What is stock market prediction in Python?

Hello there! Today we are going to learn how to predict stock prices of various categories using the Python programming language. Stock market prediction is the act of trying to determine the future value of company stock or other financial instruments traded on an exchange.

What is stock price prediction in machine learning?

Stock price prediction is a machine learning project for beginners; in this tutorial we learned how to develop a stock cost prediction model and how to build an interactive dashboard for stock analysis. We implemented stock market prediction using the LSTM model.

How can I get options chain data on Quantra?

If you are looking to get Options chain data then you can refer to the FREE course on Getting Market Data on Quantra. The nsepy package is used to get the stock market data for the futures and options for Indian stocks and indices. After you have the stock market data, the next step is to create trading strategies and analyse the performance.

How to make stock price prediction using LSTM?

Analyze the closing prices from dataframe: 4. Sort the dataset on date time and filter “Date” and “Close” columns: 5. Normalize the new filtered dataset: 6. Build and train the LSTM model: 7. Take a sample of a dataset to make stock price predictions using the LSTM model: 8. Save the LSTM model: 9.

Is Python good for stock market?

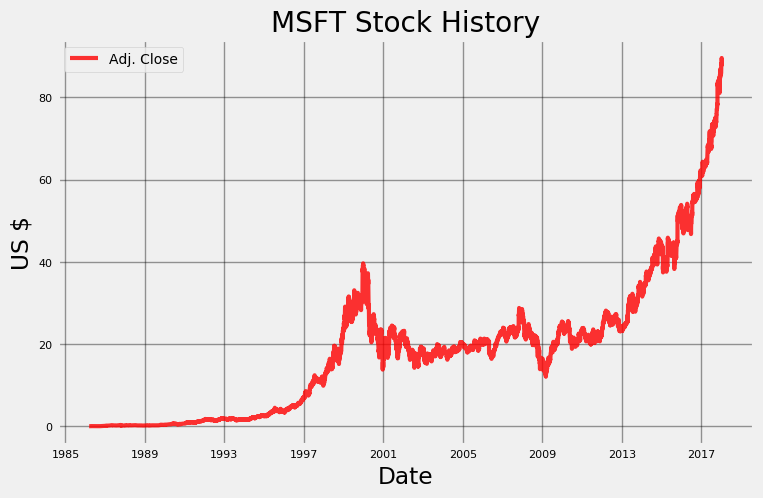

Amongst all the attributes of the class, one of it is stock data for a specific company. The benefits of using the Python class include – the functions and the data it acts on are associated with the same object. The entire history of the stock can be plotted by using the method of the Stocker object.

How does Python predict stock market?

Take a sample of a dataset to make stock price predictions using the LSTM model:X_test=[]for i in range(60,inputs_data. shape[0.X_test. append(inputs_data[i-60:i,X_test=np. array(X_test)X_test=np. reshape(X_test,(X_test. ... predicted_closing_price=lstm_model. predict.predicted_closing_price=scaler. inverse_transform.

How do I get all stock data in Python?

import pandas_datareader as pdr. # Request data via Yahoo public API. data = pdr. get_data_yahoo('NVDA') ... import yfinance as yf. # Request historical data for past 5 years. data = yf. Ticker("NVDA"). ... import quandl. # Get data via Quandl API. data = quandl. ... # Necessary imports. import pandas_datareader as pdr. # Request Data.

How do you scrape stock data in Python?

To extract data using web scraping with python, you need to follow these basic steps:Find the URL that you want to scrape.Inspecting the Page.Find the data you want to extract.Write the code.Run the code and extract the data.Store the data in the desired format.

Which algorithm is best for stock market prediction?

Building the LSTM Model for Stock Market Prediction We compile the model using Adam Optimizer and the Mean Squared Error as the loss function. For an LSTM model, this is the most preferred combination.

What is the most accurate stock predictor?

The MACD is the best way to predict the movement of a stock.

How do you pull data from stock market?

Internet Sources for Historical Market & Stock DataYahoo! Finance - Historical Prices. ... Dow Jones Industrial Averages. Historical and current performance data. ... S&P Indices. Historical performance data.IPL Newspaper Collection. ... Securities Industry and Financial Markets Association. ... FINRA: Market Data Center.

Why do traders need Python?

Python has become a preferred choice for trading recently as Python is open-source and all the packages are free for commercial use. Python has gained traction in the quant finance community. Python makes it easy to build intricate statistical models with ease due to the availability of sufficient scientific libraries.

