What is a good price to buy silver per ounce?

Silver Spot Price: $24.73 per ounce Free Shipping ; Product Dealer P/oz over Spot Lowest Price QTY for FS FS Deal $ Canada Junk Silver Dollar: eBay Free Shipping Available: 0.27 (+1.09%) $15.00

How much is silver selling for per ounce?

Right now, the silver spot is around $15.45 and the average price for a 1-ounce Silver American Eagles ranges from $17-$18 US dollars. Mint wholesalers typically charge anywhere from $2-$2.50 per ounce when selling to dealers. These dealers then add a small percentage on top when selling to the public.

What is the current market value of silver?

The worth of Silver is determined by the current Silver spot price. This price is determined by many factors such as market conditions, supply and demand, and even news of political and social events. The value or worth of a Silver product is calculated relative to the weight of its pure metal content measured in troy ounces.

What is the current price of silver per ounce?

Silver Price Now Change; Silver Price per Ounce: $23.51 +0.15: Silver Price per ...

What is 1oz silver worth?

17.06 USDUnit conversion for Silver Price TodayConversionSilver Price(Spot)Price1 Troy Ounce ≈ 31,10 GramSilver Price Per 1 Gram0.60 USD1 Troy Ounce ≈ 0,031 KilogramSilver Price Per 1 Kilogram601.86 USD1 Troy Ounce ≈ 1,097 OunceSilver Price Per 1 Ounce17.06 USD

Will silver ever reach $100 an ounce?

If inflation continues to rise and reaches double-digit values through 2022 and 2023, the price of $100 an ounce for silver could be possible. Consider that in 2021, we saw inflation rates averaging around 5%, which was the highest rate since 2008.

What is the current stock price of silver?

Silver LIVE QUOTELast 18.37 USD+/- -0.04Trade Time 12:58:00 AMPrevious Close 18.41

Will silver hit $1000 an ounce?

It is unlikely that Silver will reach $1,000 per ounce, but it is possible that Silver could reach prices of $800 or $900 per ounce.

Is silver about to skyrocket?

"There is going to be huge distortions across all markets — meaning the bond market, the stock market, the metals market, the crypto market," explained Morgan. He believes silver may break through US$30 to trade in the US$33 range in 2022. He also sees potential for silver to reach US$50 in the near future.

How do I buy silver stock?

You can buy silver stocks through reputable brokers and exchanges. You can also buy silver online through online platforms and trading apps. There is a wide variety of silver stocks, which allow you to own shares in mining companies. You can buy exchange-traded products (ETPs).

Is silver a good investment?

Silver, like gold, can be viewed as a safe-harbor investment during the end of a long bull run because it's a hard asset and a store of value. It can also be viewed as an alternative currency to fiat currencies such as the U.S. dollar or euro. Also similar to gold, silver can be viewed as a hedge against inflation.

What will silver be worth in 2030?

The short-term price prediction for silver is set at $16.91/toz by the end of 2019, according to the World Bank. The long-term prediction to 2030 forecasts a significant drop in the commodity's price, reaching $13.42/toz by then.

What will silver be worth in 2030?

The short-term price prediction for silver is set at $16.91/toz by the end of 2019, according to the World Bank. The long-term prediction to 2030 forecasts a significant drop in the commodity's price, reaching $13.42/toz by then.

What will the price of silver be in 2025?

Based on this chart our Silver price prediction 2025 is $120 per ounce. This chart was originally prepared in June 2019 and then updated in mid-February 2022. The 'Big Scary Plunge' in March 2020 distorted all of the Financial markets including Silver.

What will silver be worth in 10 years?

Using the current silver price of about $25 per ounce, a 10-year bull run could put the price of silver anywhere from $150 to $750 per ounce.

Will silver prices Go Up in 2022?

My silver price target for year-end in 2022 is $21 per troy ounce. That's slightly below the current price (about 1 percent lower), and well off of silver's previous high for the year.

Investing in Silver

Silver is available for investment in a number of forms, such as physical Silver bullion and paper Silver. Silver bullion is most found in coin,...

What is Silver bullion?

Silver bullion refers to a Silver product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectibl...

What is the price of Silver today?

The Silver bullion prices are established and adjusted by the world market, which includes both buyers and sellers, relating to the price of Silver...

What is Silver worth?

The worth of Silver is determined by the current Silver spot price. This price is determined by many factors such as market conditions, supply and...

What’s the price of Silver per ounce?

The price of Silver can fluctuate based on market conditions, supply and demand, geopolitical events and more. When someone refers to the price of...

