What happened to RJR Nabisco stock?

The RJR stock symbol would persist until 1988, when the company, which merged with Nabisco in 1986, would be taken private in a leveraged buyout (LBO) by private equity firm KKR, documented in the famous book Barbarians at the Gate: The Fall of RJR Nabisco.

Why did Johnson buy back Nabisco stock?

When RJR Nabisco's price continued to languish, Johnson began buying back shares to try and force up the price—spending $1.1 billion in the process—but the price dropped back down again. Johnson feared the low stock price would attract corporate raiders, so he began building defenses.

Will RJR Nabisco be sold to Kolberg Kravis?

Kolhberg, Kravis begins its tender offer for $90 a share. Oct. 28: RJR Nabisco agrees to give Kolberg, Kravis confidential financial data about its operations. Nov. 1: RJR's chairman, Charles E. Hugel, said it is highly likely that the company will be sold. Stock rises $1.25, to $85 a share.

When did Nabisco become a publicly traded company?

On March 21, 1991, RJR Nabisco Holdings Corp. became a publicly traded stock. In March 1999, RJR Nabisco announced the sale of the international division of R. J. Reynolds Tobacco, and in June of that year, the company sold the remainder of R. J. Reynolds Tobacco to stockholders.

How much money did KKR lose on RJR Nabisco?

