What is the highest a Molson Coors stock has ever been?

The all-time high Molson Coors Beverage stock closing price was 111.25 on October 14, 2016. The Molson Coors Beverage 52-week high stock price is 61.48, which is 26.6% above the current share price.

What is the all-time high and low for Molson Coors?

The all-time high Molson Coors Beverage stock closing price was 111.25 on October 14, 2016. The Molson Coors Beverage 52-week high stock price is 61.48, which is 26.6% above the current share price. The Molson Coors Beverage 52-week low stock price is 42.46, which is 12.6% below the current share price.

What is Molson Coors Brewing's stock price at the beginning of 2022?

Molson Coors Brewing's stock was trading at $58.00 at the beginning of 2022. Since then, TAP.A stock has increased by 2.1% and is now trading at $59.20. View the best growth stocks for 2022 here. How were Molson Coors Brewing's earnings last quarter?

What's behind Molson Coors'3rd quarter headwinds?

The Colorado and Montreal-based company's upbeat third quarter results released Thursday came despite headwinds from inflation and global supply chain challenges. Gavin Hattersley, president and CEO of Molson Coors, said transportation availability and cost stood out as a key pressure point for the company

Is Molson Coors a good stock to buy?

Molson Coors Beverage has received a consensus rating of Hold. The company's average rating score is 2.00, and is based on 1 buy rating, 8 hold ratings, and 1 sell rating.

Is Molson Coors publicly traded?

In 2016, Molson Coors acquired the full global brand portfolio of Miller Brewing Company for approximately US$12 billion. The agreement made Molson Coors the world's third largest brewer at the time. Molson Coors is a publicly traded company on both the New York Stock Exchange and Toronto Stock Exchange.

Should I invest in TAP?

The financial health and growth prospects of TAP, demonstrate its potential to outperform the market. It currently has a Growth Score of D. Recent price changes and earnings estimate revisions indicate this would be a good stock for momentum investors with a Momentum Score of B.

Is Molson Coors owned by Anheuser Busch?

On October 11, 2016, SABMiller sold its stake in MillerCoors for around US$12 billion after the company was acquired by Anheuser-Busch InBev, making Molson Coors the 100 percent owner of MillerCoors.

Who owns Molson beer company?

Molson CoorsMolson Holdco ULCMolson Brewery/Parent organizations

Who owns Molson Coors beer?

The Molson Coors Beverage Company (formerly Molson Coors Brewing Company) is a partly Canadian-owned enterprise and one of the world's largest beer makers....Molson Coors Beverage Company.Article byRichard FootUpdated byJessica PoulinApr 22, 2013

Is tap a buy or sell?

Out of 9 analysts, 1 (11.11%) are recommending TAP as a Strong Buy, 0 (0%) are recommending TAP as a Buy, 7 (77.78%) are recommending TAP as a Hold, 1 (11.11%) are recommending TAP as a Sell, and 0 (0%) are recommending TAP as a Strong Sell. What is TAP's earnings growth forecast for 2022-2024?

How do I buy Molson Coors stock?

You can purchase MCBC shares through a broker or use Molson Coors' shareholder services and transfer agent, Computershare Trust Company, N.A., which offers a direct stock purchase program.

What is tap AR?

Tap allows you to enter text and control your device just by tapping your fingers on any surface. It is the critical missing piece for the wide adoption of augmented reality and smart wearables.

Does Bud Lite own Coors?

The beer companies in question were Anheuser-Busch InBev, Molson Coors Brewing (which operates as MillerCoors in the U.S.), Heineken, and Constellation. Respectively, those companies are responsible for Bud Light, Miller Lite and Coors Light, Heineken, and Corona, some of the most popular beers in America.

Who owns Corona beer?

Anheuser-Busch InBevBeverage giant Anheuser-Busch InBev (AB InBev) acquired Corona's parent company, Grupo Modelo, in 2013, but US antitrust regulators required it to sell the company's US-based business to Constellation.

Is Anheuser-Busch bigger than Molson Coors?

Molson Coors Brewing Today, MillerCoors is the second largest brewing company in the US after Anheuser-Busch.

Molson Coors Could Move Like a Silver Bullet

From Miller Lite to Omicron: Molson Coors CEO saw more highs than lows in 2021

Molson Coors Beverage reported annual revenue growth for the first time in more than a decade on Wednesday. The company is in the middle of a turnaround that involves expanding its portfolio beyond beer and investors seem to be excited with the stock trading sharply higher today.

