Who holds Pitney Bowes'stock?

Only 4.00% of the stock of Pitney Bowes is held by insiders. 65.54% of the stock of Pitney Bowes is held by institutions. High institutional ownership can be a signal of strong market trust in this company.

What are Pitney Bowes'target prices for the next 12 months?

2 brokers have issued twelve-month target prices for Pitney Bowes' shares. Their forecasts range from $10.00 to $10.00. On average, they anticipate Pitney Bowes' stock price to reach $10.00 in the next twelve months. This suggests a possible upside of 73.0% from the stock's current price.

Is Pitney Bowes's dividend sustainable?

Pitney Bowes pays a meaningful dividend of 3.46%, higher than the bottom 25% of all stocks that pay dividends. Pitney Bowes does not have a long track record of dividend growth. The dividend payout ratio of Pitney Bowes is 222.25%. Payout ratios above 75% are not desirable because they may not be sustainable.

What is the rating of Pitney Bowes Inc (PBI)?

PITNEY BOWES INC has an Investment Rating of HOLD; a target price of $7.000000; an Industry Subrating of High; a Management Subrating of Low; a Safety Subrating of Low; a Financial Strength Subrating of Medium; a Growth Subrating of Medium; and a Value Subrating of High. PBI: What does Argus have to say about PBI?

See more

Is Pitney Bowes stock a buy?

Is Pitney Bowes Stock a good buy in 2022, according to Wall Street analysts? The consensus among 1 Wall Street analyst covering (NYSE: PBI) stock is to Strong Buy PBI stock.

Is Pitney Bowes going out of business?

Based on the latest financial disclosure, Pitney Bowes has a Probability Of Bankruptcy of 52%. This is 22.12% higher than that of the Industrials sector and significantly higher than that of the Integrated Freight & Logistics industry.

Is Pitney Bowes publicly traded?

The company provides mailing and shipping services, global e-commerce logistics, and financial services to approximately 750,000 customers globally, as of 2021....Pitney Bowes.FormerlyPitney Bowes Postage Meter CompanyTypePublicTraded asNYSE: PBI S&P 600 ComponentIndustryBusiness servicesFoundedApril 23, 19208 more rows

Is PBI a good stock?

(NYSE:PBI) is more popular among hedge funds. Our overall hedge fund sentiment score for PBI is 79.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score.

How has Pitney Bowes' stock price performed in 2022?

Pitney Bowes' stock was trading at $6.63 at the start of the year. Since then, PBI stock has decreased by 33.6% and is now trading at $4.40. View...

Are investors shorting Pitney Bowes?

Pitney Bowes saw a decline in short interest in May. As of May 15th, there was short interest totaling 11,330,000 shares, a decline of 18.7% from t...

When is Pitney Bowes' next earnings date?

Pitney Bowes is scheduled to release its next quarterly earnings announcement on Tuesday, August 2nd 2022. View our earnings forecast for Pitney B...

How were Pitney Bowes' earnings last quarter?

Pitney Bowes Inc. (NYSE:PBI) issued its quarterly earnings results on Thursday, April, 28th. The technology company reported $0.08 earnings per sha...

How often does Pitney Bowes pay dividends? What is the dividend yield for Pitney Bowes?

Pitney Bowes declared a quarterly dividend on Monday, May 2nd. Investors of record on Monday, May 23rd will be paid a dividend of $0.05 per share o...

Is Pitney Bowes a good dividend stock?

Pitney Bowes(NYSE:PBI) pays an annual dividend of $0.20 per share and currently has a dividend yield of 4.41%. PBI has a dividend yield higher than...

Who are Pitney Bowes' key executives?

Pitney Bowes' management team includes the following people: Mr. Marc B. Lautenbach , Pres, CEO & Director (Age 61, Pay $2.16M) Ms. Ana Maria Ch...

What is Marc Lautenbach's approval rating as Pitney Bowes' CEO?

628 employees have rated Pitney Bowes CEO Marc Lautenbach on Glassdoor.com . Marc Lautenbach has an approval rating of 67% among Pitney Bowes' emp...

Who are some of Pitney Bowes' key competitors?

Some companies that are related to Pitney Bowes include Avery Dennison (AVY) , MSA Safety (MSA) , HNI (HNI) , Steelcase (SCS) , Interface (TIL...

Research & Ratings Pitney Bowes Inc.(PBI)

Per-Share Earnings, Actuals and Estimates

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet.

How much does Pitney Bowes make?

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet.

When is Pitney Bowes earnings call?

Pitney Bowes has a market capitalization of $1.47 billion and generates $3.55 billion in revenue each year. The technology company earns $-181,540,000.00 in net income (profit) each year or $0.30 on an earnings per share basis.

Does Pitney Bowes have a dividend?

Pitney Bowes will be holding an earnings conference call on Tuesday, August 3rd at 8:00 AM Eastern. Interested parties can register for or listen to the call using this link.

What is Pitney Bowes known for?

Pitney Bowes does not yet have a strong track record of dividend growth. The dividend payout ratio of Pitney Bowes is 66.67%. This payout ratio is at a healthy, sustainable level, below 75%. Based on earnings estimates, Pitney Bowes will have a dividend payout ratio of 36.36% next year.

Where is the US headquartered?

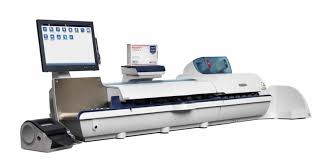

Pitney Bowes is an American technology company most known for its postage meters and other mailing equipment and services, and with expansions into e-commerce, software, and other technologies.

Where is Pitney Bowes located?

US listed security. Listed on NYSE. US headquartered. Headquartered in Stamford, Connecticut, United States .

Who invented the postage meter?

Pitney Bowes is based in Stamford, Connecticut, and operates a 300,000-square-foot Global Technology Center for manufacturing and engineering in Danbury, Connecticut. The company has 33 operating centers throughout the United States, and additional offices in Hatfield, New Delhi, Tokyo and Bielsko-Biala.

New York Stock Exchange

Pitney Bowes is an American technology company most known for its postage meters and other mailing equipment and services, and with expansions into e-commerce, software, and other technologies. The company was founded by Arthur Pitney, who invented the first commercially available postage meter, and Walter Bowes as the Pitney Bowes Postage Meter ...

Environmental, Social, and Governance Rating

Clients around the world, including 90 percent of the Fortune 500, rely on products, solutions, services and data from Pitney Bowes in the areas of customer information management, location intelligence, customer engagement, shipping, mailing, and global ecommerce.

Business Summary

"B" score indicates good relative ESG performance and an above-average degree of transparency in reporting material ESG data publicly and privately. Scores range from AAA to D.