According to the issued ratings of 4 analysts in the last year, the consensus rating for Nordic American Tankers stock is Moderate Buy based on the current 2 hold ratings and 2 buy ratings for NAT. The average twelve-month price prediction for Nordic American Tankers is $3.42 with a high price target of $5.00 and a low price target of $2.50.

Is Nordic American tankers (Nat) stock a buy or sell?

According to the issued ratings of 3 analysts in the last year, the consensus rating for Nordic American Tankers stock is Hold based on the current 2 hold ratings and 1 buy rating for NAT. The average twelve-month price target for Nordic American Tankers is $3.33 with a high price target of $5.00 and a low price target of $2.25.

What is the forecast of the Nat stock price?

Based on our forecasts, a long-term increase is expected, the "NAT" stock price prognosis for 2026-12-11 is 3.101 USD. With a 5-year investment, the revenue is expected to be around +62.36%.

Should you invest in Nat shares?

Our Ai stock analyst implies that there will be a positive trend in the future and the NAT shares might be good for investing for making money. Since this share has a positive outlook we recommend it as a part in your portfolio.

How high will NAT Stock go?

Stock Price Forecast The 3 analysts offering 12-month price forecasts for Nordic American Tanker Ltd have a median target of 2.00, with a high estimate of 5.00 and a low estimate of 1.90. The median estimate represents a -2.91% decrease from the last price of 2.06.

What is price target on Tipranks?

The average price target is $181.92 with a high forecast of $231.00 and a low forecast of $150.00.

Is NAT stock a buy?

Out of 2 analysts, 1 (50%) are recommending NAT as a Strong Buy, 0 (0%) are recommending NAT as a Buy, 1 (50%) are recommending NAT as a Hold, 0 (0%) are recommending NAT as a Sell, and 0 (0%) are recommending NAT as a Strong Sell. What is NAT's earnings growth forecast for 2022-2023?

Is TipRanks worth the money?

Yes, TipRanks is a credible stock research app that provides abundant data for most individual stocks. As a result, the company has a 4.5 out of 5 Trustpilot score, and it also has positive customer ratings on Google Play and the Apple App Store.

What is the best stock prediction site?

10 Best Stock Research Websites & Tools – Rating The Best Stock Market Websites In 2022WallStreetZen (Best Stock Research Website In 2022) ... Motley Fool Stock Advisor. ... Tokenist's Newsletter: Five Minute Finance. ... Morningstar. ... Seeking Alpha. ... AAII (American Association of Individual Investors) ... Zacks Investment Research.More items...•

Is Nordic American Tankers going out of business?

Summary. Nordic American Tankers went from seeing record earnings during 2020 to fighting for their survival during 2021. Sadly this is now coming down to the wire and they may not last another quarter given their dangerous liquidity that is threatening their solvency.

Will Nordic American Tanker stock go back up?

If you are looking for stocks with good return, Nordic American Tankers Ltd stock can be a bad, high-risk 1-year investment option. Nordic American Tankers Ltd real time quote is equal to 1.900 USD at 2022-07-13, but your current investment may be devalued in the future. Get It Now!

What does Nordic American Tankers do?

Nordic American Tankers Limited (NAT) is a tanker firm that buys and charters double-hull tankers in Bermuda and across the world. It owns and operates 24 Suezmax crude oil tankers. Its shares have gained 18.9% year-to-date.

What does price target mean?

A target price is an estimate of the future price of a stock. Target prices are based on earnings forecasts and assumed valuation multiples. Target prices can be used to evaluate stocks and may be even more useful than an equity analyst's rating.

How is target price calculated?

The formula to calculate the target price is: (Price / Estimated EPS) = Trailing PE where Price is the variable we are solving for.

What is a price target on a stock?

A price target is a price at which an analyst believes a stock to be fairly valued relative to its projected and historical earnings. When an analyst raises their price target for a stock, they generally expect the stock price to rise.

How accurate are analyst price targets?

Based on their 2012 study of more than 11,000 analysts from 41 countries, the overall accuracy of target prices is not very high, averaging around 18% for a three-month horizon and 30% for a 12-month horizon.

What is NAT’s average 12-month price target, according to analysts?

Based on analyst ratings, Nordic American Tanker’s 12-month average price target is $2.38.

What is NAT’s upside potential, based on the analysts’ average price target?

Nordic American Tanker has 14.42% upside potential, based on the analysts’ average price target.

Can I see which stocks the top-ranking analysts are rating?

Yes, go to the [object Object] tool to see stocks with a Strong Buy or Strong Sell analyst rating consensus, according to the top performers.

How can I follow the stock ratings of top Wall Street analysts?

Head over to our Expert Center to see a list of the [object Object] and follow the analysts of your choice. Visit their profiles for more details a...

What is Nordic American Tankers's consensus rating and price target?

According to the issued ratings of 3 analysts in the last year, the consensus rating for Nordic American Tankers stock is Hold based on the current...

Do Wall Street analysts like Nordic American Tankers more than its competitors?

Analysts like Nordic American Tankers stock less than the stock of other Transportation companies. The consensus rating for Nordic American Tankers...

Do MarketBeat users like Nordic American Tankers more than its competitors?

MarketBeat users like Nordic American Tankers stock less than the stock of other Transportation companies. 52.06% of MarketBeat users gave Nordic A...