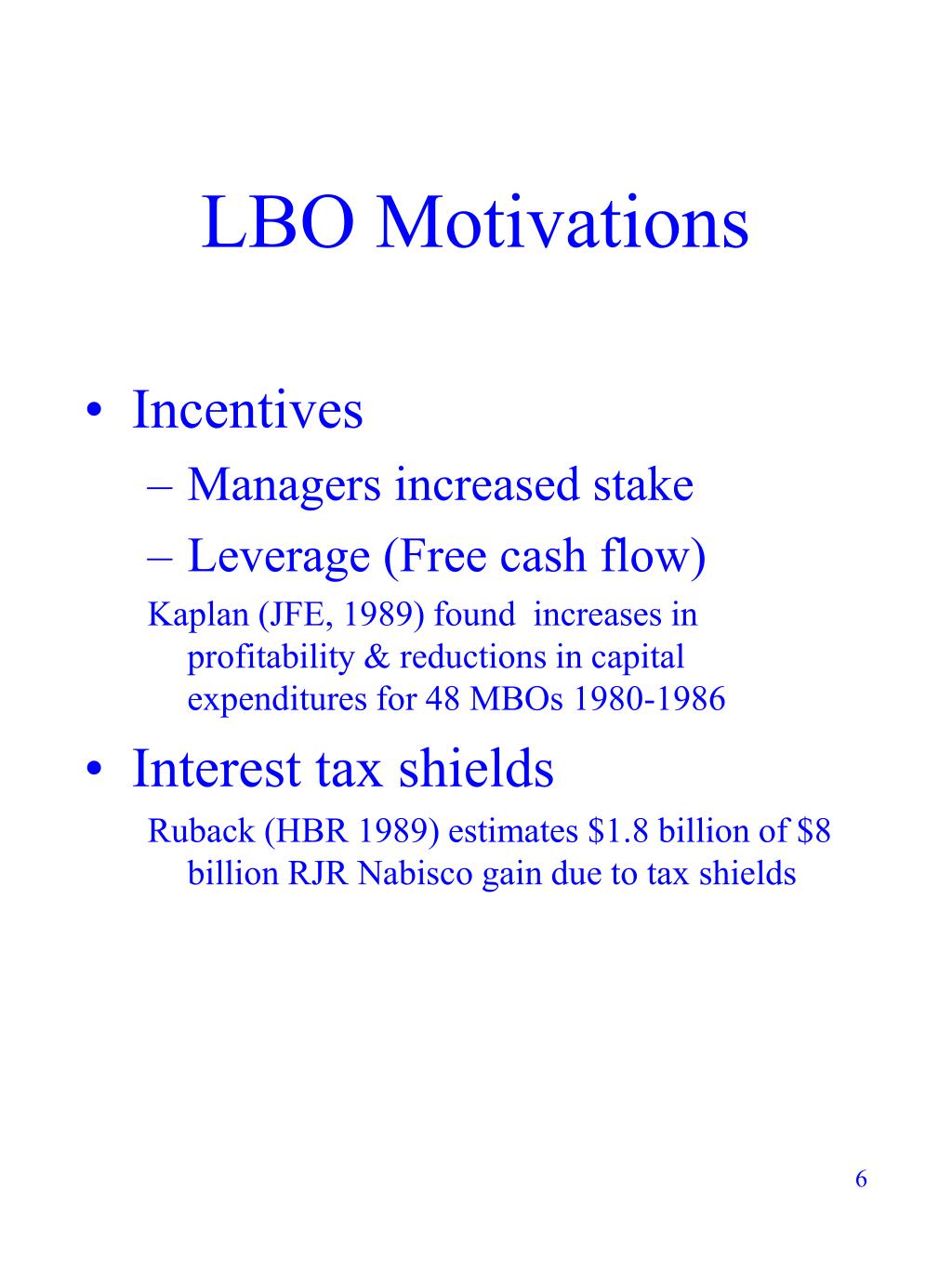

Kohlberg Kravis's equity investment of $3.5 billion came from its 1987 fund, which raised a total of $5.6 billion from institutional investors. That fund will wind up losing $730 million on the RJR Nabisco and Borden investments, according to one person who has been briefed on the details of Kohlberg Kravis finances.

What happened to RJR Nabisco after the buyout?

Johnson's offer touched off a bidding war for RJR Nabisco. A decade later, RJR Nabisco didn't exist. The tobacco division was sold off and Nabisco became part of General Foods. It is now part of the Mondelez conglomerate.

How much did RJR Nabisco sell for?

plans to put only a little more than $15 million of its own money into the $25 billion purchase of RJR Nabisco Inc., according to sources familiar with the way the takeover firm is financing the biggest acquisition ever of a U.S. company.

When did RJR buy Nabisco?

In 2000, Philip Morris bought Nabisco Holdings. Soon after that, R. J. Reynolds Tobacco Holdings, Inc., first traded in June 1999, announced the acquisition of Nabisco Group Holdings. The deal was completed in December 2000.

What is the largest LBO in history?

The largest leveraged buyout in history was valued at $32.1 billion, when TXU Energy turned private in 2007.

Why did RJR Nabisco Want to go private?

Ross Johnson, RJR Nabisco's chief executive, told the board that the company's share price simply did not reflect the inherent worth of its businesses and that he wanted to take it private to release that pent-up value.

What firm won the bidding war for RJR Nabisco?

With a stunning, eleventh-hour bid of about $24.5 billion, the nation's leading corporate buyout firm late Wednesday won control of tobacco and food giant RJR Nabisco and brought to a close the biggest takeover battle in corporate history.

How much is Nabisco worth?

Reynolds Tobacco Holdings Inc., based in Winston-Salem, N.C., will pay $30 a share, or $9.8 billion, to acquire Nabisco Group Holdings . The holding company's sole asset is its 80.6% ownership of the food company, so it will become a cash-filled shell of $11.7 billion.

What was KKR's return on RJR Nabisco?

A footnote chimes in: “The 1987 fund includes KKR's investment in RJR Nabisco/Borden. Excluding this investment, the fund would have returned 25.2 percent.” To most observers, this alone would seem to vindicate popular accounts that KKR's buyout of the food and tobacco conglomerate was a flop.

Is Nabisco on the NYSE?

NABISCO is owned by Mondelez International, listed on the stock exchange of New York NABISCO belongs to the Consumer Packaged Goods business sector.

Was RJR Nabisco a hostile takeover?

Its holdings make it the second-largest U.S. conglomerate, behind only General Electric Co., in annual revenue. The RJR Nabisco win is Kohlberg Kravis` first hostile takeover. The firm had made a number of bids for other companies this year but had been unsuccessful until Wednesday night.

Does Nabisco still exist?

Nabisco (/nəˈbɪskoʊ/, abbreviated from the earlier name National Biscuit Company) is an American manufacturer of cookies and snacks headquartered in East Hanover, New Jersey....Nabisco.FormerlyNational Biscuit Company (1898–1971) Nabisco (1971–85) RJR Nabisco (1985–99)FateAcquired by R.J. Reynolds in 1985, then other owners11 more rows

What was KKR's return on RJR Nabisco?

