.png)

Should you buy Qcom stock?

The average Qualcomm price target of $197.28 implies 5.37% upside potential to current levels. The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc. TipRanks is the most ...

How to buy Qualcomm stock?

Steps To Buying Or Selling Qualcomm Inc Stocks and Shares

- Decide how you want to buy, sell or trade Qualcomm Inc QCOM stocks and shares. ...

- Register with an Qualcomm Inc QCOM broker that suits your needs. ...

- Research Qualcomm Inc financial reports. ...

- Decide your budget for Qualcomm Inc stock and how many Qualcomm Inc QCOM shares you want to buy.

Is Qualcomm stock a buy now?

Now the key question is: Where could the stock be headed in the near term ... has resulted in a Zacks Rank #2 (Buy) for Qualcomm.

Is Qualcomm a buy?

That means Qualcomm receives royalty payments for every device sold that includes its technology. Qualcomm stock traded as high as $193.58 in January, prior to declining by 25% to the current $146.00. QCOM stock actually surged by more than eight percent on April 28 after Qualcomm, Inc. reported market-beating first-quarter financial results.

See more

What is the Target price for QUALCOMM?

Stock Price Target QCOMHigh$471.60Median$184.00Low$130.00Average$196.80Current Price$152.20

Is Qualcomm a buy hold or sell?

QUALCOMM has received a consensus rating of Buy. The company's average rating score is 2.67, and is based on 14 buy ratings, 9 hold ratings, and no sell ratings.

Is QUALCOMM a Buy now?

QUALCOMM Incorporated - Hold Its Value Score of B indicates it would be a good pick for value investors. The financial health and growth prospects of QCOM, demonstrate its potential to outperform the market. It currently has a Growth Score of B.

Is QCOM a good long term investment?

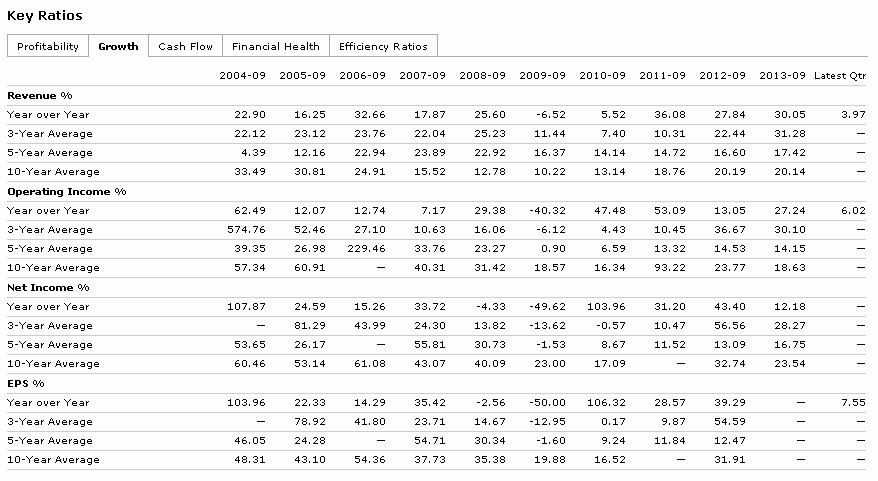

The components consider a company's success in growing its sales, earnings per share and operating cash on a year-over-year basis for the latest reported fiscal quarter and on an annualized basis over the last five years. High rates, especially compared to the sector median, lead to better scores.

What is the future of Qualcomm stock?

Stock Price Forecast The 28 analysts offering 12-month price forecasts for Qualcomm Inc have a median target of 184.00, with a high estimate of 471.60 and a low estimate of 130.00. The median estimate represents a +20.13% increase from the last price of 153.17.

Who is Qualcomm biggest competitor?

The list of top ten Qualcomm competitors and alternatives is as below.1 1. Broadcom.2 2. Intel.3 3. AMD.4 4. Nvidia.5 5. Cirrus Logic.6 6. MediaTek.7 7. Apple.8 8. Infineon Technologies.More items...

Is Qualcomm a Chinese company?

Qualcomm (/ˈkwɒlkɒm/) is an American multinational corporation headquartered in San Diego, California, and incorporated in Delaware. It creates semiconductors, software, and services related to wireless technology.

Who owns Qualcomm stock?

Top 10 Owners of Qualcomm IncStockholderStakeShares ownedThe Vanguard Group, Inc.9.02%101,028,885BlackRock Fund Advisors4.95%55,390,119SSgA Funds Management, Inc.4.30%48,140,313Fidelity Management & Research Co...2.71%30,293,2306 more rows

Is AMD a buy or sell?

For example, a stock trading at $35 with earnings of $3 would have an earnings yield of 0.0857 or 8.57%. A yield of 8.57% also means 8.57 cents of earnings for $1 of investment....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.75%2Buy18.15%3Hold9.70%4Sell5.35%2 more rows

Who is Qualcomm buying?

