Apple Stock Split: Apple Stock Split History

| Date | Split | Price before Split | 3 Months Change | 1-year Change |

| Aug 31, 2020 | 4 :1 | $502 | (4.8%) | 21.4% |

| June 9, 2014 | 7:1 | $656 | 6.7% | 38.6% |

| Feb 28, 2005 | 2:1 | $90 | (8.8%) | 59.6% |

| June 21, 2000 | 2:1 | $111 | 20.6% | (57.2%) |

How much was Apple stock before split?

Apple Stock Price – Technical Analysis. The Apple stock price has reached a new all-time high above $460 before the split. In this video, I explain why I have set buy limit orders at $394 and $357. Apple stock (AAPL) price analysis 2020. The price remains above the daily Ichimoku cloud.

What would Apple stock be worth if it never split?

What would Apple stock be worth if it never split? If the stock never split after its IPO, the price would be at $6,552. The stock has done a 2:1 split 3 times, and a 7:1 split. So that is 2 * 2 * 2 * 7 = 56:1 split, so simply multiply the current price by 56. If AAPL didn’t split 7:1 last year, it would be worth $807.17 (115.31*7). What ...

When will Apple split its stock again?

Since Apple stock currently trades above $380, it means investors should expect to again have a chance to buy a share of Apple for around $100, depending on where the stock trades at the end of August. The shares will be distributed to shareholders at the close of business on August 24, and trading will begin on a split-adjusted basis on August 31.

When did Apple last split its stock?

Since Apple went public in 1980, shares have split four times. When did Apple stock split last? In June 2014, Apple stock was split 7-to-1. Whether it was on purpose or not, the split changed Apple stock's pre-split all-time high from a few dollars above $700 to about $100 after accounting for the split.

How much was Apple stock if it didnt split?

If Apple never split its stock, a single share would have been worth around $1,800 as of 2021.

What was Apple's stock before the split?

If today you own 100 shares worth $500 each, on Monday you will have 400 shares worth $125 each. But it turns out that splits matter more than you'd logically think. The last Apple (ticker: AAPL) split was 7-for-1, in June 2014. There were 2-for-1 splits in February 2005, June 2000, and May 1987.

What would $1000 invested in Apple be worth today?

Based on a price of $149.31 for Apple shares at the time of writing, the $1,000 investment would now be worth $425,596.59. This represents a return of 42,559.67% over the last 21+ years.

What will Apple be worth in 10 years?

The Bottom Line Assuming 18% compound annual growth over the next decade, your $10,298 investment in Apple would be worth $53,898.

What was Apple's stock price before split 2014?

Apple stock split historySplit ratioPrice before split16 June 19872:1$79 (31 May 1987)21 June 20002:1$111 (31 May 2000)28 February 20052:1$90 (31 January 2005)9 June 20147:1$656 (31 May 2014)1 more row•Aug 27, 2020

How many stock splits did Apple have?

five timesSince the tech hardware leader went public more than 40 years ago, Apple has split its shares five times and created massive shareholder wealth.

What happened to Apple stock in August 2020?

On August 31, 2020, Apple completed a 4-for-1 forward stock split. As of 8/31/20, shareholders will now hold 4 shares of AAPL for every 1 share previously held. As a result, Apple has adjusted their price per share to accommodate the increase in the company's shares outstanding.

What was the Apple stock split?

The shares rose more than 8% on the news on Feb. 2 when they approached $3,000. The 20-for-1 split outdoes recent stock splits from Apple and Tesla, which split 4-for-1 and 5-for-1 respectively on the same day in August 2020.

When did Apple stock split?

Apple's stock has split several times since it first went public in December 1980. The first split came on June 16, 1987, on a two-for-one basis at a pre-split price of $79. The next split came on June 21, 2000, when share prices reached $111. On Feb. 28, 2005, Apple split its stock again when it hit $90. These last two were also two-for-one splits.

What is the market share of Apple in 2021?

As of the first quarter of 2021, its market share in the personal computer space was 15.1%. 8.

What is Apple Arcade?

Apple Arcade: Apple's video game subscription service provides users with interactive games and entertainment. There are free games with the option to make upgrades through in-app purchases.

How much did Apple spend on R&D in 2020?

Apple spent $18.75 billion on research and development (R&D) in 2020. 2 By comparison, other Fortune 500 companies focus more of their energy on advertising, cost-cutting, or overall efficiency, and the difference between Apple and other companies is clear.

Why do companies like Apple beat their earnings?

Companies like Apple must beat collective market expectations of their earnings to positively influence their market capitalization. It's no accident that they often manipulate their earnings reports to match or beat estimates to artificially enhance their stock prices.

How many markets does Apple have?

