What does Roe tell more than EPS growth?

Return on Equity (ROE) Tells More than EPS Growth. As another earnings season rolls around and companies EPS (Earnings Per Share) numbers are making headlines, here’s why you should pay particular attention to ROE (Return on Equity) instead. “Most companies define “record” earnings as a new high in earnings per share.

What is the difference between P/E ratio and EPs?

Key Takeaways The basic definition of a P/E ratio is stock price divided by earnings per share (EPS). EPS is the bottom-line measure of a company’s profitability and it's basically defined as net income divided by the number of outstanding shares. Earnings yield is defined as EPS divided by the stock price (E/P).

What does a high P/E ratio indicate?

High P/E. Companies with a high Price Earnings Ratio are often considered to be growth stocks. This indicates a positive future performance, and investors have higher expectations for future earnings growth and are willing to pay more for them.

Can the price earnings ratio be too high?

Additionally, the Price Earnings Ratio can produce wonky results as demonstrated below. Negative EPS resulting from a loss in earnings will produce a negative P/E. An exceedingly high P/E can be generated by a company with close to zero net income, resulting in a very low EPS in the decimals.

Does higher EPS mean higher stock price?

EPS Acceleration/Deceleration Acceleration in EPS growth will usually result in a stock price increase. For example: If company A, which has grown earnings 15 percent annually, suddenly reports a 20 and then a 25 percent increase in EPS, its stock price could shoot up 25 or even 50 percent.

What happens when EPS is high?

A higher or increasing earnings per share indicates that the company is earning more profits to distribute to its shareholders. Higher or increasing growth on EPS gives a good indication about the company's efficiency on its business prospects.

What is the relationship between EPS and stock price?

How EPS affect on share price movement: While a company's EPS will often influence the market price of its stock, the relationship is rarely inverse. The company's EPS is determined by dividing the earnings by the number of outstanding shares. The market price of each share is immaterial.

Does EPS affect ROE?

The results show earnings per share (EPS) have a significant positive effect on dividend policy, return on equity (ROE) and debt to equity ratio (DER) have a significant negative effect on dividend policy, dividend policy (DPR) have a significant negative effect on stock returns, earnings per share (EPS) have an ...

Should I buy stocks with high EPS?

In theory, a higher EPS would suggest that a company is more valuable. If investors are comfortable paying a higher price for shares, then that could reflect strong profits or expectations of high profits.

Why are ROE and EPS such important measures of performance to investors?

EPS. The ROE is a better gauge than simple EPS of how a company is deploying its capital to build a profitable business. The higher the ROE, the more wealth the company is creating for its shareholders, and the better return they can expect from their investment.

Why does EPS matter to the share price of a company's IPO?

The reasons for selecting this study is because the earnings per share (EPS) reflects the performance of the company, from the value of the EPS that need to be taken before and after the IPO, it can be seen whether the company has a good performance or not related after the IPO.

What is a good EPS for a stock?

"The EPS Rating is invaluable for separating the true leaders from the poorly managed, deficient and lackluster companies in today's tougher worldwide competition," O'Neil wrote. Stocks with an 80 or higher rating have the best chance of success.

Is high PE ratio good?

P/E ratio, or price-to-earnings ratio, is a quick way to see if a stock is undervalued or overvalued. And so generally speaking, the lower the P/E ratio is, the better it is for both the business and potential investors. The metric is the stock price of a company divided by its earnings per share.

What is the relationship between ROE and EPS?

ROE measures the return shareholders are getting on their investments. EPS measures the net earnings attributable to each share of common stock. Companies usually provide EPS and other ratios in their quarterly and annual reports.

Is it good to have a high ROE?

High and stable ROE is generally better, but the absolute number should be considered in the context of the industry. It's also a good sign if ROE increases over time. Use ROE to sift through potential stocks and find the companies that turn invested capital into profit fairly efficiently.

How does ROE affect share price?

