If you are wondering what food to buy before inflation hits more, some of the best food items to stockpile include:

- Peanut butter

- Pasta

- Canned tomatoes

- Baking goods – flour, sugar, yeast, etc.

- Cooking oils

- Canned vegetables and fruits

- Applesauce

...

Following are some of the best options if you're looking to add to your stockpile.

- Cleaning supplies. ...

- Soap. ...

- Peanut butter. ...

- White rice. ...

- Prescription medications. ...

- Dried beans and lentils. ...

- Candy. ...

- Pasta.

What are the best stocks to invest during the inflation?

Wells Fargo: Here's The Best Asset To Own When Inflation Strikes

- Top Assets During Inflation. If you want to know what to own during inflation, know one word: Oil. ...

- Drilling Into Stocks, In The S&P 500 And Out. What does inflation do to S&P 500 stocks and others? ...

- The Bottom Line: Be Inflation Smart. Don't let the risk of inflation chase you out of S&P 500 stocks. ...

- Best And Worst Assets During Inflation

How do stocks perform during periods of inflation?

Warren Buffett explains how to invest in stocks when inflation hits markets

- When you are doing great, it is the time to remember inflation. ...

- During high inflation, earnings are not the dominant variable for investors. ...

- Understand the math of the ‘Misery Index.’. ...

- Inflation is a ‘tapeworm’ that makes bad businesses even worse for shareholders. ...

- Focus on companies that generate rather than consume cash. ...

How does inflation affect stocks?

Stock futures flat with inflation, jobless claims in focus ... CEO Dara Khosrowshahi, however, said uncertainly linked to the fading Omicron wave would continue to affect ride activity, but noted that "mobility is already starting to bounce back, with ...

Do stocks rise with inflation?

While stocks, in general, fare better than bonds during periods of high inflation, our theme of Inflation Stocks includes companies from the banking, insurance, consumer staples, and energy sector that could be more likely to benefit from high inflation and possibly higher interest rates.

What should I buy before hyperinflation hits 2022?

Other food items to purchase when preparing for hyperinflation are wheat, corn, potatoes, and dairy. Another essential commodity to buy before hyperinflation hits is canned foods, including vegetables, fruits, and meats. These foods are easy to store and use in different ways. For example, you can dry or buydried meat.

What should I stock up on now?

Here's what we're stocking up on right now:Pasta! All shapes—linguine, fettuccine, spaghetti, penne, and rigatoni are our faves. ... Other grains. ... Canned goods. ... Dry goods! ... Eggs. ... Dairy! ... Fresh vegetables that last: cabbage, cauliflower, potatoes and sweet potatoes last and last, so we're loading up. ... Frozen veggies.More items...

What foods are not affected by inflation?

The 5 Foods Least Affected by InflationTomatoes. Interestingly, tomatoes have seen the lowest increase in price over the last year, at just 1.7%. ... Cheese. Another relief: cheese prices haven't been terribly affected by inflation, at least as of this month. ... Ice Cream. ... Potatoes. ... Canned fish and seafood.

What to buy now before hyperinflation hits?

Storing the Basics Before HyperinflationDry Goods Shortages of dry goods, like pasta, rice, beans, and spices, cropped up during the early days of the Covid-19 pandemic. ... Canned foods, including vegetables, fruit, and meats are easy to store and useable in a variety of ways.More items...•

What will be scarce in 2022?

Eggs and Meat According to Business Insider, nearly half of Americans in a survey reported seeing a shortage of meat and eggs in the beginning of 2022. It might be time to switch to vegetarian dinners (sans the eggs) for a while to combat this food shortage.

What should I stock up on 2021?

You don't need a year's supply of toilet paper to survive an outbreak, but consider stocking up on these items....Following are some of the best options if you're looking to add to your stockpile.Cleaning supplies. ... Soap. ... Peanut butter. ... White rice. ... Prescription medications. ... Dried beans and lentils. ... Candy. ... Pasta.More items...

How can I eat cheap inflation?

12 Savvy Ways to Fight Price InflationShop Your Pantry. Before you go grocery shopping, make a habit of checking the shelves of your pantry first. ... Do Meal Prep. ... Minimize Food Waste. ... Choose Store Brands Over Name Brands. ... Buy in Bulk. ... Cut Back on Meat. ... Save Money on Produce. ... Buy Reusable Instead of Disposable.More items...•

How do you beat inflation?

So we asked experts how consumers should think about investing and saving in this high-inflation period.Invest smartly in your employer-sponsored retirement plan — and a brokerage account. ... Consider TIPS. ... Weigh real estate and commodities. ... Think about value stocks in the consumer staples arena. ... Look for tax efficienciecs.More items...•

Should you save money during inflation?

The bottom line. Though inflation is making consumer spending more expensive, you can mitigate its effects by budgeting, saving, consolidating debt, as well as knowing where to cut back on monthly expenses.

How do you prepare for hyperinflation 2022?