Does Nordic American Tankers's stock price have much upside?

According to analysts, Nordic American Tankers's stock has a predicted upside of 52.30% based on their 12-month price targets.

What analysts cover Nordic American Tankers?

Nordic American Tankers has been rated by Jefferies Financial Group in the past 90 days.

Company Description

Nordic American Tankers Ltd. is an international tanker company, which engages in owning and operating of Suezmax crude oil tankers. The company was founded by Herbjørn Hansson on June 12, 1995 and is headquartered in Hamilton, Bermuda.

Nordic American Tanker News

Investment firm B. Riley FBR has been looking at dividend yields, and is telling investors that now is...

How does MarketBeat calculate stock ratings?

MarketBeat calculates consensus analyst ratings for stocks using the most recent rating from each Wall Street analyst that has rated a stock within the last twelve months. Each analyst's rating is normalized to a standardized rating score of 1 (sell), 2 (hold), 3 (buy) or 4 (strong buy). Analyst consensus ratings scores are calculated using the mean average of the number of normalized sell, hold, buy and strong buy ratings from Wall Street analysts. Each stock's consensus analyst rating is derived from its calculated consensus ratings score (0-1.5 = Sell, 1.5-2.5 = Hold, 2.5-3.5 = Buy, >3.5 = Strong Buy). MarketBeat's consensus price targets are a mean average of the most recent available price targets set by each analyst that has set a price target for the stock in the last twelve months. MarketBeat's consensus ratings and consensus price targets may differ from those calculated by other firms due to differences in methodology and available data.

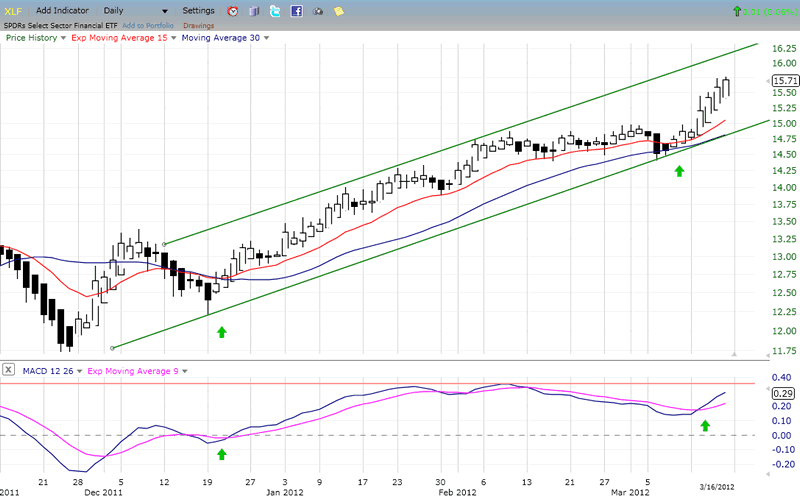

What does the blue line on the chart below mean?

The chart below shows how a company's share price and consensus price target have changed over time. The dark blue line represents the company's actual price. The lighter blue line represents the stock's consensus price target. The even lighter blue range in the background of the two lines represents the low price target and the high price target for each stock.

Which stocks are similar to NAT?

Stocks that are quantitatively similar to NAT, based on their financial statements, market capitalization, and price volatility, are NGD, NGL, RIG, RFP, and GASS.

What is the quality of NAT?

NAT has a Quality Grade of D, ranking ahead of 14.27% of graded US stocks.

Is the tanker market down in 2021?

Monday, November 1, 2021 Dear Shareholders and Investors, Tanker markets have been down in 2021. This was also the case for the third quarter. There are now improved conditions for our Suezmax vessels. During the last two weeks, we have concluded contracts reflecting this. We wish to share the following with you: 1. Improving market conditions We are concluding contracts almost daily for individual vessels in our 25 ship fleet. The shortest duration last week is for an inter-European voyage for

How long are futures trading delayed?

Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Source: FactSet

Is index time real time?

Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays. Source: FactSet

Stock Price Forecast

The 8 analysts offering 12-month price forecasts for Nordic American Tanker Ltd have a median target of 2.53, with a high estimate of 5.00 and a low estimate of 2.00. The median estimate represents a +59.81% increase from the last price of 1.58.

Analyst Recommendations

The current consensus among 8 polled investment analysts is to Buy stock in Nordic American Tanker Ltd. This rating has held steady since February, when it was unchanged from a Buy rating. Move your mouse over past months for detail

Component Grades

We have 9 different ratings for every stock to help you appreciate its future potential. You can unlock it all now.

The Trend in the Analyst Price Target

Over the past 21 months, NAT's average price target has gone down $1.96.

The Trend in the Broker Recommendations

Over the past 123 days, NAT's average broker recommendation rating worsened by 0.17.

Analyst price target for NAT

Based on 3 analyst s offering 12 month price targets for NORDIC AMERICAN TANKERS Ltd.

NAT earnings per share forecast

What is NAT 's earnings per share in the next 2 years based on estimates from 3 analyst s?

NAT revenue forecast

What is NAT 's revenue in the next 2 years based on estimates from 3 analyst s?

NAT revenue growth forecast

How is NAT forecast to perform vs Marine Shipping companies and vs the US market?