| Stockholder | Stake | Shares bought / sold |

|---|---|---|

| The Vanguard Group, Inc. | 7.89% | +605,278 |

| BlackRock Fund Advisors | 5.66% | -282,804 |

| SSgA Funds Management, Inc. | 5.01% | +282,166 |

| Geode Capital Management LLC | 1.98% | +142,247 |

How much are Prudential shares worth?

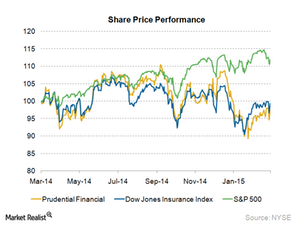

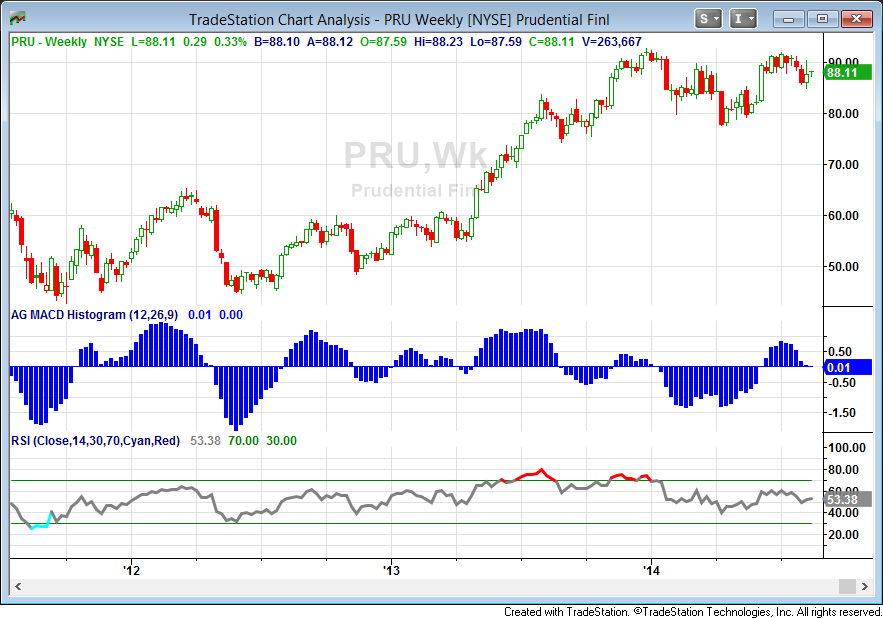

With PRUDENTIAL FINANCIAL stock trading at $106.68 per share, the total value of PRUDENTIAL FINANCIAL stock (market capitalization) is $40.01B. PRUDENTIAL FINANCIAL stock was originally listed at a price of $29.30 in Dec 13, 2001.

Is Prudential (Pru) a great value stock right now?

but they help show that Prudential is likely being undervalued right now. Considering this, as well as the strength of its earnings outlook, PRU feels like a great value stock at the moment.

Is Prudential plc (PUK) a good stock to buy?

This should instill investors' confidence in the stock. Prudential Financial has a decent earnings surprise ... 2022 earnings has moved up 10.4% and 10.3% in the past 60 days. ORI, PUK and LGGNY have gained 30.1%, 1.1% and 14.8%, respectively, in the ...

What's my Prudential stock worth?

How much is Prudential Financial stock worth today? (NYSE: PRU) Prudential Financial currently has 378,000,000 outstanding shares. With Prudential Financial stock trading at $110.90 per share, the total value of Prudential Financial stock (market capitalization) is $41.92B.

Is Prudential stock a good buy?

Prudential Financial, Inc. may be undervalued. Its Value Score of A indicates it would be a good pick for value investors. The financial health and growth prospects of PRU, demonstrate its potential to outperform the market. It currently has a Growth Score of F.

What is the highest Prudential stock has ever been?

Prudential Financial - Stock Price History | PRUThe all-time high Prudential Financial stock closing price was 126.02 on January 26, 2018.The Prudential Financial 52-week high stock price is 124.22, which is 24.2% above the current share price.More items...

