Just because the market is down doesn’t mean you have to buy anything. Buying stocks on impulse just because they’re cheaper might throw a wrench, just like rushing to sell. Taking time to consider your long-term needs and doing research typically pays off.

Why is the market falling right now?

The truth is that, when a high-flying stock comes crashing back to Earth, there's usually a reason why--slumping sales, management turmoil or a negative earnings report, to name just a few. That's why scraping the bottom of the barrel for stock market bargains rarely makes good investment sense.

What past stock market declines can teach us?

· You don't necessarily want to buy stocks just because their prices are down. There has to be rationale behind your decision. This is where fundamental analysis comes in to evaluate a stock to make...

What causes stock market drop?

· Emphatically, No. Investing in the stock market works best if you are prepared to stay invested for the long term. Investing in stocks for …

Is the stock market healthy or not?

· Both major indices are well into correction territory and the Nasdaq Composite is approaching a bear market (when a market index is down by 20% or more). Even more, many growth stocks are down ...

Is it good to buy stocks when the market crashes?

During a stock market crash, investors are generally advised not to panic and take action to protect their portfolios. Some investors believe that a stock market crash is the best investment time, although it is possible to "catch a falling knife" by buying a stock that still has more to lose.

Should you buy when the market drops?

Be ready to buy the dip Market dips can also be a buying opportunity. Think of it as buying stocks on sale when the market crashes. The trick is to be ready for the fall and willing to commit some cash to snap up investments whose prices are dropping.

Is it better to buy a stock when its down or up?

Stocks should be no different. If you're already planning to invest, buying while prices are down can be a smart move. After all, “buy low, sell high” is a standard mantra for successful investors. However, just like regular shopping, it's not wise to buy things because they're on sale.

Do you owe money if stock goes down?

If you invest in stocks with a cash account, you will not owe money if a stock goes down in value. The value of your investment will decrease, but you will not owe money. If you buy stock using borrowed money, you will owe money no matter which way the stock price goes because you have to repay the loan.

How do you make money when stocks go down?

One way to make money on stocks for which the price is falling is called short selling (also known as "going short" or "shorting"). Short selling sounds like a fairly simple concept in theory—an investor borrows a stock, sells the stock, and then buys the stock back to return it to the lender.

Is now a good time to invest 2021?

So, if you're asking yourself if now is a good time to buy stocks, advisors say the answer is simple, no matter what's happening in the markets: Yes, as long as you're planning to invest for the long-term, are starting with small amounts invested through dollar-cost averaging and you're investing in highly diversified ...

What time is best to buy stocks?

The opening 9:30 a.m. to 10:30 a.m. Eastern time (ET) period is often one of the best hours of the day for day trading, offering the biggest moves in the shortest amount of time. A lot of professional day traders stop trading around 11:30 a.m. because that is when volatility and volume tend to taper off.

When should you buy a stock?

The period after any correction or crash has historically been a great time for investors to buy at bargain prices. If stock prices are oversold, investors can decide whether they are "on sale" and likely to rise in the future. Coming to a single stock-price target is not important.

What should I invest in when market drops?

The bonds that do best in a market crash are government bonds such as U.S. Treasuries; riskier bonds like junk bonds and high-yield credit do not fare as well.

What does it mean to buy on the dip?

"Buy the dips" means purchasing an asset after it has dropped in price. The belief here is that the new lower price represents a bargain as the "dip" is only a short-term blip and the asset, with time, is likely to bounce back and increase in value.

Should you sell during a crash?

A market crash can cause a lot of fear and anxiety as portfolio values fall and volatility rises. As a result, you may be tempted to sell your holdings and sit out of the market and wait until things blow over. However, this can be a bad tactic, causing you to sell low and miss opportunities for future price increases.

Where does the money go when the stock market crashes?

When a stock tumbles and an investor loses money, the money doesn't get redistributed to someone else. Essentially, it has disappeared into thin air, reflecting dwindling investor interest and a decline in investor perception of the stock.

