See more

Is KMB a buy or sell?

The median P/B ratio for stocks in the S&P is just over 3. While a P/B of less than 3 would mean it's trading at a discount to the market, different industries have different median P/B values....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.75%2Buy18.15%3Hold9.70%4Sell5.35%2 more rows

Is KMB undervalued?

Relative to the current share price of US$129, the company appears quite undervalued at a 50% discount to where the stock price trades currently. Valuations are imprecise instruments though, rather like a telescope - move a few degrees and end up in a different galaxy.

How many shares does Kimberly Clark have?

336.93MKimberly-Clark Corp.Volume1.87MShares Outstanding336.93MEPS (TTM)$5.19P/E Ratio (TTM)25.53Dividend Yield3.50%7 more rows

What stock sector is Kimberly Clark in?

Consumer DiscretionaryKey DataLabelValueExchangeNYSESectorConsumer DiscretionaryIndustryPaper1 Year Target$135.0014 more rows

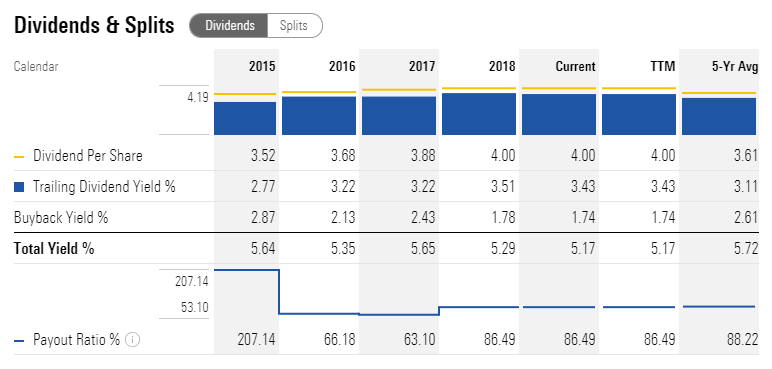

Does Kimberly Clark pay a dividend?

How much is Kimberly Clark's dividend? KMB pays a dividend of $4.60 per share. KMB's annual dividend yield is 3.47%. Kimberly Clark's dividend is higher than the US industry average of 3%, and it is lower than the US market average of 3.79%.

Who owns Kimberly-Clark stock?

Ownership. Kimberly-Clark shares are mainly held by institutional investors (Vanguard group, BlackRock, State Street Corporation and others). Its subsidiaries include Kimberly-Clark Professional.

How can I buy Kimberly-Clark stock?

How to buy shares in Kimberly-Clark CorporationCompare share trading platforms. Use our comparison table to help you find a platform that fits you.Open your brokerage account. ... Confirm your payment details. ... Research the stock. ... Purchase now or later. ... Check in on your investment.

What company owns Kleenex?

Kimberly-ClarkThe Kleenex trademark is owned by Kimberly-Clark, which launched the brand in 1924 as a disposable cleaning tissue for removing cosmetics. The brand launched as a handkerchief substitute in 1930 and has been the No. 1 selling facial tissue in the world ever since. Today it is sold in more than 170 countries.

Is KMB a good buy now?

As of July 22, 2022 the (KMB) stock price is $132.40. Over the previous five trading days (KMB) stock is down -1.7%, compared with being down -1.89% in the past year. (KMB) is down -7.4% so far in 2022.

Is Kimberly-Clark a Buy Sell or Hold?

Kimberly-Clark has received a consensus rating of Hold. The company's average rating score is 1.85, and is based on no buy ratings, 11 hold ratings, and 2 sell ratings.

Is toilet paper a good investment?

While it's possible to turn a profit investing in toilet paper stocks, keep in mind that — like any investment — toilet paper stocks are not immune to risk. These stocks are subject to fluctuating conditions — both in the market and in the paper products industry, so carefully vet your picks before you invest.

What is Kimberly Clark's sustainability strategy?

Can you sell all your stocks in the short term?

Kimberly-Clark today published its annual report on sustainability, providing the first update on the company's global progress toward its 2030 sustainability strategy and goals, aimed at addressing the social and environmental challenges of the next decade with commitments to improve the lives and well-being of 1 billion people in underserved communities around the world with the smallest environmental footprint.

Is Kimberly Clark on the inclusion index?

You could sell many or all of your stocks just in case there's a stock market correction, but if it doesn't happen, you'll likely end up losing out on gains while sitting on the sidelines. It's hard to get more resilient in the face of a recession than Kimberly-Clark (NYSE: KMB).

Is Kimberly Clark a biotech?

Kimberly-Clark Named to Seramount's Inclusion Index. Kimberly-Clark announced today that it was named to Seramount's (formerly Working Mother Media) fifth annual Inclusion Index for the second consecutive year.