How many times has Prudential stock split?

According to our Prudential stock split history records, Prudential has had 1 split.

Who owns Prudential Financial?

Prudential GroupIn 2019, Prudential was the largest insurance provider in the United States with $815.1 billion in total assets....Prudential Financial.The Prudential headquarters is the white tower in the Newark skyline.Total equityUS$68.210 billion (2020)Number of employees41,671 (2020)ParentPrudential GroupWebsitewww.prudential.com14 more rows

Is there a problem with Prudential?

Prudential.com is UP and reachable by us.

What year did prudential go public?

20012001 IPO. Prudential becomes a public company on December 13, the first NY Stock Exchange IPO after the September 11, 2001 terrorist attack.

What is Prudential Computershare?

Computershare has been appointed by Prudential Financial, Inc. to act as its transfer agent, to maintain shareholder records and to provide a variety of services to Prudential Financial shareholders.

Does Prudential have a dividend reinvestment plan?

Does Prudential offer a dividend reinvestment program? Although the Company does not currently offer a dividend reinvestment program, Prudential periodically reviews the decision of whether to offer such a program, with all relevant factors being thoroughly considered.

How do I buy Prudential stock?

How to buy shares in Prudential FinancialCompare share trading platforms. Use our comparison table to help you find a platform that fits you.Open your brokerage account. Complete an application with your details.Confirm your payment details. ... Research the stock. ... Purchase now or later. ... Check in on your investment.

Who took over Prudential?

Our group. Prudential is part of M&G plc.

Is Prudential a good company?

On average, employees at Prudential give their company a 4.0 rating out of 5.0 - which is 3% higher than the average rating for all companies on CareerBliss. The happiest Prudential employees are Executive Assistants submitting an average rating of 4.9 and Sales Agents with a rating of 4.8.

Can prudential be trusted?

Policy illustrations for Prudential's cash value products tend to be highly reliable. This can give you confidence that the product you're buying won't require additional premiums and you will have the cash value and internal costs that you're expecting.

Is Prudential losing money?

Corporate & Other reported a loss, on an adjusted operating income basis, of $366 million for the first quarter of 2022, compared to a loss of $322 million in the year-ago quarter.

What is Prudential Computershare?

Computershare has been appointed by Prudential Financial, Inc. to act as its transfer agent, to maintain shareholder records and to provide a variety of services to Prudential Financial shareholders.

Who is the head of Prudential?

Charles F. Lowrey (Dec 1, 2018–)Prudential Financial / CEOLowrey. Charles F. Lowrey is Chairman and CEO of Prudential Financial, Inc. Prior to assuming his current roles, Lowrey served as executive vice president and chief operating officer of Prudential's International businesses.

When will Prudential Financial release its earnings?

When will Prudential pay dividends in 2021?

NEWARK, N.J., July 07, 2021--Prudential Financial, Inc. (NYSE: PRU) will release its second quarter 2021 earnings on Tuesday, August 3, 2021, after the market closes. The earnings news release, the financial supplement and related materials will be posted on the company’s Investor Relations website at investor.prudential.com.

What is PGIM annuity?

(NYSE: PRU) announced today the declaration of a quarterly dividend of $1.15 per share of Common Stock, payable on December 16, 2021, to shareholders of record at the close of business on November 23, 2021.

When is the PRU earnings call 2021?

An annuity is a long-term insurance contract which allows consumers to generate a steady income during retirement.

Is bonus for senior British financiers tied to diversity goals?

PRU earnings call for the period ending September 30, 2021.

Is there a lot of momentum in new disruptive stocks?

(Bloomberg) -- Bonuses for senior British financiers could be tied to diversity goals and boards could face extra membership targets under proposals from regulators Wednesday.Senior staff could also become directly responsible for inclusion at their companies, according to a report from the Financial Conduct Authority and the Prudential Regulation Authority.“While some progress has been made to improve diversity and inclusion in parts of the financial services sector over the last decade, the di

What is a link by Prudential?

