| Date | Price Target | Change |

| 2022-03-28 | 5.72 | 0.26 % |

| 2022-03-29 | 5.68 | -0.71 % |

| 2022-03-30 | 5.67 | -0.27 % |

| 2022-03-31 | 5.72 | 0.90 % |

Is Sandfire Resources ( Sandfire) stock a buy or sell?

Sandfire Resources has received a consensus rating of Hold. The company's average rating score is 2.00, and is based on no buy ratings, 2 hold ratings, and no sell ratings. According to analysts' consensus price target of $6.00, Sandfire Resources has a forecasted upside of 66.0% from its current price of $3.62.

Is SFR's revenue forecasted to increase or decrease?

High Growth Revenue: SFR's revenue (4% per year) is forecast to grow slower than 20% per year. Future ROE: SFR's Return on Equity is forecast to be low in 3 years time (10%).

Where can I buy shares of sfrrf?

Shares of SFRRF can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here.

Is sandfire resources a good investment?

The latest financial results were strong: Revenue for the first half was up 13.6% to $355.6 million, EBITDA was up 30.6% at $238 million, and NPAT was up 78% to $60.8 million. And this is reflected in the balance sheet. SFR has no debt and $463 million in the bank. Sandfire is currently a single mine company.

Who owns sandfire resources?

Sandfire – originally called Borroloola Resources – was a private little company established in the early 2000s by current chief exec Karl Simich, prospector Graeme Hutton, and mining entity Miles Kennedy.

How much copper is sandfire?

According to Sandfire's preliminary 2021 financial year production, the company produced 70,845 tonnes of contained copper above its guidance range of 67,000 to 70,000 tonnes.

What do sandfire resources do?

Sandfire Resources is an international and diversified sustainable mining company which is listed on the Australian Securities Exchange (ASX).

Who owns Aeris resources?

Aeris Resources is not owned by hedge funds. The company's largest shareholder is Tudor Court Limited, with ownership of 20%. GSCO - ECA Resource Geologic Partners is the second largest shareholder owning 12% of common stock, and SG Hiscock & Company Ltd. holds about 7.7% of the company stock.

Who owns Regis Resources?

The company's largest shareholder is Van Eck Associates Corporation, with ownership of 11%. With 6.1% and 5.0% of the shares outstanding respectively, AllianceBernstein L.P. and BlackRock, Inc. are the second and third largest shareholders.

Is Sandfire Resources a buy right now?

2 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Sandfire Resources in the last year. There are currently 2 hold r...

Are investors shorting Sandfire Resources?

Sandfire Resources saw a increase in short interest during the month of April. As of April 15th, there was short interest totaling 233,100 shares,...

What price target have analysts set for SFRRF?

2 Wall Street analysts have issued 1-year target prices for Sandfire Resources' stock. Their forecasts range from $6.00 to $6.00. On average, they...

Who are Sandfire Resources' key executives?

Sandfire Resources' management team includes the following people: Mr. Karl Matthew Simich B.Com. , B.Comm, FCA, ASIA, F Fin, MD, CEO & Exec. Dir...

Who are some of Sandfire Resources' key competitors?

Some companies that are related to Sandfire Resources include Admiralty Resources (ADY) , Aeon Metals (AML) , Apollo Minerals (AON) , Archer Ma...

What is Sandfire Resources' stock symbol?

Sandfire Resources trades on the OTCMKTS under the ticker symbol "SFRRF."

How do I buy shares of Sandfire Resources?

Shares of SFRRF can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBu...

What is Sandfire Resources' stock price today?

One share of SFRRF stock can currently be purchased for approximately $3.62.

How many employees does Sandfire Resources have?

Sandfire Resources employs 251 workers across the globe.

Is Sandfire Resources America a buy right now?

2 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Sandfire Resources America in the last year. There are currently 2 sell ra...

Are investors shorting Sandfire Resources America?

Sandfire Resources America saw a decline in short interest in May. As of May 15th, there was short interest totaling 43,700 shares, a decline of 40...

Who are Sandfire Resources America's key executives?

Sandfire Resources America's management team includes the following people: Mr. Robert Scargill , Pres, CEO & Director Ms. Nancy Schlepp , VP of...

Who are some of Sandfire Resources America's key competitors?

Some companies that are related to Sandfire Resources America include Accelerate Resources (AX8) , Aclara Resources (ARA.TO) , Aclara Resources...

What is Sandfire Resources America's stock symbol?

Sandfire Resources America trades on the OTCMKTS under the ticker symbol "SRAFF."

How do I buy shares of Sandfire Resources America?

Shares of SRAFF can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBu...