ROE is not an absolute indicator of investment value. After all, the ratio gets a big boost whenever the value of shareholders' equity, the denominator, goes down. If, for instance, a company takes a large write-down, the reduction in income (ROE's numerator) occurs only in the year that the expense is charged.

What EPS means?

Earnings per shareEarnings per share (EPS) is a figure describing a public company's profit per outstanding share of stock, calculated on a quarterly or annual basis. EPS is arrived at by taking a company's quarterly or annual net income and dividing by the number of its shares of stock outstanding.

What is an EPS in medical terms?

Intracardiac electrophysiology study (EPS) is a test to look at how well the heart's electrical signals are working. It is used to check for abnormal heartbeats or heart rhythms.

Price Earnings Ratio Formula

P/E = Stock Price Per Share / Earnings Per ShareorP/E = Market Capitalization / Total Net EarningsorJustified P/E = Dividend Payout Ratio / R – Gwh...

P/E Ratio Formula Explanation

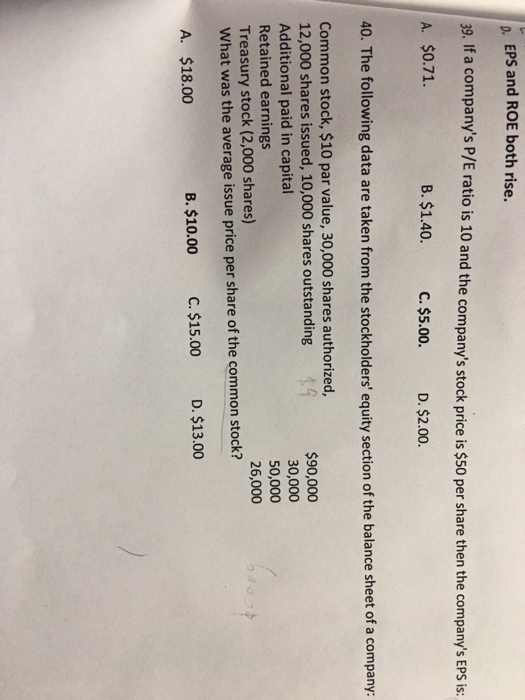

The basic P/E formula takes current stock price and EPS to find the current P/E. EPS is found by taking earnings from the last twelve months divide...

Why Use The Price Earnings Ratio?

Investors want to buy financially sound companies that offer cheap shares. Among the many ratios, the P/E is part of the research process for selec...

Limitations of Price Earnings Ratio

Finding the true value of a stock cannot just be calculated using current year earnings. The value depends on all expected future cash flows and ea...

What does ROE tell investors?

ROE tells investors so much more than a simple EPS number. ROE gives investors a glimpse at the management’s efficiency in making profits, not just simply how much it earned. ROE gives insights on the company’s margins, revenue, retained earnings and much more.

What is ROE percentage?

ROE is represented as a percentage, and tells the return shareholders receive on their investment.

What is the denominator of ROE?

The denominator in the equation for ROE is Shareholder Equity, which is simply assets minus liabilities. This means that as a company takes on more debt its liabilities increase, which reduces Shareholder Equity, which will increase ROE.

Why should ROE be used?

ROE should be used to compare companies within the same industry. Don’t expect as much use out of it comparing Intel to J C Penny’s, because those companies have completely different business models.

Why is EPS important?

EPS is important, but it does not tell the whole story. By looking at a company’s return on equity, investors get a much better picture of the ability for a company to make profits.

What is the difference between a higher ROE and a lower ROE?

The higher the percentage, the more “efficiently” the company is creating profits. In other words, a company with a higher ROE is able to make more profits per dollar invested than a company with a lower ROE.

What is a good ROE?

As a VERY general rule, companies with ROE of 15% or more are considered decent. Investors should also look for consistent or increasing ROE over longer periods of time.

What does low P/E mean in stocks?