Is Quandl API free?

The Quandl API is free to use and grants access to all free datasets. Quandl users have to pay to access Quandl's premium data products.

How do you scrape stock price data?

The first step when scraping stock data is to download the target content from the database where the data is stored. Second, use the data scraper to extract data from its unstructured form into a structured format.

Is it legal to pull data from NSE website?

You may not conduct any systematic or automated data collection activities (including scraping, data mining, data extraction and data harvesting) on or in relation to our website without our express written consent. You may not use our website to transmit or send unsolicited commercial communications.

Is it legal to scrape data from Moneycontrol?

It is legal. It won't be consider as “Insider Trading”.

Can stock market be predicted?

Whoever figures out how to predict the stock market will get rich quick. Unfortunately, the market's ups and downs ultimately depend on the choices of a massive number of people—and you don't know what they're thinking about before they decide to buy or sell a stock.

Can neural networks predict stock market?

Neural networks do not make any forecasts. Instead, they analyze price data and uncover opportunities. Using a neural network, you can make a trade decision based on thoroughly examined data, which is not necessarily the case when using traditional technical analysis methods.

Can machine learning predict stock market?

No, because the stock prices are basically noise. The best invesment strategy is the Random Walk. Any Learning Machine can obtain good results only in the training data.

Can data science predict the stock market?

So Does The Science Point To Data Science Being Able To Predict The Stock Market. The answer to this is a resounding YES! In a recent MIT study, it was revealed that computers outperformed humans by 57%.

How to get Stock Market Data in Python?

One of the first sources from which you can get historical daily price-volume stock market data is Yahoo finance. You can use pandas_datareader or yfinance module to get the data and then can download or store in a csv file by using pandas.to_csv method.

How to get Stock Market Data for different geographies?

To get stock market data for different geographies, search the ticker symbol on Yahoo finance and use that as the ticker

S&P 500 Stock Tickers

If you want to analyse the stock market data for all the stocks which make up S&P 500 then below code will help you. It gets the list of stocks from the wikipedia page and then fetches the stock market data from yahoo finance.

Intraday or Minute Frequency Stock Data

yfinance module can be used to fetch the minute level stock market data. It returns the stock market data for the last 7 days.

Resample Stock Data

During strategy modelling, you might be required to work with a custom frequency of stock market data such as 15 minutes or 1 hour or even 1 month.

Fundamental Data

We have used yfinance to get the fundamental data. The first step is to set the ticker and then call the appropriate properties to get the right stock market data.

Futures and Options Data

If you are looking to get Options chain data then you can refer to the FREE course on Getting Market Data on Quantra.

What is a Python package?

A Python package is basically an extension to Python that allows you to do certain tasks more easily.

How does algorithmic trading work?

Algorithmic trading typically uses a computer to follow a set of rules and instructions to place trade to hopefully generate profits at a speed and frequency impossible for a human. Algorithmic trades account for upwards of 80% of all stock movement.

How to create a variable in Python?

You can create variables in python by stating an equals clause. Such as: answer = 2+2. answer is now equal to 4. Python has multiple variable types, but the main ones are either: A) Numbers or B) Strings (any form of letters). Strings are usually denoted with “ or ‘ around the variable name.

What is a string in a program?

Strings are usually denoted with “ or ‘ around the variable name. To see what you’ve done, the print function is useful. Simple put any variable instead of that function and the program will give a print out of what that variable is. For example print (answer) would log a 4 to my console.

Where do neural nets come from?

The idea of neural nets comes from biological neurons in the human brain. There are million of neurons in our brain. Each is a small decision maker that takes information in and makes an output. One neuron alone never makes a decision, but a unique layered, network of them combine to make decisions.

Does Apple's product release affect stock price?

Things like dates could also be influential. Apple often does product releases in the Fall and those product releases often heavily affect the stock price. Companies also have quarterly reports discussing their operations that drive prices. These type of date factors could be useful when predicting the price.

What is stocker in Python?

Stocker is a Python tool for stock exploration. Once we have the required libraries installed (check out the documentation) we can start a Jupyter Notebook in the same folder as the script and import the Stocker class:

Which line does not follow training data?

The lowest prior, the blue line, does not follow the training data, the black observations , very closely. It kind of does its own thing and picks a route through the general vicinity of the data. In contrast, the highest prior, the yellow line, sticks to the training observations as closely as possible.