What is Sandfire Resources America's stock price today?

One share of SRAFF stock can currently be purchased for approximately $0.12.

What is Sandfire Resources America's official website?

The official website for Sandfire Resources America is www.sandfireamerica.com .

What is the ticker symbol for Sandfire Resources?

Sandfire Resources America trades on the OTCMKTS under the ticker symbol "SRAFF."

What is Sandfire Resources America's stock symbol?

Sandfire Resources America trades on the OTCMKTS under the ticker symbol "SRAFF."

Where are Sandfire Resources America's headquarters?

Sandfire Resources America is headquartered at 595 Howe Street, Vancouver, BC V6C.

What is MarketBeat community ratings?

MarketBeat's community ratings are surveys of what our community members think about Sandfire Resources America and other stocks. Vote “Outperform” if you believe SRAFF will outperform the S&P 500 over the long term. Vote “Underperform” if you believe SRAFF will underperform the S&P 500 over the long term. You may vote once every thirty days.

Where is Sandfire Resources located?

The company explores for copper, cobalt, zinc, lead, and silver deposits. Its flagship property is the Black Butte copper project that consists of approximately 7,684 acres of fee-simple lands and 4,541 acres in 239 Federal unpatented lode-mining claims located in central Montana, the United States. The company was formerly known as Tintina Resources Inc. and changed its name to Sandfire Resources America Inc. in January 2018. The company was founded in 1998 and is headquartered in Vancouver, Canada. Sandfire Resources America Inc. is a subsidiary of Sandfire Resources NL.

Is Sandfire Resources America a hold?

Wall Street analysts have given Sandfire Resources America a "Hold" rating, but there may be better buying opportunities in the stock market . Some of MarketBeat's past winning trading ideas have resulted in 5-15% weekly gains. MarketBeat just released five new stock ideas, but Sandfire Resources America wasn't one of them.

Does Sandfire pay dividends?

Sandfire Resources America does not currently pay a dividend.

SFRRF Target Price

SFRRF price target in 14 days: 5.489 USD* upside and 4.940 USD* downside. (Highest and lowest possible predicted price in a 14 day period)

Sandfire Resources Limited ( SFRRF ) Stock Market info

Recommendations: Buy or sell Sandfire Resources stock? Wall Street Stock Market & Finance report, prediction for the future: You'll find the Sandfire Resources share forecasts, stock quote and buy / sell signals below.

Sandfire Resources Limited ( SFRRF ) Stock Price Prediction, Stock Forecast for next months and years

Short-term and long-term SFRRF (Sandfire Resources Limited) stock price predictions may be different due to the different analyzed time series.

Who is Sandfire Resources Limited?

Sandfire Resources Limited explores for, evaluates, and develops mineral tenements and projects in Australia and internationally.

Where is Sandfire located?

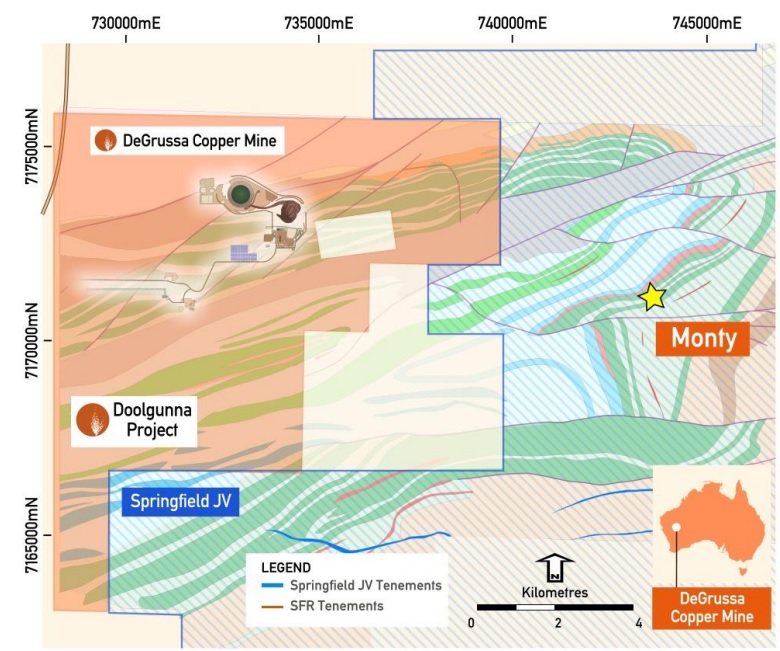

Sandfire Resources Limited explores for, evaluates, and develops mineral tenements and projects in Australia and internationally. It primarily explores for copper, gold, and silver, as well as sulphide deposits. The company owns a 100% interest in the DeGrussa copper-gold mine located in the Bryah Basin mineral province of Western Australia; and 87% interest in the Black Butte copper project situated in central Montana, the United States.

