Does RHHBY pay dividends?

RHHBY pays a dividend of $0.79 per share. RHHBY's annual dividend yield is 1.89%. When is Roche Holding ex-dividend date? Roche Holding's previous ex-dividend date was on Mar 16, 2022.

Should I invest in Roche?

Roche Holding AG (RHHBY) could be a solid choice for investors given its recent upgrade to a Zacks Rank #1 (Strong Buy). This upgrade primarily reflects an upward trend in earnings estimates, which is one of the most powerful forces impacting stock prices.

Can you buy Roche stock in US?

The Roche ADRs trade, clear and settle just like any U.S.-listed company shares and can be bought or sold through any U.S. registered brokerage (including online brokerages such as TD Ameritrade, E-Trade, Scottrade, etc.).

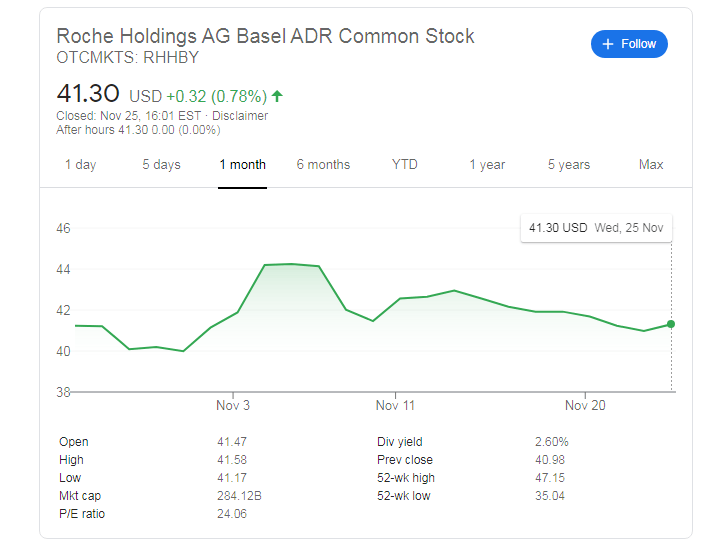

What is Roche market cap?

As of July 2022 Roche has a market cap of $337.85 Billion. This makes Roche the world's 19th most valuable company by market cap according to our data.

Is Roche a good stock to buy 2021?

The drug garnered $662 million in 2021, and it will likely be a blockbuster drug this year. On the diagnostics side, Roche is likely to see a pickup in routine diagnostics over the coming quarters, but it is unlikely to offset the expected decline from Covid-19 related testing.

What is Genentech stock price?

Stock market history ROCHE HOLDING (GENENTECH)XPriceJun 2, 2022323.35Jun 1, 2022322.7May 31, 2022326.4May 30, 2022330.7214 more rows

What Exchange is Roche listed on?

SIX Swiss ExchangeRoche's non-voting equity securities and Roche bearer shares are listed on SIX Swiss Exchange.

How are ADR dividends paid?

Investors who purchase the ADRs are paid dividends in US dollars. The foreign bank pays dividends in the native currency, and the dealer/broker distributes the dividends in US dollars after factoring in currency conversion costs and foreign taxes.

What sector is Roche?

Roche Holding AG operates as a research healthcare company. It operates through the following divisions: Pharmaceuticals and Diagnostics. The Pharmaceutical division comprises the business segments, such as Roche Pharmaceuticals and Chuga.

Why Roche is a good company?

Roche is a global pioneer in pharmaceuticals and diagnostics focused on advancing science to improve people's lives. The combined strengths of pharmaceuticals and diagnostics, as well as growing capabilities in the area of data-driven medical insights help Roche deliver truly personalized healthcare.

How often does Roche pay a dividend?

Roche pays a dividend 1 times a year. The payment month is March.

Who is Roche owned by?

Roche is the third-largest pharma company worldwide. Descendants of the founding Hoffmann and Oeri families own slightly over half of the bearer shares with voting rights (a pool of family shareholders 45%, and Maja Oeri a further 5% apart), with Swiss pharma firm Novartis owning a further third of its shares.

Will Roche stock go up?

The 20 analysts offering 12-month price forecasts for Roche Holding AG have a median target of 48.14, with a high estimate of 56.91 and a low estimate of 42.00. The median estimate represents a +15.65% increase from the last price of 41.63.

Is Roche a buy or sell?

Roche has received a consensus rating of Hold. The company's average rating score is 2.33, and is based on 5 buy ratings, 6 hold ratings, and 1 sell rating.

Is Genentech stock publicly traded?

The Wall Street Journal called it “one of the most spectacular market debuts in recent history.” Genentech—trading then under the symbol GENE—was the first biotechnology company to go public, and set the pace for a series of heady biotech IPOs that defined the era.

What is Otcqx best market?

What Is the OTCQX?The OTCQX is the highest quality tier of OTC markets and offers trading in companies that are not listed on traditional exchanges.Companies listed on the OTCQX markets have to follow certain rules and criteria and are subject to SEC regulation.More items...

Blueprint Medicines (BPMC) Q4 Loss Widens, Revenues Top Mark

Why ProQR Therapeutics Is Crashing Today

Blueprint Medicines (BPMC) misses on earnings while revenue beat estimates for the fourth quarter of 2021. Stock down.

