Can machine learning predict stock returns?

Stock Price Prediction – Machine Learning Project in Python Machine learning has significant applications in the stock price prediction. In this machine learning project, we will be talking about predicting the returns on stocks. This is a very complex task and has uncertainties.

How accurate are LSTM models in predicting stock prices?

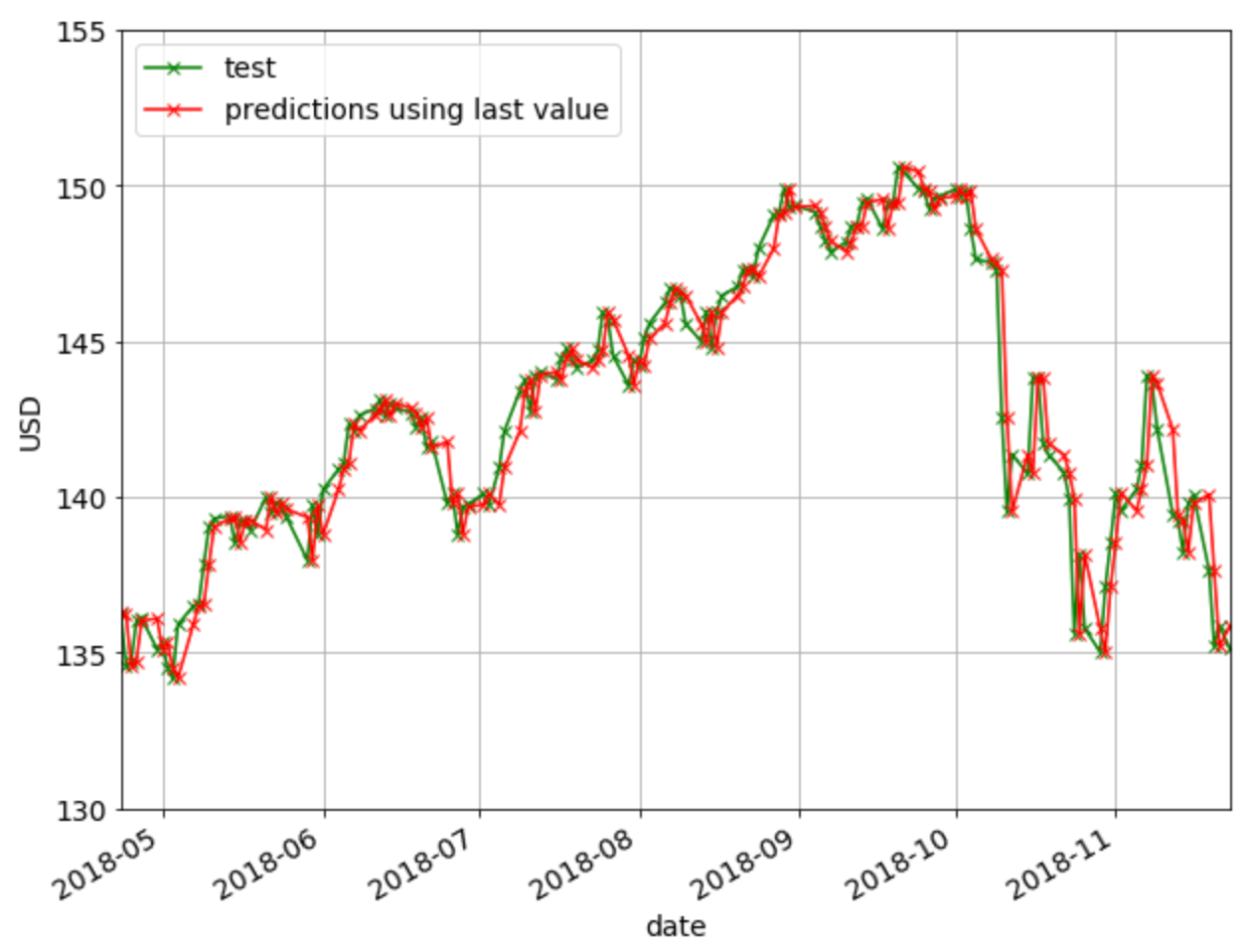

As you can see above, the model can predict the trend of the actual stock prices very closely. The accuracy of the model can be enhanced by training with more data and increasing the LSTM layers. Enhance your skill set and give a boost to your career with the Post Graduate Program in AI and Machine Learning.

What is the final output value of the machine learning model?

The final output value that is to be predicted using the Machine Learning model is the Adjusted Close Value. This value represents the closing value of the stock on that particular day of stock market trading.

