An employee stock purchase plan (ESPP) is a great deal. It lets employees use after-tax payroll ...

What are the benefits of employee stock purchase plans?

Here are four benefits of participating in your employee stock purchase plan: Both qualified and non-qualified employee stock purchase plans feature an employee discount, which is set by the company. For qualified ESPPs, this discount can range between 2% and 15%.

What are employee stock purchase plans (ESPP)?

Offered by most publicly traded companies, an ESPP is an employee benefit that allows you to purchase shares of your company stock at a discount. It’s this discount that’s the most significant advantage of Employee Stock Purchase Plans.

Do companies offer stock discounts to employees?

In some cases, organizations offer stock discounts as high as 15%. Rather than directly purchasing their organization’s stock, participating employees contribute to their plan through automatic payroll deduction. An employee stock purchase plan (ESPP) is an organizational-wide stock plan that is offered to employees who meet specific requirements.

How much discounts can you get on stock purchase plans?

These discounts can be up to 15% on the market price on the day, and vesting differs from 1-3 years. Some attractive offers might be even greater than 15% and can vest immediately, but these are rare. Why Do Company’s Have Stock Purchase Plans?

What percentage should an employee stock purchase plan be?

1% to 15%You can usually purchase ESPP plan stock worth 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. If you participate, your employer will deduct your contribution directly from your paycheck. Your employer will then purchase the company stock for you, typically at the end of a 6-month period.

Is 5% discount on ESPP good?

In reality, an ESPP is a valuable benefit offered by some publicly traded companies. It allows employees like you to purchase company shares at a discount, often at 5%–15% of the fair market value. It doesn't take a degree in mathematics to recognize that can be a good deal.

What is the average ESPP discount?

If you compare that to an ESPP, you're likely guaranteed a discount, usually 15%.

Is enrolling in ESPP a good idea?

Investing in an ESPP can be a good idea, but it should complement your financial goals. These goals can be either long-term or short-term objectives for your overall financial health. Depending on when you buy and sell your shares, your ESPP could fit well into both.

Should I buy my company stock at discount?

Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment. To understand this return, consider a stock trading at $10 per share.

How do you avoid double tax on ESPP?

Paying tax twice on the discount. Thus, when you sell the shares, do not make the purchase price your cost basis when you complete Form 8949 to report the sale. Avoid double taxation on the discount by understanding what the cost basis on your 1099-B includes and why it may be wrong (see #3 above).

Is it better to invest in 401k or ESPP?

The no-match 401(k) is significantly better than the ESPP. The tax arbitrage in the 401(k) translates into a 7.04% IRR. Pretty impressive, because the net-of-fees equity return is only 5.90%, so you gain a full 114 basis points (1.14 percentage points) in annual returns from the tax arbitrage.

How do you maximize ESPP?

Here are 5 ways to use your ESPP to improve your financial life.Contribute To Long Term Wealth. Contributing to an ESPP can boost your efforts towards building wealth through long-term investing. ... Reinvest Into A Roth IRA. ... Supplement Cash Flow. ... Short Term Savings Goals. ... Pay down debt.

How is ESPP discount taxed?

When you buy stock under an employee stock purchase plan (ESPP), the income isn't taxable at the time you buy it. You'll recognize the income and pay tax on it when you sell the stock. When you sell the stock, the income can be either ordinary or capital gain.

How do you calculate basis for ESPP?

For ESPP shares, the cost basis is the discounted purchase price, plus the compensatory income recognized on Form W-2. Under new IRS rules, starting in 2014, brokers who sell any ESPP shares will only be allowed to report the discounted purchase price of ESPP shares as the cost basis on Form 1099-B.

How do I calculate cost basis for ESPP?

The cost basis is the actual price paid per share times the number of shares ($12.75 x 100 = $1,275), plus the amount that you're reporting as compensation income on line 7 of your Form 1040 ($225).

How much should you contribute to company stock?

The average value of the company stock held this way is just shy of $99,000, according to the study. Schwab generally recommends that shares in your own employer make up no more than 10 percent to 20 percent of your portfolio, although some advisors suggest an even lower limit of 5 percent to 10 percent.

Can you lose money on ESPP?

Can you lose money on an ESPP? This is one of those things that surprises people — it's possible to lose money on an ESPP. You're buying shares of stock, and the value of ESPP shares can go up or down very quickly. A 15% drop in price can eliminate the value from participating in the plan in the first place.

Why do companies have stock purchase plans?

In fact, most of these plans are targeted to increase capital and save the company money in the long run.

What happens if you don't have a large net worth?

If you don’t have a large net worth or assets outside of what you would like to put in your ESPP, you become vulnerable to your company’s stock fluctuation. One company scandal or piece of bad press could flatten your entire savings. Diversify your investments outside of your company’s stock purchase plan.

Can you lose money in the long run due to compound interest?

The answer here is most likely not. Unless you have the benefit of working for a company that is doing extremely well and has a promising future. You are likely to lose money in the long run due to the power of continuous compound interest.

What is the discount on company shares?