Companies with a low Price Earnings Ratio are often considered to be value stocks. It means they are undervalued because their stock price trade lower relative to its fundamentals. This mispricing will be a great bargain and will prompt investors to buy the stock before the market corrects it. And when it does, investors make a profit as a result of a higher stock price. Examples of low P/E stocks can be found in mature industries that pay a steady rate of dividends#N#Dividend A dividend is a share of profits and retained earnings that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend.#N#.

What is the difference between EPS and fair value?

It is a popular ratio that gives investors a better sense of the value. Fair Value Fair value refers to the actual value of an asset - a product, stock, or security - that is agreed upon by both the seller and the buyer.

What is a peg ratio?

PEG Ratio PEG Ratio is the P/E ratio of a company divided by the forecasted Growth in earnings (hence "PEG"). It is useful for adjusting high growth companies. The ratio adjusts the traditional P/E ratio by taking into account the growth rate in earnings per share that are expected in the future. Examples, and guide to PEG

What is justified P/E ratio?

The justified P/E ratio#N#Justified Price to Earnings Ratio The justified price to earnings ratio is the price to earnings ratio that is "justified" by using the Gordon Growth Model. This version of the popular P/E ratio uses a variety of underlying fundamental factors such as cost of equity and growth rate.#N#above is calculated independently of the standard P/E. In other words, the two ratios should produce two different results. If the P/E is lower than the justified P/E ratio, the company is undervalued, and purchasing the stock will result in profits if the alpha#N#Alpha Alpha is a measure of the performance of an investment relative to a suitable benchmark index such as the S&P 500. An alpha of one (the baseline value is zero) shows that the return on the investment during a specified time frame outperformed the overall market average by 1%.#N#is closed.

What is a growth stock?

Companies with a high Price Earnings Ratio are often considered to be growth stocks. This indicates a positive future performance, and investors have higher expectations for future earnings growth and are willing to pay more for them. The downside to this is that growth stocks are often higher in volatility, and this puts a lot of pressure on companies to do more to justify their higher valuation. For this reason, investing in growth stocks will more likely be seen as a risky#N#Risk Aversion Risk aversion refers to the tendency of an economic agent to strictly prefer certainty to uncertainty. An economic agent exhibiting risk aversion is said to be risk averse. Formally, a risk averse agent strictly prefers the expected value of a gamble to the gamble itself.#N#investment. Stocks with high P/E ratios can also be considered overvalued.

How to find current P/E?

The basic P/E formula takes the current stock price and EPS to find the current P/E. EPS is found by taking earnings from the last twelve months divided by the weighted average shares outstanding#N#Weighted Average Shares Outstanding Weighted average shares outstanding refers to the number of shares of a company calculated after adjusting for changes in the share capital over a reporting period. The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) on a company's financial statements#N#. Earnings can be normalized#N#Normalization Financial statements normalization involves adjusting non-recurring expenses or revenues in financial statements or metrics so that they only reflect the usual transactions of a company. Financial statements often contain expenses that do not constitute a company's normal business operations#N#for unusual or one-off items that can impact earnings#N#Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through#N#abnormally. Learn more about normalized EPS#N#Normalized EPS Normalized EPS refers to adjustments made to the income statement to reflect the up and down cycles of the economy.#N#.

What is equity research analyst?

Equity Research Analyst An equity research analyst provides research coverage of public companies and distributes that research to clients.

What is EPS in stock?

EPS is the bottom-line measure of a company’s profitability and it's basically defined as net income divided by the number of outstanding shares. Earnings yield is defined as EPS divided by the stock price (E/P).

What is EPS in accounting?

EPS. EPS is the bottom-line measure of a company’s profitability and it's basically defined as net income divided by the number of outstanding shares. Basic EPS uses the number of shares outstanding in the denominator while fully diluted EPS (FDEPS) uses the number of fully diluted shares in the denominator.

How to calculate payout ratio?