Stock Price Forecast

Sepofarsen's failure to meet efficacy endpoints in the Illuminate trial isn't sitting well with investors.

Analyst Recommendations

The 19 analysts offering 12-month price forecasts for Roche Holding AG have a median target of 54.18, with a high estimate of 63.49 and a low estimate of 44.89. The median estimate represents a +16.09% increase from the last price of 46.67.

Roche Holding AG Stock Forecast

The current consensus among 23 polled investment analysts is to Buy stock in Roche Holding AG. This rating has held steady since February, when it was unchanged from a Buy rating. Move your mouse over past months for detail

Will Roche Holding AG Stock Go Up Next Year?

Over the next 52 weeks, Roche Holding AG has on average historically risen by 5 % based on the past 23 years of stock performance.

Roche Holding AG Stock Price History

Over the next 52 weeks, Roche Holding AG has on average historically risen by 5% based on the past 23 years of stock performance.

Stock Predictions

Based on the share price being below its 5, 20 & 50 day exponential moving averages, the current trend is considered strongly bearish and RHHBY is experiencing selling pressure, which indicates risk of future bearish movement.

Roche Holdings Naive Prediction Price Forecast For the 4th of February

Is Roche Holding AG stock public? Yes, Roche Holding AG is a publicly traded company.

Roche Holdings Forecasted Value

Given 90 days horizon, the Naive Prediction forecasted value of Roche Holdings on the next trading day is expected to be 49.59 with a mean absolute deviation of 0.42, mean absolute percentage error of 0.27, and the sum of the absolute errors of 25.72.

Model Predictive Factors

In the context of forecasting Roche Holdings' OTC Stock value on the next trading day, we examine the predictive performance of the model to find good statistically significant boundaries of downside and upside scenarios. Roche Holdings' downside and upside margins for the forecasting period are 48.46 and 50.73, respectively.

Predictive Modules for Roche Holdings

The below table displays some essential indicators generated by the model showing the Naive Prediction forecasting method's relative quality and the estimations of the prediction error of Roche Holdings otc stock data series using in forecasting.

Other Forecasting Options for Roche Holdings

There are currently many different techniques concerning forecasting the market as a whole, as well as predicting future values of individual securities such as Roche Holdings. Regardless of method or technology, however, to accurately forecast the stock or bond market is more a matter of luck rather than a particular technique.

View Currently Related Equities

For every potential investor in Roche, whether a beginner or expert, Roche Holdings' price movement is the inherent factor that sparks whether it is viable to invest in it or hold it better. Roche OTC Stock price charts are filled with many 'noises.' These noises can hugely alter the decision one can make regarding investing in Roche.

Roche Holdings Technical and Predictive Analytics

One of the popular trading techniques among algorithmic traders is to use market-neutral strategies where every trade hedges away some risk. Because there are two separate transactions required, even if one position performs unexpectedly, the other equity can make up some of the losses.

Weekly Stock List

The stock market is financially volatile. Despite the volatility, there exist limitless possibilities of gaining profits and building passive income portfolios. With the complexity of Roche Holdings' price movements, , a comprehensive understanding of forecasting methods that an investor can rely on to make the right move is invaluable.

The Argus Min Vol Model Portfolio

The onset of the coronavirus in 2020 knocked stocks into a bear market. Though equities have recovered, the U.S. economy is about to slow down and COVID-19 cases are rising again as virus variants spread. Volatility, which has dropped from the highs of 2020, still has not returned to pre-COVID levels.

Market Digest: CSX, INCY, SLB, STT, RHHBY

The onset of the coronavirus in 2020 knocked stocks into a bear market. Though equities recovered, the U.S. economy is about to slow down and COVID-19 cases are rising again as virus variants spread. Volatility, which has dropped from the highs of 2020, still has not returned to pre-COVID levels.

Weekly Stock List

While stocks continue to trade downward, insider sentiment remains generally benign. Indeed, the overall Insider Index from Vickers Stock Research is resting at its most-attractive level since November 2020. Broadly speaking, insiders have maintained a sense of calm during the selloff, with data from Vickers suggesting no panic.

Daily Spotlight: U.S. Stocks Priced at Premium to Global Stocks

In our view, the Life Sciences segment of the U.S. Healthcare industry is poised for strong growth over the next few years. This is the part of the industry that is developing the next generation of gene therapies, oncology biologics, and vaccines.

Market Update: ETR, NTAP, TOL, RHHBY

As global markets are recovering from the onset of COVID-19 and the global recession, one thing has not changed. U.S. stocks are more expensive than global stocks on numerous valuation metrics. Consider P/E ratios.

Weekly Stock List

Stocks rose on Monday morning, led by the Technology and Consumer Discretionary sectors, on continued optimism that the Fed would be cautious and measured in tapering bond purchases. On the housing front, sales contracts for previously owned homes declined for a second month.

Pre-Market Trades

Dividends are supposed to lend stability to a portfolio. However, U.S.-based equity income investors have experienced a high degree of volatility in recent years. In 2018, the Federal Reserve embarked on an aggressive campaign to raise interest rates, causing Treasury yields to swoop and dive and resulting in a wild ride for supposedly stable U.S.

About Pre-Market Quotes

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET). Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may also move more quickly in this environment.