How do I find the value of a nonconstant growth stock?

Price: The Nonconstant Growth Stock Calculator can be used to find the value of a Nonconstant or Supernormal Growth Stock. Dividend Fiels - Enter the Current Dividend (D0) in this field. Growth Rate Fields - Enter the Dividend Growth Rates in these fields. The last rate entered is used as the constant or normal dividend growth rate.

What is a nonconstant growth dividend valuation?

This is the easiest form of valuation, since you need to simply apply a percentage growth rate to your current rate, then continue applying it for future years to determine what your stock will be worth year after year. What Is a Nonconstant Growth Dividend Model? Nonconstant growth models assume the value will fluctuate over time.

What is a nonconstant growth model?

Nonconstant growth models assume the value will fluctuate over time. You may find that the stock will stay the same for the next few years, for instance, but jump or plunge in value in a few years after that.

How do you find the constant growth of a stock?

Find the PV of the dividends during the period of nonconstant growth. Find the price of the stock at the end of the nonconstant growth period, at which point it has become a constant growth stock, and discount this price back to the present.

How do you find the present value of a stock with nonconstant growth?

0:4224:53Non-Constant Growth Dividends | EXAMPLES - YouTubeYouTubeStart of suggested clipEnd of suggested clipTo the d 1 divided by ke.MoreTo the d 1 divided by ke.

How do you find the growth price of a stock?

Take the selling price and subtract the initial purchase price. The result is the gain or loss. Take the gain or loss from the investment and divide it by the original amount or purchase price of the investment. Finally, multiply the result by 100 to arrive at the percentage change in the investment.

How do you calculate supernormal growth?

StepsFind the four high growth dividends.Find the value of the constant growth dividends from the fifth dividend onward.Discount each value.Add up the total amount.

When valuing a stock using the constant growth model D1 represents the?

When valuing a stock using the constant-growth model, D1 represents the: the next expected annual dividend. Jensen Shipping has four open seats on its board of directors.

What is growth rate formula?

How to calculate growth rate percentage? To calculate the percentage growth rate, use the basic growth rate formula: subtract the original from the new value and divide the results by the original value. To turn that into a percent increase, multiply the results by 100.

How do we calculate growth?

How to Calculate YOY GrowthTake your current month's growth number and subtract the same measure realized 12 months before. ... Next, take the difference and divide it by the prior year's total number. ... Multiply it by 100 to convert this growth rate into a percentage rate.

What is a supernormal growth rate?

A supernormal dividend growth rate is a period of time in which the dividends issued on shares of stock are increasing at a higher than normal rate.

What is supernormal growth?

Supernormal growth is a period of escalating earnings, for one year or more. Supernormal growth periods are unsustainable over the long-term as competition or market saturation eventually result in lower growth levels.

What is constant growth stock valuation?

The Constant Growth Model is a way of share evaluation. Also known as Gordon Growth Model, it assumes that the dividends paid by the company will continue to go up at a constant growth rate indefinitely. It helps investors determine the fair price to pay for a stock today based on future dividend payments.

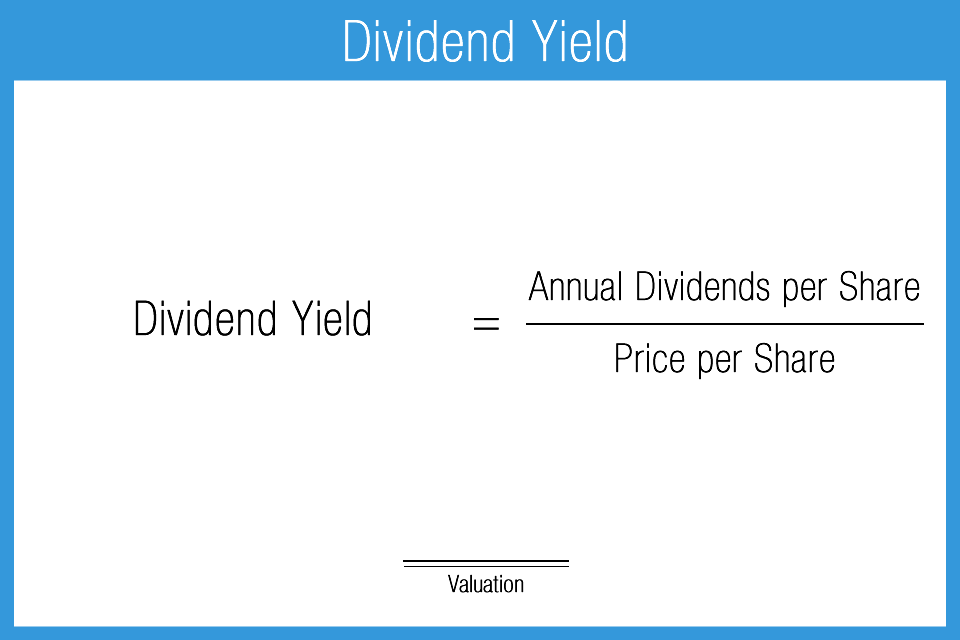

How do you calculate share price using dividend growth model?