A footnote chimes in: “The 1987 fund includes KKR's investment in RJR Nabisco/Borden. Excluding this investment, the fund would have returned 25.2 percent.” To most observers, this alone would seem to vindicate popular accounts that KKR's buyout of the food and tobacco conglomerate was a flop.

Was RJR Nabisco a good LBO target?

RJR Nabisco's operations exhibited moderate and consistent growth, required little capital investment and carried low debt levels. All these features made it a particularly attractive LBO candidate. Though it had problems of declining ROA and falling inventory turnover, they appeared fixable.

What happened Nabisco?

acquired Nabisco and merged it with Kraft Foods in one of the largest mergers in the food industry. In 2011, Kraft Foods announced that it was splitting into a grocery company and a snack food company. Nabisco became part of the snack-food business, which took the name Mondelēz International.

What company took over Nabisco?

1993 Kraft General Foods acquires NABISCO ready-to-eat cold cereals from RJR Nabisco. 2000 Philip Morris Companies, Inc. acquires Nabisco and merges it with Kraft Foods, Inc.

What was the RJR Nabisco buyout?

The RJR Nabisco leveraged buyout was, at the time, widely considered to be the preeminent example of corporate and executive greed. Bryan Burrough and John Helyar published Barbarians at the Gate: The Fall of RJR Nabisco, a successful book about the events which was later turned into a television movie for HBO .

Who owns RJR Nabisco?

In 1988 RJR Nabisco was purchased by Kohlberg Kravis Roberts & Co. in what was at the time the largest leveraged buyout in history. In 1999, due to concerns about tobacco lawsuit liabilities, the tobacco business was spun off into a separate company, and RJR Nabisco was renamed Nabisco Holdings Corporation. Nabisco is currently owned by Mondelēz International Inc .

Why did RJR Nabisco move to Atlanta?

After ruling out New York City and Dallas, the company decided on Atlanta because it was "nouveau riche and overbuilt". On January 15, 1987, the RJR Nabisco board approved a headquarters move from Winston-Salem to Cobb County, Georgia, north of Atlanta, where the company had rented space.

How much did Johnson get from the RJR buyout?

Johnson received compensation worth more than $60 million from the buyout, then left in February 1989. In March 1989, Louis V. Gerstner of American Express became the new head of RJR Nabisco.

When did RJR Nabisco fire Saatchi and Saatchi?

Advertising controversy. In April 1988 , RJR Nabisco fired the Saatchi & Saatchi advertising agency after their Northwest Airlines ad introducing the airline's in-flight smoking ban. This was despite the agency only being contracted for Nabisco products, not any tobacco products.

When did RJR Nabisco move to Wake Forest?

RJR Nabisco donated the 519,000-square-foot World Headquarters Building to Wake Forest University but continued to use it until the September 1987 move. Later, RJR Nabisco's Planters - Life Savers Division moved to the former headquarters building.

Where is RJR Nabisco located?

RJR Nabisco, Inc., was an American conglomerate, selling tobacco and food products, headquartered in the Calyon Building in Midtown Manhattan, New York City. RJR Nabisco stopped operating as a single entity in 1999; however, both RJR (as R. J. Reynolds Tobacco Company) and Nabisco (now part of Mondelēz International) still exist.

The Original: RJR (c. 1927 – 1988)

The original use of the RJR stock ticker covered its many years as a successful tobacco company headquartered in Winston-Salem, NC. During this period, the company harvested the gains from seeds planted in the previous century including the advent of the Camel cigarette brand and a dominant early position in the chewing tobacco market.

The RJR Nabisco Years: RN (1991 – 1999)

After nearly three years as a privately held company and the loss of many its brands and minority investment stakes (including a 20% share of ESPN), RJR Nabisco reemerged as a public company in 1991 trading under the stock ticker RN.

The Return: RJR (1999 – 2004)

RJR returned to the public markets in 1999, refocused on its domestic tobacco businesses, including famous brands ranging from Camel, Newport, Winston and Doral.

