What is the Southwest Airlines (Luv) stock price prediction?

Southwest Airlines (LUV) stock price prediction is 86.924816979542 USD. The Southwest Airlines stock forecast is 86.924816979542 USD for 2023 March 14, Tuesday; and 382.605 USD for 2027 March 14, Sunday. Southwest Airlines stock forecast, LUV price prediction: Buy or sell Southwest Airlines Co. shares? LUV Price is 40.240 USD today.

Is Luv a good value stock to buy now?

The Score for LUV is 56, which is 12% above its historic median score of 50, and infers lower risk than normal. LUV is currently trading in the 50-60% percentile range relative to its historical Stock Score levels.

What is the Southwest Airlines stock forecast for 2023?

The Southwest Airlines stock forecast is 86.924816979542 USD for 2023 March 14, Tuesday; and 382.605 USD for 2027 March 14, Sunday. Southwest Airlines stock forecast, LUV price prediction: Buy or sell Southwest Airlines Co. shares?

Is Southwest Airlines'stock overvalued or undervalued?

The P/E ratio of Southwest Airlines is -916.40, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings. Southwest Airlines has a PEG Ratio of 4.11. PEG Ratios above 1 indicate that a company could be overvalued. Southwest Airlines has a P/B Ratio of 3.05.

See more

IS LUV stock a good buy?

Out of 12 analysts, 6 (50%) are recommending LUV as a Strong Buy, 1 (8.33%) are recommending LUV as a Buy, 4 (33.33%) are recommending LUV as a Hold, 0 (0%) are recommending LUV as a Sell, and 1 (8.33%) are recommending LUV as a Strong Sell.

Is LUV stock overvalued?

LUV' has a weak valuation at its current share price on account of a overvalued PEG ratio despite strong growth. LUV's PE and PEG are worse than the market average leading to a below average valuation score.

Should I sell my Southwest stock?

There are currently 1 sell rating, 5 hold ratings, 10 buy ratings and 1 strong buy rating for the stock. The consensus among Wall Street equities research analysts is that investors should "buy" Southwest Airlines stock.

Is LUV stock a buy Zacks?

The Zacks database contains over 10,000 stocks. All of those stocks are classified into three groups: Sector, M Industry and X Industry....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.75%2Buy18.15%3Hold9.70%4Sell5.35%2 more rows

Will Southwest Airlines stock go up?

Stock Price Forecast The 16 analysts offering 12-month price forecasts for Southwest Airlines Co have a median target of 56.50, with a high estimate of 72.00 and a low estimate of 40.00. The median estimate represents a +39.03% increase from the last price of 40.64.

Is Southwest Airline a buy?

Currently, the company has a high amount of cash, and there's high growth potential given the high demand for travel. So, if the air travel market recovers, the repressed demand might prove beneficial for the company and help it do more than just return to profitability in 2022.

Is DAL a buy right now?

Delta Air Lines Inc (DAL) With the stock under renewed selling pressure, Delta is not a buy now.

Does LUV stock pay dividends?

Southwest Airlines Co (NYSE: LUV) does not pay a dividend. Is Southwest Airlines Co's dividend stable? Southwest Airlines Co (NYSE: LUV) does not pay a dividend.

How many times has Southwest Airlines stock split?

Southwest Airlines (LUV) has 11 splits in our Southwest Airlines stock split history database.

Should you buy overvalued or undervalued stocks?

Invest in the stock If you believe that a stock is undervalued, you should invest in it because the stock's price will eventually increase to its fair value. This approach is less risky than trading overvalued stocks because you are investing in a company that has been incorrectly priced by the market.

Can RIVN recover?

RIVN's shares have witnessed a recovery in the past few weeks after the company reported its financial performance for the first quarter of the current year. Rivian's stock price jumped by +18% from $20.60 as of May 11, 2022 to $24.30 as of May 12, 2022.

Why is rivian dropping so much?

Now what. Rivian already told investors it only expects to produce 25,000 EVs this year, even though it has capacity to make double that number. The shortfall is due to current supply chain challenges that most global automakers are facing.

Is Roku overvalued?

Overvalued. At a valuation similar to that of Apple, Roku would be valued at only $2.8 billion, a decline of 38 percent from its current valuation. Apple trades at 3.2 times 2019 sales estimates of $273.83 billion, while Roku currently trades at 4.9 times 2019 sales estimates of $862.9 million.

