What happens when a company goes public?

During an initial public offering, or IPO, a company offers shares of stock for sale to the general public for the first time—hence the phrase “going public.” Shares of the company are given a starting value known as an IPO price, and when trading begins, the price can rise amid investor demand, or fall if there is little demand.

What happens to a stock price when it goes public?

What Happens to a Stock Price When It Goes Public? The process of selling shares in a new company to the public for the first time is called an initial public offering (IPO). What happens to a stock price in an IPO depends on several factors such as the underwriting process, market conditions and investor sentiment.

How can I be notified when the stock price increases?

This investor can create a price alert and choose to be notified by primary email when the price increases 10% above its current market price. For illustrative purposes only. 2. Press releases, dividend payment date, and other company news.

What happens to employee stock options when a company goes public?

In any case, the stock will now have some type of value on the open market. As an employee, you may have a stake in the company before the IPO through employee stock options, restricted stock units (RSUs), or you may own shares in the company outright.

How can I be notified when a stock goes public?

Some of the most reliable sources of information on upcoming IPOs are exchange websites. For example, the New York Stock Exchange (NYSE) and NASDAQ both maintain dedicated sections for IPOs. NASDAQ has a dedicated section called "IPO Calendar" and NYSE maintains an "IPO Center" section.

How do I set up a stock news alert?

Setting Up a News AlertEnter a ticker.Choose which type of news your interested in.Add any additional comments.Choose your notification type.Add to your alerts list.

What happens when stocks go public?

When a company goes public, the previously owned private share ownership converts to public ownership, and the existing private shareholders' shares become worth the public trading price. Share underwriting can also include special provisions for private to public share ownership.

Do stocks go up when a company goes public?

IPOs can be volatile, with prices swinging up and down. Employees may want to wait for a stock's prices to stabilize after an IPO to suss out whether it's the right time to exercise their options.

What is the best stock alert app?

These free stock market apps for Android and iPhone help you track prices, get alerts, manage your portfolio, and invest better....The 7 Best Free Stock Trading Apps for Android and iPhoneInvesting.com. 3 Images. ... 2. Yahoo Finance. 3 Images. ... Stocktwits. ... Real Time Stocks Tracker. ... My Stocks Portfolio & Widget. ... Bloomberg. ... JStock.

How do I set up stock alerts on iPhone?

On your iPhone, iPad, and iPod touch, go to Settings > [your name] > iCloud, then turn on Stocks. On your Mac, choose Apple menu > System Preferences, then do one of the following: macOS 10.15 or later: Click Apple ID, select iCloud, then turn on Stocks. macOS 10.14 or earlier: Select iCloud, then turn on Stocks.

Do stocks usually drop after IPO?

Investors usually accept prices that are lower than a company's owners would anticipate. Consequently, stock prices after an IPO can rise, and indicate that the company could have raised more money. But too high an offer price, and possibly flawed investor expectations, can result in a precipitous stock price fall.

Can you buy stocks before a company goes public?

Can you buy pre-IPO stocks? Prior to the IPO, generally the only people who own the stock are professional investors, including venture capitalists, private equity firms, and company insiders such as founders and employees.

How can I buy an IPO before it goes public?

Steps for buying an IPO stockHave an online account with a broker that offers IPO access. Brokers like Robinhood and TD Ameritrade offer IPO trading, so you'll need an account with them or another broker that offers similar access.Meet eligibility requirements. ... Request shares. ... Place an order.

Should I join a company right before IPO?

So joining right before an IPO means the chance of successful IPO is high. So the salary will go up and options will go down compared to earlier rounds. Less potential downside, less potential upside for the employee. If you are a VC investing in tens of startups it all averages out to paying market rate.

How much does a stock go up after going public?

IPOs are typically priced so that they go up about 15%-30% on the first day.

Is it a good thing when a company goes public?

Going public does have positive and negative effects, which companies must consider. Advantages: Strengthens capital base, makes acquisitions easier, diversifies ownership, and increases prestige.

What happens if a stock sells poorly?

If the stock does poorly, it can have an outsized effect on a portfolio. To avoid taking on too much risk, it may make sense to use the proceeds from the sale of company stock to accomplish other goals. Here’s a look at some of the options you may want to consider.

What happens if stock prices fall?