How machine learning algorithms are used in stock market analysis?

In short, Machine Learning Algorithms are being used widely by many organisations in analysing and predicting stock values. This article shall go through a simple Implementation of analysing and predicting a Popular Worldwide Online Retail Store’s stock values using several Machine Learning Algorithms in Python.

Can you predict stock prices with machine learning?

No, because the stock prices are basically noise. The best invesment strategy is the Random Walk. Any Learning Machine can obtain good results only in the training data.

What is the best machine learning algorithm for stock prediction?

LSTM, short for Long Short-term Memory, is an extremely powerful algorithm for time series. It can capture historical trend patterns, and predict future values with high accuracy.

Can we use AI to predict stock price?

Not only are machines incapable of predicting a black swan event, but, in reality, they are more likely to cause one, as traders found out the hard way during the 2010 flash crash when an algorithmic computer malfunction caused a temporary market meltdown. Ultimately, A.I is doomed to fail at stock market prediction.

How do you predict future stock prices?

Topics#1. Influence of FPI/FII and DII.#2. Influence of company's fundamentals. #2.1 About fundamental analysis. #2.2 Correlation between reports, fundamentals & fair price. #2.3 Two methods to predict stock price. #2.4 Future PE-EPS method. #1 Step: Estimate future PE. #2 Step: Estimate future EPS.

What is the best model to predict stock prices?

One method for predicting stock prices is using a long short-term memory neural network (LSTM) for times series forecasting.

Does Arima work for stocks?

One of the most widely used models for predicting linear time series data is this one. The ARIMA model has been widely utilized in banking and economics since it is recognized to be reliable, efficient, and capable of predicting short-term share market movements.

What is the algorithm for stock prices?

The algorithm of stock price is coded in its demand and supply. A share transaction takes place between a buyer and a seller at a price. The price at which the transaction is executed sets the stock price.

Which algorithm is used for stock market analysis?

In summary, Machine Learning Algorithms are widely utilized by many organizations in Stock market prediction. This article will walk through a simple implementation of analyzing and forecasting the stock prices of a Popular Worldwide Online Retail Store in Python using various Machine Learning Algorithms.

How do analysts predict stock prices?

The price-to-earnings ratio is likely the ratio most commonly used by investors to predict stock prices. Specifically, investors use the P/E ratio to determine how much the market will pay for a particular stock. The P/E ratio shows how much investors are willing to pay for $1 of a company's earnings.

Can neural networks predict stock market?

Neural networks do not make any forecasts. Instead, they analyze price data and uncover opportunities. Using a neural network, you can make a trade decision based on thoroughly examined data, which is not necessarily the case when using traditional technical analysis methods.

How is machine learning used in stock market?

Machine learning algorithms can process social media content such as tweets, posts, and comments of people who generally have stakes in the stock market. This data is then used to train an AI model so that it can forecast the stock prices in different scenarios.

What is the algorithm for stock prices?

The algorithm of stock price is coded in its demand and supply. A share transaction takes place between a buyer and a seller at a price. The price at which the transaction is executed sets the stock price.

Is linear regression A good machine learning model for predicting stock prices?

