For LI AUTO INC - ADR stock forecast for 2030, 12 predictions are offered for each month of 2030 with average LI AUTO INC - ADR stock forecast of $21.92, a high forecast of $26.55, and a low forecast of $15.24. The average LI AUTO INC - ADR stock forecast 2030 represents a -31.96% decrease from the last price of $32.2200012207031.

Full Answer

What is Li Auto Inc - ADR stock price targets for 2022?

For LI AUTO INC - ADR stock forecast for 2022, 5 predictions are offered for each month of 2022 with average LI AUTO INC - ADR stock forecast of $40.04, a high forecast of $40.84, and a low forecast of $39.31. The average LI AUTO INC - ADR stock forecast 2022 represents a 2.93% increase from the last price of $38.9000015258789.

What is Li auto's (Lia) stock price potential next year?

Their forecasts range from $34.00 to $62.00. On average, they anticipate Li Auto's stock price to reach $43.80 in the next year. This suggests a possible upside of 48.3% from the stock's current price.

Does Li auto stock have an upside of 43%?

According to analysts' consensus price target of $43.80, Li Auto has a forecasted upside of 43.7% from its current price of $30.47. Li Auto has only been the subject of 3 research reports in the past 90 days.

What are the resistance levels for Li auto stocks?

For Li Auto stocks, the 50-day moving average is the resistance level today. For Li Auto stocks, the 200-day moving average is the resistance level today. Are you interested in Li Auto Inc. stocks and want to buy them, or are they already in your portfolio?

What will Li Auto stock be worth in 5 years?

Based on our forecasts, a long-term increase is expected, the "LI" stock price prognosis for 2027-07-19 is 54.008 USD. With a 5-year investment, the revenue is expected to be around +60.98%. Your current $100 investment may be up to $160.98 in 2027. Get It Now!

Is Li Auto a good long term stock?

Li Auto stock has an EPS Rating of 76 out of 99. That rating compares quarterly and annual earnings-per-share growth with all other stocks.

What is the future of Li Auto?

Is Li Auto Overvalued Now?StockConsensus Forward Next Twelve Months' Price-to-Sales MultipleConsensus Forward FY 2022 Revenue Growth MetricLi Auto4.01+95.1%XPeng3.98+94.9%NIO3.43+68.6%Jul 5, 2022

How high can LI stock go?

Li Auto Inc (NASDAQ:LI) The 25 analysts offering 12-month price forecasts for Li Auto Inc have a median target of 39.61, with a high estimate of 61.34 and a low estimate of 13.98. The median estimate represents a +15.31% increase from the last price of 34.35.

Is Li Auto worth buying?

Li Auto is worth noting, too Adjusted earnings per share finished positive at 0.23 yuan ($0.04), representing a nice jump from its negative 0.10 yuan in Q1 2021. Total deliveries ascended 152% year over year to 31,716, as the company has really started to scale its business.

What is better Nio or Li?

While NIO stock is valued at a forward price to 2022 sales multiple of 4.1x, the ratio for Li Auto is also similar at 4.2x. However, I believe Li Auto is currently a better investment, given its higher gross margins and narrower losses.

What cars does Li Auto make?

Li Auto is a pioneer to successfully commercialize extended-range electric vehicles in China. The Company started volume production in November 2019. Its model lineup includes Li ONE, a six-seat, large premium smart electric SUV, and Li L9, a six-seat, full-size, flagship smart SUV.

Why is Li stock going up?

Li Auto stock rallies after June EV deliveries rise nearly 70% The U.S.-listed shares of Li Auto Inc. rose 1.5% in premarket trading Friday, after the China-based electric vehicle maker reported a more than 63% jump in second-quarter deliveries.

Is Tesla stock a buy?

Tesla Stock Not A Buy Despite 42% Revenue Growth.

Should I sell Li Auto stock?

12 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Li Auto in the last year. There are currently 11 buy ratings and 1 strong buy rating for the stock. The consensus among Wall Street research analysts is that investors should "buy" Li Auto stock.

What is Li target price?

Based on analysts offering 12 month price targets for LI in the last 3 months. The average price target is $46.5 with a high estimate of $60 and a low estimate of $33.

What is the forecast for LI stock?

Analyst Price Target on LI Based on 6 Wall Street analysts offering 12 month price targets for Li Auto in the last 3 months. The average price target is $46.50 with a high forecast of $60.00 and a low forecast of $33.00. The average price target represents a 20.94% change from the last price of $38.45.

Will Li Auto be delisted?

