What is a leveraged buyout (LBO)?

What is a Leveraged Buyout (LBO)? In corporate finance, a leveraged buyout (LBO) is a transaction where a company is acquired using debt as the main source of consideration. These transactions typically occur when a private equity (PE) firm

What is an LBO transaction?

An LBO transaction typically occur when a private equity (PE) firm borrows as much as they can from a variety of lenders (up to 70-80% of the purchase price) to achieve an internal rate return IRR >20% transaction, which is the acquisition of a company that is funded using a significant amount of debt.

What type of debt is used in LBO?

Leveraged Buyout (LBO) A leveraged buyout (LBO) is a transaction where a business is acquired using debt as the main source of consideration. Senior Term Debt Senior term debt is a loan with a priority repayment status in case of bankruptcy, and typically carries lower interest rates and lower risk.

How do you value a company for an LBO?

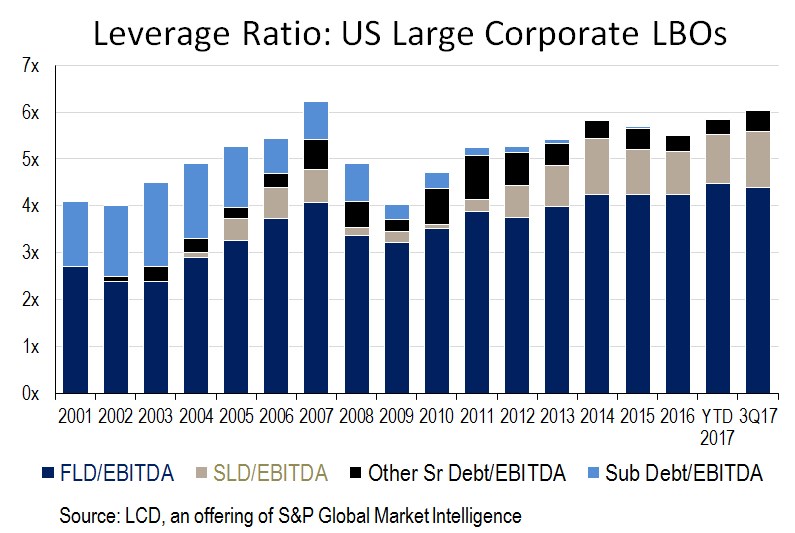

Calculate the minimum valuation for a company since, in the absence of strategic buyers, an LBO firm should be a willing buyer at a price that delivers an expected equity return that meets the firm’s hurdle rate. What is LBO? The following chart summarizes some of the important considerations of a Leveraged Buyout.

What is purchase price in LBO?

Financing and Leverage TermsOffer priceThe price offered per share by the sponsorStock considerationThe portion of the purchase price given to the target in the form of shares of the acquirer's stockLine of creditA loan that can be drawn based on required usage up to a maximum amount9 more rows•Nov 5, 2019

What is an LBO in finance?

A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money (bonds or loans) to meet the cost of acquisition.

How much is LBO debt?

LBO Overview Generally speaking, the debt will constitute a majority of the purchase price—after the purchase of the company, the debt/equity ratio is typically around 2.0x or 3.0x (i.e., usually the total debt will be about 60-80% of the purchase price).

What is the LBO market?

A leveraged buyout, also called an LBO, is a financial transaction in which a company is purchased with a combination of equity and debt so the company's cash flow is the collateral used to secure and repay the borrowed money.

What is the largest LBO in history?

The largest leveraged buyout in history was valued at $32.1 billion, when TXU Energy turned private in 2007.

Why are LBOs popular?

LBOs enjoy popularity in the mergers and acquisitions environment because they are often capable of delivering a win-win for both the bank and the financial sponsor. Banks can make significantly greater margins by supporting the financing of LBOs compared to typical corporate financing.

How are Lbos profitable?

Leveraged buyouts allow companies to make large acquisitions without having to commit significant amounts of their own capital or money. Instead, the assets of the company being acquired help to make an LBO possible since the acquired company's assets are used as collateral for the debt.

Who pays the debt in an LBO?

In the event of a liquidation, high yield debt is paid before equity holders, but after the bank debt. The debt can be raised in the public debt market or private institutional market. Its payback period is typically 8 to 10 years, with a bullet repayment and early repayment options.