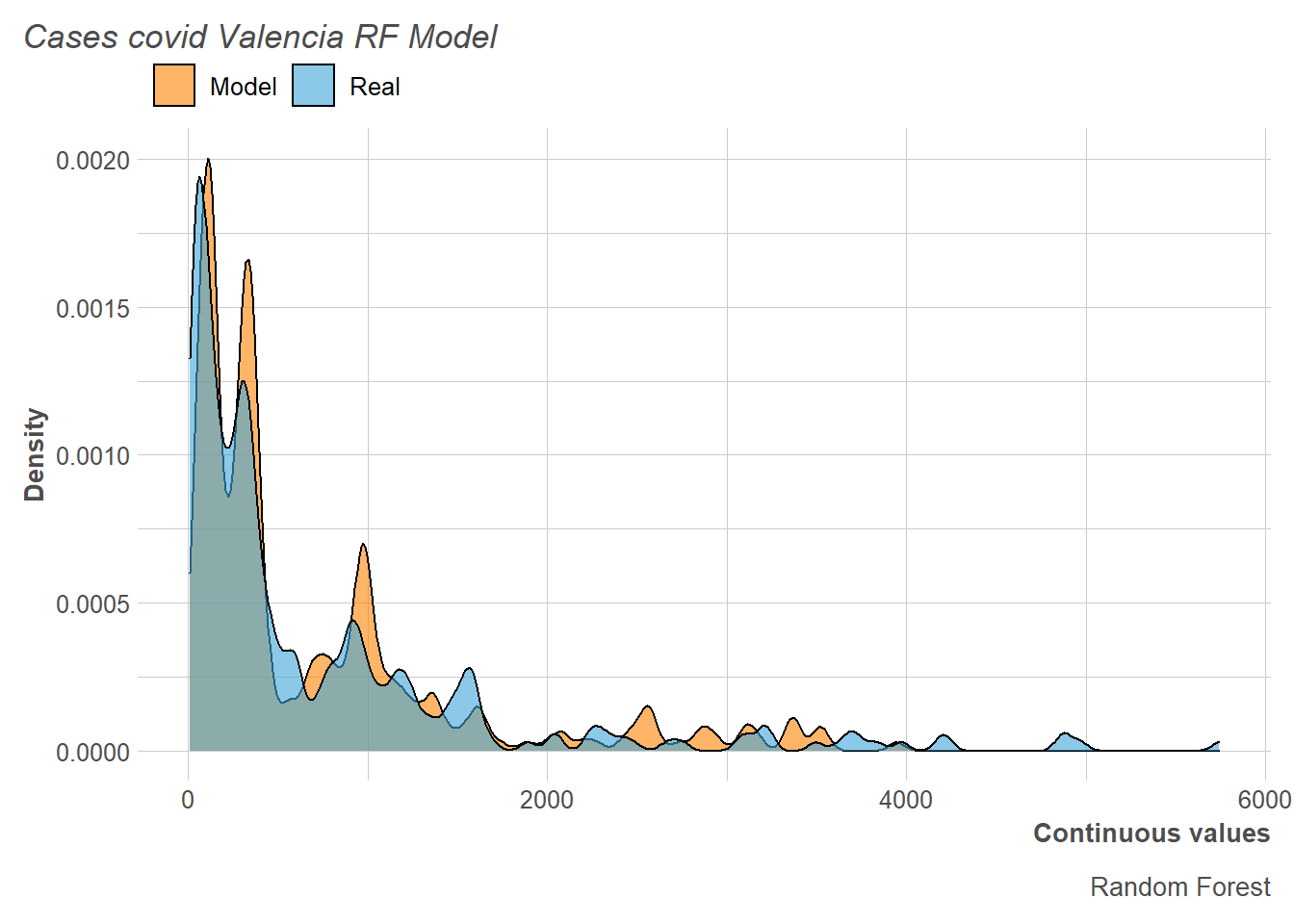

SVM exhibits great accuracy on non-linear classification data, Linear regression is recommended for linear data as it has a high confidence value, Random Forest Approach shows a high accuracy rate on a binary classification model and the Multilayer Perceptron gives the least error in prediction.

How does Python predict stock price?

Take a sample of a dataset to make stock price predictions using the LSTM model:X_test=[]for i in range(60,inputs_data. shape[0.X_test. append(inputs_data[i-60:i,X_test=np. array(X_test)X_test=np. reshape(X_test,(X_test. ... predicted_closing_price=lstm_model. predict.predicted_closing_price=scaler. inverse_transform.

Stock analysis: fundamental analysis vs. technical analysis

When it comes to stocks, fundamental and technical analyses are at opposite ends of the market analysis spectrum.

Stock prices as time-series data

Despite the volatility, stock prices aren’t just randomly generated numbers. So, they can be analyzed as a sequence of discrete-time data; in other words, time-series observations taken at successive points in time (usually on a daily basis).

Dataset analysis

For this demonstration exercise, we’ll use the closing prices of Apple’s stock (ticker symbol AAPL) from the past 21 years (1999-11-01 to 2021-07-09). Analysis data will be loaded from Alpha Vantage, which offers a free API for historical and real-time stock market data.

Create a Neptune project

With regard to model training and performance comparison, Neptune makes it convenient for users to track everything model-related, including hyper-parameter specification and evaluation plots. This complete guide provides step-by-step instructions on how to set up and configure your Neptune projects with Python.

Evaluation metrics and helper functions

Since stock prices prediction is essentially a regression problem, the RMSE (Root Mean Squared Error) and MAPE (Mean Absolute Percentage Error %) will be our current model evaluation metrics. Both are useful measures of forecast accuracy.

Predicting stock price with Moving Average (MA) technique

MA is a popular method to smooth out random movements in the stock market. Similar to a sliding window, an MA is an average that moves along the time scale/periods; older data points get dropped as newer data points are added.

Introduction to LSTMs for the time-series data

Now, let’s move on to the LSTM model. LSTM, short for Long Short-term Memory, is an extremely powerful algorithm for time series. It can capture historical trend patterns, and predict future values with high accuracy.

