What is lemonade's (lmnd) stock price?

What is Lemonade's stock price today? One share of LMND stock can currently be purchased for approximately $69.27.

Who sold lmnd stock in the last quarter?

LMND stock was sold by a variety of institutional investors in the last quarter, including Citadel Advisors LLC, Susquehanna International Group LLP, Wolverine Trading LLC, Baillie Gifford & Co., Mitsubishi UFJ Trust & Banking Corp, PEAK6 Investments LLC, LPL Financial LLC, and Mirador Capital Partners LP.

How much did lmnd raise in its IPO?

(LMND) raised $270 million in an initial public offering on Thursday, July 2nd 2020. The company issued 11,000,000 shares at a price of $23.00-$26.00 per share. Goldman Sachs, Morgan Stanley, Allen & Company and Barclays Capital served as the underwriters for the IPO and JMP Securities, Oppenheimer, William Blair and LionTree were co-managers.

How much of lemonade stock is owned by institutions?

58.52% of the stock of Lemonade is held by institutions. High institutional ownership can be a signal of strong market trust in this company. Earnings for Lemonade are expected to decrease in the coming year, from ($3.92) to ($4.34) per share.

See more

Is LMND overvalued?

While the company has executed well on its growth strategy and multiple drivers are supporting continued growth in 2021, the stock is heavily overvalued. The company trades at nearly an 80x forward revenue multiple.

What kind of stock is LMND?

New York-based Lemonade, Inc. (NYSE: LMND) provides insurance services through an artificial intelligence-based platform. Its services include term life insurance, pet insurance, car insurance, homeowners' insurance and re...

Does Lemonade pay dividends?

Does Lemonade pay dividends? Lemonade has not declared or paid cash dividends on its common stock to date.

How much debt does Lemonade have?

Compare LMND With Other StocksLemonade Debt/Equity Ratio Historical DataDateLong Term DebtDebt to Equity Ratio2020-12-31$0.29B0.532020-09-30$0.26B0.462020-06-30$0.14B0.5510 more rows

Should I buy or sell Lemonade stock right now?

7 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Lemonade in the last year. There are currently 2 sell ratings, 2...

What is Lemonade's stock price forecast for 2022?

7 equities research analysts have issued twelve-month price targets for Lemonade's stock. Their forecasts range from $22.00 to $53.00. On average,...

How has Lemonade's stock price performed in 2022?

Lemonade's stock was trading at $42.11 at the beginning of the year. Since then, LMND shares have decreased by 57.7% and is now trading at $17.81....

When is Lemonade's next earnings date?

Lemonade is scheduled to release its next quarterly earnings announcement on Wednesday, August 3rd 2022. View our earnings forecast for Lemonade .

How were Lemonade's earnings last quarter?

Lemonade, Inc. (NYSE:LMND) announced its quarterly earnings results on Monday, May, 9th. The company reported ($1.21) earnings per share for the qu...

What guidance has Lemonade issued on next quarter's earnings?

Lemonade updated its second quarter 2022 earnings guidance on Monday, June, 6th. The company provided EPS guidance of for the period. The company i...

Who are Lemonade's key executives?

Lemonade's management team includes the following people: Mr. Daniel Asher Schreiber , Co-Founder, Chairman & Co-CEO (Age 51, Pay $373.74k) Mr....

What is Daniel Schreiber's approval rating as Lemonade's CEO?

121 employees have rated Lemonade CEO Daniel Schreiber on Glassdoor.com . Daniel Schreiber has an approval rating of 99% among Lemonade's employee...

Who are some of Lemonade's key competitors?

Some companies that are related to Lemonade include Enstar Group (ESGR) , White Mountains Insurance Group (WTM) , Kemper (KMPR) , Mercury Gener...

When will Lemonade release its results?

Is lemonade a rocket ship?

NEW YORK, July 22, 2021--Lemonade, Inc. (NYSE: LMND) today announced it will release its second quarter 2021 financial results on Wednesday, August 4, 2021 after market close. Lemonade will host a conference call the following day, Thursday, August 5, at 8:00 am Eastern time (5:00 am Pacific time) to discuss the results.

About Lemonade

Lemonade (NYSE: LMND) has been a volatile rocket ship since its IPO in July 2020. The bulls believe Lemonade's disruptive potential justifies that premium. It already offers home, renters, pet, and term life insurance plans, and intends to add auto insurance in the near future.

Lemonade (NYSE:LMND) Frequently Asked Questions

Lemonade, Inc. provides various insurance products in the United States and Europe. Its insurance products cover stolen or damaged property, and personal liability that protects its customers if they are responsible for an accident or damage to another person or their property.

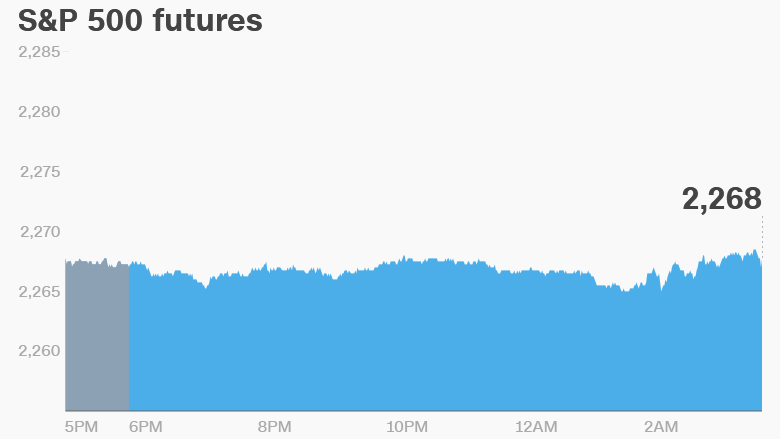

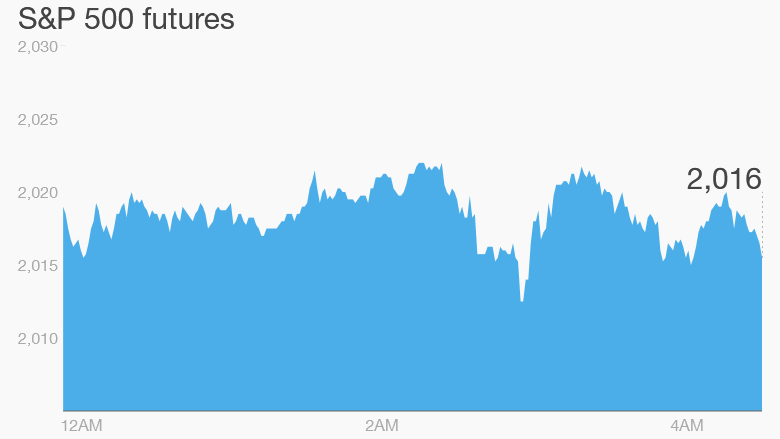

Pre-Market Trades

8 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Lemonade in the last year. There are currently 3 sell ratings, 2 hold ratings and 3 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should "hold" Lemonade stock.

About Pre-Market Quotes

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET). Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may also move more quickly in this environment.