What is difference between LBO and DCF?

However, the difference is that in DCF analysis, we look at the present value of the company (enterprise value), whereas in LBO analysis, we are actually looking for the internal rate of return.

Who invented LBO?

The first LBO wave started in early 1980s with high yield bonds invented by Michael Milken (commonly called 'junk bonds') being an essential source of financing.

Are leveraged buyouts good?

Leveraged buyouts (LBOs) have probably had more bad publicity than good because they make great stories for the press. However, not all LBOs are regarded as predatory. They can have both positive and negative effects, depending on which side of the deal you're on.

Where are leveraged loans traded?

Leveraged bank loans may be sold in the primary (new issuance) or secondary markets, typically to banks and other institutional investors, such as insurance companies. The secondary market is where financial instruments trade after they have been initially issued and sold, and are no longer considered new issues.

How is an LBO different than a DCF?

An LBO type analysis models cash flows to and from various parties and from that you can calculate a rate of return to each party; a DCF models cash flows and a required rate of return, based on risk, in order to value a company or particular security.

What is the difference between LBO and MBO?

LBO is leveraged buyout which happens when an outsider arranges debts to gain control of a company. MBO is management buyout when the managers of a company themselves buy the stakes in a company thereby owning the company.

What is a leveraged buyout example?

In an LBO, the leverage makes up a large portion of the buyout price—around 90%. The buyer covers the balance with their own equity and often uses their own assets or the assets of the acquired company as collateral. For example, imagine you buy out a company whose net income is $2.5 million per year.

What is a good LBO candidate?

What Makes a Good LBO Candidate? LBO Candidates are characterized by strong, predictable free cash flow (FCF) generation, recurring revenue, and high profit margins from favorable unit economics.

How much does LBO charge?

Management fees typically range from 0.75% to 3% of committed capital, although 2% is common.

What is LBO analysis?

LBO (Leveraged Buyout) analysis helps in determining the maximum value that a financial buyer could pay for the target company and the amount of debt that needs to be raised along with financial considerations like the present and future free cash flows of the target company, equity investors required hurdle rates and interest rates, financing structure and banking agreements that lenders require.

What is operating leverage?

Operating Leverage Operating Leverage is an accounting metric that helps the analyst in analyzing how a company’s operations are related to the company’s revenues. The ratio gives details about how much of a revenue increase will the company have with a specific percentage of sales increase – which puts the predictability of sales into the forefront. read more

What is financial projection?

The Financial Projections Financial projection is a statistical forecast of a company's future revenue and expenditure based on historical market patterns, internal factors, data interpretation, anticipated market developments, and experiences.

Is LBO a dense word?

LBO sounds like a dense word, and indeed it is. The billion-dollar deals which are taking place each year have made LBO’s quite fascinating. have found that 25+ big and small Leveraged Buyout deals have taken place until the first half of the year 2014, valuing over billions of dollars. That’s quite a lot of money!

What is LBO capital?

is a small middle layer in the LBO capital structure that is a hybrid of debt and equity and is junior or subordinate to other debt financing options. It is often financed by hedge funds and private equity investors and comes with a higher interest rate than bank debt and high-yield debt.

How long does a high yield debt payback last?

The debt can be raised in the public debt market or private institutional market. Its payback period is typically 8 to 10 years, with a bullet repayment and early repayment options.

What is high yield debt?

High yield debt#N#Junk Bonds Junk Bonds, also known as high-yield bonds, are bonds that are rated below investment grade by the big three rating agencies (see image below). Junk bonds carry a higher risk of default than other bonds, but they pay higher returns to make them attractive to investors.#N#is typically unsecured debt and carries a high interest rate that compensates the investors for risking their money. They have less restrictive limitations or covenants than there are in bank debts. In the event of a liquidation, high yield debt is paid before equity holders, but after the bank debt. The debt can be raised in the public debt market or private institutional market. Its payback period is typically 8 to 10 years, with a bullet repayment and early repayment options.

Why do companies do LBOs?

LBOs are primarily conducted for three main reasons - to take a public company private; to spin-off a portion of an existing business by selling it; and to transfer private property, as is the case with a change in small business ownership.

Why are LBOs considered junk bonds?

Because of this high debt/equity ratio, the bonds issued in the buyout are usually not investment grade and are referred to as junk bonds. LBOs have garnered a reputation for being an especially ruthless and predatory tactic as the target company doesn't usually sanction the acquisition.

