Is QQQ a good investment?

Dec 21, 2021 · QQQ is an ETF that tracks the Nasdaq 100 Index. It has 102 holdings and is the fourth-most popular ETF in the world. 1 The index excludes financial companies and is based on market capitalization....

What does QQQ invest in?

The Invesco QQQ ETF (NASDAQ: QQQ) is an index fund that mirrors the Nasdaq-100 index, which consists of the 100 largest U.S. and international nonfinancial companies listed on …

What companies are in QQQ?

Nov 30, 2020 · The QQQ is widely considered to be one of the safer ETFs on the market and has received positive performance rankings from analysts. The fund enjoys high liquidity, being the second-most-traded ETF in the United States as of mid-2020. Most of the QQQ involves large international and United States-based companies.

What companies are in QQQ ETF?

Apr 18, 2022 · What is QQQQ stock? QQQ Stocks, or Invesco QQQ Trust (QQQ), lists the top 100 Nasdaq stocks in its portfolio in a single trade. In addition, it excludes financial services and focuses its portfolio on companies in high-growth sectors. QQQ is an inexpensive way to own companies that build the economy of the future. What are the best ETFs of 2020?

What does QQQ company do?

An investment in innovation. Invesco QQQ is an exchange-traded fund that tracks the Nasdaq-100 Index™ and features Apple, Google, Microsoft, and more. A ticker symbol is a string of letters used to identify a security (stock, bond, mutual fund, ETF, etc.) traded on an exchange.

What does QQQ stock mean?

the Nasdaq 100 TrustWhat Is QQQQ? The QQQQ is the original ticker symbol for the Nasdaq 100 Trust, an ETF that trades on the Nasdaq exchange. This security offers broad exposure to the tech sector by tracking the Nasdaq 100 Index, which consists of the 100 largest and most actively traded non-financial stocks on the Nasdaq.

What stocks are QQQ made of?

QQQ ETF Top HoldingsInvesco QQQ ETF Top HoldingsStockShare of QQQMicrosoft (MSFT)9.98%Amazon (AMZN)7.83%Tesla Inc. (TSLA)4.53%7 more rows

What is the difference between Nasdaq and QQQ?

Difference Between QQQ and Other Major Index ETFs QQQ only tracks the 100 companies included in the Nasdaq-100. The full Nasdaq Composite Index includes more than 3,000 symbols. If you want to track that index, look into an ETF like ONEQ, rather than QQQ.

Why is QQQ so good?

QQQ: Pros and cons Because tech stocks often experience rapid growth, this ETF has the potential for higher-than-average returns. In fact, it's earned an average annual return of nearly 23% per year over the last 10 years compared to VOO's average return of around 14% per year in the same time frame.Apr 5, 2022

Does QQQ stock pay dividends?

Invesco QQQ Trust (QQQ) QQQ has a dividend yield of 0.51% and paid $1.74 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Mar 21, 2022.

Is QQQ a good stock to buy?

Conclusion. QQQ stock is a great option for investors who want to make sure they don't miss out on the next Amazon or Google. When leading Nasdaq stocks get big, they land on the QQQ. This is a low-fuss way to own a diversified basket of hot stocks.Mar 18, 2022

Is QQQ ETF a good buy?

Invesco QQQ holds a Zacks ETF Rank of 2 (Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, QQQ is a great option for investors seeking exposure to the Style Box - Large Cap Growth segment of the market.Mar 16, 2022

Is QQQ an ETF or mutual fund?

Invesco QQQ is an exchange-traded fund based on the Nasdaq-100 Index®. The Fund will, under most circumstances, consist of all of stocks in the Index. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization.

Is QQQ an ETF?

Invesco QQQ ETF (QQQ) Invesco QQQ is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index™. The Index includes the 100 largest non-financial companies listed on the Nasdaq based on market cap. Click here to see how QQQ has helped power portfolios for over 20 years.

Can you hold QQQ long term?

For long-term buy-and-hold investors, the QQQ is a good choice to get broad exposure to the Nasdaq 100 index. This may be used in conjunction with other index ETFs to create a well-diversified portfolio for the long run.

Is QQQ good for long term?

It also has a strong history, earning an average 9.38% annual rate of return since its inception. This makes it an excellent choice for long-term investors. While nobody can predict future returns, QQQ's decades-long track record is a good indication that it will perform well over time.Apr 8, 2021

What Is the QQQ ETF?

The Invesco QQQ ETF, formerly known as the PowerShares ETF, is an exchange-traded fund that tracks the Nasdaq 100 index. The QQQ is widely consider...

