Is Shopify a good investment?

TipRanks is the most comprehensive data set of sell side analysts and hedge fund managers. TipRanks' multi-award winning platform ranks financial experts based on measured performance and the accuracy of their predictions so investors know who to trust when making investment decisions.

How high will Shopify stock go?

Shopify Inc. gained 14.12% on the last trading... Shopify Inc. [NYSE: SHOP] gained 14.12% on the last trading session, reaching $587.65 price per share at the time. The company report on February 16, 2022 that Shopify Announces Fourth-Quarter and Full-Year ...

What is the target price for Shopify?

Wallet Investor is unabashedly bullish on Shopify. They site has a one-year forecast of $1,849.59 and a staggering five-year price target of $3,791.56 per share. Gov Capital is surprisingly even more confident in Shopify’s future upside. The site has Shopify reaching $2,584.55 this year, nearly double its current price.

Is Shopify stock getting ahead of its fundamentals?

Shopify stock (NYSE: SHOP) has declined by almost 35% year to date, considerably underperforming the broader Nasdaq-100, which has declined about 8% over the same period. The stock is also down by about 48% off all-time highs seen in early November, trading at levels of around $885 currently. So what’s really changed for Shopify?

What is the forecast for Shopify stock?

Stock Price Forecast The 35 analysts offering 12-month price forecasts for Shopify Inc have a median target of 44.20, with a high estimate of 75.00 and a low estimate of 30.00. The median estimate represents a +25.46% increase from the last price of 35.23.

Is Shopify rated as a buy?

Shopify has received a consensus rating of Buy. The company's average rating score is 2.50, and is based on 20 buy ratings, 17 hold ratings, and 1 sell rating.

Will Shopify go up tomorrow?

Tomorrow's movement Prediction of Shopify Inc. SHOP as on 25 Jul 2022 appears undecisive. It can be Bearish or Bullish....Munafa value: 49 as on 25 Mon Jul 2022.Downside target34.9Downside target36.62Upside target37.52Upside target37.99Upside target38.344 more rows

Is Shopify a sell?

The best online selling platform is Shopify. Other great online selling platforms include: BigCommerce.

Will Shopify stock go back up?

Key Points. After soaring in 2021, shares of Shopify have fallen hard in 2022. The software provider is showing investors reasons to expect strong gains in the years ahead. A low price-to-sales ratio is just one of several reasons to buy Shopify stock right now.

What is wrong with Shopify stock?

Shopify's stock is down 30% since news of the acquisition talks broke last month, far exceeding market-wide declines. Whatever it does, Shopify risks antagonizing either its customers or investors. The second issue weighing on Shopify is the encroachment of its most fearsome competitor: Amazon.

Is Shopify losing money?

On an adjusted basis, Shopify reported a loss of 3 cents per share for the second quarter, while analysts on average had expected a profit of 2 cents. However, revenue rose 16% to $1.3 billion, in line with estimate of $1.33 billion, according to Refinitiv IBES data.

Will shop stock recover?

Undoubtedly, Shopify (TSX:SHOP)(NYSE:SHOP) stock, which lost over two-thirds of its value, is unlikely to recover such losses in an abrupt fashion. Although possible, the stock is most likely to take five years at minimum to recover. And along the way, even more pain will have to be suffered by investors.

Does Shopify pay dividends?

Does Shopify pay dividends? No, we have never declared or paid any dividends and we do not anticipate paying any cash dividends in the foreseeable future. We currently intend to retain future earnings, if any, to finance operations and expand our business.

Who is Shopify's biggest competitor?

The best Shopify competitors on the ecommerce scene are:Wix.Squarespace.Square Online.BigCommerce.Volusion.WooCommerce.

Is Shopify profitable 2022?

Gross profit dollars grew 14% to $637.6 million in the first quarter of 2022, compared with $558.7 million for the first quarter of 2021, reflecting primarily a greater mix of lower-margin Merchant Solutions revenue, lower margins in Shopify Payments due to mix, increased investments in our cloud infrastructure, and ...

Why is Shopify stock so high?

This surge in valuation has much to do with their incredible growth – revenue grew over 22 times since 2014's $67 million to 2019's $1.6 billion, creating a market capitalization that began at $1.3 billion and skyrocketed to $86 billion.

Is Shopify profitable 2022?

Gross profit dollars grew 14% to $637.6 million in the first quarter of 2022, compared with $558.7 million for the first quarter of 2021, reflecting primarily a greater mix of lower-margin Merchant Solutions revenue, lower margins in Shopify Payments due to mix, increased investments in our cloud infrastructure, and ...

Who is Shopify's biggest competitor?

The best Shopify competitors on the ecommerce scene are:Wix.Squarespace.Square Online.BigCommerce.Volusion.WooCommerce.