Apple has a looming presence in each of its five markets, which include the iPhone, Mac products, the iPad, services, and its wearables, home, and accessories segment.

How much did the iMac stock increase in 1998?

This represented a 21.6% increase in its share price. The iMac went on to become the "number one selling machine through the retail and mail-order channels in the 1998 holiday season," according to The New York Times. 7 Apple's stock traded at $27.53 two years after its release—a whopping 263% rise.

How much did Apple split in 2014?

At the time, Apple was trading above $600 per share. The split brought shares of Apple to about $92 a share .

Do stock splits change anything?

Stock splits are cosmetic and do not fundamentally change anything about the company, other than possibly making the shares accessible to a larger number of investors because of their cheaper price.

Is Apple stock split?

Apple on Thursday announced in its fiscal third-quarter earnings that the Board of Directors has approved a four-for-one stock split.

Is Apple stock split for third quarter?

Closing Bell. Apple on Thursday announced in its fiscal third-quarter earnings that the Board of Directors has approved a four-for-one stock split. That means that, for each share of Apple stock that an investor owns, they’ll receive three additional shares. It also makes single shares in Apple more affordable for investors to buy.

When did Apple stock split?

Apple's board of directors announced a four-for-one stock split that would occur on August 31.

When will Apple stock hit $500?

Aug 24, 2020. Apple's stock has hit a new milestone — $500 per share — in pre-market trading on Monday after a particularly profitable quarter. The milestone comes shortly after Apple blew away all expectations for the June quarter.

How much is Apple's revenue in 2020?

Apple reported revenue of $59.7 billion for the third quarter of 2020, profoundly beating Wall Street estimates, in a quarter where the company continued to feel the effects of the COVID-19 pandemic. Overall revenue for Apple was up 11% from Q3 2019, when it reported a record-setting $53.8 billion.

How many shares did Apple split?

Apple split each of its shares into four. Image source: Getty Images. First of all, investors need to understand that a stock split does not change the fundamental value of a business. Stock splits simply divide up a company into more pieces, with the value of each piece reduced in kind.