What is LUV’s average 12-month price target, according to analysts?

Based on analyst ratings, Southwest Airlines’s 12-month average price target is $54.20.

What is LUV’s upside potential, based on the analysts’ average price target?

Southwest Airlines has 28.92% upside potential, based on the analysts’ average price target.

Can I see which stocks the top-ranking analysts are rating?

Yes, go to the [object Object] tool to see stocks with a Strong Buy or Strong Sell analyst rating consensus, according to the top performers.

How can I follow the stock ratings of top Wall Street analysts?

Head over to our Expert Center to see a list of the [object Object] and follow the analysts of your choice. Visit their profiles for more details a...

Stock Price Forecast

Analyst Recommendations

The 19 analysts offering 12-month price forecasts for Southwest Airlines Co have a median target of 58.00, with a high estimate of 67.00 and a low estimate of 28.00. The median estimate represents a +28.46% increase from the last price of 45.15.

Southwest Airlines Co Stock Forecast

The current consensus among 23 polled investment analysts is to Buy stock in Southwest Airlines Co. This rating has held steady since February, when it was unchanged from a Buy rating. Move your mouse over past months for detail

Will Southwest Airlines Co Stock Go Up Next Year?

Over the next 52 weeks, Southwest Airlines Co has on average historically risen by 30.6 % based on the past 49 years of stock performance.

Southwest Airlines Co Stock Price History

Over the next 52 weeks, Southwest Airlines Co has on average historically risen by 30.6% based on the past 49 years of stock performance.

Stock Predictions

The current trend is moderately bullish and LUV is experiencing selling pressure, which indicates risk of future bearish movement.

Analyst price target for LUV

Is Southwest Airlines Co stock public? Yes, Southwest Airlines Co is a publicly traded company.

LUV earnings per share forecast

Based on 10 analyst s offering 12 month price targets for Southwest Airlines Co.

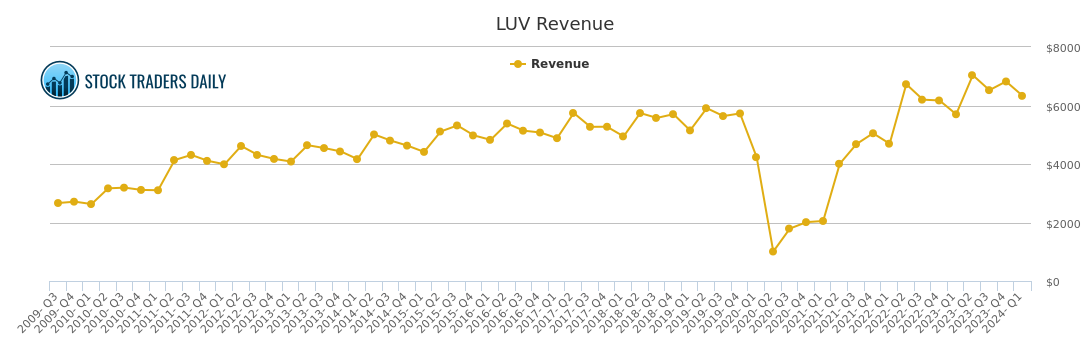

LUV revenue forecast

What is LUV 's earnings per share in the next 3 years based on estimates from 12 analyst s?

LUV earnings growth forecast

What is LUV 's revenue in the next 3 years based on estimates from 10 analyst s?

LUV revenue growth forecast

How is LUV forecast to perform vs Industrials companies and vs the US market?

What does the final quote on Southwest Airlines mean?

How is LUV forecast to perform vs Industrials companies and vs the US market?

What is dividend per share?

The final quotes of the instrument at the close of the previous trading day are a signal to adjust the forecasts for Southwest Airlines shares. This happens once a day.

How to calculate market capitalization?

Dividend Per Share is a financial indicator equal to the ratio of the company's net profit available for distribution to the annual average of ordinary shares.

What is split share?

It is calculated by the formula multiplying the number of shares in the company outstanding by the market price of one share.

What is a short prior month?

Splitting of shares is an increase in the number of securities of the issuing company circulating on the market due to a decrease in their value at constant capitalization.

What does EPS mean in stock market?

Shares Short Prior Month - the number of shares in short positions in the last month.

When did Southwest Airlines start?

EPS shows how much of the net profit is accounted for by the common share.