Company shares generally are offered at a discount, which is typically around 15%, she said. Many plans also include a lookback. So, if you enroll when the stock is at $10 per share, and the transaction occurs when the stock is $15, you get the discount on the lower of the two prices.

How does a stock plan work?

The purchase of company stock is made via payroll deductions. That means the money comes out of your pay after taxes, noted Emily Cervino, head of thought leadership at Fidelity.

How long does it take for an employee to sell shares?

Employee contributions typically accumulate over three to six months, at which point they are aggregated together to purchase shares. In most cases, employees can sell the shares immediately after they’ve purchased them. Or, they can choose to sell them at a later date.

How long do you have to sell a stock to qualify for long term capital gains?

To qualify as long-term capital gains, you generally need to sell at least two years from the first day of the offering period or at least one year from the purchase date.

Do publicly traded companies offer stock plans?

Nearly three-quarters of publicly traded companies offer employee stock purchase plans, or ESPPs, to at least some of their employees, according to a 2018 Deloitte survey. Yet employee participation in the plans is generally low, the study found.

How long do you have to hold on to ESPP shares?

You must hold onto the shares for at least another year after the purchase date and run the risk that the price of the shares drop. Unless you’re intentionally trying to accumulate shares of your company stock, the tax benefits of ESPP shares are not an area where you have an advantage.

How much can you contribute to an ESPP?

Under an ESPP program, employees can elect to defer salary and bonus up to the IRS limit of $25,000 per year (the “ Contribution Limit” ). You elect how much to contribute per pay period during an initial “ Enrollment Period”. At the end of this enrollment period, typically every six months, this money is used to purchase shares at a discount ...

What is an ESPP?

Offered by most publicly traded companies, an ESPP is an employee benefit that allows you to purchase shares of your company stock at a discount. It’s this discount that’s the most significant advantage of Employee Stock Purchase Plans. For most employers, you can expect that discount to range between 5%-15%—obviously the higher the better for you! ...

What is the advantage of an ESPP?

As mentioned above, the primary advantage to exploit in an ESPP is the discount. Shares can be sold immediately (known as a “Quick Sale”) and assuming a 15% discount, lock in a minimum 18% pre-tax gain on your money.

How often does an ESPP have an enrollment period?

Typically, every six months your ESPP will have an enrollment period. You’ll elect to participate in the plan and select how much to contribute each pay period. Your contributions into the plan will be directly pulled from payroll at each pay period and accumulate in your ESPP account. At the end of the period, on the purchase date, ...

What is stock purchase plan?

Employee stock purchase plans are sometimes part of compensation or benefits packages at work. Companies who are public and represented on the stock market, or those expecting to go public, can offer these plans to their employees. If your job includes an employee stock purchase plan option, then it's beneficial to find out how they work.

What is a non qualified stock purchase plan?

The primary difference between qualified and non-qualified ESSPs is that unqualified plans have different tax implications at the point of sale.

How long do you have to be with an employer to get an ESPP?

An employer may choose to have a waiting period of six months or one-year before an employee can become eligible to participate in an ESPP. Additionally, there is a three-year maximum for companies offering qualified ESPPs. So anyone who has been with the company longer than the offering period would not be eligible to partake in the benefits.

How long do you have to hold stock for a tax deposition?

To get a tax deposition, you must hold a stock for a minimum of one year after the purchase date and a minimum of two years after the offered date.

Can you put money from stock sales into a savings account?

Any money you earn from selling your shares can also be put in a savings account . Unlike rolling your earnings into a 401k, when you move your earned income to a savings account, the gains are considered realized and are subject to taxes.

Can you participate in ESPP if you own a company?

Most companies do not allow people who already have a significant percentage of ownership in the company to participate in ESPP. Typically, people who hold more than 5% ownership of a company through a previously negotiated stock option benefit are ineligible.

What are the two types of stock purchase plans?

Generally, organizations offer two forms of employee stock purchase plans – qualified and non-qualified plans.

How long can a stock purchase extension last?

The extension can be as long as a maximum of 27 months. Purchase Period: The purchase period is a subset of the offering period that generally occurs every six months. Purchase Date: The purchase date is the final day of the purchasing period. It is when payroll contributions are used to buy organizational stocks.

What is an ESPP?

What is an Employee Stock Purchase Plan (ESPP)? An employee stock purchase plan (ESPP) refers to a stock program that allows participating employees to purchase their organization’s stock at a discounted price. In some cases, organizations offer stock discounts as high as 15%. Rather than directly purchasing their organization’s stock, ...

What is an ESPP plan?

Summary. An employee stock purchase plan (ESPP) is an organizational-wide stock plan that is offered to employees who meet specific requirements. There are two main types of plans – qualified and non-qualified plans. In order to enroll in an ESPP, it is beneficial to first educate yourself on eligibility, deduction, and taxation.

What is the enrollment period?

Enrollment Period: The enrollment period is the period of time where you can choose to either enroll or deny entry into the purchase plan. Offering Date: The offering date is the period when payroll deductions begin. Offering Period: The offering period is an extension of the offering date.

