What stocks pay good dividends?

These stocks are:

- Apple (NASDAQ: AAPL)

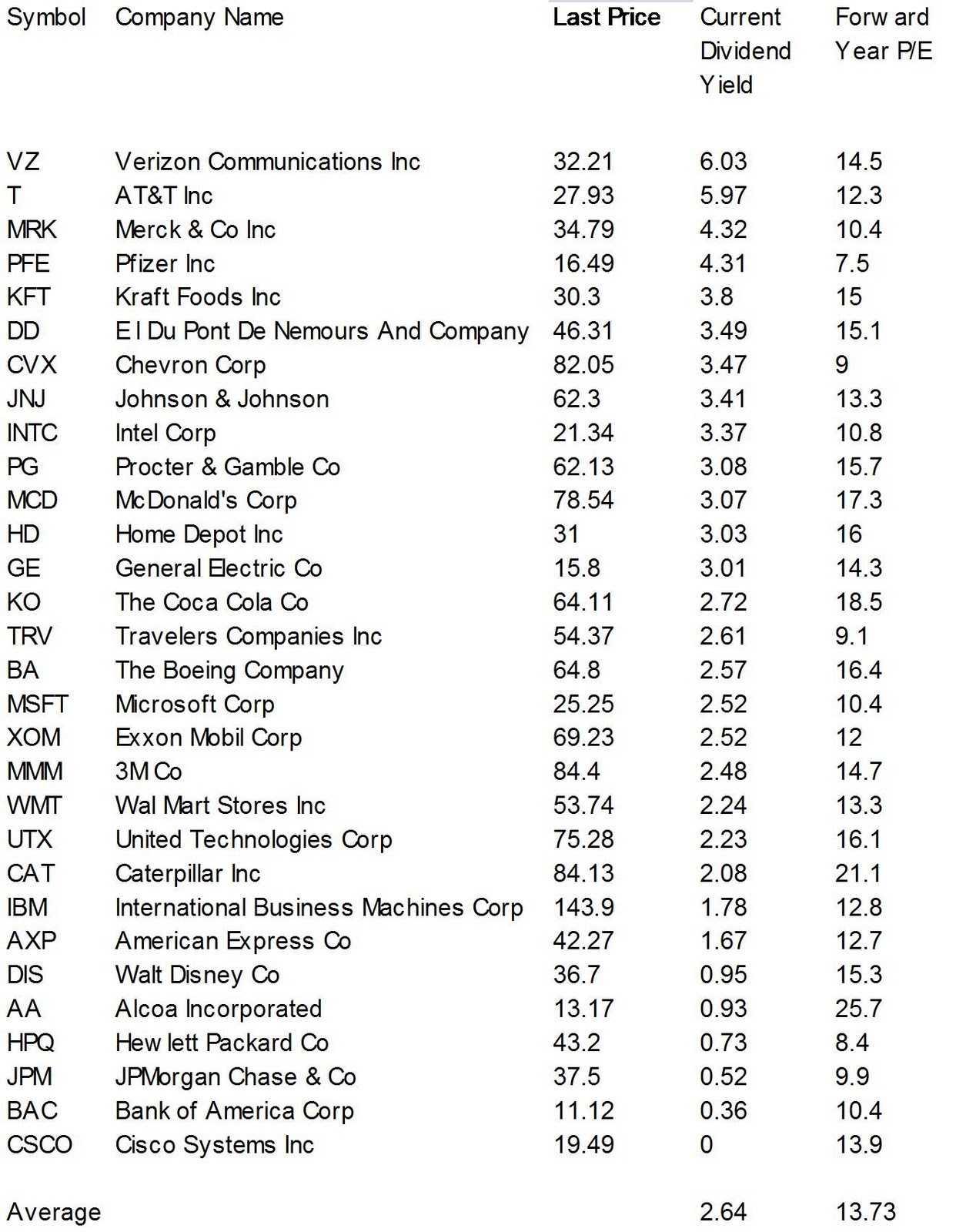

- Microsoft (NASDAQ: MSFT)

- Nvidia (NASDAQ: NVDA)

- Visa (NYSE: V)

- Procter & Gamble (NYSE: PG)

- UnitedHealth (NYSE: UNH)

- Oracle (NYSE: ORCL)

What are the best dividend stocks to buy?

The Smartest Dividend Stocks to Buy With $400 Right Now

- A high-yielding oil titan. ExxonMobil ( XOM -1.11% ) is one of the largest energy companies in the world. ...

- A smoking hot dividend. Altria Group ( MO 0.72% ) is a tobacco and nicotine products company that sells Marlboro branded cigarettes in the United States, as well as ...

- Calling all dividend investors. ...

- Peanut butter and jelly time. ...

Which dividend stocks have the highest yield?

