Logically and theoretically, the last price traded on any given day should be the same as the closing price of a stock. But that isn't always the case. In particular, a late-afternoon online search for the closing price or last quote on any stock might reveal conflicting results from different sources.

Is the last Price traded the same as the closing price?

Logically and theoretically, the last price traded should be the same as the closing price of a stock. However, the way we trade stocks and the markets we trade them on have undergone numerous innovations over the last decade.

Why are stock prices different when the market is closed?

The closing price of a stock one day and its opening price the next day are often different. That's because the stock market doesn't work like a supermarket. There's no label on the shelf telling you how much a share of stock will cost. Prices are constantly in motion -- even when the markets are closed.

What is the difference between closing price and adjusted closing price?

Closing Price vs. Adjusted Closing Price. The adjusted closing prices depict the effects of corporate actions on a stock's prices. For example, on June 6, 2014, Apple's closing price was $645.57, but the stock was undergoing a stock split. Therefore, the adjusted closing price was $92.22 on the trading day prior to its 7-for-1 stock split.

What is the difference between after-hours and closing prices?

The adjusted closing price factors in anything that might affect the stock price after the market closes, such as dividends or splits. Most stocks and other financial instruments are traded after-hours, although in far smaller volumes. Therefore, the closing price of any security is often different from its after-hours trading price.

Is market price same as closing price?

In simple terms, the closing price is the weighted average of all prices during the last 30 minutes of the trading hours. Whereas the previous trading price is the final price at which the stock was traded before the market closed for the day.

Is market and stock price the same?

There is a big difference between the two. The stock's price only tells you a company's current value or its market value. So, the price represents how much the stock trades at—or the price agreed upon by a buyer and a seller.

What is market price of closing stock?

The closing price is the last price at which a security traded during the regular trading day. A security's closing price is the standard benchmark used by investors to track its performance over time. The closing price will not reflect the impact of cash dividends, stock dividends, or stock splits.

What is market price also known as?

Market price is also known as market value.

What is an example of market price?

To take a market price example, let's assume a stock has bid prices up to $24.99 and ask prices at $25.01 and above. When an investor places a market order to buy it will execute at $25.01. This becomes the market price and bids will need to move up to complete the next trade.

What does market price of the company mean?

The market price is the current average price at which an asset or service can be bought from retailers by customers. The market price is determined by the basic rule of supply and demand. The point at which quantity supplied equals quantity demanded is called the market price.

Can you buy stock at closing price?

The post-market session or closing session is open from 3:40 PM to 4:00 PM. During this session, people can place buy/sell orders in equity (delivery segment using the CNC product code) at the market price but do note that even if you place a market order it will be placed on the exchange at the closing price.

What is the difference between opening stock and closing stock?

The unsold goods in the beginning of the accounting period is called opening stock, whereas the unsold goods at the end of the accounting period is called closing stock.

How do you find closing stock without opening stock?

To calculate closing inventory by the gross profit method, use these 3 steps:Add the cost of beginning inventory plus the cost of purchases during the time frame = the cost of goods available for sale.Multiply the expected gross profit percentage by sales during the time period = the estimated cost of goods sold.More items...•

How do you find the market price?

To determine market price, find where supply equals demand. Find market price by researching things like market trends, and the number of suppliers and existing buyers.

What is the difference between market value and market price?

If you want to be a successful real estate investor, you need to understand the difference between market price and market value. Essentially, market price is what someone is willing to pay for a property. Market value, on the other hand, indicates what a property is actually worth.

What is market price formula?

Market price = Discount + Selling price Discount Percentage = (Discount/Marked price) x 100.

What is the difference between market value and market price?

If you want to be a successful real estate investor, you need to understand the difference between market price and market value. Essentially, market price is what someone is willing to pay for a property. Market value, on the other hand, indicates what a property is actually worth.

How is the market price of a stock determined?

Once a company goes public on the stock market and its shares start trading on an exchange, the share price is determined by supply and demand. But, over the long term, share prices are determined by the economics of the business.

How is stock price calculated?

To figure out how valuable the shares are for traders, take the last updated value of the company share and multiply it by outstanding shares. Another method to calculate the price of the share is the price to earnings ratio.

How does market cap affect stock price?

Market cap does not influence share prices. It works the other way around. Market cap is arrived at by multiplying the share price by the number of shares outstanding. So when a stock's price rises, so too does its market cap.

Why is the closing price of a stock different from the open price?

That's because news about a company can, and often does, come out while the market is closed, shifting what investors are willing to pay to own a share of the company.

What is the difference between open and closed stock?

Previous close by definition in stock market language refers to essentially the last trading price of the previous day, while open price refers to the first trading price of the day. Investors can change their minds based on new information about what a stock is worth while it's closed, meaning prices can shift without any trades taking place.

What time does the stock market close?

The major U.S. exchanges are generally open from 9:30 a.m. to 4 p.m. Eastern time. The closing price is just a snapshot of the stock at 4 p.m. This price does carry a lot of psychological weight, as it's often interpreted as the market's "final say" on a stock for the day.

What is the difference between closing and opening price?