Why is Shopify tanking?

But high-flying inflation, a pullback in consumer spending online compared to during the pandemic, and increased competition are punishing the company, sending shares of Shopify plummeting 76% year-to-date to $331.42 at the start of trading Monday.

Will shop stock recover?

Undoubtedly, Shopify (TSX:SHOP)(NYSE:SHOP) stock, which lost over two-thirds of its value, is unlikely to recover such losses in an abrupt fashion. Although possible, the stock is most likely to take five years at minimum to recover. And along the way, even more pain will have to be suffered by investors.

Should I buy or sell Shopify stock right now?

36 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Shopify in the last year. There are currently 1 sell rating, 15 hold rati...

What is Shopify's stock price forecast for 2022?

36 Wall Street analysts have issued 12-month target prices for Shopify's shares. Their forecasts range from $400.00 to $2,000.00. On average, they...

How has Shopify's stock performed in 2022?

Shopify's stock was trading at $1,377.39 at the start of the year. Since then, SHOP shares have decreased by 74.7% and is now trading at $348.43....

When is Shopify's next earnings date?

Shopify is scheduled to release its next quarterly earnings announcement on Wednesday, July 27th 2022. View our earnings forecast for Shopify .

How were Shopify's earnings last quarter?

Shopify Inc. (NYSE:SHOP) issued its earnings results on Thursday, May, 5th. The software maker reported $0.20 earnings per share (EPS) for the quar...

When did Shopify's stock split? How did Shopify's stock split work?

Shares of Shopify split before market open on Wednesday, June 29th 2022. The 10-1 split was announced on Monday, April 11th 2022. The newly created...

Who are Shopify's key executives?

Shopify's management team includes the following people: Mr. Tobias Lütke , Founder, Chairman & CEO (Age 41, Pay $1) Mr. Harley Finkelstein , P...

What is Tobias Lütke's approval rating as Shopify's CEO?

468 employees have rated Shopify CEO Tobias Lütke on Glassdoor.com . Tobias Lütke has an approval rating of 93% among Shopify's employees. This pu...

Who are some of Shopify's key competitors?

Some companies that are related to Shopify include Oracle (ORCL) , Salesforce (CRM) , Intuit (INTU) , ServiceNow (NOW) , NetEase (NTES) , Act...

How much of Shopify stock is held by institutions?

What is Shopify software?

59.83% of the stock of Shopify is held by institutions. High institutional ownership can be a signal of strong market trust in this company.

What is Marketbeat ratings?

Its software is used by merchants to run business across all sales channels, including web, tablet and mobile storefronts, social media storefronts, and brick-and-mortar and pop-up shops. The firm's platform provides merchants with a single view of business and customers and enables them to manage products and inventory, process orders and payments, build customer relationships and leverage analytics and reporting. It focuses on merchant and subscription solutions. The company was founded by Tobias Albin Lütke, Daniel Weinand, and Scott Lake on September 28, 2004 and is headquartered in Ottawa, Canada.

What is the P/E ratio of Shopify?

MarketBeat's community ratings are surveys of what our community members think about Shopify and other stocks. Vote “Outperform” if you believe SHOP will outperform the S&P 500 over the long term. Vote “Underperform” if you believe SHOP will underperform the S&P 500 over the long term. You may vote once every thirty days.

Where does Shopify trade?

The P/E ratio of Shopify is 60.81, which means that it is trading at a less expensive P/E ratio than the Computer and Technology sector average P/E ratio of about 77.14.

Does Shopify pay dividends?

Shopify trades on the New York Stock Exchange (NYSE) under the ticker symbol "SHOP."

Stock Price Forecast

Shopify does not currently pay a dividend.

Analyst Recommendations

The 31 analysts offering 12-month price forecasts for Shopify Inc have a median target of 900.00, with a high estimate of 3,300.00 and a low estimate of 660.00. The median estimate represents a +41.24% increase from the last price of 637.20.

How much will Shopify grow in 2020?

The current consensus among 37 polled investment analysts is to Hold stock in Shopify Inc. This rating has held steady since February, when it was unchanged from a Hold rating. Move your mouse over past months for detail

What is the 14 day RSI for Shopify?

