company earns $33.81 million in net income (profit) each year or $1.11 on an earnings per share basis.

What is the dividend payout ratio of Sprague Resources?

Sprague Resources does not yet have a strong track record of dividend growth. The dividend payout ratio of Sprague Resources is 240.54%. Payout ratios above 75% are not desirable because they may not be sustainable. Based on EPS estimates, Sprague Resources will have a dividend payout ratio of 127.14% in the coming year.

How much dividend does Sprague pay?

Sprague Resources pays an annual dividend of $2.67 per share and currently has a dividend yield of 9.21%. SRLP has a dividend yield higher than 75% of all dividend-paying stocks, making it a leading dividend payer. Sprague Resources does not yet have a strong track record of dividend growth.

When will Sprague Resources stock be ex dividend?

The stock is expected to become ex-dividend 1 business day (s) before the record date. Sprague Resources has an ex-dividend date set for for February 1, 2021.

Where is Sprague Resources located?

Sprague Resources has been around since 1870, and is headquartered in Portsmouth, New Hampshire. Having been around this long you can assume that it provides essential services to northern New England and beyond.

Is midstream energy a limited partnership?

Structured as a limited partnership, its net profits are distributed to shareholders as dividends, but the stock has been moving up as the energy markets have rebounded. And midstream companies act as toll-takers for energy, so when demand increases so does their revenue.

Research & Ratings Sprague Resources LP(SRLP)

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet.

Per-Share Earnings, Actuals and Estimates

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet.

Transparency is our policy. Learn how it impacts everything we do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

How we make money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

How we use your personal data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

How we approach editorial content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view.

What is Sprague Resources's dividend yield?

The current dividend yield for Sprague Resources (NYSE:SRLP) is 10.34%. Learn more

How much is Sprague Resources's annual dividend?

The annual dividend for Sprague Resources (NYSE:SRLP) is $1.74. Learn more

How often does Sprague Resources pay dividends?

Sprague Resources (NYSE:SRLP) pays quarterly dividends to shareholders.

When was Sprague Resources's most recent dividend payment?

Sprague Resources's most recent quarterly dividend payment of $0.4338 per share was made to shareholders on Wednesday, February 9, 2022.

Is Sprague Resources's dividend growing?

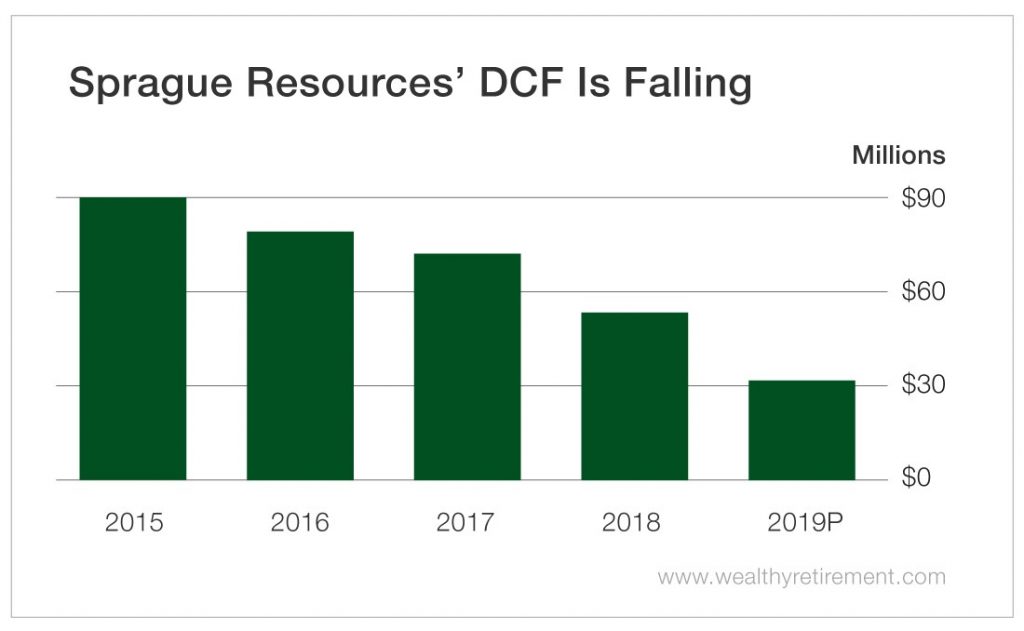

Over the past three years, Sprague Resources's dividend has not grown. It has decreased by -7.19%.

When did Sprague Resources last increase or decrease its dividend?

The most recent change in Sprague Resources's dividend was a decrease of $0.0002 on Tuesday, January 25, 2022.