Reynolds American Merger: RAI (2004 – 2017)

The new RJR years didn’t last long, however. In 2004 the company announced a merger with Brown & Williamson, a subsidiary of British American Tobacco to merge its US-based tobacco businesses. The new publicly traded company would trade under the stock symbol: RAI.

British American Tobacco Takeover: BTI (2017 – Present)

After an initial failed bid, British American Tobacco succeeded in taking over the remaining 58% of Reynolds American it did not already own in 2017. As a result, the RAI stock symbol would cease to trade and RJ Reynolds would now become a subsidiary of British American Tobacco and trade under the ticker BTI, as it still does today.

Who bought RJR Nabisco?

LBO firm, KKR acquired RJR Nabisco for $25 billion for one the largest leveraged buyouts in U.S. history and ousted Johnson as CEO.

Why did RJR Nabisco crash?

It took a huge hit in the 1987 crash, dipping from around $70 per share to the low $40s. Johnson believed that the bad publicity of tobacco products was holding back the profitable foods division of the company. He started putting feelers out for merger candidates and asking investment bankers for ideas. Several suggested a leveraged buyout (LBO) with shareholders taking up the tobacco business and Johnson and his management taking Nabisco private. Johnson initially didn't like this idea because owing money to a bank would bring oversight, thus forcing him to rein in his rapacious spending.

What happened after the Nabisco deal?

After the deal, RJR Nabisco continued to get juggled about. KKR cut jobs and divisions, spinning the international tobacco business off to Japan Tobacco. The domestic parts, both tobacco and food, were separated and recombined in a shuffle involving almost as many players as the original dance—even Carl Icahn was in there.

Why did Johnson buy back Nabisco?

When RJR Nabisco's price continued to languish, Johnson began buying back shares to try and force up the price—spending $1.1 billion in the process —but the price dropped back down again. Johnson feared the low stock price would attract corporate raiders , so he began building defenses. In the meantime, Kravis started to wonder about Johnson's lack of follow up on his proposal. Kravis started to run numbers on taking over RJR Nabisco.

When did Nabisco merge with Standard?

Nabisco Brands was already a merged company created in 1981 by joining food companies Standard Brands and Nabisco. The CEO of the original Standard Brands, F. Ross Johnson, had managed to stay on through the merger and wrest control of the new entity. Johnson had established a clear M.O., despite only holding the CEO post at two companies.

How much did Johnson buy out?

Johnson's greed stunned everyone involved, including the investment banking team that was working with him. Johnson offered a buyout at $75 a share or $17.6 billion. The board refused outright—they were shocked to find a black knight on their own payroll. The board issued a press release, putting the company into play while they considered their options.

Did Johnson have a bigger larder?

With RJR Nabisco, Johnson had a much bigger larder to raid. The salaries and perks of the management quickly grew to outsized proportions. When Johnson ran into troubles with the new board chair for his growing expense, Johnson managed to get the chair switched and began filling key positions with sympathetic friends.

When was RJR Nabisco formed?

RJR Nabisco was formed in 1985 when Nabisco merged with RJ Reynolds tobacco. YouTube. By 1988, the time of the LBO, the company was lead by CEO F. Ross Johnson. Originally from Canada, Johnson was known for a risky, bold decision making process inside the board room and a lavish lifestyle outside of it.

When did Johnson take RJR private?

Three years later, Johnson decided to take company private. He proposed a $17 million LBO on October 20th. He made the announcement on October 20th, 1988. Company shares rose sharply on the news, though critics were skeptical about the move because it meant that RJR would have to fund its ventures with borrowed money.

How much did Kravis bid on Nabisco?

RJR Nabisco management and Kohlberg, Kravis deliver bids of of $22.7 billion and $21.3 billion.

How much was the 1988 LBO?

You could say that the story of RJR Nabisco's 1988 LBO is an example of that. At $24 billion, it was the biggest deal of its time and had every bank and private equity firm on Wall Street scrambling to get a piece of the action in October and November of 1988. The deal was also eventually immortalized in a book and a movie, ...

How much did Ross Johnson get from the buyout?

F. Ross Johnson received $53 million from the buyout, $23 million after taxes.

What firm did not enter the race?

Meanwhile, PE firm Forstmann Little played with entering the race, but ultimately decided not to, which caused the stock to plummet.