Europe, U.S. Levy Financial Sanctions Against Russia

In October 2019, Molson Coors Beverage Co. CEO Gavin Hattersley made the impactful decision to restructure the company, changing its name, reorganizing its business units and announcing a revitalization plan that would propel the company forward.

Stocks in play: Molson Coors Canada Inc

U.S. stocks rise a day after the S&P 500 hit correction territory, while European stocks gain as Putin says diplomacy is still an option.

Molson Coors Beverage Company to Webcast 2021 Fourth Quarter and Full Year Earnings Conference Call

Announced the expansion of its exclusive agreement with The Coca-Cola Company to develop and commercialize ...

Molson Coors Canada (TSE:TPX.B) Could Be Struggling To Allocate Capital

GOLDEN, Colo. & MONTREAL, January 19, 2022--Molson Coors Beverage Company to Webcast 2021 Fourth Quarter and Full Year Earnings Conference Call

Molson Coors Beverage Company Announces Regular Quarterly Dividend

To avoid investing in a business that's in decline, there's a few financial metrics that can provide early indications...

Molson Coors Announces Europe President and CEO Simon Cox to Retire at the End of the Year

GOLDEN, Colo. & MONTREAL, Quebec, November 11, 2021--Molson Coors Beverage Company Announces Regular Quarterly Dividend

Molson Coors Beverage Company Reports 2021 Third Quarter Results

GOLDEN, Colo. & MONTREAL, November 03, 2021--Molson Coors Europe President and CEO Simon Cox Retire End of Year, Sergey Yeskov, Managing Director Central and Eastern Europe, transition into role

Molson Coors Beverage Company to Webcast 2021 Third Quarter Earnings Conference Call

GOLDEN, Colo. & MONTREAL, October 28, 2021--Reaffirms Key 2021 Financial Guidance as Company Continues to Deliver on its Revitalization Plan and Premiumize its Portfolio

About Molson Coors Brewing

GOLDEN, Colo. & MONTREAL, October 04, 2021--MOLSON COORS BEVERAGE COMPANY TO WEBCAST 2021 THIRD QUARTER EARNINGS CONFERENCE CALL

0.0 Analyst's Opinion

Molson Coors Brewing Company manufactures and sells beer and other beverage products in the United States, Canada, Europe, and internationally.

How has Molson Coors Brewing's stock price been impacted by Coronavirus?

Molson Coors Brewing has received 1 “outperform” votes. (Add your “outperform” vote.)

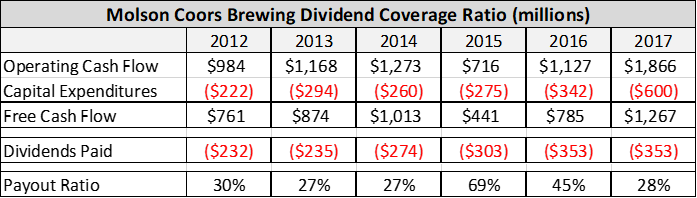

How often does Molson Coors Brewing pay dividends? What is the dividend yield for Molson Coors Brewing?

Molson Coors Brewing's stock was trading at $61.59 on March 11th, 2020 when Coronavirus reached pandemic status according to the World Health Organization. Since then, TAP.A shares have increased by 5.5% and is now trading at $65.00. View which stocks have been most impacted by COVID-19.

Who are some of Molson Coors Brewing's key competitors?

Molson Coors Brewing announced a quarterly dividend on Monday, November 15th. Stockholders of record on Friday, December 3rd will be paid a dividend of $0.34 per share on Wednesday, December 15th. This represents a $1.36 annualized dividend and a yield of 2.09%.

What is Molson Coors Brewing's stock symbol?

Some companies that are related to Molson Coors Brewing include C&C Group (CCR), Brick Brewing (BRB), Big Rock Brewery (BR), Distil (DIS), Anheuser-Busch InBev SA/NV (ABI), Asahi Group (ASBRF) and Waterloo Brewing (BIBLF). View all of TAP.A's competitors.

How do I buy shares of Molson Coors Brewing?

Molson Coors Brewing trades on the OTCMKTS under the ticker symbol "TAP.A."