What is the upside for Realogy stock?

On average, they expect Realogy's stock price to reach $11.2857 in the next year. This suggests a possible upside of 84.1% from the stock's current price. View Analyst Price Targets for Realogy.

Where can I buy Realogy shares?

Shares of RLGY can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here. What is Realogy's stock price today?

Is Realogy efficiently growing its dividend?

Realogy does not have a long track record of dividend growth. In the past three months, Realogy insiders have not sold or bought any company stock. Only 1.90% of the stock of Realogy is held by insiders. Earnings for Realogy are expected to decrease by -14.77% in the coming year, from $2.98 to $2.54 per share.

Do analysts agree on Realogy's (Rogy) price targets?

The company's average rating score is 3.00, and is based on 3 buy ratings, no hold ratings, and no sell ratings. According to analysts' consensus price target of $24.00, Realogy has a forecasted upside of 43.8% from its current price of $16.69.

Is realogy a good stock to buy?

Realogy Holdings Corp finds support from accumulated volume at $9.95 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested. Our recommended stop-loss: $9.80 (-3.70%) (This stock has low daily movements and this gives low risk.

What companies does realogy own?

Realogy also owns the franchisors of the BETTER HOMES & GARDENS® REAL ESTATE, COLDWELL BANKER®, COLDWELL BANKER COMMERCIAL®, THE CORCORAN GROUP®, CENTURY 21®, ERA®, AND SOTHEBY'S INTERNATIONAL REALTY® franchise systems.

Is realogy a REIT?

Anywhere Real Estate Inc., formerly Realogy (/ˈriːlədʒi/), is an American publicly owned real estate services company....Anywhere Real Estate.TypePublicTraded asNYSE: HOUS S&P 600 componentIndustryReal estateFounded2006HeadquartersMadison, New Jersey, U.S.13 more rows

Who owns Realogy Holdings Corp?

Anywhere Real EstateAnywhere Real Estate / Parent organization

Is Realogy a Fortune 500 company?

MADISON, N.J., May 16, 2019 /PRNewswire/ -- For the sixth consecutive year, Realogy Holdings Corp. (NYSE: RLGY), the largest full-service residential real estate services company in the United States, today was named to the Fortune 500, Fortune magazine's annual list of the largest U.S. companies by revenue.

Is CBRE owned by Realogy?

“CBRE Group History In 1989, in a leveraged buyout, CB Commercial was spun off from Coldwell Banker as a privately held company, CB Commercial Real Estate Group Inc., which, after financial difficulties, was later acquired by Realogy.

Did realogy change their name?

MADISON, N.J. , June 9, 2022 /PRNewswire/ -- Anywhere Real Estate Inc. (NYSE: HOUS), a global leader in residential real estate services (formerly known as Realogy Holdings Corp.), today announced the completion of the corporate rebrand.

Who owns Coldwell Banker?

Anywhere Real EstateColdwell Banker / Parent organization

Who is the CEO of realogy?

Ryan M. Schneider (Dec 31, 2017–)Anywhere Real Estate / CEOAlthough his vision of a digitized real estate transaction started well before the pandemic, Realogy CEO Ryan Schneider has spent the past two years accelerating his vision of a seamless transaction experience led, of course, by Realogy and its six franchise brands.

What does Realogy Holdings Corp do?

Realogy Holdings Corp. is a preeminent and integrated provider of residential real estate services in the U.S. It operates through the following business segments: Real Estate Franchise Services, Company Owned Real Estate Brokerage Services, Relocation Services, and Title and Settlement Services.

Is realogy a good company to work for?

Is Realogy a good company to work for? Realogy has an overall rating of 3.7 out of 5, based on over 514 reviews left anonymously by employees. 63% of employees would recommend working at Realogy to a friend and 61% have a positive outlook for the business. This rating has improved by 5% over the last 12 months.

New York Stock Exchange

Environmental, Social, and Governance Rating

Provides residential real estate services and technology to independent sales agents.