What Is the Nasdaq 100?

The Nasdaq exchange is the second-largest stock exchange in the world, based on market cap. In addition to hosting the stocks of some of the world’...

What Is in the QQQ ETF?

Most of the QQQ involves large international and United States-based companies in sectors like telecommunications, health care, industrial matters,...

Influencers with Andy Serwer: Laura Alber

In this episode of Influencers, Andy speaks with Williams-Sonoma CEO & President, Laura Alber, as she shares the secrets of her success and how pandemic restrictions helped to boost sales at Williams-Sonoma.

The labor market still 'as tight as a drum' despite Delta-driven slowdown

The current state of economic play can be accurately summarized using an artful (at least I’d like to think) paraphrase of Winston Churchill. In 1939, the historic wartime leader famously described Russia as "a riddle, wrapped in a mystery, inside an enigma."

Lululemon (LULU) Option Traders Cautious Before Earnings

Trading volumes indicate that traders have been buying puts and selling calls in anticipation of a negative earnings report.

DocuSign (DOCU) Option Traders Making Bearish Bets

The open interest for DocuSign (DOCU) shows an increasing number of put options, and option premiums are unusually high right now.

Influencers with Andy Serwer: Patrik Frisk

In this episode of Influencers, Andy is joined by Under Armour President & CEO Patrik Frisk as they discuss new challenges for the retail industry, big changes for college athletics, and how raising the wage floor is affecting Under Armour's business overall.

2 Nasdaq ETFs for Q4 2021

Investors who want to own stocks in the technology sector may decide to buy exchange traded funds (ETFs) that track the Nasdaq. When investors refer to the Nasdaq, they typically refer to the tech-heavy Nasdaq Composite Index, which is comprised of more than 2,500 companies.

What is Invesco QQQ ETF?

The Invesco QQQ ETF is a popular exchange-traded fund that tracks the Nasdaq 100 index. Like any investment choice, the QQQ has pros and cons. One of the easiest ways to invest in an ETF like the QQQ might be to buy shares on an exchange like SoFi’s.

What are the negatives of QQQ?

One of the negatives of the QQQ is a relative lack of diversification. While the fund may be more diversified than an ETF that invests exclusively in technology, it’s still less diversified than many similar securities.

What is an ETF fund?

The ETF provides cost-efficient exposure to many large companies with high levels of innovation. Investors don’t have to be burdened with picking specific stocks or being limited to a technology-only fund (although the QQQ is heavily weighted toward tech, but it also invests in other sectors).

What is the second largest stock exchange in the world?

The Nasdaq exchange is the second-largest stock exchange in the world, based on market cap. In addition to hosting the stocks of some of the world’s largest companies, the exchange has had several notable accomplishments over the years.

What is expense ratio in ETFs?

ETFs come with something called an expense ratio, which represents the amount of fees paid to the company that manages the fund. The fees cover the expenses of operating and maintaining the fund. Expense ratios are expressed as percentages that will be taken from the fund’s assets before paying investors.

What is the Nasdaq 100?

The Nasdaq 100 is an index that tracks the top 100 largest stocks in the Nasdaq. The QQQ ETF is a popular fund that tracks the Nasdaq 100. After understanding some of the basics about what is in the QQQ ETF, let’s assume an investor wants to gain exposure.

Is QQQ an ETF?

The QQQ is widely considered to be one of the safer ETFs on the market and has received positive performance rankings from analysts. The fund enjoys high liquidity, being the second-most-traded ETF in the United States as of mid-2020.