How long has SFR been paying dividends?

Stability and Growth of Payments. Stable Dividend: SFR has been paying a dividend for less than 10 years and during this time payments have been volatile. Growing Dividend: SFR's dividend payments have increased, but the company has only paid a dividend for 7 years.

What is SFR trading?

Significantly Below Fair Value: SFR is trading below fair value, but not by a significant amount.

How long is SFR management experience?

Experienced Management: SFR's management team is not considered experienced ( 1.3 years average tenure), which suggests a new team.

How long will SFR's return on equity be low?

Future ROE: SFR's Return on Equity is forecast to be low in 3 years time (5.2%).

Who bought Matsa mines?

(MATSA) from Mubadala Investment Company PJSC and Trafigura Pte Ltd for $1.9 billion on September 23, 2021. The agreed transaction delivers Sandfire the MATSA mining complex in Spain, which comprises the Aguas Teñidas, Magdalena and Sotiel underground mines, and a 4.7Mtpa central processing facility at Aguas Teñidas. Consideration will be paid in cash. Sandfire has agreed to pay $300 million deposit of which $100 million is paid on signing of the agreement and $200 million to be paid 10 business days thereafter. Sandfire to fund the transaction from $905 million fully underwritten equity raising consisting of; AUD 120 million ($87 million) of the Placement to AustralianSuper, AUD 165 million ($120 million) of institutional placement and AUD 963 million ($698 million) 1 for 1 accelerated non-renounceable entitlement offer; $650 million syndicated and underwritten debt facility secured against MATSA; $145 million corporate debt facility secured against DeGrussa and $215 million funded through existing cash reserves. AustralianSuper to further sub-underwrite up to AUD 150 million ($108.75 million) of the Retail Entitlement Offer. Entitlement Offer consists of AUD 626 million ($454 million) of Institutional Entitlement Offer and AUD 337 million ($244 million) of Retail Entitlement Offer. Sandfire has entered into a binding credit-approved underwritten commitment letter and term sheet with Citi, Macquarie Bank, Natixis and Société Générale to provide the $650 million syndicated and underwritten debt facility. Natixis and Société Générale are existing lenders to MATSA and drawdown is expected to occur on completion of the transaction. The syndicated debt facility fully amortises over its scheduled term (5 years from drawdown) and contains customary provisions including a cash sweep. The facility is expected to be fully repaid within 4 years of drawdown due to forecast strong cashflows from MATSA. Sandfire has also entered into a binding credit-approved commitment letter and term sheet with ANZ to provide a $145 million corporate debt facility. This is a short-term facility for ~12 months, supported by DeGrussa cash flows over its remaining mine life, with recourse to Sandfire. The syndicated and ANZ debt facilities include a number of conditions precedent to drawdown which are customary for facilities of this nature, including completion of full form documentation. As a part of equity raising, Sandfire to issue approximately 231 million new fully paid ordinary shares at an issue price of AUD 5.4 ($3.915) per share. Consideration implies an acquisition multiple of 4.8x MATSA’s FY21A EBITDA of $387 million. Sandfire intends to retain MATSA’s highly experienced in-country management team. The transaction is subject to key conditions precedent including Spanish Foreign Direct Investment, which is expected to take 3-6 months and Anti-trust Merger approval. The transaction is expected to complete in the March 2022 quarter. The acquisition of MATSA is expected to be accretive to Sandfire’s earnings and cash flow per share in its first full year of ownership (FY23), transforming Sandfire’s growth trajectory and providing a cornerstone asset with an anticipated mine life of over 10 years. Citigroup Global Markets Australia Pty Ltd and Macquarie Capital (Australia) Limited are acting as Joint Lead Managers and Underwriters to the Placement and Entitlement Offer. Natixis Wealth Management acted as financial advisor to the board of Sandfire. Macquarie Group Limited (ASX:MQG) acted as financial advisor and Allen & Overy LLP acted as legal advisor to Sandfire. BurnVoir Corporate Finance as debt advisor and Gilbert + Tobin acted as legal advisor to Sandfire in respect of the Equity Raising.

What is fair value in accounting?

Fair Value is the appropriate price for the shares of a company, based on its earnings and growth rate also interpreted as when P/E Ratio = Growth Rate. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected.

Do Institutions Own Sandfire Resources Limited (ASX:SFR) Shares?

A look at the shareholders of Sandfire Resources Limited ( ASX:SFR ) can tell us which group is most powerful...