What to Do With Your Money to Protect Against HyperinflationNegotiate a lower interest rate on your credit cards.Pay off high-interest debt first.Consolidate your debt into a single loan with a lower interest rate.Take out a personal loan to pay off your high-interest credit cards.

Should I buy gold during hyperinflation?

They found that gold typically doesn't maintain its purchasing power during a hyperinflation. In other words, its real price usually declines during such periods.

What are some ways to hedge against inflation?

Commodities. Commodities are another suitable hedge against inflation. These are raw materials including oil, natural gas, precious metals, wheat and corn. They can be traded on the futures market where commodities futures contracts are bought and sold at a certain time in the future.

Why do smart investors want to make sure to address inflation?

Savvy investors want to make sure to address inflation because if they don't, it can decrease their purchasing power.

What is the difference between nominal interest rate and inflation rate?

The difference between the rate of inflation and the nominal interest rate is your real rate of return. TIPS are worth the investment if the return on investments minus inflation yields positive. The concern may be that if inflation is lower than expected, the return on conventional bonds may be better.

What is inflation protected?

Treasury inflation-protected securities, or TIPS, are investments that account for inflation. More specifically, they're inflation-protected bonds whose principal rises when there is inflation and falls when there is deflation. They pay interest twice a year at a fixed rate, which is applied to the adjusted principal. These interest payments increase with inflation and decrease with deflation.

Why do investors need to diversify their portfolio?

When thinking about how much to allocate toward commodities in your portfolio, Yung says, "Investors need to consider diversifying because we don't know year to year which particular commodity is going to outperform."

How long do TIPS last?

TIPS are issued at either five-, 10- or 30-year terms. At maturity, investors either receive the adjusted principal or the original principal. If you choose to sell TIPS before they mature, there is a possibility that you could get back less than what you initially invested.

How to invest in commodities?

Given that there is some volatility tied to the commodities market, experts recommend investing in commodities through a diversified investment vehicle such as a mutual fund or exchange-traded fund.

How do stocks predict inflation?

One way investors can predict expected inflation is to analyze the commodity markets, although the tendency is to think that if commodity prices are rising, stocks should rise since companies “produce” commodities. However, high commodity prices often squeeze profits, which in turn reduces stock returns. Therefore, following the commodity market may provide insight into future inflation rates. 21

When inflation is on the upswing, what happens to stock prices?

When inflation is on the upswing, income-oriented or high-dividend-paying stock prices generally decline.

What happens to the purchasing power of a dollar when inflation increases?

When inflation increases, purchasing power declines, and each dollar can buy fewer goods and services. For investors interested in income-generating stocks, or stocks that pay dividends, the impact of high inflation makes these stocks less attractive than during low inflation, since dividends tend to not keep up with inflation levels. 19

How do dividend paying stocks affect inflation?

Similar to the way interest rates impact the price of bonds—when rates rise, bond prices fall—dividend-paying stocks are affected by inflation: When inflation is on the upswing, income stock prices generally decline. So owning dividend-paying stocks in times of increasing inflation usually means the stock prices will decrease. But investors looking to take positions in dividend-yielding stocks are allowed to buy them cheap when inflation is rising, providing attractive entry points .

Why is inflation greater than or less than this range?

Inflation greater than or less than this range tends to signal a U.S. macroeconomic environment with larger issues that have varying impacts on stocks. 14 Perhaps more important than the actual returns are the volatility of returns inflation causes and knowing how to invest in that environment.

How does rising inflation affect the economy?

Rising inflation has an insidious effect: input prices are higher, consumers can purchase fewer goods, revenues, and profits decline, and the economy slows for a time until a measure of economic equilibrium is reached.

Why should stocks hedge against inflation?

In theory, stocks should provide some hedge against inflation, because a company's revenues and profits should grow at the same rate as inflation, after a period of adjustment. However, inflation's varying impact on stocks confuses the decision to trade positions already held or to take new positions.

Beat Inflation by Investing in Gold

Gold is the oldest hedge against inflation. The yellow metal has seen an average annual gain of 9.48% over the 20 years between September 2001 and September 2021. Over the same period, inflation averaged 2.4%, netting investors a 7.08% rate of return.

Invest in Stocks to Beat Inflation

Investing in a diversified portfolio of stocks is an excellent way to fend off inflation. From September 2001 to September 2021, the S&P 500 —a key benchmark for U.S. stocks—generated an average return of around 9.5% (with dividends reinvested). After accounting for inflation, you’re still looking at about 7% average annual returns.

Beat Inflation with Real Estate

Many inflation-averse investors turn to real estate to hedge their holdings, although the size and variability of the market can make it very difficult to generalize about this particular asset class.

TIPS Are Designed to Beat Inflation

Treasury Inflation-Protected Securities ( TIPS) are designed to protect your investment from rising prices. The U.S. Treasury sells TIPS and adjusts their par value each year to keep up with inflation. This boosts your interest payments, and it also ensures you’ll likely see some appreciation from inflation-adjustments too.

Beat Inflation with I Bonds

Series I savings bonds, better known as I bonds, are another government-issued security designed to beat inflation.