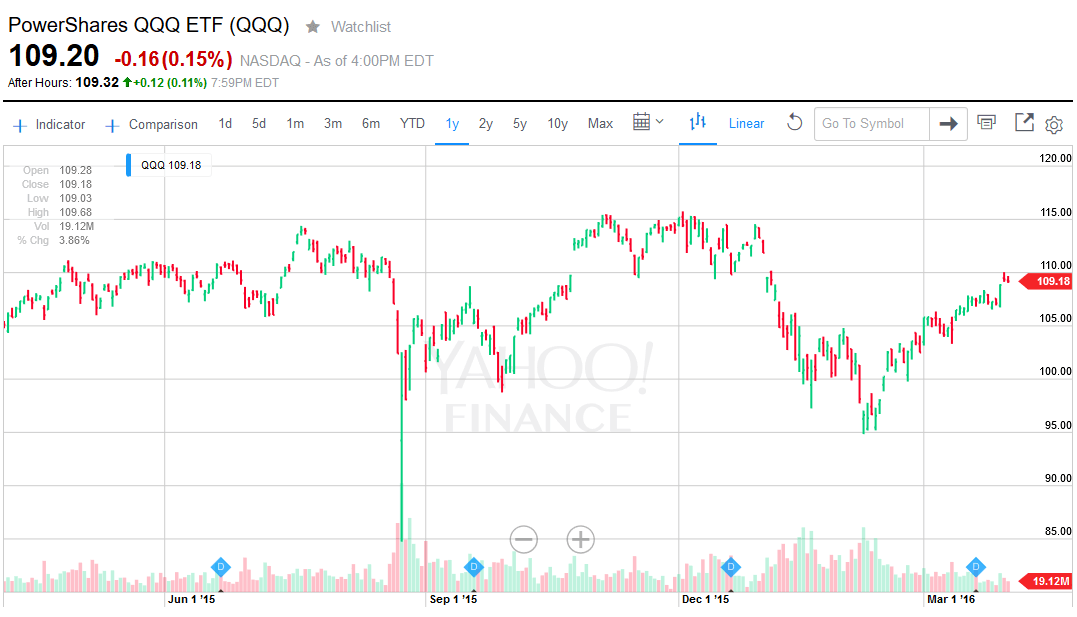

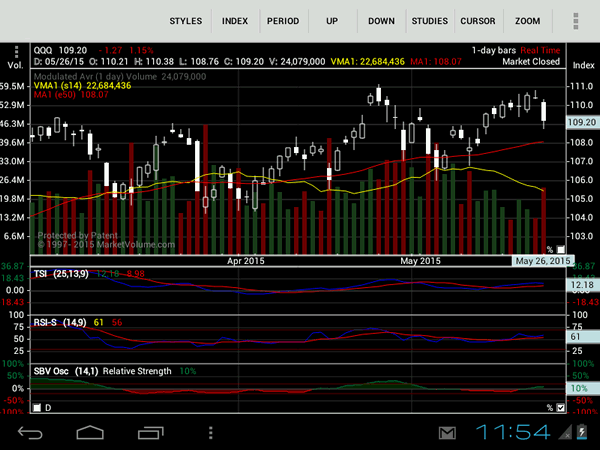

Signals & Forecast

The PowerShares QQQ Trust stock holds a sell signal from the short-term moving average; at the same time, however, there is a buy signal from the long-term average. Since the short-term average is above the long-term average there is a general buy signal in the stock giving a positive forecast for the stock.

Support, Risk & Stop-loss

PowerShares QQQ Trust finds support from accumulated volume at $362.42 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

Is PowerShares QQQ Trust stock A Buy?

Several short-term signals, along with a general good trend, are positive and we conclude that the current level may hold a buying opportunity as there is a fair chance for PowerShares QQQ Trust stock to perform well in the short-term.

What is QQQ stock?

QQQ stock is the fifth most-popular exchange-traded fund in the world, holding more than $166 billion in investors' assets. It tracks the Nasdaq-100 index, which owns the most valuable nonfinancial stocks on the Nasdaq. QQQ is also the largest ETF that tracks a narrower slice of the stock market. The largest ETF is the broad SPY stock, which owns ...

What is the largest ETF?

The largest ETF is the broad SPY stock, which owns all the stocks in the S&P 500. But while the QQQ stock isn't a broad market ETF, it owns the most valuable stocks trading on the Nasdaq. That definition means the QQQ is very tech heavy. Most of the world's biggest technology stocks still trade on the Nasdaq.

What is an ETF?

Like mutual funds, ETFs are investments that own a bucketful of other investments. And ETFs can own everything from individual stocks, like QQQ does, to bonds, commodities and currencies. Nearly all ETFs own the investments dictated by an index. QQQ stock owns the stocks in the Nasdaq-100.

What is QQQ ETF?

What is the QQQ ETF? Summary - The QQQ ETF is an index fund that features a tiered weighting system that focuses on market capitalization making it one of the most popular index ETFs. One of the distinguishing features of the QQQ ETF is its weighting methodology that makes it heavy in technology stocks including all of the FAANG stocks.

How old is PowerShares QQQ?

And while the PowerShares QQQ, at 18 years old, is considered to be one of the giants in the sector, it can seem downright vanilla when compared to the flavor portfolio of some other ETFs that have arisen in the sector. One of these is the ProShares UltraPro QQQ or the TQQQ ETF.

Why are ETFs so popular?

One of the reasons for this is that they trade more like stocks, which allows investors to get the benefits of investing in a particular group or sector of stocks but being able to execute their trades without the delay involved in mutual fund trading.