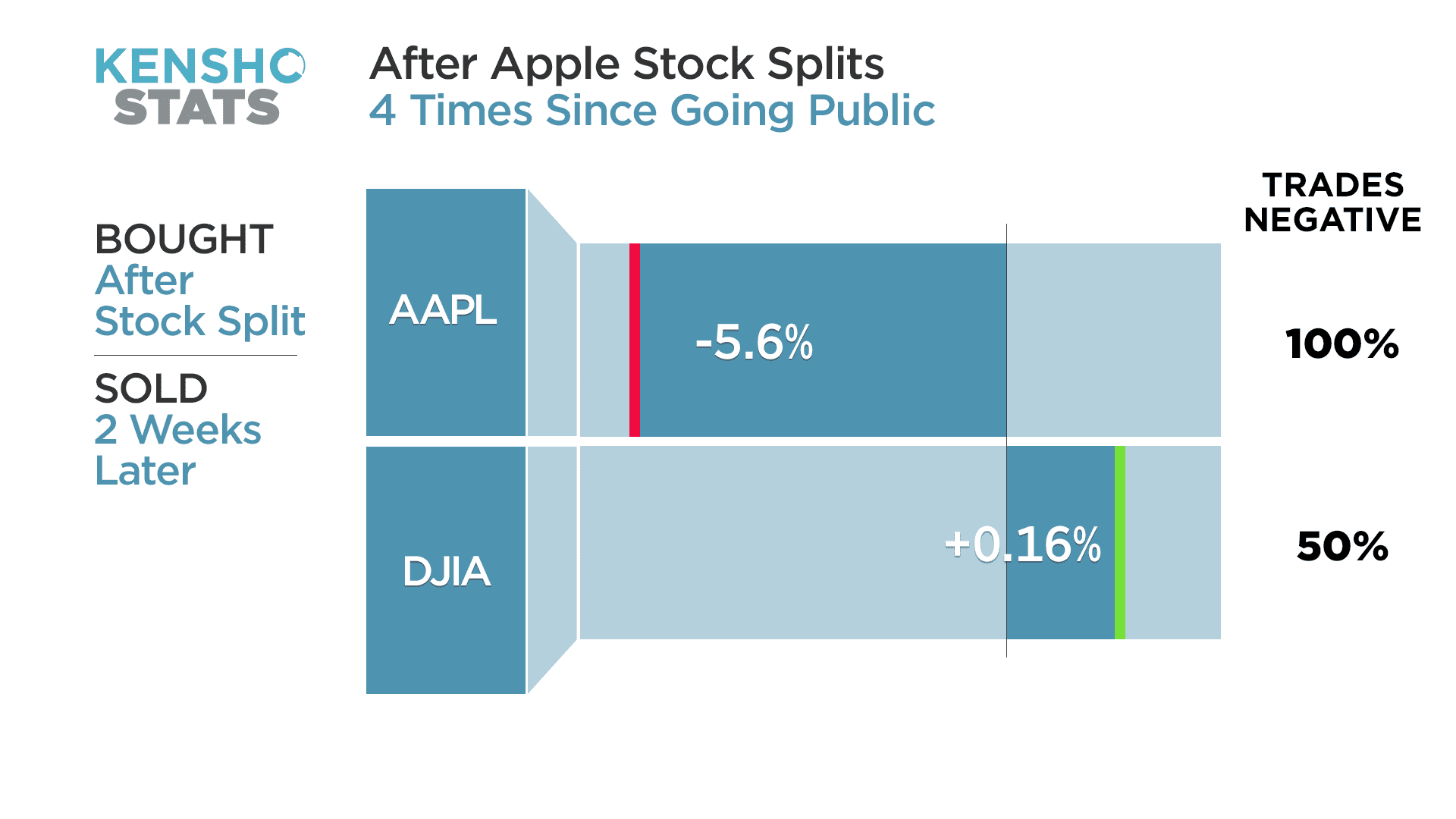

Why do people buy stocks after a split?

Perhaps the best explanation is that professional traders know that many people do get excited about splits, and so they buy the stock ahead of what they expect will be a herd of individual investors rushing in to buy shares after the split is announced.

What is a 4 for 1 stock split?

Here's another way to think about it: A 4-for-1 stock split is like exchanging a $1 bill for four quarters. You still have the same amount of money, it's just divided into more portions.

Is Apple stock a buy post split?

And in this regard, Apple's future is bright. Its stock, in turn, remains a buy post-split.

Is the tech giant a buy now that its shares have split 4-to-1 and its share price is just 25% of what it was before?

Joe honed his investing skills as an analyst for Stock Advisor. He battle-tested his investment philosophy and strategies as portfolio manager of Tier 1, a market-crushing Motley Fool real-money portfolio that delivered 24.58% annualized returns. Now, Joe’s mission is to pass on what he’s learned -- and what he continues to learn -- as a contributing writer to Fool.com. Follow @Tier1Investor

What happens to the market after Apple splits?

When a company such as Apple splits its shares, the market capitalization before and after the split takes place remains stable, meaning the shareholder now owns more shares but each are valued at a lower price per share. Often, however, a lower priced stock on a per-share basis can attract a wider range of buyers. If that increased demand causes the share price to appreciate, then the total market capitalization rises post-split. This does not always happen, however, often depending on the underlying fundamentals of the business.

How many splits does Apple have?

Apple (AAPL) has 5 splits in our Apple stock split history database. The first split for AAPL took place on June 16, 1987. This was a 2 for 1 split, meaning for each share of AAPL owned pre-split, the shareholder now owned 2 shares. For example, a 1000 share position pre-split, became a 2000 share position following the split. AAPL's second split took place on June 21, 2000. This was a 2 for 1 split, meaning for each share of AAPL owned pre-split, the shareholder now owned 2 shares. For example, a 2000 share position pre-split, became a 4000 share position following the split. AAPL's third split took place on February 28, 2005. This was a 2 for 1 split, meaning for each share of AAPL owned pre-split, the shareholder now owned 2 shares. For example, a 4000 share position pre-split, became a 8000 share position following the split. AAPL's 4th split took place on June 09, 2014. This was a 7 for 1 split, meaning for each share of AAPL owned pre-split, the shareholder now owned 7 shares. For example, a 8000 share position pre-split, became a 56000 share position following the split. AAPL's 5th split took place on August 31, 2020. This was a 4 for 1 split, meaning for each share of AAPL owned pre-split, the shareholder now owned 4 shares. For example, a 56000 share position pre-split, became a 224000 share position following the split.

When did the second AAPL split happen?

AAPL's second split took place on June 21, 2000. This was a 2 for 1 split, meaning for each share of AAPL owned pre-split, the shareholder now owned 2 shares. For example, a 2000 share position pre-split, became a 4000 share position following the split.

When did AAPL split?

AAPL's third split took place on February 28, 2005. This was a 2 for 1 split, meaning for each share of AAPL owned pre-split, the shareholder now owned 2 shares. For example, a 4000 share position pre-split, became a 8000 share position following the split. AAPL's 4th split took place on June 09, 2014.

What is Apple's business?

Apple designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. Co.'s products include: iPhone; Mac; iPad; and wearables, home and accessories, which includes AirPods®, Apple TV®, Apple Watch®, Beats® products, HomePod®, iPod touch® and other Apple-branded ...