Introduction

pXtract v2.0 is a portable application to extract text-plain spectra from binary Thermo Scientific RAW files. The supporting output formats are MS1, MS2, MGF. Xcalibur must be installed first due to the invocation of Thermo’s Xcalibur APIs in this program. You can use it without installation.

Downloads

pXtract v2.0 is currently free to use. Please read carefully the pXtract Software License Agreement before downloading and using the software. Please visit i.pfind.org to get the download link.

Predicting Future Stock Market Trends with Python & Machine Learning

Note from Towards Data Science’s editors: While we allow independent authors to publish articles in accordance with our rules and guidelines, we do not endorse each author’s contribution. You should not rely on an author’s works without seeking professional advice. See our Reader Terms for details.

1. Imports and Data Collection

To begin, we include all of the libraries used for this project. I used the yfinance API to gather all of the historical stock market data. It’s taken directly from the yahoo finance website, so it’s very reliable data.

2. Data Processing & Feature Engineering

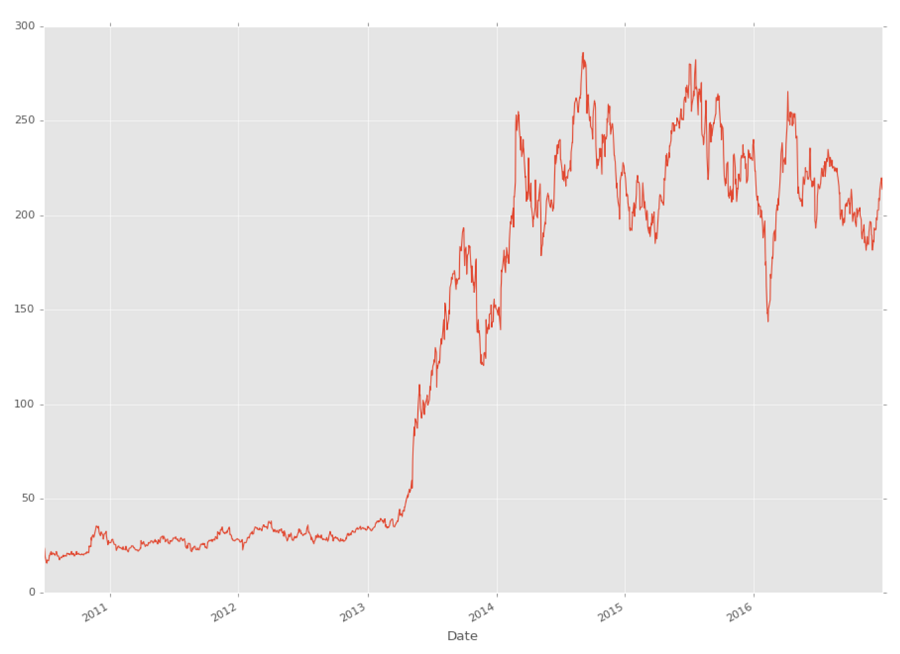

We see that our data above is rough and contains lots of spikes for a time series. It isn’t very smooth and can be difficult for the model to extract trends from. To reduce the appearance of this we want to exponentially smooth our data before we compute the technical indicators.

3. Model Creation

Right before we train our model we must split up the data into a train set and test set. However, due to the nature of time-series’, we need to handle this part carefully. If we randomize our train-test set, we could encounter a look-ahead bias which is not good for predicting the stock market.

4. Verification of Results

For the next step we’re going to predict how the S&P500 will behave with our predictive model. I’m writing this article on the weekend of August 17th. So to see if this model can produce accurate results, I’m going to use the closing data from this week as the ‘truth’ values for the prediction.

What dataset is used to build a stock price prediction model?

To build the stock price prediction model, we will use the NSE TATA GLOBAL dataset. This is a dataset of Tata Beverages from Tata Global Beverages Limited, National Stock Exchange of India: Tata Global Dataset

What is stock price prediction?

Stock price prediction is a machine learning project for beginners; in this tutorial we learned how to develop a stock cost prediction model and how to build an interactive dashboard for stock analysis. We implemented stock market prediction using the LSTM model. OTOH, Plotly dash python framework for building dashboards.

What is dash in Python?

Dash is a python framework that provides an abstraction over flask and react.js to build analytical web applications.# N#Before moving ahead, you need to install dash. Run the below command in the terminal.