Why is it so hard to predict the stock market?

There are several reasons for this, such as the market volatility and so many other dependent and independent factors for deciding the value of a particular stock in the market. These factors make it very difficult for any stock market analyst to predict ...

What is the final output value that is to be predicted using the Machine Learning model?

The final output value that is to be predicted using the Machine Learning model is the Adjusted Close Value. This value represents the closing value of the stock on that particular day of stock market trading.

What is LSTM in machine learning?

To develop a Machine Learning model to predict the stock prices of Microsoft Corporation, we will be using the technique of Long Short-Term Memory (LSTM). They are used to make small modifications to the information by multiplications and additions. By definition, long-term memory (LSTM) is an artificial recurrent neural network (RNN) architecture used in deep learning.

Visualize decision tree predictions

predictions = treePrediction valid = apple [x.shape [0]:] valid ["Predictions"] = predictions plt.figure (figsize= (10, 6)) plt.title ("Apple's Stock Price Prediction Model (Decision Tree Regressor Model)") plt.xlabel ("Days") plt.ylabel ("Close Price USD ($)") plt.plot (apple ["Close Price"]) plt.plot (valid [ ["Close Price", "Predictions"]]) plt.legend ( ["Original", "Valid", "Predictions"]) plt.show ().

Visualize the linear model predictions

predictions = linearPrediction valid = apple [x.shape [0]:] valid ["Predictions"] = predictions plt.figure (figsize= (10, 6)) plt.title ("Apple's Stock Price Prediction Model (Linear Regression Model)") plt.xlabel ("Days") plt.ylabel ("Close Price USD ($)") plt.plot (apple ["Close Price"]) plt.plot (valid [ ["Close Price", "Predictions"]]) plt.legend ( ["Original", "Valid", "Predictions"]) plt.show ().

Overview

Here is and implementation of the application of the Artificial Neural Network (ANN) is a learning method that can be used for predicion and classification. In this repository, ANN back-propagation is implemented to predict the closing price of the S&P 500 stock exchange using historical data.

Conclusions

After doing some experiment, we explain the conclusions and suggestions of the final work done. Here are the conclusions:

What are the methods used in machine learning?

You then learn several other popular methods: Nearest neighbors, support vector machines, decision trees, random forests, and boosting.

How many nodes can be added to a deep learning model?

This is usually a second step to improving a deep learning model. In the code below, you can see additional nodes are added up to 32 nodes, but still a single-layer model.

What is deep learning model?

Deep learning models have come to light as useful for prediction in so many cases. Deep learning models with no “fancy” layers work well for most traditional classification and regression predictions where many samples are available. Deep Learning with no “fancy” layers.

Does dropout of capacity improve time series?

In many cases, dropout of any capacity does not lead to improvements in time series models. For illustration purposes, you can see how dropout may be added to a model. However, note the above points anytime you decide to use dropout in one of these types of recurrent models.

What dataset is used to build a stock price prediction model?

To build the stock price prediction model, we will use the NSE TATA GLOBAL dataset. This is a dataset of Tata Beverages from Tata Global Beverages Limited, National Stock Exchange of India: Tata Global Dataset

What is stock price prediction?

Stock price prediction is a machine learning project for beginners; in this tutorial we learned how to develop a stock cost prediction model and how to build an interactive dashboard for stock analysis. We implemented stock market prediction using the LSTM model. OTOH, Plotly dash python framework for building dashboards.

Stock Analysis: Fundamental Analysis vs. Technical Analysis

Stock Prices as Time-Series Data

Dataset Analysis

Create A Neptune Project

Evaluation Metrics and Helper Functions

Predicting Stock Price with Moving Average (MA) Technique

- MA is a popular method to smooth out random movements in the stock market. Similar to a sliding window, an MA is an average that moves along the time scale/periods; older data points get dropped as newer data points are added. Commonly used periods are 20-day, 50-day, and 200-day MAfor short-term, medium-term, and long-term investment respectively....

Introduction to LSTMs For The Time-Series Data

Comparison of SMA, Ema, and LSTM Models

Final Thoughts on New Methodologies

Introduction

Problem Statement

Long Short-Term Memory

- To develop a Machine Learning model to predict the stock prices of Microsoft Corporation, we will be using the technique of Long Short-Term Memory (LSTM). They are used to make small modifications to the information by multiplications and additions. By definition, long-term memory (LSTM) is an artificial recurrent neural network (RNN) architecture ...

Program Implementation

Conclusion