Luckin, Li Auto among 17 Chinese companies added to US delisting list.

Why is Li Auto dropping?

For February, Li delivered 8,414 Li ONE vehicles, up 266% from the prior year, but down 31% since January. The company attributed the month-over-month decline to pandemic and holiday-related supply shortages in China.

What is the forecast for LI stock?

Analyst Price Target on LI Based on 6 Wall Street analysts offering 12 month price targets for Li Auto in the last 3 months. The average price target is $46.50 with a high forecast of $60.00 and a low forecast of $33.00. The average price target represents a 20.94% change from the last price of $38.45.

What cars does Li Auto make?

Li Auto is a pioneer to successfully commercialize extended-range electric vehicles in China. The Company started volume production in November 2019. Its model lineup includes Li ONE, a six-seat, large premium smart electric SUV, and Li L9, a six-seat, full-size, flagship smart SUV.

Is LI AUTO Stock a good buy in 2022, according to Wall Street analysts?

The consensus among 8 Wall Street analysts covering ( NASDAQ : LI ) stock is to Strong Buy LI stock. Out of 8 analysts , 6 ( 75% ) are re...

What is LI's earnings growth forecast for 2022-2023?

( NASDAQ : LI ) LI AUTO 's forecast annual earnings growth rate of N/A is not forecast to beat the US Auto Manufacturers industry's average...

What is LI's revenue growth forecast for 2022-2023?

( NASDAQ : LI ) LI AUTO 's forecast annual revenue growth rate of 46.01% is not forecast to beat the US Auto Manufacturers industry's avera...

What is LI's forecast return on assets (ROA) for 2022-2023?

(NASDAQ: LI) forecast ROA is 4.93%, which is lower than the forecast US Auto Manufacturers industry average of 18.26%.

What is LI's Price Target?

According to 8 Wall Street analyst s that have issued a 1 year LI price target, the average LI price target is $40.80 , with the highest LI...

What is LI's Earnings Per Share (EPS) forecast for 2022-2023?

(NASDAQ: LI) LI AUTO's current Earnings Per Share (EPS) is $0.00. On average, analysts forecast that LI's EPS will be -$0.33 for 2022, with the low...

What is LI's forecast return on equity (ROE) for 2022-2023?

(NASDAQ: LI) forecast ROE is 7.83%, which is considered weak.

When did Li Auto go public?

Li Auto went public on the Nasdaq on 30 July 2020 under the ticker symbol LI. The stock closed at $16.46 a share on its first day of trading and rose to $23.38 a share on 26 August. It then declined to $15.09 in September but rallied to reach a high of $47.70 a share in late November.

Where is Li Auto made?

Based in Shanghai, Li Auto was founded in 2015 and started production of its plug-in hybrid SUV the Li Xiang One in November 2019. As of December 2020, it had delivered 32,624 vehicles. It delivered 5,539 vehicles in April, which was up by 111.3% compared with April 2020, taking the cumulative number of vehicles delivered to 51,175 since ...

How many ADRs did Li Auto acquire?

In the meantime, the Swiss National Bank acquired more than 420,000 American depositary receipts (ADRs) of Li Auto during the first quarter of 2021, indicating confidence that the share price will rebound.

How many electric cars will be sold in 2020?

Global sales of electric and plug-in hybrids climbed by 43% in 2020 to 3.24 million, according to EV-volumes.com, even as sales of conventional vehicles fell. EV sales are expected to continue rising in the coming years, as consumer interest grows and all of the major automotive manufacturers plan to bring out new models.

Stock Price Forecast

The 21 analysts offering 12-month price forecasts for Li Auto Inc have a median target of 40.26, with a high estimate of 64.48 and a low estimate of 19.39. The median estimate represents a +45.40% increase from the last price of 27.69.

Analyst Recommendations

The current consensus among 23 polled investment analysts is to Buy stock in Li Auto Inc. This rating has held steady since February, when it was unchanged from a Buy rating. Move your mouse over past months for detail

LI earnings per share forecast

What is LI 's earnings per share in the next 2 years based on estimates from 2 analyst s?

LI revenue forecast

What is LI 's revenue in the next 2 years based on estimates from 1 analyst?

LI revenue growth forecast

How is LI forecast to perform vs Auto Manufacturers companies and vs the US market?

About Li Auto

Li Auto Inc., through its subsidiaries, designs, develops, manufactures, and sells smart electric sport utility vehicles (SUVs) in China. It offers Li ONE, a six-seat electric SUV that equipped with a range of extension system and smart vehicle solutions. The company was formerly known as Leading Ideal Inc. and changed its name to Li Auto Inc.

