Is seanergy maritime efficiently growing its dividend?

Seanergy Maritime does not have a long track record of dividend growth. In the past three months, Seanergy Maritime insiders have not sold or bought any company stock. Only 23.14% of the stock of Seanergy Maritime is held by institutions.

What is the ticker symbol for seanergy maritime?

Seanergy Maritime trades on the NASDAQ under the ticker symbol "SHIP." Who are Seanergy Maritime's major shareholders? Seanergy Maritime's stock is owned by a number of retail and institutional investors.

What are Wall Street analysts'forecasts for seanergy Maritime's stock?

3 Wall Street analysts have issued 12-month price objectives for Seanergy Maritime's shares. Their forecasts range from $1. 50 to $2. 50. On average, they anticipate Seanergy Maritime's stock price to reach $2. 00 in the next twelve months. This suggests a possible upside of 63. 3% from the stock's current price.

How many ships does Sean Energy Maritime Holdings own?

It owns a modern fleet of seventeen dry bulk carriers, consisting of seventeen Capesizes, with a combined cargo-carrying capacity of approximately 3,011,083 deadweight tonnages (dwt) and an average fleet age of about 11.7 years.... All news about SEANERGY MARITIME HOLDINGS CORP.

Is Seanergy Maritime a good investment?

Seanergy Maritime has received a consensus rating of Buy. The company's average rating score is 3.00, and is based on 3 buy ratings, no hold ratings, and no sell ratings.

Will seanergy stock go back up?

The Wall Street analyst predicted that Seanergy Maritime Holdings's share price could reach $2.50 by Oct 7, 2022. The average Seanergy Maritime Holdings stock price prediction forecasts a potential upside of 252.61% from the current SHIP share price of $0.71.

What is Seanergy Maritime Holdings?

Seanergy Maritime Holdings Corp. is an international shipping company. The Company provides marine dry bulk transportation services through the ownership and operation of dry bulk vessels.

What happened to Seanergy Maritime Holdings Corp?

Seanergy Maritime Holdings Corp. announced today that it intends to effect a spin-off of the Company's oldest Capesize vessel, the M/V Gloriuship, through a wholly-owned subsidiary. The newly formed subsidiary, United Maritime Corporation (“United”), will act as the holding company for the M/V Gloriuship.

Why was top ships stock so high?

Instead, the reason for the increase to Top Ships (NASDAQ:TOPS) stock likely has to do with a change in position from the U.S. government. The Trump Administration has announced that the U.S. is planning to leave the Universal Postal Union. The Universal Postal Union is a treaty that has been in place for 144 years.

Why shipping stocks are down?

Shipping stocks are falling on Wednesday as the dry bulk transportation market suffers from demand issues. The big news here is that the demand for dry bulk shipping is pulling several stocks in the space lower. This comes as the Baltic Exchange Dry Index has fallen roughly 25% over the last couple of weeks.

What price target have analysts set for ship?

Stock Price Forecast The 3 analysts offering 12-month price forecasts for Seanergy Maritime Holdings Corp have a median target of 1.50, with a high estimate of 2.16 and a low estimate of 1.30.

Did ship do a reverse split?

Announces Reverse Stock Split to be Effective March 25, 2019. LONDON , March 20, 2019 (GLOBE NEWSWIRE) -- Global Ship Lease, Inc.

What does castor maritime ship?

We are a growth-oriented global shipping company engaged in the seaborne transportation of a wide range of commodities along worldwide shipping routes through our ownership of dry bulk and tanker vessels.

Should I buy or sell Seanergy Maritime stock right now?

3 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Seanergy Maritime in the last twelve months. There are currently 3 buy rat...

What is Seanergy Maritime's stock price forecast for 2022?

3 Wall Street analysts have issued 1 year price targets for Seanergy Maritime's shares. Their forecasts range from $1.50 to $2.50. On average, they...

How has Seanergy Maritime's stock performed in 2022?

Seanergy Maritime's stock was trading at $0.9180 on January 1st, 2022. Since then, SHIP stock has increased by 14.4% and is now trading at $1.05....

When is Seanergy Maritime's next earnings date?

Seanergy Maritime is scheduled to release its next quarterly earnings announcement on Thursday, August 4th 2022. View our earnings forecast for Se...

How were Seanergy Maritime's earnings last quarter?

Seanergy Maritime Holdings Corp. (NASDAQ:SHIP) issued its quarterly earnings data on Tuesday, May, 31st. The shipping company reported $0.04 EPS fo...

How often does Seanergy Maritime pay dividends? What is the dividend yield for Seanergy Maritime?

Seanergy Maritime declared a quarterly dividend on Wednesday, June 1st. Shareholders of record on Tuesday, June 28th will be given a dividend of $0...

Is Seanergy Maritime a good dividend stock?

Seanergy Maritime(NASDAQ:SHIP) pays an annual dividend of $0.10 per share and currently has a dividend yield of 9.57%. SHIP has a dividend yield hi...

When did Seanergy Maritime's stock split? How did Seanergy Maritime's stock split work?

Seanergy Maritime's stock reverse split on the morning of Wednesday, March 20th 2019. The 1-15 reverse split was announced on Tuesday, February 26t...

Who are Seanergy Maritime's key executives?

Seanergy Maritime's management team includes the following people: Mr. Stamatios Tsantanis , Chairman & CEO (Age 50) Mr. Stavros Gyftakis , Chi...

When will Seanergy Maritime release its earnings?

What is the official website of Seanergy Maritime?

Seanergy Maritime is scheduled to release its next quarterly earnings announcement on Wednesday, August 4th 2021. View our earnings forecast for Seanergy Maritime.

What is the P/B ratio of Seanergy Maritime?

The official website for Seanergy Maritime is www.seanergymaritime.com.

Does Seanergy Maritime pay dividends?

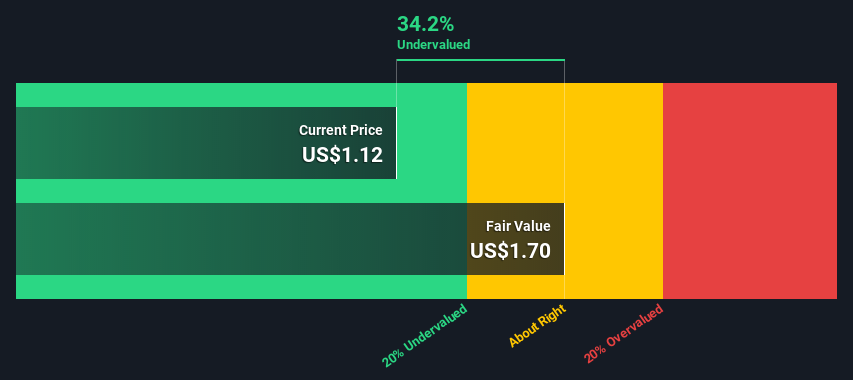

Seanergy Maritime has a P/B Ratio of 0.65. P/B Ratios below 1 indicate that a company could be undervalued with respect to its assets and liabilities.