Qualcomm Incorporated (NASDAQ: QCOM) today announced it has completed its acquisition of Arriver™ from SSW Partners, enhancing Qualcomm Technologies ability to deliver open, fully integrated, and competitive Advanced Driver Assistance System (ADAS) solutions to automakers and Tier-1 suppliers at scale.

Why is QCOM dropping?

Qualcomm QCOM +2.30% forecast less revenue than expected for the September quarter, citing softening demand for smartphones. The stock fell in after-hours trading.

How big is Qualcomm?

The company reported revenue of $24.3 billion at the end of the 2019 fiscal year. That's a 7% increase from the previous year which saw revenue come in a $22.6 billion. The company's shares closed at $61.19 on March 18, 2020, and the company had a market capitalization of $73.4 billion.

Is Onsemi a buy?

ON Semiconductor has received a consensus rating of Buy. The company's average rating score is 2.76, and is based on 18 buy ratings, 5 hold ratings, and 1 sell rating.

Is TSM a buy Zacks?

Taiwan Semiconductor Manufacturing Company Ltd. - Buy. Zacks' proprietary data indicates that Taiwan Semiconductor Manufacturing Company Ltd. is currently rated as a Zacks Rank 1 and we are expecting an above average return from the TSM shares relative to the market in the next few months.

Is AMD a buy?

AMD stock is available at an attractive valuation, even after last week's gains. Its price-to-earnings (P/E) ratio of 32 may not be cheap when compared to the Nasdaq 100's multiple of 25, but it is worth noting AMD previously traded at much higher levels, as its five-year average earnings multiple of 103 indicates.

Is Intel a buy?

Intel is not a good investment candidate deserving of a Buy rating notwithstanding its share price dip. There are signs that INTC might struggle to deliver what it guided for in the long-term as it relates to the company's outlook for 2025 and beyond.

What is QUALCOMM's consensus rating and price target?

According to the issued ratings of 24 analysts in the last year, the consensus rating for QUALCOMM stock is Buy based on the current 9 hold ratings...

Do Wall Street analysts like QUALCOMM more than its competitors?

Analysts like QUALCOMM stock more than the stock of other Computer and Technology companies. The consensus rating score for QUALCOMM is 2.67 while...

Do MarketBeat users like QUALCOMM more than its competitors?

MarketBeat users like QUALCOMM stock more than the stock of other Computer and Technology companies. 79.22% of MarketBeat users gave QUALCOMM an ou...

Is QUALCOMM being downgraded by Wall Street analysts?

Over the previous 90 days, QUALCOMM's stock had 1 downgrade by analysts.

Does QUALCOMM's stock price have much upside?

According to analysts, QUALCOMM's stock has a predicted upside of 23.43% based on their 12-month price targets.

What analysts cover QUALCOMM?

QUALCOMM has been rated by Barclays , Deutsche Bank Aktiengesellschaft , JPMorgan Chase & Co. , KeyCorp , Mizuho , Morgan Stanley , Piper Sa...

QUALCOMM (NASDAQ:QCOM) Price Target and Consensus Rating

MarketBeat calculates consensus analyst ratings for stocks using the most recent rating from each Wall Street analyst that has rated a stock within the last twelve months. Each analyst's rating is normalized to a standardized rating score of 1 (sell), 2 (hold), 3 (buy) or 4 (strong buy).

Analyst Price Target Consensus

Sign-up to receive the latest news and ratings for QCOM and its competitors with MarketBeat's FREE daily newsletter.

Analyst Ratings By Month

The chart below shows how a company's ratings by analysts have changed over time. Each bar represents the previous year of ratings for that month. Within each bar, the sell ratings are shown in red, the hold ratings are shown in yellow, the buy ratings are shown in green, and the strong buy ratings are shown in dark green.

Average Share Price and Price Target by Month

The chart below shows how a company's share price and consensus price target have changed over time. The dark blue line represents the company's actual price. The lighter blue line represents the stock's consensus price target.

QUALCOMM (NASDAQ:QCOM) Analyst Ratings Frequently Asked Questions

According to the issued ratings of 23 analysts in the last year, the consensus rating for QUALCOMM stock is Buy based on the current 8 hold ratings, 14 buy ratings and 1 strong buy rating for QCOM. The average twelve-month price target for QUALCOMM is $205.17 with a high price target of $250.00 and a low price target of $137.00.

How is Qualcomm's target price determined?

Qualcomm target price is determined by taking all analyst projections and averaging them out. There is no one specific way to measure analysis performance other than comparing it to the past results via a very sophisticated attribution analysis. Qualcomm target price projections below should be used in combination with other traditional price prediction techniques such as stock price forecasting, technical analysis, earnings estimate, and various momentum models.

What is a Qualcomm stock option?