If stock prices fall, your portfolio will likely feel the full effect of that downward pressure. Now imagine that you hold stock in 100 different companies. If any one of them does poorly, the effect it will have on your portfolio will be much smaller. This is the concept behind diversification.

What is a RSU stock?

RSUs, on the other hand, are a transfer of restricted stock shares from your employer to give you a certain number of stocks or grants that vest at a later date. Once it does so, the stock is yours to do with what you will.

What is stock option?

Stock options give employees the right to buy a specific number of shares of the company, at a set price, by the option’s expiration date . In any case, the stock will now have some type of value on the open market. As an employee, you may have a stake in the company before the IPO through employee stock options, restricted stock units (RSUs), ...

What is an IPO?

During an initial public offering, or IPO, a company offers shares of stock for sale to the general public for the first time—hence the phrase “going public.”. Shares of the company are given a starting value known as an IPO price, and when trading begins, the price can rise amid investor demand, or fall if there is little demand.

Why should employees hold on to stocks?

Other employees may feel they should hold on to stocks out of a sense of loyalty. However, a concentrated position in any one stock can open you up to risk.

What happens if an employee exercises their stock options?

If the employee exercised their stock options, they would still have to pay $60 per share, which is more than the stock is worth at that time. At this point, the stock option is essentially underwater and its value is negative.

What is the process of selling shares in a new company to the public for the first time called?

The process of selling shares in a new company to the public for the first time is called an initial public offering (IPO). What happens to a stock price in an IPO depends on several factors such as the underwriting process, market conditions and investor sentiment.

How does an IPO work?

IPO Share Pricing and Release. A company releases shares to the IPO subscribers at the price set by the underwriter. Once a stock is released, it starts trading on the open market and its price is set by supply and demand. A stock can rise above or drop below the subscription price.

Why does the price of an IPO drop?

If, on the other hand, investors are lukewarm towards an offering, or if general market conditions are poor, an IPO share price may decline as initial investors scramble to unload their shares to cut losses while there are few new buyers.

What is underwriting for an IPO?

Part of the process is gauging investor interest, structuring the offering and setting the initial, or subscription, price -- the price at which the stock will be released to the IPO investors (called IPO subscribers) before it starts trading on the open market. The quality of the underwriting greatly affects the stock price when IPO shares open for trading.