With that in mind, we put together a panel of Motley Fool contributors and asked each participant to profile a high-yield dividend stock that has defensive characteristics and growth opportunities that should help it survive and thrive through the next crash.

What company has the highest dividends?

Williams Companies Has A Solid Track Record The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from US$0.50 in 2011 to the most recent ...

Which cheap stocks pay the highest dividends?

7 best cheap dividend stocks under $10:Yamana Gold Inc. (AUY)Ardagh Metal Packaging SA (AMBP)United Microelectronics Corp. (UMC)Annaly Capital Management Inc. (NLY)Gilat Satellite Networks Ltd. (GILT)Ambev SA (ABEV)Pangaea Logistics Solutions Ltd. (PANL)

What stock has the highest dividend ever?

#1: Exxon Mobil Over the last 35 years alone, amid cycles of oil booms and oil busts, the company has increased its dividend payment at an average annual rate of 6.3%. Exxon has been part of the Dow ever since the industrial average expanded to 30 companies in 1928.

What stocks pay the highest monthly dividends?

8 monthly dividend stocks with high yields:Pembina Pipeline Corp. (PBA)AGNC Investment Corp. (AGNC)Prospect Capital Corp. (PSEC)Main Street Capital Corp. (MAIN)LTC Properties Inc. (LTC)Broadmark Realty Capital Inc. (BRMK)Ellington Financial Inc. (EFC)EPR Properties (EPR)

Do Tesla pay dividends?

Tesla (NASDAQ: TSLA) does not pay a dividend.

Is it good to buy high dividend stocks?

In addition to providing consistent income, many dividend-paying stocks are in defensive sectors that can weather economic downturns with reduced volatility. Dividend-paying companies also have substantial amounts of cash, and therefore, are usually strong companies with good prospects for long-term performance.

What are the six dividend stocks to buy and hold forever?

9 dividend stocks to buy and hold forever:AbbVie Inc. (ABBV)Altria Group Inc. (MO)AT&T Inc. (T)Cardinal Health Inc. (CAH)Dominion Energy Inc. (D)Kraft Heinz Co. (KHC)Morgan Stanley (MS)Oneok Inc. (OKE)More items...•

How much money do you need to live off of dividends?

To live off dividends, the average household in the United States needs to have $1,687,500 invested. This amount is based on the median household income of $67,500. And assumes a 4% dividend yield on the amount invested in dividend stocks.

Are dividends profitable?

Dividend is usually a part of the profit that the company shares with its shareholders. Description: After paying its creditors, a company can use part or whole of the residual profits to reward its shareholders as dividends.

How can I earn 1000 a month in dividends?

Look for $12,000 Per Year in Dividends To make $1,000 per month in dividends, it's better to think in annual terms. Companies list their average yield on an annual basis, not based on monthly averages. So you can make much more sense of how much you might earn if you build your numbers around annual goals as well.

Are monthly dividends worth it?

But the benefits actually go beyond financial planning. If you're still working and reinvesting your dividends for growth, a monthly dividend will compound faster over time. It won't make much of a difference in a single year or two, but over an investing lifetime, it adds up.

Does Coca Cola pay dividends monthly?

Coca-Cola does NOT pay a monthly dividend.

Which company gives dividend every month?

The company may decide to reinvest its profits in business as well without providing dividends....Dividend payout ratio:Company NameIndiabulls Housing Finance LtdSectorThrifts & Mortgage FinanceDividend Per Share (Rs.)**52.8Dividend Yield (%)**4.19 more columns

What is ATAX mortgage?

ATAX is a mortgage servicing company that primarily invests in mortgage revenue bonds issued to finance multifamily and student housing apartments. These debts are backed up by the potential rent from tenants after the facilities are completed, providing a continuous flow of cash down the road. Right now, the America First portfolio consists of roughly 12,000 rental units in 15 states, and it's growing every year. Shares are up more than 50% year to date on a total-return basis, which includes dividends, thanks to strong performance but also to a bump in distributions from 9 cents to 11 cents quarterly in June.

What is cheap dividend stock?

Cheap dividend stocks allow investors to buy hundreds of shares – not just a handful. Cheap dividend stocks allow investors to buy hundreds of shares – not just a handful. Money.

What is the market capitalization of MUFG?

The international financial company MUFG is a major Japanese bank with a market capitalization of $75 billion, on par with other global names like Switzerland's UBS Group Inc. ( UBS) and roughly triple the size of leading U.S. regional banks. Founded in 1880 and headquartered in Tokyo, MUFG is a rock-solid company with the scale to weather any economic environment. And in 2021, the Japanese economy has been doing quite well now that the region has turned a corner from COVID-19, and this stock has ridden these tailwinds to roughly 35% gains year to date.

Is SXC a good dividend stock?