Headlines

Is Recovery Already Here? Alibaba Rises In Hong Kong, Alongside JD, Tesla Rival Li Auto And Other Tech Stocks

Li Auto (NASDAQ:LI) Frequently Asked Questions

10 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Li Auto in the last twelve months. There are currently 9 buy ratings and 1 strong buy rating for the stock. The consensus among Wall Street analysts is that investors should "buy" Li Auto stock. View analyst ratings for Li Auto or view top-rated stocks.

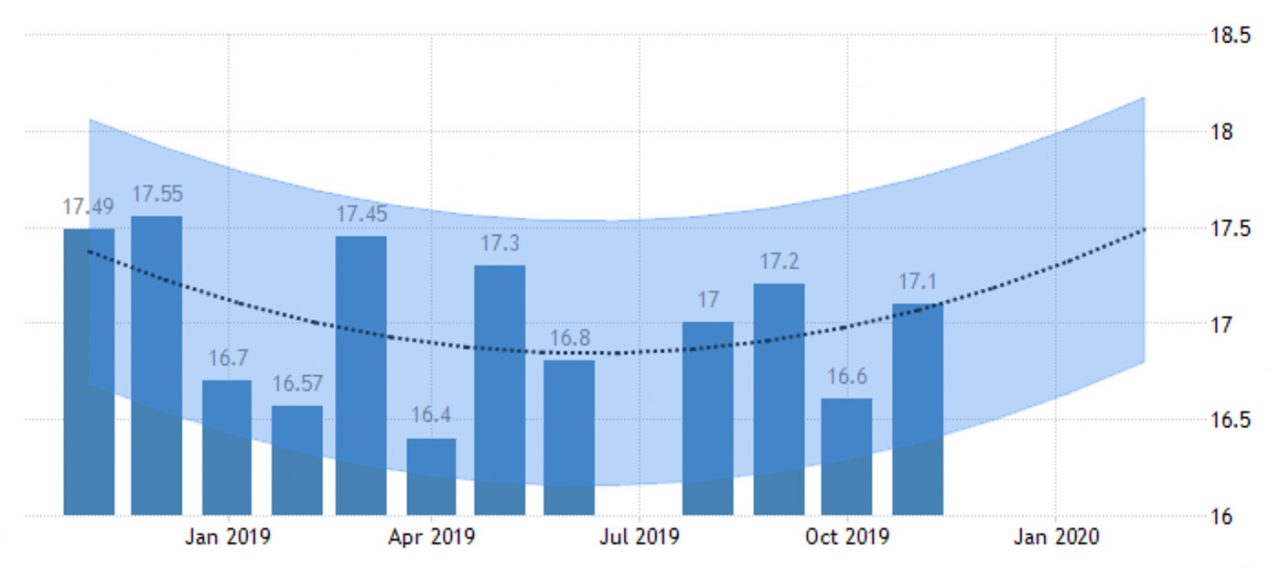

Historical and forecast chart of Li Auto stock

The chart below shows the historical price of Li Auto stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Li Auto stock price can be found in the table below.

Li Auto Daily Price Targets

Forecast target price for 02-23-2022: $ 30.74. Positive dynamics for Li Auto shares will prevail with possible volatility of 3.840%.

Li Auto information and performance

Li Auto Inc. (Nasdaq: LI) is a Chinese automotive company that designs, develops, manufactures and markets premium smart electric SUVs.

Fundamental Analysis

Ramping Up Operations

- Li Auto has been quite aggressive with its expansion plans. Li ONE debuted in the markets in December 2019. However, since then the company has already completed cumulative deliveries of 124,088 vehicles until the end of 2021. By the end of 2021, the company has 278 servicing centers and 206 retail stores in 102 cities. In addition to this, Li Auto has its authorised body an…

Stock Price Movements

- From the close price of $26.29 on 1 October 2021 to the end of year close price of $32.10, the Li Auto stock has rallied by 22% during Q4 2021. However, in 2021, it was significantly affected by the worldwide chip shortage due to the Covid-19 restrictions and disruption of supply chains. Considering the need for chips in EV production is more than that for traditional carmakers, the …

Future Price Forecasts

- According to the algorithmic forecasting of Wallet Investoras of 13 January 2022, the Li Auto share target price could increase to the range of $55.354 to $56.342 in December 2025, three years from now. Additionally, in its Li Auto share price forecast, it was mentioned that the price could close at $36.641 by December 2022. Based on the data compi...