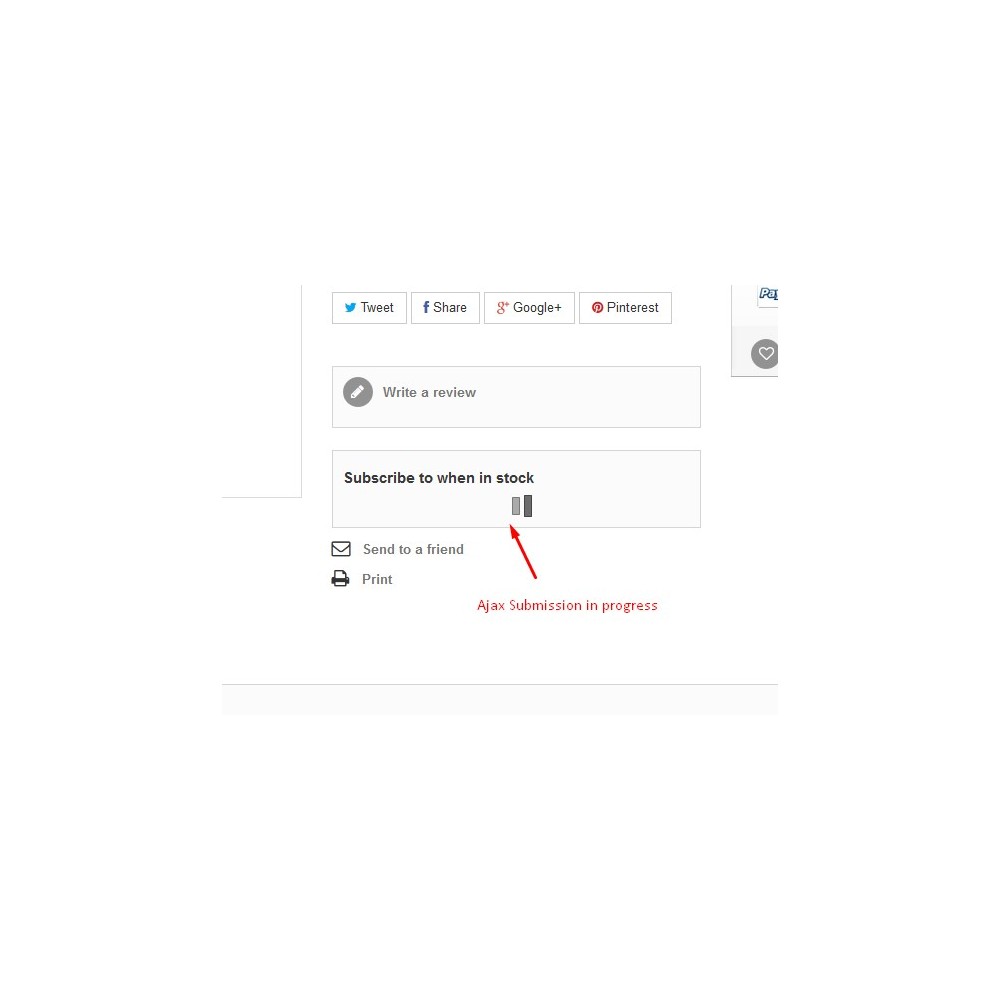

See if stock price alerts are right for your investment strategy

Robin Hartill is a Certified Financial Planner (CFP) who writes about money management, investing, and retirement planning. She has written and edited personal finance content since 2016.

Pros and Cons of Using Stock Price Alerts

Stocks alerts are a valuable tool for many investors, especially active traders who don’t want to miss out on buying or selling opportunities. However, they do have some downsides to consider, like the fact that traders using them may make more trades driven by emotions like panic or greed.

What Stock Price Alerts Are Available?

Your options for stock price alerts and other stock alerts will vary based on the platform you’re using, but here are some common options:

Stock Price Alert Options

Many of the best stock market apps for iPhone users and the top Android stock market apps offer free stock price alerts, as do many major brokerages. Here’s some examples of what price alerts some popular investing platforms and other companies offer. (Keep in mind these are just some examples of the many companies that can provide stock alerts.)

Using Stock Price Alerts in Your Investment Strategy

Whether you’re a beginning investor or an advanced trader, stock price alerts can be helpful for monitoring financial news. They can help you spot opportunities to buy and sell stocks that you might otherwise miss.

Does it cost money to set up stock price alerts?

Most platforms and companies that offer stock price alerts allow you to set up alerts for stock price changes for free if you have an account. However, some companies offer a premium version for enhanced alerts.

If I set up a stock price alert, how will I be notified?

Notification options for stock prices vary widely by platform. Push notifications, text messages, and emails are commonly used for stock price alerts.

What happens when a company goes public?

When a company goes public via a share offering, its privately owned stock trades on public markets for the first time and it ceases to be a privately owned company. This process allows companies to raise capital which may be reinvested in the business. In exchange for that capital, the founder or current owner forfeits a percentage ...

Why do companies go public?

Increased capital: Going public gives companies increased capital and liquidity to reinvest in the company’s growth. Higher market value: Companies often see their market value increase after going public because of the increased transparency and liquidity. But that is not true for every company that goes public.

What are the benefits of public selling shares?

A benefit of this type of public sale of shares is that it increases the number of investors that can purchase shares of the company, which helps to level the playing field. In recent years, companies such as Spotify, Slack, and Coinbase have opted for direct listings to go public.

How long does it take for an IPO to happen?

An IPO is a lengthy process, and afterward, firms are subject to many strict requirements. A typical IPO gets executed over a six- to 12-month time frame.

How do private companies go public?

A private company can go public by either selling its shares on a public market or voluntarily disclosing certain business or financial information to the public. Often, private companies go public through the sale of shares through an initial public offering ( IPO).

What is the first phase of an IPO?

The first phase of an IPO is when the company begins to prepare for the move and performs a readiness assessment to identify any issues. This is when the firm hires an investment banker, identifies its goals, lays out a timeline, and more. Next, the company begins executing the plan it developed in the first phase.

What are the reporting requirements for a public company?

Public company reporting requirements include: Quarterly and annual financial statements. Important events that shareholders should know about.

What does it mean when a company goes public?

To attract investors, a public company needs to have officers and managers who are experienced and have a track record of leading companies to profitability. If there is a full-scale overhaul in the upper echelons of a company , it may be a signal that it is trying to improve its image in advance of going public.