Business Summary

"B" score indicates good relative ESG performance and an above-average degree of transparency in reporting material ESG data publicly and privately. Scores range from AAA to D.

Realogy (NYSE:RLGY) Price Target and Consensus Rating

Provides residential real estate services and technology to independent sales agents.

Analyst Ratings By Month

MarketBeat calculates consensus analyst ratings for stocks using the most recent rating from each Wall Street analyst that has rated a stock within the last twelve months. Each analyst's rating is normalized to a standardized rating score of 1 (sell), 2 (hold), 3 (buy) or 4 (strong buy).

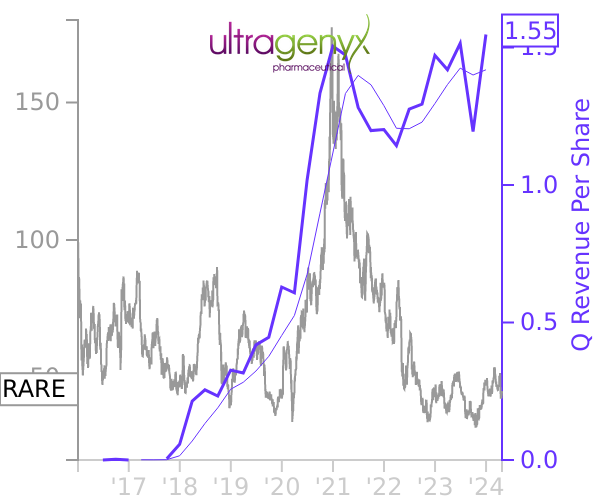

Average Share Price and Price Target by Month

The chart below shows how a company's ratings by analysts have changed over time. Each bar represents the previous year of ratings for that month. Within each bar, the sell ratings are shown in red, the hold ratings are shown in yellow, the buy ratings are shown in green, and the strong buy ratings are shown in dark green.

Realogy (NYSE:RLGY) Analyst Ratings Frequently Asked Questions

The chart below shows how a company's share price and consensus price target have changed over time. The dark blue line represents the company's actual price. The lighter blue line represents the stock's consensus price target.

Is RLGY upside or downside?

According to the issued ratings of 3 analysts in the last year, the consensus rating for Realogy stock is Buy based on the current 3 buy ratings for RLGY. The average twelve-month price target for Realogy is $22.75 with a high price target of $28.00 and a low price target of $19.00. Learn more on RLGY's analyst rating history

Is Realogy Holdings stock a sell signal?

JPMorgan Chase & Co. does not see either upside or downside right now giving RLGY "Underweight - Neutral" on their last update on December 21, 2020. The price target was changed from $13.00 to $16.00 .

Verde Bio Holdings Stock Forecast, "VBHI" Share Price Prediction Charts

The Realogy Holdings Corp stock holds a sell signal from the short-term moving average; at the same time, however, there is a buy signal from the long-term average. Since the short-term average is above the long-term average there is a general buy signal in the stock giving a positive forecast for the stock. On further gains, the stock will meet resistance from the short-term moving average at approximately $18.33. On a fall, the stock will find some support from the long-term average at approximately $18.00. A break-up through the short-term average will send a buy signal, whereas a breakdown through the long-term average will send a sell signal. Furthermore, there is a buy signal from the 3 months Moving Average Convergence Divergence (MACD). Some negative signals were issued as well, and these may have some influence on the near short-term development. A sell signal was issued from a pivot top point on Wednesday, May 26, 2021, and so far it has fallen -6.38%. Further fall is indicated until a new bottom pivot has been found. Volume fell together with the price during the last trading day and this reduces the overall risk as volume should follow the price movements.

KPIT Technologies Stock Forecast, "KPITTECH" Share Price Prediction Charts

JoetheDetailer — The predictions of this VBHI is so whacky!! One day prices where way up and now they are way down. I'm not sure I this...

Vodafone Idea Stock Forecast, "532822" Share Price Prediction Charts

PVS — Kindly refresh this stock with the current live data as it is not showing the current market stock price level.