Qualcomm's stock options are financial instruments that give investors the right to buy or sell shares of Qualcomm common stock at a specified price for a given time period. Generally speaking, an option to purchase or sell Qualcomm stock makes it part of the underlying stock when the option's price is tied to the movement of the underlying stock. If Qualcomm's stock price goes up or down, the stock options follow.

What is Qualcomm's analyst recommendation?

That suggests that analyst recommendations are the outcome of an objective and thorough examination of Qualcomm's financials, market performance, and future outlook by experienced professionals. Qualcomm's historical ratings below, therefore, can serve as a valuable tool for investors.

Why do you use Qualcomm options?

Qualcomm option prices can potentially be used to forecast stock returns because most option chains provide information not only about the current prices but also about the future conditions in Qualcomm's lending market. For example, when Qualcomm's puts are not actively trading or completely missing in the marketplace, investors can use it to internalize expected shorting costs. So if an investor is writing a put option on Qualcomm, he or she must hedge the risk by shorting Qualcomm stock over its option's life.

What is max pain in stock options?

Max pain usually refers to a trading concept that asserts that market manipulation can cause the market price of particular securities such as Qualcomm close to expiration to expire worthless. According to most research, approximately 10% to 15% of all stock options are exercised, while about 35% expire worthlessly, with roughly 50% traded out before the expiration date. So, Max pain occurs when market makers reach a net positive position across all options at a strike price where option holders stand to lose the most money. By contrast, option sellers may reap the most after selling more options than buying, causing them to expire worthless.

How often do analysts rate Qualcomm?

Most Qualcomm analysts issue ratings four times a year, at intervals of three months. Ratings are usually accompanied by a target price to helps potential investors understand Qualcomm stock's fair price compared to its market value. Analysts arrive at stock ratings after researching public financial statements of Qualcomm, talking to its executives and customers, or listening to those companies' conference calls.

What is Qualcomm's open interest?

Qualcomm's open interest and total value indicators provide investors with the necessary information to digest the overall options buildup for its expiring contracts. In addition, it helps Qualcomm Stock's traders understand whether a recent fall or rise in the market is unreasonable and if the time has come to take contrarian positions. These ratios are calculated based on options trading volumes and current open interest.

Stock Price Forecast

The 26 analysts offering 12-month price forecasts for Qualcomm Inc have a median target of 220.00, with a high estimate of 450.68 and a low estimate of 180.00. The median estimate represents a +31.16% increase from the last price of 167.73.

Analyst Recommendations

The current consensus among 30 polled investment analysts is to Buy stock in Qualcomm Inc. This rating has held steady since February, when it was unchanged from a Buy rating. Move your mouse over past months for detail

What is the consensus rating of QUALCOMM?

QUALCOMM has received a consensus rating of Buy. The company's average rating score is 2.62, and is based on 14 buy ratings, 11 hold ratings, and no sell ratings.

When will QUALCOMM repurchase its shares?

QUALCOMM declared that its Board of Directors has approved a share repurchase plan on Tuesday, October 12th 2021, which allows the company to repurchase $10,000,000,000.00 in outstanding shares, according to EventVestor. This repurchase authorization allows the company to purchase up to 7.2% of its shares through open market purchases. Shares repurchase plans are usually a sign that the company's board of directors believes its shares are undervalued.

How much does QUALCOMM make?

QUALCOMM has a market capitalization of $159.30 billion and generates $23.53 billion in revenue each year. The wireless technology company earns $5.20 billion in net income (profit) each year or $3.34 on an earnings per share basis.

What is the ticker symbol for QCOM?

QUALCOMM trades on the NASDAQ under the ticker symbol "QCOM."

What is the peg ratio of QUALCOMM?

QUALCOMM has a PEG Ratio of 0.99. PEG Ratios around 1 indicate that a company is correctly valued.

What is QCOM stock worth in 2020?

QUALCOMM's stock was trading at $74.59 on March 11th, 2020 when COVID-19 reached pandemic status according to the World Health Organization. Since then, QCOM stock has increased by 89.3% and is now trading at $141.22. View which stocks have been most impacted by COVID-19.

When did QCOM release earnings?

QUALCOMM Incorporated (NASDAQ:QCOM) released its quarterly earnings data on Wednesday, April, 28th. The wireless technology company reported $1.90 EPS for the quarter, beating analysts' consensus estimates of $1.41 by $0.49.

Analyst price target for QCOM

Based on 15 analyst s offering 12 month price targets for Qualcomm Inc.

QCOM earnings per share forecast

What is QCOM 's earnings per share in the next 2 years based on estimates from 9 analyst s?

QCOM revenue forecast

What is QCOM 's revenue in the next 3 years based on estimates from 8 analyst s?

QCOM earnings growth forecast

How is QCOM forecast to perform vs Semiconductors companies and vs the US market?

QCOM revenue growth forecast

How is QCOM forecast to perform vs Semiconductors companies and vs the US market?