Highlighted back in March as one of the best small-cap dividend stocks to consider in 2021, SXC has delivered big time in the intervening months as shares have appreciated by 50% in 2021. While SunCoke is indeed a coal stock, it's focused primarily on "coking" coal, which is used to make iron ore into steel – rather than being a coal miner dependent on power plants continuing to use this admittedly dirty fossil fuel. Because of strong industrial and construction demand for steel thanks to a recovering global economy, SXC has been doing quite well lately. That's on top of its reliable 6-cent-per-share quarterly dividend that survived the pandemic-related disruptions of 2020 intact.

Where is SFL based?

A $1 billion marine shipper based out of Bermuda, SFL operates roughly 80 vessels including tankers that serve the global oil and gas industry and dry bulk container ships that transport goods for manufacturers and other enterprises worldwide. Thanks to global supply disruptions and a general inflationary environment driving up prices in all corners of the economy, shippers have been able to command better rates this year – and SFL is no exception. The 15-cent quarterly payouts from SFL are good for a generous yield, further showing that even nominally cheap income stocks can boast great yields.

Does Suncoke have coal?

While the company does provide some coal for electric utilities still, its metallurgical operations are the real draw here for investors. After all, steel is a compound made of two things – iron and carbon. So as long as the world needs steel, SunCoke will find ample demand for its carbon-rich coking coal.

Is Two Harbors a REIT?

Two Harbors is structured as a real estate investment trust, or REIT. This special class of corporation must deliver 90% of its taxable income back to shareholders, creating a mandate for juicy dividends. However, TWO is a curiosity as it doesn't own physical real estate – just mortgage "paper" and related assets.

What is dividend investing?

Dividend investing is a practice ingrained in investor circles, with many prospective investors constantly on the lookout for high-yielding stocks with a track record of financial stability and consecutive annualized dividend growth.

What is KMI in stock?

The company currently owns interests in or operated around 85,000 miles of pipelines and 152 terminals. With a $19 share price and a 5.74% dividend yield, Kinder Morgan, Inc. (NYSE: KMI) ranked 7th on our list of the cheapest dividend stocks with high yields.

Where is Sumitomo Mitsui Financial Group located?

Sumitomo Mitsui Financial Group, Inc. (NYSE: SMFG) is a Japanese commercial banking company. Its headquarters are in Chiyoda City, Tokyo, and it was founded in 2002. Currently traded at $7.16 with a dividend yield of 10%, Sumitomo Mitsui Financial Group, Inc. (NYSE: SMFG) ranks 10th on our list of cheap dividend stocks with high yields.

What is Vodafone Group?

Vodafone Group Plc (NYSE: VOD) is a British multinational telecommunications company. It provides telecommunications services in Asia, Africa, Europe, and Oceania. The company ranked 6th on our list of the cheapest high-yielding dividend stocks because of its 5.97% dividend yield and its $18.66 share price.

Is dividends good for the S&P 500?

The above information is not meant to conclude that dividends are the most important thing to consider when trying to decide where to invest. However, they are a testament to the fact that dividends are a vital contributor to both the S&P 500 Index and to individual investors, based on financial records such as the ones above, and the convenience of using dividend stocks to earn on the side. However, past examples of companies like General Motors Company (NYSE: GM) also show us how dividend investing can be risky and quite dangerous. After paying reliable dividends for decades in its prime, General Motors Company (NYSE: GM) had to suspend its dividend in 2008, after first cutting it in half to 25 cents a share. The stock price for the company also fell during this time of financial strife, from $60 to $20 in 2006. While attempting to save itself, General Motors Company (NYSE: GM) tried everything from selling $4 to $7 billion in assets, to cutting 20% of its salary costs, but to no avail. In 2009, the company declared bankruptcy, its stock price fell to zero, and it was only saved from complete ruin because of the US government bailing it out.

Is it difficult to find dividend stocks?

It has become extremely difficult to find valuable dividend stocks amid the financial volatility, which is also shaking the hedge fund industry. The entire hedge fund industry is feeling the reverberations of the changing financial landscape. Its reputation has been tarnished in the last decade, during which its hedged returns couldn’t keep up with the unhedged returns of the market indices. On the other hand, Insider Monkey’s research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 124 percentage points since March 2017. Between March 2017 and February 26th 2021 our monthly newsletter’s stock picks returned 197.2%, vs. 72.4% for the SPY. Our stock picks outperformed the market by more than 124 percentage points ( see the details here ). We were also able to identify in advance a select group of hedge fund holdings that significantly underperformed the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 13% through November 16th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to. You can subscribe to our free newsletter on our homepage to receive our stories in your inbox.

Where is Energy Transfer LP located?

Energy Transfer LP (NYSE: ET) is an American gas industry company, with headquarters in Dallas, Texas. Some of its subsidiaries include Energy Transfer Partners and Sunoco LP. The company ranks 8th on our list of cheap dividend stocks with high yields, with an $11.05 share price and a 5.61% dividend yield.