Just as the closing price is the price paid in the last transaction of a business day, the opening price is the price from the first transaction of a business day. That price can be influenced by anything that has happened since the previous close.

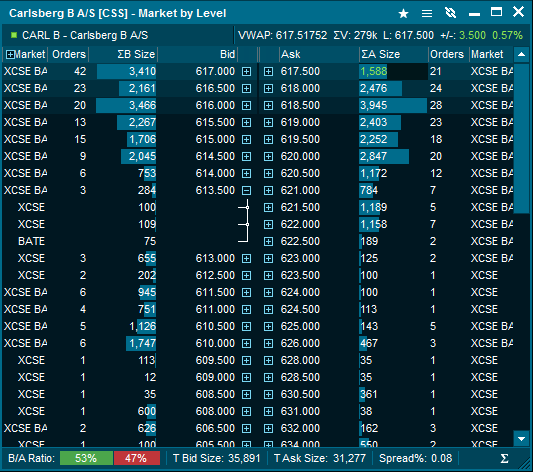

What does "bid price" mean in stock trading?

Technically, there are bid prices, meaning what people are offering for the stock, and ask prices, meaning what people are looking to be paid for it. When those prices converge, trades take place.

Is the stock market fluid?

But in the stock market, prices are fluid. The price quoted for a stock at any point is simply the price paid the last time that stock changed hands. There's no guarantee that you'll get that price if you place an order to buy or sell shares.

Can you trade stocks after hours?

Trading in stocks continues even after exchanges close. Investors can place " after-hours" buy and sell orders. Depending on the system, these orders either are filled immediately or are queued up to be filled when the market opens. Those trades will affect the next day's opening price.

How does investor sentiment affect stock price?

Investor sentiment can drive up the market value of a stock, particularly with initial public offerings (IPOs). When a company goes public, the buzz and industry hype around this first stock it offers – the IPOs – may inordinately drive up the value of the stock. And because the newly issued stock doesn't have a trading history, the high initial market price may plummet after a few weeks or months after its debut.

How long does it take for a stock to plummet after IPO?

And because the newly issued stock doesn't have a trading history, the high initial market price may plummet after a few weeks or months after its debut. The U.S. Securities and Exchange Commission (SEC) urges investors to research a company's IPO registration statement, which is published on the SEC's online EDGAR database.

Why does the stock market fluctuate?

The market price will usually fluctuate throughout the trading day as investors buy and sell stocks. The market price will rise if more people want to buy it and fall as people begin selling more of the stock. Be aware, however, that the market price isn't necessarily an accurate indicator of a stock's value.

What do you need to know about buying a stock?

As an investor, the most basic piece of information you need to know about when buying or selling a stock is its market price, which will give you an indication of how much you can buy or sell a stock for and can be used to analyze the value of a company and historic stock trends. Use the market price to make an informed decision ...

How to find market cap?

The market cap is a company's worth, represented by the total market value of all its publicly traded shares. Find the market cap by multiplying the number of shares outstanding in the company by ...

Why is market value important?

If you are buying or selling a stock, the market value is of obvious importance because it indicates how much you can sell it for or how many shares you can buy with what you have to invest. You can use historic market prices to find trends in a stock. For instance, you might find that the stock has been steadily climbing ...

Which exchanges offer closing quotes?

In addition to a consolidated closing quote, many exchanges, including the New York Stock Exchange (NYSE) and the Nasdaq, offer an official last trade or closing price for trades on their exchanges.

What is the last half hour of trading?

The Final Half-Hour. In fact, the last trade you see at the moment of the close may not truly be the last trade. Many stocks trade heavily in the last half hour of the trading day. A few minutes are required to process the orders and determine which among them actually was the last trade. Depending on the exchange or the stock quote service you're ...

How long does it take to post a stock trade?

Depending on the exchange or the stock quote service you're using, the genuine last trade may be posted anywhere from 30 seconds to 30 minutes after the closing bell rings.

How long after the close can you trade?

Assuming you can wait 10 minutes after the close, you'll get a closing price and a last trading price that are identical or close to it.

When did after hours trading start?

Since the advent of after-hours trading in 1991, it has been quite normal to see a last price quote that differs greatly from the closing price of the same stock.

Does Investopedia include all offers?

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Can a stock trade again?

In another instant, the stock may trade again and have a new last price, which may or may not match when compared to the closing price from normal trading hours.

What Is the Market Price per Share?

Market price per share simply refers to the most recent price of a single share in a publicly-traded stock. This is not a fixed price—it fluctuates throughout the trading day as various market forces push the price in different directions. Unlike the book value per share, the market price per share has no specific relation to the value of the company's assets or any other balance sheet information.

What happens when market forces push down a stock?

When market forces push down the price of a stock, a seller may be willing to settle for a smaller ask price, and the market price falls. Conversely, when market forces push the price of a stock up, a buyer may be willing to pay a higher bid price, and the market price rises.

How is the price of a stock influenced by supply and demand?