What is a Troy Ounce of Silver?

An ounce is not a "regular" ounce when paying the spot on Silver prices. When Americans refer to ounces, they generally are referring to Avoirdupo...

What is the difference between the Silver Bid, Ask and Spread Price?

The Silver Bid price per ounce is the price the dealer is willing to buy Silver while the Silver Ask price is the price at which the dealer off...

Does my coin value change with the Silver Spot Price?

The overall price of your coin will change with the Silver spot price, but Silver coin values also vary depending on factors such as mintage, scarc...

Are the Silver Spot Prices today the same no matter where I live?

Silver prices, at any given moment, are the same no matter where you buy in the world. Live Silver prices always reflect Silver traded in U.S. doll...

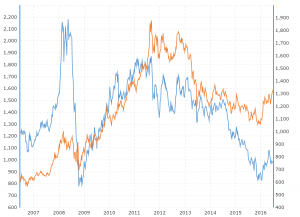

How much did silver cost in 2011?

As the financial crises of 2008/2009 got underway, silver prices per ounce began to climb rapidly, eventually rising to nearly $50 per ounce in 2011. Silver prices eventually came back down, however, bottoming out in 2016 at less than $14 per ounce.

Why should I buy silver?

Investment demand also plays a major role in the price of silver. Investors may seek to buy silver for numerous reasons. Some of the potential reasons may include: 1 The potential for price appreciation 2 To act as a hedge against inflation 3 To act as a hedge against declining currency values 4 For portfolio diversification

Why do dealers mark up silver?

Dealers also mark up silver in order to cover the costs of doing business and make a profit. Dealers will purchase silver from the public as well, but will typically pay less than the spot price. The difference, or spread, between the spot price and what a dealer pays or charges is known as the dealer spread.

Is silver a premium?

Silver is typically bought for a premium over spot, and usually sold at a discount to spot. This is due to the fact that fabricators of silver coins, bars and rounds must not only pay for the silver content of their products, but must also pay for fabrication costs and a reasonable profit.

Does silver increase over time?

As the potential uses for silver increase over time, rising demand for the metal could potentially drive prices higher. In addition, if the supply of silver becomes constrained, it could also possibly fuel higher prices. Investment demand also plays a major role in the price of silver.

Silver Converter

Depending on where you live, the Silver spot price may not be listed in the currency you require. For that reason, APMEX provides a Silver converter tool to calculate the Silver price based on various factors, such as the currency, quantity, unit of measure and purity of the Silver.

Investing in Silver

Silver is available for investment in a number of forms, such as physical Silver bullion and paper Silver. Silver bullion is most found in coin, round and bar form with numerous size options for each. Some investors appreciate government-minted coins while others prefer purchasing Silver bullion bars and rounds at lower premiums.

What is Silver bullion?

Silver bullion refers to a Silver product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Silver bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government.

What is the price of Silver today?

The Silver bullion prices are established and adjusted by the world market, which includes both buyers and sellers, relating to the price of Silver futures. There are established markets throughout the world that are known for their Precious Metal exchanges and international client bases such as – the Commodity Exchange Inc.

What is Silver worth?

The worth of Silver is determined by the current Silver spot price. This price is determined by many factors such as market conditions, supply and demand, and even news of political and social events. The value or worth of a Silver product is calculated relative to the weight of its pure metal content measured in troy ounces.

What is a Troy Ounce of Silver?

An ounce is not a "regular" ounce when paying the spot on Silver prices. When Americans refer to ounces, they generally are referring to Avoirdupois ounces. The price of Silver per ounce is always measured in Troy ounces, which are equal to 1.09711 Avoirdupois ounces. One Troy ounce equals 31.1035 grams.

What is the difference between the Silver Bid, Ask and Spread Price?

The Silver Bid price per ounce is the price the dealer is willing to buy Silver while the Silver Ask price is the price at which the dealer offers to sell the Silver to customers. Generally, the difference between the Bid and Ask price includes the costs for fabrication and distribution of the coin which is called the Premium.

Silver Markets Give Back Early Gains

Silver markets initially gapped higher to kick off the Monday session ever so slightly, but then pulled back to reach towards the 200 day EMA.

What Does This Year Have in Store for Gold & Silver Trading?

2022 is set to be a big year for precious metals. We’re only two months into the year, but the gold and silver markets have already seen significant activity.

Oil prices swing on hopes of easing Ukraine tension

Oil prices tumbled and then recovered in volatile trading on Monday after French president Emmanuel Macron said the US and Russian presidents had agreed in principle to a meeting over Ukraine.