How to generate positive income?

When companies generate positive income they have two options: (1) reinvest the money, or (2) distribute the money to shareholders. As an investor who loves dividends, it’s always nice to get some cash in your bank account.

What is financial leverage?

Financial leverage measures a company’s debt and preferred equity load. With a high degree of financial leverage, a company generally pays more interest, and is impacted more by overall economic changes. Which means, the investment likely carries more risk. To avoid trouble down the road, it’s important to understand the financial leverage ...

Is a high dividend a good investment?

High dividend yielding stocks can add a source of income to your stock portfolio. But a high dividend yield doesn’t guarantee that a stock is a good investment. Finding great stocks that pay high dividends can be a difficult task.

Is it safe to buy high dividend stocks?

Stocks with high growth potential generally reinvest earnings, rather than pay out dividends, and high dividend yield stocks aren’t always safe. High quality dividend paying stocks provide both dividend income, and the potential for stock price growth.

Can a company sustain a dividend payout ratio over 100%?

This can be a leading indicator that the company’s growth will stall, as they aren’t reinvesting their operating income. And no company can sustain a dividend payout ratio over 100% for long... Dividend payout ratios can fluctuate depending on the industry, but below are general industry averages to use as a guide.

Is industry averages a good sanity check?

Industry averages can be a good sanity check when evaluating a company’s dividend payout ratio.

What is a tip rank?

TipRanks is the most comprehensive data set of sell side analysts and hedge fund managers. TipRanks' multi-award winning platform ranks financial experts based on measured performance and the accuracy of their predictions so investors know who to trust when making investment decisions.

What is a D ividend stock?

D ividend stocks are the Swiss army knives of the stock market.

Is Investcorp under Dodd's rating?

Investcorp has slipped under most analysts’ radar; Dodd's rating is the only one on file for Investcorp at the moment. ( See ICMB stock analysis on TipRanks)

Is Investcorp paring back dividends?

In recent years, Investcorp has been paring back the dividend, to keep it in line with the tougher business climate. The most recent declaration, for fiscal Q4, was set at 15 cents per common share; this was down from 18 cents in the last payment.

Is Presidio under the radar?

Presidio appears to be flying under the Street’s radar and currently Toti's is the sole review. ( See SQFT stock analysis on TipRanks)

Is Investcorp diversified?

So, Investcorp’s portfolio is highly diversified, entering East Asia was as including previous investments in Western private equity, real estate, and credit management. In the most recent quarter, the third of fiscal year 2021, the company reported net profit from that portfolio of $29 million. This came out to 29 cents per share, a dramatic year-over-year turnaround from 3Q20, when the company posted 3-cent net loss per share. Revenue, however, came in below the Street’s estimates, with $6.01 million reported at the top line compared to the $6.76 million expected.

What is Sunoco fuel?

Sunoco is a Master Limited Partnership that distributes fuel products through its wholesale and retail business units. The wholesale unit purchases fuel products from refiners and sells those products to both its own and independently-owned dealers. Sunoco is the largest fuel distributor in the U.S, but also operates a small number of retail stores, and a terminal facility in Hawaii.

How much revenue did WarnerMedia generate in 2020?

For the quarter the company generated $43.9 billion in revenue, up 2.7% from $42.8 billion in Q1 2020, as higher mobility and WarnerMedia revenue more than offset declines in domestic video, business wireline and Latin America. Source: Investor Presentation.

What is AT&T's deal with Discovery?

On May 17th, 2021 AT&T announced an agreement to combine WarnerMedia with Discovery, Inc. (DISCA) to create a new global entertainment company. AT&T will receive $43 billion in a combination of cash, securities and retention of debt. AT&T shareholders receive stock representing 71% of the new company, with Discovery shareholders owning 29%.We believe these various deals with allow AT&T to simplify its operations, become more efficient, and return to its core focus on telecom services such as 5G rollout.

What is Magellan Midstream Partners?

Magellan Midstream Partners is a Master Limited Partnership, or MLP. Magellan has the longest pipeline system of refined products, which is linked to nearly half of the total U.S. refining capacity.

What is AT&T 2021?

AT&T is a telecommunications giant, as its core Communications segment provides mobile, broadband and video to 100 million U.S. consumers and 3 million businesses. On April 22nd, 2021 AT&T reported Q1 2021 results for the period ending March 31st, 2021.

What happens when you retire?

When a person retires, they no longer receive a paycheck from working. While traditional sources of retirement income such as Social Security help investors make up the gap, many could still face an income shortfall in retirement.

Is Altria a dividend stock?

Altria is a legendary dividend stock, because of its impressive history of steady increases. Altria has raised its dividend for 50 consecutive years, placing it on the very exclusive list of Dividend Kings. Altria reported first-quarter results on April 29th. Revenue net of excise taxes declined 3.3% year-over-year.