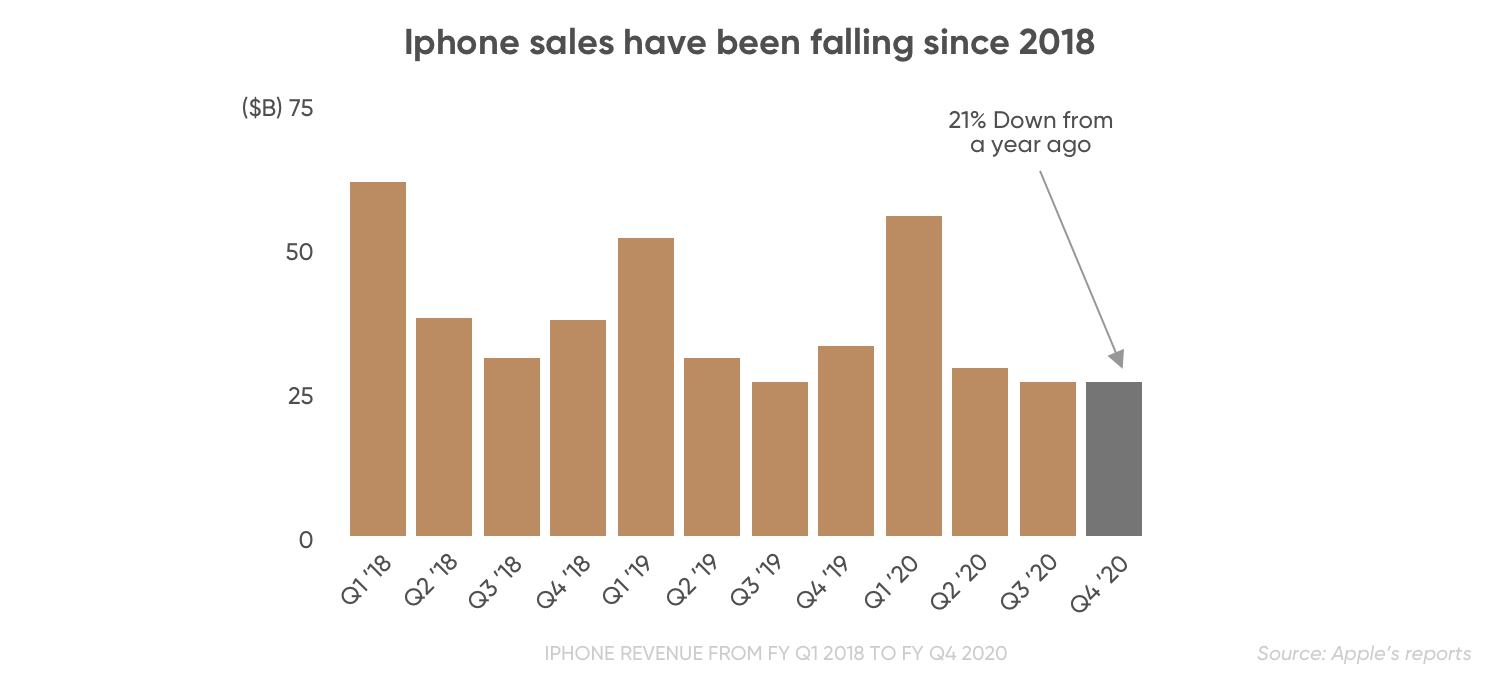

Shopify’s revenues increased 85.6% in 2020 which was preceded by a rise of 47% and 59.4% in 2019 and 2018 respectively. While the company’s growth rates had slowed down somewhat in 2018 and 2019 from the preceding years, the growth bounced back last year. Most of the e-commerce companies reported stellar numbers last year as the lockdowns fuelled growth. SHOP’s gross margins have been holding above 52 percent over the last five years.

Is Shopify overvalued?

The 14-day RSI for SHOP stock is 43.10 which is a neutral indicator and indicates neither oversold nor overbought positions. The 12,26 MACD (moving average convergence divergence) meanwhile gives a sell signal. Notably, Shopify stock has delivered strong returns since its listing. The gains have been supported by the solid topline growth that the Canadian company has been posting.

Is Shopify good for the long term?

To be sure, Shopify has always appeared overvalued to a section of the market. The same holds true for names like Tesla. However, companies like these bring strong growth and quality management to the table, something that investors are willing to pay a premium for.

Is Shopify stock up in 2021?

Over the long term, Shopify would benefit from the digitization of the retail market. The platform is popular among merchants and during the second-quarter earnings call it said that during the last year 46,000 partners referred at least one merchant to Shopify, which was 53% higher than the previous year. The company had $7.76 billion as cash and cash equivalents on its balance sheet at the end of June which is a good enough war chest and would help Shopify fuel its growth.

Is Shopify a good business?

Even as e-commerce plays like Amazon, ContextLogic, and Coupang have sagged in 2021, Shopify (SHOP) stock is outperforming the markets and is up over 26% for the year.

How many merchants does Shopify have?

While Shopify looks like a good business to own, many have been concerned about its valuation. For instance, the company trades at an NTM (next-12 months) EV (enterprise value)-to-sales multiple of 31.4x while the NTM EV-to-EBITDA is 236x. The multiples don’t look cheap when looked at in isolation. Barclays’s analyst Trevor Young increased the stock’s target price from $1,340 to $1,700 while maintaining the firm’s equal weight rating. While Young sounded bullish on Shopify’s business, he is apprehensive of the valuations which he termed “challenging on any metric.”