The payout ratio could also be calculated by merely dividing the DPS ($2.87) by the EPS ($3.66) for the past year. However, in reality, this calculation requires one to know the actual values for per-share dividends and earnings, which are generally less widely known by investors than the dividend yield and P/E of a specific stock.

How to calculate earnings yield?

In other words, it is the reciprocal of the P/E ratio. Thus, Earnings Yield = EPS / Price = 1 / (P/E Ratio), expressed as a percentage .

Why is stock B 10% yield?

But using Stock B’s 10% earnings yield makes it easier for the investor to compare returns and decide whether the yield differential of 4 percentage points justifies the risk of investing in the stock rather than the bond. Note that even if Stock B only has a 4% dividend yield (more about this later), the investor is more concerned about total potential return than actual return.

Why is earnings yield important?

The earnings yield makes it easier to compare potential returns between, for example, a stock and a bond. Let’s say an investor with a healthy risk appetite is trying to decide between Stock B and a junk bond with a 6% yield. Comparing Stock B’s P/E of 10 and the junk bond’s 6% yield is akin to comparing apples and oranges.

What is P/E ratio?

The price/earnings (P/E) ratio , also known as an “earnings multiple,” is one of the most popular valuation measures used by investors and analysts. The basic definition of a P/E ratio is stock price divided by earnings per share (EPS). The ratio construction makes the P/E calculation particularly useful for valuation purposes, but it's tough to use intuitively when evaluating potential returns, especially across different instruments. This is where earnings yield comes in.

Is the S&P 500 a fair value?

Goldman believes that the S&P 500 is at a fair value relative to interest rates and profitability. However, they warn that "policy uncertainty and negative revisions to 2020 EPS forecasts will limit equity upside.". Take the Next Step to Invest. Advertiser Disclosure.

Is the S&P 500 index going to be challenging?

"The path forward for [S&P 500] index ROE is likely to be challenging, although lower interest rates and lower tax rates may provide support," Goldman says. On the matter of weakening growth, their U.S. Current Activity Indicator slowed from 1.7% at the start of 2019 to 1.1% in June.

Significance For Investors

The median stock in Goldman's high ROE growth basket has a forward ROE of 19% and a projected ROE growth rate of 23%. The figures for the median stock in the S&P 500 Index (SPX) are 19% and 2%, respectively. These findings were presented in the same report which asserts that fundamentals remain strong, pointing to more stock market gains ahead.

Looking Ahead

Rising interest rates, inflation, and labor costs, as well as the likelihood of a slowdown in demand, are forces that give stocks with fast-growing ROE the potential to outperform going forward. Third quarter profit reports should indicate whether these stocks are still on a growth path, or if they are starting to encounter headwinds.

What is the numerator of ROE?

In the ROE formula, the numerator is net income or the bottom-line profits reported on a firm’s income statement. The denominator is equity, or, more specifically, shareholders’ equity .

Why should investors see negative returns on shareholders' equity?

In that case, investors should regard negative returns on shareholders' equity as a warning sign that the company is not as healthy. For many companies, something as simple as increased competition can eat into returns on equity.

What is the meaning of ROE?

Return on equity (ROE) is measured as net income divided by shareholders' equity. When a company incurs a loss, hence no net income, return on equity is negative. A negative ROE is not necessarily bad, mainly when costs are a result of improving the business, such as through restructuring. If net income is negative, free cash flow can be used ...

Why do new businesses have losses?

New businesses have losses in their early years due to costs from capital expenditures, advertising expenses, debt payments, vendor payments, and more, all before their product or service gains traction in the market.

Do startups lose money?

Most startup companies lose money in their early days. Therefore, if investors only looked at the negative return on shareholder equity, no one would ever invest in a new business. This type of attitude would prevent investors from buying into some great companies early on at relatively low prices.

Is net income a bad investment?

A firm may report negative net income, but it doesn’t always mean it is a bad investment. Free cash flow is another form of profitability and can be measured instead of net income.