That formula is:Rate of Return = (Dividend Payment / Stock Price) + Dividend Growth Rate.($1.56/45) + .05 = .0846, or 8.46%Stock value = Dividend per share / (Required Rate of Return – Dividend Growth Rate)$1.56 / (0.0846 – 0.05) = $45.$1.56 / (0.10 – 0.05) = $31.20.

What is the basic assumption of the constant growth model?

The Gordon growth model (GGM) assumes that a company exists forever and that there is a constant growth in dividends when valuing a company's stock. The GGM works by taking an infinite series of dividends per share and discounting them back into the present using the required rate of return.

What is the formula to calculate market price of shares as per Gordon's model?

Gordon Growth Model Share Price Calculation The formula consists of taking the DPS in the period by (Required Rate of Return – Expected Dividend Growth Rate). For example, the value per share in Year is calculated using the following equation: Value Per Share ($) = $5.15 DPS ÷ (8.0% Ke – 3.0% g) = $103.00.

What is D1 P0?

D1 = dividend to be paid at the end of year 1. P0 = share price.

What is dividend growth rate?

The dividend growth rate is the annualized percentage rate of growth that a particular stock's dividend undergoes over a period of time. Many mature companies seek to increase the dividends paid to their investors on a regular basis.

How do you use the Gordon growth model?

To apply the Gordon growth model, you must first know the annual dividend payment and then estimate its future growth rate. Most investors simply look at the historic dividend growth rate and make the assumption that future growth will be comparable to past growth.

What do you mean by dividend model?

What Is the Dividend Discount Model? The dividend discount model (DDM) is a quantitative method used for predicting the price of a company's stock based on the theory that its present-day price is worth the sum of all of its future dividend payments when discounted back to their present value.

What does G c mean?

g c = the long-term constant growth rate in dividends, and

Can rapid growth continue indefinitely?

However, the period of rapid growth cannot continue indefinitely. Eventually, competitors will enter the market and catch up with the firm. These firms cannot be valued properly using the Constant Growth Stock Valuation approach.

What is supernormal growth?

The purpose of the supernormal growth model is to value a stock that is expected to have higher than normal growth in dividend payments for some period in the future. After this supernormal growth, the dividend is expected to go back to normal with constant growth.

Why is supernormal growth so difficult?

Calculations using the supernormal growth model are difficult because of the assumptions involved, such as the required rate of return, growth or length of higher returns. If this is off it could drastically change the value of the shares. In most cases, such as tests or homework, these numbers will be given. But in the real world, we are left to calculate and estimate each of the metrics and evaluate the current asking price for shares. Supernormal growth is based on a simple idea, but can even give veteran investors trouble.

How to find the value of a common share?

To find the value of a common share, take the dividends you expect to receive during your holding period and discount it back to the present period. But there is one additional calculation: When you sell the common shares, you will have a lump sum in the future which will have to be discounted back as well.

What is the discount rate for dividends?

For example, if you have a stock that pays a $1.45 dividend which is expected to grow at 15% for four years, then at a constant 6% into the future, the discount rate is 11% .

How to calculate the value of the remaining dividends?

Still working with the last period of higher growth, calculate the value of the remaining dividends using the V = D 1 ÷ (k - g) equation from the previous section. But D 1, in this case, would be next year's dividend, expected to be growing at the constant rate. Now the discount goes back to the present value through four periods.

What does P mean in stock?

We will use "P" to represent the future price of the shares when you sell them. Take this expected price (P) of the stock at the end of the holding period and discount it back at the discount rate. You can already see there are more assumptions you need to make which increases the odds of miscalculating.

Which part of the dividend has a higher growth?

One way to think about the dividend payments is in two parts: A and B. Part A has a higher growth dividend, while Part B has a constant growth dividend.

What is non constant growth?

Nonconstant growth models assume the value will fluctuate over time. You may find that the stock will stay the same for the next few years, for instance, but jump or plunge in value in a few years after that. In that case, you can calculate for steady growth for those early years, then estimate upward or downward movement at whatever point you see necessary.

What Is a Constant Growth Dividend Model?

One of the easiest ways to calculate dividend growth is to come from the assumption that the company’s growth will continue at the same percentage rate that it’s currently demonstrating.

Is 35.3 percent constant or non constant?

This isn’t guaranteed, but neither constant nor nonconstant growth predictions are foolproof.