Why is it difficult to know if a company is going public?

Because of the ability of a private company to keep quiet on its intentions to go public until the formal SEC-required filings and announcements, it can be difficult to assess whether a company is heading in that direction. However, there are always more subtle signals for those seeking them out.

What does a prospectus show?

In order to market a company in an initial public offering, the prospectus is expected to show a clear business direction. If a company is shedding its non-core operations, it may be a sign that it is getting lean and mean in preparation for a public share offering.

Is it easier to prepare for an anonymity filing?

There are, however, several signs prior to the official notification and filing that can indicate that a company is about to make the big leap.

Do public companies have to report quarterly financial statements?

Public companies, and those that are about to go public, have their annual and quarterly financial statements scrutinized by investors and analysts. Private companies considering going public often assess their own financial statements and take any write-offs they are allowed under Generally Accepted Accounting Principles (GAAP) all at once to present better income statements in the future.

What happens when a company goes public through an IPO?

When a company goes public through the IPO process, new shares of the company are created and brought to market by an investment bank. There's a ton that occurs behind the scenes ...

Why is the stock price volatile?

In turn, there is often more initial volatility because the price range in which the stock is trading is less predictable.

What is the difference between an IPO and a direct listing?

One important difference between an IPO and a direct listing is that the latter does not have a lockup period. Since no new shares are issued, transactions will only occur if existing shareholders are seeking to cash out and choose to sell some or all of their shares.

How long does an IPO take to lock up?

The Lockup. In a traditional IPO, existing company shareholders agree to a lockup period, usually 180 days from the date of the IPO pricing, when they are restricted from selling or hedging their shares. One important difference between an IPO and a direct listing is that the latter does not have a lockup period.

What is SPAC in IPO?

A SPAC is a company that raises money from its own IPO with the sole purpose of acquiring another--generally privately held--company. That privately held company then essentially turns into a publicly traded company. Before announcing the deal, the SPAC and the target company usually negotiate a fixed valuation.

Why is price stability important for SPAC?

This initial price stability is good for shareholders such as employees because there will likely be less volatility once the shares begin trading in the public market.

How long before an IPO should you exercise options?

For instance, a common strategy I have recommended to clients is to exercise options six months before the IPO, which will start the clock for your stock holding period.

What is an IPO on Google News?

Performing a search on Google News with relevant search terms like “IPO” can offer some of the most up-to-date news items, including analyst opinions, market commentary, and other developments for any upcoming IPO offering.

How do private companies raise capital?

A private company can raise capital by selling shares publicly to institutional investors and retail investors through a new stock issuance, called an initial public offering (IPO).

Why is it important to invest in an IPO?

It's important for IPO investors to track upcoming IPOs in order to capitalize on available opportunities. Below are seven sources for tracking upcoming IPOs.

What is Renaissance IPO?

Renaissance maintains a dedicated IPO section that has a weekly calendar for IPO offerings. It also offers other related content such as articles about the largest U.S. IPOs and the largest global IPOs, in addition to dedicated sections like “IPO News” and “IPO Poll."

What is Yahoo Finance IPO?

Yahoo's finance portal has a dedicated IPO section with details on the IPO date, symbol, price, and links to IPO profiles and news items. It also offers performance tracking of past IPOs.

Can I access IPO prospectuses on exchange?

Exchange websites will also provide access to the official IPO prospectuses. The drawback of relying on exchange websites is that you may not get the most recent news because exchanges only update their sites after proper verification.

What is a press release?

Press releases, dividend payment date, and other company news. Receive notifications on the date dividends are scheduled to be paid, and for press releases, which can include announcements on new products or acquisitions.

What can investors do with alerts?

Still others can provide information on key economic data or general market news. Investors can customize alerts to suit their needs, such as by setting a specific target price or other criteria that signals a need to buy or sell a security or exit a trade.

What is portfolio performance alert?

Similar to alerts for individual securities, alerts for portfolio performance can notify you when the value of your assets change. You can receive daily or weekly notices recapping your portfolio’s status, or get updated on specific changes or events related to companies in your portfolio such as stock splits.

Why do we need alerts?

Use alerts to get notifications with timely information that will help you monitor your portfolio, inform your investment decisions and act on trade opportunities. They’ll help cut through the clutter of news and information and alert you with the information you choose to receive, when and how you choose to receive it.