Instead, the market price per share is influenced by supply and demand. 1 When more people are trying to buy a stock than sell it, the market price will rise. When more people are trying to sell a stock than buy it, the market price will fall. These actions may be driven by company assets, such as good or bad news released in a quarterly earnings report. Supply and demand can also be driven by non-financial factors, such as controversy about a CEO, new laws from the government, or natural disasters.

What is market forces?

It's a function of market forces, occurring when the price a buyer is willing to pay for a stock meets the price a seller is willing to accept for a stock. Learn more about what the stock price reflects, the forces that influence it, and how it impacts traders.

What does "ask" mean in stock market?

In technical terms, a seller offers an "ask" price at which they're willing to sell, and the buyer offers a "bid" price at which they're willing to buy. 3 When the bid and ask prices meet, it creates a market price, and the trade is executed. When market forces push down the price of a stock, a seller may be willing to settle for ...

Why is price to book value ratio important?

This is useful for investors, especially value investors, because they can compare the book value per share to the market price per share to potentially identify opportunities . This is known as the price-to-book-value ratio. It tells you how much of a company's assets you're entitled to for every dollar you spend on the stock. 5

What does "book value" mean in a quarterly report?

While market prices fluctuate with investor sentiment, the book value refers to the specific value of an asset.

What is the price of a stock?

A stock's price is often at or near its value, aside from daily changes due to a rising or falling market. But it can happen that a stock's price, or the amount at which it trades on the open market, is quite different from its value. A stock's trading price is the number that an arm's-length, willing seller and a willing buyer would find to be agreeable to each party.

What is the trading price of a stock?

A stock's trading price is the number that an arm's-length, willing seller and a willing buyer would find to be agreeable to each party. A stock's value is what someone is willing to pay for it. Basic factors affect stock prices over the long term, but the law of supply and demand rules stock prices in the short term.

How do you determine if a stock is worth buying?

When considering if a stock would make a powerful long-term investment, there are a couple of different criteria an investor should look for. These signs of a good investment include being able to describe how they make money, if they are in a competitive niche, whether the stocks are set at a fair price, and how well the company can survive a drop in the market.

What does it mean when a stock has more buyers than sellers?

It can mean that the stock's price will rise when there are more buyers than sellers, while more sellers than buyers can mean that the price is about to fall. The number of buyers or sellers for a given stock on any day depends on many factors, such as market trends and the current news.

How to find the value of a stock?

Investors in the stock market can pinpoint a stock's value by looking at factors such as earnings (past, present, and future projections) and market share. You would look at sales volume over time, future and current competitors, and a variety of metrics such as P/E ratio, the current price divided by current earnings per share.

What are the influences on stock prices?

Influences on Stock Prices. A stock's price is often at or near its value, aside from daily changes due to a rising or falling market. But it can happen that a stock's price, or the amount at which it trades on the open market, is quite different from its value.

Why is it important to take a long term view of a stock?

Taking a long-term view doesn't mean to buy and forget because the market changes, and it often does so quite quickly. It's key for investors to assess their stocks' values on a regular basis. This makes it unlikely that you'll hold a failing stock or make the mistake of selling one that has strong prospects.

Is the last price the same as the market price?

The last price is the one at which the most recent transaction occurs, while the market price is whatever price the brokerage can find to fulfill your order as soon as possible. If you're buying a stock, then the market price is the ask price at that moment. If you're selling, then the market price is the bid. Note that these prices may change rapidly, even in the seconds it takes to fill out an order form.

How to calculate a pip in forex?

A pip is a $.0001 change in price movement. To determine the value of a pip, the volume traded is multiplied by .0001. 6 One common example that is used to demonstrate a pip value is the Euro to U.S. dollar (EUR/USD), where a pip equals $10 per $100,000 traded (.0001 x 100,000). 7 If the EUR/USD had a bid price of 1.1049 and an ask price of 1.1051, the spread would be two pips (1.1051 - 1.1049).

What is bid price?

The bid price is the highest price that a trader is willing to pay to go long (buy a stock and wait for a higher price) at that moment. Prices can change quickly as investors and traders act across the globe. These actions are called current bids. Current bids appear on the Level 2—a tool that shows all current bids and offers. The Level 2 also shows how many shares or contracts are being bid at each price. 3

What happens when you place a bid order?

When a bid order is placed, there's no guarantee that the trader placing the bid will receive the number of shares, contracts, or lots that they want. Each transaction in the market requires a buyer and a seller, so someone must sell to the bidder for the order to be filled and for the buyer to receive the shares.

What are the three main price updates in day trading?

Day trading markets such as stocks, futures, forex, and options have three separate prices that update in real-time when the markets are open: the bid price, the ask price, and the last price. They provide important and current pricing information for the market in question.

What is market order?

A market order is also an option. A market order is an order placed by a trader to accept the current price immediately, initiating a trade. 4 It is used when a trader is certain of a price or when the trader needs to exit a position quickly.

What is spread in stock trading?

The spread can act as a transaction cost. Always buying stock with a market order, or placing a limit order to buy at the ask price means paying a slightly higher price than might be attained if the trader were to place a limit order to buy in between the bid and the ask price. The risk is that the trader may not get the order filled.