What is leveraged buyout?

What Is a Leveraged Buyout? A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company.

What is a Leveraged Buyout (LBO)?

A leveraged buyout (LBO) is when a sponsor, typically a private equity (PE) firm, uses a relatively high amount of debt combined with some equity capital to purchase a company in the hopes that it can increase the company's share value before exit.

How to Build an LBO Model?

LBO models are considered one of the more complex financial models, requiring a lot of due diligence to make them accurate and reliable. Usually, these models are created within Excel, as many of its functions are useful for the calculations necessary in this model. Further, a good LBO model automatically updates itself when its inputs are changed.

M&A vs. LBO

Mergers and acquisitions (M&As) and leveraged buyouts have similarities and differences, and it is worth outlining those differences here.

LBO vs. MBO

A leveraged buyout (LBO) and management buyout (MBO) are very different, though they may sound very similar. We explore these differences below.

What is a bond in LBO?

Bonds and private notes can be a source of financing for an LBO. A bond is a debt instrument that a company can issue and sell to investors. Investors pay cash upfront for the face value of the bond and in return, get paid, an interest rate until the maturity date or expiration of the bond.

What is leveraged buyout?

A leveraged buyout (LBO) is a type of acquisition in the business world whereby the vast majority of the cost of buying a company is financed by borrowed funds. LBOs are often executed by private equity firms who attempt to raise as much funding as possible using various types of debt to get the transaction completed.

What is a private equity firm?

The private equity firm is typically the private equity sponsor, meaning the firm earns a rate of return on their investment. A private equity firm represents funds from investors that directly invest in buyouts of publicly-traded companies as well as private companies .

What Type of Company Is A Good Candidate For An LBO?

- Generally speaking, companies that are mature, stable, non-cyclical, predictable, etc. are good candidates for a leveraged buyout. Given the amount of debt that will be strapped onto the business, it’s important that cash flows are predictable, with high margins and relatively low capi…

What Are The Steps in A Leveraged Buyout (LBO)?

- The LBO analysis starts with building a financial model for the operating company on a standalone basis. This means building a forecast five years into the future (on average) and calculating a terminal valuefor the final period. The analysis will be taken to banks and other lenders in order to try and secure as much debt as possible to maximize the returns on equity. O…

LBO Financial Modeling

- When it comes to a leveraged buyout transaction, the financial modelingthat’s required can get quite complicated. The added complexity arises from the following unique elements of a leveraged buyout: 1. A high degree of leverage 2. Multiple tranches of debt financing 3. Complex bank covenants 4. Issuing of Preferred shares 5. Management equity compensation 6. Operatio…

Additional Resources

- Thank you for reading CFI’s guide to Leveraged Buyout (LBO). To further your education, see the following CFI resources: 1. Free guide to financial modeling best practices 2. DCF modeling guide 3. How to link the 3 financial statements 4. Corporate finance career map

Structure of An LBO Model

Capital Structure in An LBO Model

- Capital structurein a Leveraged Buyout (LBO) refers to the components of financing that are used in purchasing a target company. Although each LBO is structured differently, the capital structure is usually similar in most newly-purchased companies, with the largest percentage of LBO financing being debt. The typical capital structure is financing with the cheapest and less risky fi…

Credit Metrics

- One of the keys to building an LBO model is making sure the credit metrics and debt covenants work for the deal. In the screenshot below, you will see how an analyst would model the credit metrics for this leveraged buyout. Key credit metrics in an LBO model include: 1. Debt/EBITDA 2. Interest Coverage Ratio(EBIT/Interest) 3. Debt Service Coverage Ratio(EBITDA – Capex) / (Intere…

Sponsor IRR

- The ultimate goal of the model is to determine what the internal rate of return is for the sponsor (the private equity firm buying the business). Due to the high degree of leverage used in the transaction, the IRR to equity investors will be much higher than the return to debt investors. The model will calculate both the levered and unlevered rates of return to assess how big the advant…

Learn More About Financial Modeling

- Thank you for reading CFI’s guide to an LBO Model. To help you advance your career, check out the additional CFI resources below: 1. Leveraged Buyout 2. Senior Term Debt 3. M&A Process 4. Financial Modeling Templates