Why does the stock market crash back to Earth?

The truth is that, when a high-flying stock comes crashing back to Earth, there's usually a reason why--slumping sales, management turmoil or a negative earnings report, to name just a few.

Do you make money when you buy or sell?

Conventional wisdom says that you make money when you buy, not when you sell. Think about it: Most of the time, you're better off buying

How does time affect investment?

For most investors, the total time they are invested in the market, rather than the day they got in the market, will have the bigger effect on their potential investment growth. The longer you are invested, the longer your money can compound in value and the longer you have to rebound from any downturns.

Can you predict the market by reading the daily newspaper?

As Berkshire Hathaway CEO Warren Buffett reiterated recently, “you can’t predict the market by reading the daily newspaper.”. In the meantime, though, you should still consistently invest for retirement and other financial goals. This strategy is called dollar-cost averaging.

Can you invest your money for the long term?

If the market keeps sinking, remember that, for many investors, this is okay: You are investing your money for the long term, not for this week or even this year. Unless you’re near retirement, you will likely have time to recover. Future gains are never guaranteed, but the stock market reflects the economy, which will eventually recover from the coronavirus. History shows that if you can ride out market lows, stocks should gain in value over time.

Is it a good time to buy more stocks?

But many financial advisors say there is no “ideal” time to buy more stocks. Because no one knows what will happen with the market, it’s impossible to tell when it will hit bottom and share prices will be at their lowest, Jennifer Weber, vice president of financial planning for Weber Asset Management, tells CNBC Make It .

Do stocks gain value over time?

Future gains are never guaranteed, but the stock market reflects the economy, which will eventually recover from the coronavirus. History shows that if you can ride out market lows, stocks should gain in value over time. Many advisors suggest not changing up your investing strategy at all in uncertain and unstable times.

What happens if you stop investing in stocks?

If you stop investing during a market plunge, you could end up missing out on a rebound in prices, which would help you turn a profit. Investing Tips When Stocks Are Falling.

How to reduce risk of stock market falling?

One of the best ways to reduce your exposure to risk when the stock market is falling is to diversify your portfolio —this means investing in different types of stocks and other assets, such as bonds, mutual funds, real estate investment trusts (REITs), and more.

What is the top down approach to investing?

One needs to put three things in line before thinking of investing in a stock- broader market direction, sector direction, and stock direction. This is called the Top down approach. Stock markets are cyclical in nature. If it is falling this time, it is bound to rise soon and vice versa.

What does it mean when a stock is trading on a low volume pullback?

But always remember this means that the stock is trading on low volumes pullback meaning weak holders are exiting . So if the stock is trading on low vols pullback it is good to average down and bring the price low. But if the stock is in downtrend never never ever average the stock in downtrend.

What is the key to success in the stock market?

Patience is one of the keys to success in the stock market. The only thing that you need to do in the stock market is to buy good stocks and give them time to grow. However, most people who lose money in the stock market are those that are impatient.

Is it a good idea to invest when the market has taken a big hit?

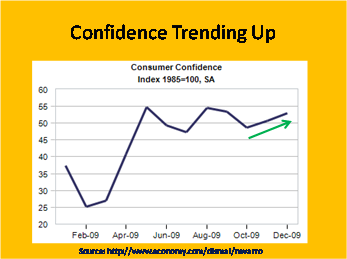

But be careful and verify your opinion more than once because statistically it is very likely that the market has a slight rebound, like shown in the picture below: Summarize: Yes, it is for sure a good idea to start investing when the market has taken a big hit. But be careful and sure to build and verify your belief.

Is it a good idea to buy stocks?

If the stock market is clearly low, like below 10 at Shiller P/E ( Shiller PE Ratio) then yes, it is probably a good idea to buy almost any stocks. That will likely be in a period where most people are warning about the end of the world and stockpiling canned goods and survival sets rather than buying stocks.