What is defined contribution plan?

Defined-Contribution Plan A defined-contribution plan (also known as a DC plan) is a type of pension fund payment plan to which an employee, and sometimes an employer, Employee Retention.

What is a shareholder?

Shareholder A shareholder can be a person, company, or organization that holds stock (s) in a given company. A shareholder must own a minimum of one share in a company’s stock or mutual fund to make them a partial owner. .

How long is an employee eligible for a stock offering?

Eligibility. Offering periods are generally six months, twice per year though some companies have shorter periods of 1-3 months or as long as 18 months. An employee cannot participate in a plan if they own 5% or more of company shares.

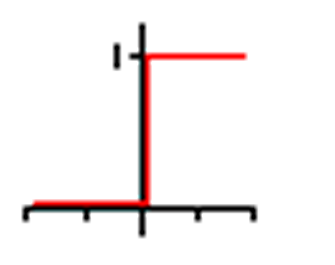

How long is a stock purchase period?

Most plans have purchase periods of 6 months. So your purchase price is discounted either at the beginning of the end of the period. Assume the stock price is $15 at the beginning of the purchase period. Let’s say it goes up to $20 at the end.

How much can you contribute to an ESPP plan?

You can contribute via paychecks. Contributions typically are 1-10% of wages. It is a right way for employees to participate in the success of their company.

How long do you have to hold ESPP shares?

However, a 2017 NASPP Deloitte Consulting Survey reported that two-thirds of companies that offer an ESPP say participants hold their purchased shares under Section 423 for at least one year and a day and get the favorable capital gains treatment.

Why are concentrations in few stocks so risky?

Concentration in few stocks can be very risky. Companies go through downturns due to the economy, increased competition, increased regulation, management changes, and potential fraud. Those that worked at companies like Worldcom and Enron received generous compensation, including discounted stock purchase plans.

How long does an employee have to work for an ESPP?

Companies may require that an employee work at the company for a specific duration, such as one year, before participating in the plan. The ESPP may exclude contractors, highly compensated employees, and part-time employees from participation.

What is the difference between a qualified and non qualified ESPP?

A qualified plan has more restrictions but favorable tax treatment. Non-qualified plans have fewer restrictions but less favorable tax benefits. To implement a qualified ESPP plan, a majority of shareholders must vote to approve it. All employees must have equal access to the plan.

How long does the stock offer last?

Once you opt in, you’ll choose a percentage of your after-tax income for your company to withhold from your paycheck for a timeframe known as the “offering period,” which usually lasts six months. When that period ends, the company buys stock for you and everyone enrolled in the plan.

What is an ESPP plan?

Plenty of publicly traded U.S. companies, including about half the firms in the S&P 500, per professional services firm Aon, offer an employee stock purchase plan (ESPP), which allows the rank and file to periodically purchase shares in the company at a discount.

Is a discount on a stock price taxable?

Your discount will often be assessed on the lower of two prices: the share price at the beginning and at the end of the offering period. The account in which you hold your company stock is taxable, though you won’t be taxed until you sell your shares.

Does Rotblut invest in ESPPs?

Rotblut doesn’t disapprove of investing in ESPPs altogether. “If there’s an attractive discount, it’s worth considering,” he says. “But it shouldn’t be your primary savings vehicle.”. Instead, invest the bulk of the money you set aside from your paycheck in your 401 (k), he says.

How long do you have to exercise stock options after leaving a company?

When you leave the company, you’ll have a certain period to exercise your stock option grants. Often this is 90 days. If the company is bought out or merges with another company, this can change your vesting schedule. Be sure to check with your HR department in either case.

How to get started with ESPP?

Getting started with your company’s ESPP is usually easy. HR will have all the information necessary. You’ll want to know when the offering date is , which allows you to start contributing, along with the date range for the offering period.

How does an ESPP work?

You deposit a certain amount of your paycheck into your retirement. The company will match that amount up to a certain percentage, which trails off to a lower match the more you invest in the plan. ESPPs work in a similar way but usually have a fixed match. If you are investing $200 in your company’s stock with each paycheck, ...

What is an ESPP?

An ESPP allows you to invest directly from your paycheck into your company’s stock. There may be periods in which you can purchase or it could be open all year, which allows you to continually invest. Some companies will include ESPP configurations as part of your benefits plan.

How much does a company match for each $200 invested?

If you are investing $200 in your company’s stock with each paycheck, the company will match it dollar for dollar, depending on how the match is set up. Some companies may match 50%. This means for each $200 invested; the company will invest $100 into your account.

What does "lowest price" mean?

Lowest price can mean at the beginning or end of the period. Employees get a great deal when lookbacks are used because they are getting a discount on the stock. The following is an example of how a lookback works: The stock price is $20 at the beginning of purchase period. At the end it is $26.

Can I dump money into ESPP?

Depending on the discounts being offered by your employer , it can be difficult to not dump as much money as possible into the ESPP. But overweighting your portfolio into any single investment increases risk.