What are the narratives of inflation?

There are two narratives that are getting conflated when it comes to inflation. The first is whether or not inflation is occurring. And the second is whether inflation will get out of control.

Will hotel stocks drop in 2020?

Like any group of stocks related to travel and tourism, hotel stocks saw a steep drop in share prices in 2020. The leisure and hospitality sector that once had 15 million employees has lost 4 million jobs since February.#N#Many major cities will be feeling the ripple effects of the Covid-19 pandemic for years. However, there is ample evidence that shows the pandemic may be coming to an end. The number of new cases is dropping. The number of those getting vaccinated is rising. And even in the cities with the most restrictive mitigation measures, the slow process of reopening is beginning.#N#All of this can’t come fast enough for individuals who rely on the travel and tourism industry for their livelihood. Hotel chains had at least some revenue coming in the door. And when earnings season concludes, the more budget-friendly hotel chains may realize revenue that is 75% of its 2019 numbers. But that is not enough to bring the hotels to anywhere near full employment. Particularly with hotels that have bars and restaurants that have remained closed or open at limited capacity.#N#Many economists are optimistic that travel may begin to look more normal by the summer of this year. And the global economy may deliver 6.4% GDP growth this year. With that in mind, the hotel chains with the best fundamentals and the broadest footprint will be in the best position as the economy reopens.

Inflation and The Value of $1

Inflation and Stock Market Returns

- Examining historical returns data during periods of high and low inflation can provide some clarity for investors. Numerous studies have looked at the effect of inflation on stock returns. Unfortunately, the studies have often produced conflicting results.78 Still, most researchers have found that higher inflation has generally correlated with lowe...

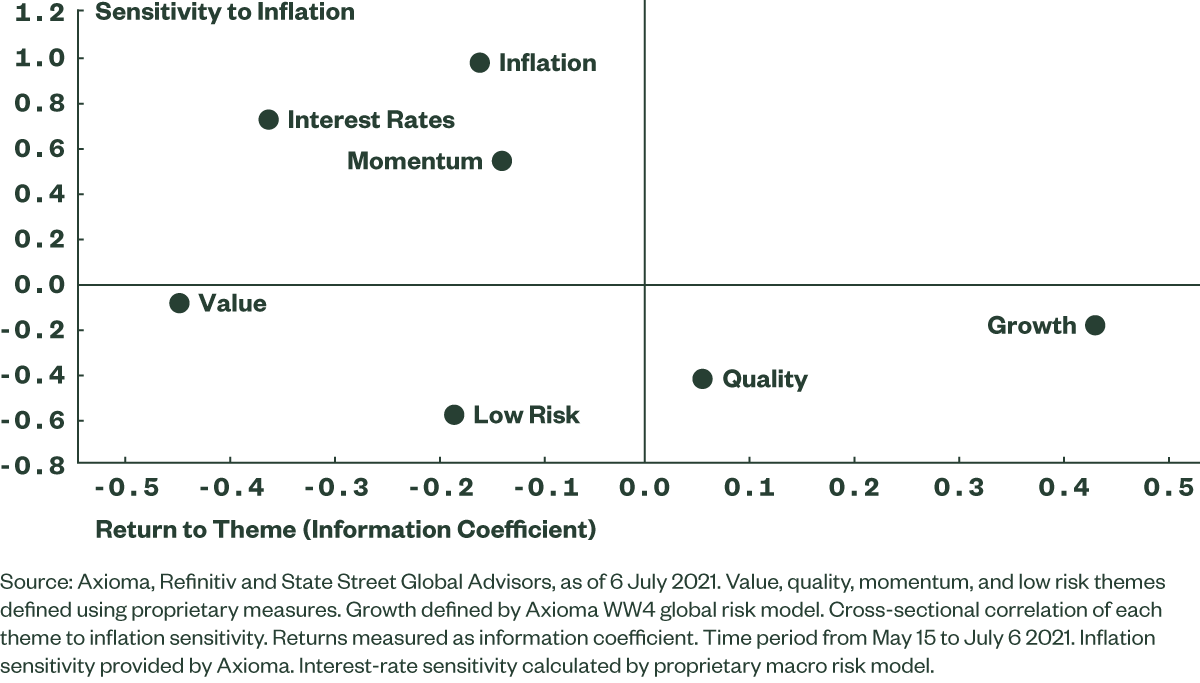

Growth vs. Value Stock Performance and Inflation

- Stocks are often subdivided into value and growth categories. Value stocks have strong current cash flows more likely to grow slowly or diminish over time, while growth stocks are likely to represent fast-growing companies that may not be profitable.12 Therefore, when valuing stocks using the discounted cash flow method, in times of rising interest rates, growth stocks are negat…

The Bottom Line

- Investors try to anticipate the factors that impact portfolio performanceand make decisions based on their expectations. Inflation is one of the factors that may affect a portfolio. In theory, stocks should provide some hedge against inflation, because a company's revenues and profits should grow with inflation after a period of adjustment. However, inflation's varying impact on st…