Is Shopify still growing?

Shopify is more than a new start up. It boasts more than one million merchants building businesses on their platform worldwide. The company likes to emphasizes the entrepreneur, but its merchants are small and medium-sized businesses.

Is Shopify a value stock?

In short, Shopify is still early in its growth, and the company is still positioning itself for the long term. This does not mean that the company is financially unstable. The Net Current Asset Value, or NCAV, is a valuable old tool picked out of value hunters' gear.

SHOP earnings per share forecast

This is likely enough to drive away value investors, but Shopify is not a value stock. It is a stock that investors see has a bright future, and this valuation shows the premium they are willing to pay today. Its valuation is high but not as high when one takes into account its recent growth rates.

SHOP revenue forecast

What is SHOP 's earnings per share in the next 3 years based on estimates from 28 analyst s?

SHOP earnings growth forecast

What is SHOP 's revenue in the next 3 years based on estimates from 33 analyst s?

SHOP revenue growth forecast

How is SHOP forecast to perform vs Software - Application companies and vs the US market?

Shopify Inc - Class A ( SHOP ) Stock Market info

How is SHOP forecast to perform vs Software - Application companies and vs the US market?

Verde Bio Holdings Stock Forecast, "VBHI" Share Price Prediction Charts

Recommendations: Buy or sell Shopify Inc - Class A stock? Wall Street Stock Market & Finance report, prediction for the future: You'll find the Shopify Inc - Class A share forecasts, stock quote and buy / sell signals below.

KPIT Technologies Stock Forecast, "KPITTECH" Share Price Prediction Charts

JoetheDetailer — The predictions of this VBHI is so whacky!! One day prices where way up and now they are way down. I'm not sure I this...

What is the revenue source of Shopify?

PVS — Kindly refresh this stock with the current live data as it is not showing the current market stock price level.

Why is it important to have more sellers on Shopify?

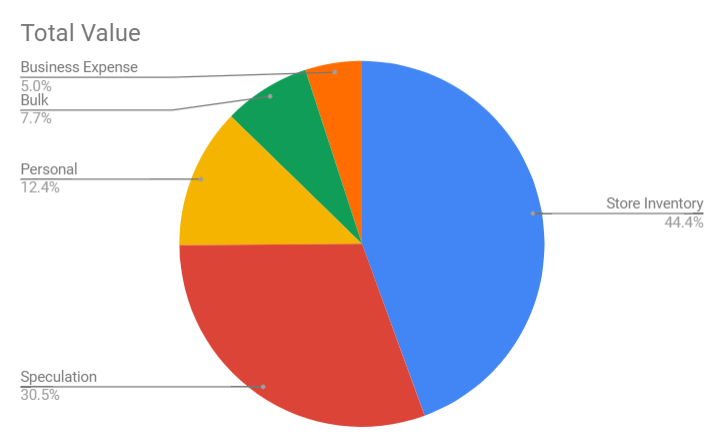

Shopify's smaller revenue source is subscription services, the fees it charges sellers, or "merchants, " to use its tools. The second is merchant services, which consists of the revenue Shopify earns from those merchants in the form of add-on services like payment processing and transaction fees.

Is Shopify a stock?

This is an encouraging development because the number of sellers on Shopify's platform will be the most important long-term driver of results. Keeping all other factors equal, more sellers leads to higher gross merchandise volumes on Shopify's platform , which will boost future revenue from its merchant services segment. Consider this as a virtual circle that begins with growing the number of sellers on its platform.

Is Amazon a good comparison to Shopify?

Shopify (NYSE: SHOP) stock has made long-term investors a boatload of money. If you would have been able to buy shares of the e-commerce subscription platform at its 2015 IPO price, you'd be sitting on gains of nearly 9,000%!

Who is the Motley Fool?

The Amazon comparison isn't perfect due to business model differences, particularly using revenue as a benchmark. Amazon works as both a retailer that sells its own inventory and as a third-party e-commerce platform, whereas Shopify is essentially the latter. That said, even bottom-line growth at these levels will be difficult to obtain.

Is Shopify a competitor to Amazon?

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community. Reaching millions of people each month through its website, books, newspaper column, radio show, television appearances, and subscription newsletter services, The Motley Fool champions shareholder values and advocates tirelessly for the individual investor. The company's name was taken from Shakespeare, whose wise fools both instructed and amused, and could speak the truth to the king -- without getting their heads lopped off.

Is it impossible to buy megacap stocks?

These trends boosted Shopify's biggest competitor, Amazon, which became a trillion-dollar company last year as shares soared 78%.