How to make sure the stock market is not going down?

Here are two steps you can take to make sure that you do not commit the number one mistake when the stock market goes down. 1. Understand Your Risk Tolerance. Investors can probably remember their first experience with a market downturn.

When stocks go down, is it time to try and time the market?

In other words, when stocks are going down, it's not the time to try and time the market. Instead of passing up the opportunity to have your money earning more money, formulate a bear market strategy to protect your portfolio from different outcomes. Here are two steps you can take to make sure that you do not commit the number one mistake when ...

Why do we use stock simulators?

Experimenting with stock simulators (before investing real money) can provide insight into the market’s volatility and your emotional response to it.

What happens when you panic selling stocks?

Panic selling is often people's first reaction when stocks are going down, leading to a drastic drop in the value of their hard-earned funds. It's important to know your risk tolerance and how it will affect the price fluctuations—called volatility —in your portfolio.

What bonds do best in a market crash?

Generally, but not all the time. The bonds that do best in a market crash are government bonds such as U.S. Treasuries; riskier bonds like junk bonds and high-yield credit do not fare as well. U.S. Treasuries benefit from the " flight to quality " phenomenon that is apparent during a market crash, as investors flock to the relative safety of investments that are perceived to be safer. Bonds also outperform stocks in an equity bear market as central banks tend to lower interest rates to stimulate the economy.

What is the best way to capitalize on the stock market?

Investing in the stock market at predetermined intervals, such as with every paycheck, helps capitalize on an investing strategy called dollar-cost averaging. With dollar-cost averaging, your cost of owning a particular investment is averaged out by purchasing the same dollar amount at periodic intervals, which may result in a lower average cost for the investment.

How to understand market losses?

One way to understand your reaction to market losses is by experimenting with a stock market simulator before actually investing. With stock market simulators, you can invest an amount such as $100,000 of virtual cash and experience the ebbs and flows of the stock market. This will enable you to assess your own particular tolerance for risk.

It's been a rough few weeks for the market. What does that mean for your investments?

The stock market has been shaky over the last several weeks, with the S&P 500 down close to 9% since the beginning of the year.

Should you withdraw your money?

It's impossible to predict exactly how the market will perform over the coming weeks or months. Even the experts can't say for certain what will happen, which can make it challenging to prepare for a potential crash. While pulling your money out of the market may seem like a wise choice, it can be riskier than you might think.

What should you do with your investments?

Although it may sound counterintuitive, one of the best ways to protect your investments against market downturns is to do nothing.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

1. Do Nothing During a Market Crash

If you believe in your investing strategy and your current portfolio assets, don’t change your plans unless you have a good reason. When you built your portfolio, after all, you might have had a market crash just like this one in mind.

2. Go Shopping During a Market Crash

Market crashes are frequently the result of events like the emergence of Covid-19 or the news that the Federal Reserve will change its monetary policy strategy.

3. Dollar-Cost Average, Even on the Way Down

When the market is in turmoil, the safest way to go on a buying spree is to dollar-cost average your purchases. That means making purchases of a set dollar value at regular intervals, even when the market looks scary.

4. Hunt for Dividends during a Stock Market Crash

For the slightly more adventurous, down markets can be a good time to consider letting dividends drive your investment choices. Many companies share their profits with shareholders through a small dividend yield annually, a bit like banks pay interest to savings account holders.

5. Ride the Sector Rotation

A time-honored strategy for dealing with market downturns is to move money from one stock market sector to another. During times of high growth, for instance, tech stocks seem to do well. When the economy slows, meanwhile, “boring” sectors like utilities stocks tend to hold up better.

6. Buy Bonds during a Market Crash

Down markets are also a chance for investors to consider an area that novice investors might miss: Bond investing.

7. Cut Your Losses during a Crash (and Save on Taxes)

Despite our advice above, sometimes cutting your losses is the smartest investing move you can make.