Whether its crypto or stable coins or electric vehicles, cannabis or other hot sectors, the fact is there’s a lot of momentum in new disruptive stocks. That’s great for the short term. But for long-term investors, dividend stocks still need a significant place in your portfolio. And that’s more important now than ever. Inflation is becoming the hot new word when it comes to the economy and the markets. Initially, the Federal Reserve said that inflation was “transitory,” meaning it was going to f

Who is Prudential Annuities?

LINK by Prudential is an umbrella marketing name for various subsidiaries of The Prudential Insurance Company of America. Investment advisory products and services of LINK by Prudential are made available through Pruco Securities, LLC, (sometimes referred to as “Pruco”) doing business as Prudential Financial Planning Services, pursuant to separate agreement. Prudential LINK and LINK by Prudential occasionally may be referred to as LINK.

What is PWSGS link?

Variable annuities are distributed by Prudential Annuities Distributors, Inc., Shelton, CT. All are Prudential Financial companies and each is solely responsible for its own financial condition and contractual obligations. Prudential Annuities is a business of Prudential Financial, Inc.

Is Prudential Financial a subsidiary of M&G?

PWSGS provides access to a number of Financial Wellness products, services, seminars and tools offered by PWSGS, its affiliates or third parties. PWSGS is a subsidiary of Prudential PWSGS is not a licensed insurance company, does not provide insurance products or services and does not provide financial, investment or other advice. Individuals should consult appropriate professionals when making financial, investment and tax decisions.

Is there risk in investing in securities?

Prudential Financial is not affiliated in any manner with Prudential plc, an international group incorporated in the United Kingdom or the Prudential Assurance Company, a subsidiary of M&G plc, a company incorporated in the United Kingdom.

Who owns assurance IQ?

Investing in securities involves risk, and there is always the potential of losing money. Asset allocation and rebalancing do not ensure a profit or guarantee against loss.

Is PWSGS a subsidiary of Prudential?

Assurance IQ, LLC a wholly-owned subsidiary of Prudential Financial, Inc. ("Prudential") matches buyers with products such as life and health insurance and auto insurance, enabling them to make purchases online or through an agent. Neither Prudential Financial, Inc. nor Assurance IQ offers, underwrites, or administers health plans ...

What is Prudential's shareholder dividend history?

PWSGS is a subsidiary of Prudential PWSGS is not a licensed insurance company, does not provide insurance products or services and does not provide financial, investment or other advice. Individuals should consult appropriate professionals when making financial, investment and tax decisions.

What is the stock price?

Dividends are only paid on shares of Prudential Financial, Inc. Common Stock if declared by the Board of Directors. For the years 2002 through 2012, the Board declared an annual dividend on its Common Stock. On November 7, 2012, Prudential announced the move to a quarterly Common Stock dividend schedule beginning in the first quarter of 2013. To view Prudential's shareholder dividend history, please click here opens in a new window.

What is the cost basis of the shares I have at Computershare?

Current and historical stock prices are available here Opens in new window.

Does Prudential demutualize shares?

In general, most registered shareholders received their shares through Prudential's demutualization. Prudential received a Private Letter Ruling from the IRS indicating that the cost basis of shares received through a demutualization is zero. Prudential is aware of a court ruling regarding the cost basis of demutualization shares, and that the IRS’ appeal of this ruling was denied. It is our understanding that the IRS is currently awaiting a Federal District Court ruling and is evaluating their next steps. Please consult your personal tax advisor for any tax-related questions you may have regarding the cost basis of shares issued as part of a demutualization.

Does changing address affect Prudential stock policy?

In general, most registered shareholders received their shares through Prudential's demutualization. Prudential received a Private Letter Ruling from the IRS indicating that the cost basis of shares received through a demutualization is zero.

Are these shares part of my policy?

Any action taken on your stock account, such as selling your shares or changing your address, will not impact your policy records. Similarly, changes made to your policy will not carry over to your stock account. You will need to manage your stock account separately through Computershare, Prudential's transfer agent.