What are indicators in stocks?

A market indicator is a quantitative tool that is used by traders to interpret financial data in order to forecast stock market movements. Market indicators are considered a subset of technical indicators.

What are 3 indicators of the stock market?

Popular market indicators include Market Breadth, Market Sentiment, Advance-Decline, and Moving Averages.

What are the indicators of price?

The three major price level indicators that economists and policymakers often refer to are, the Consumer Price Index (CPI), GDP deflator, and the Producer Price Index (PPI). These indicators are used by central banks to monitor inflation levels in their respective economies.

What indicators tell you that a stock is going up?

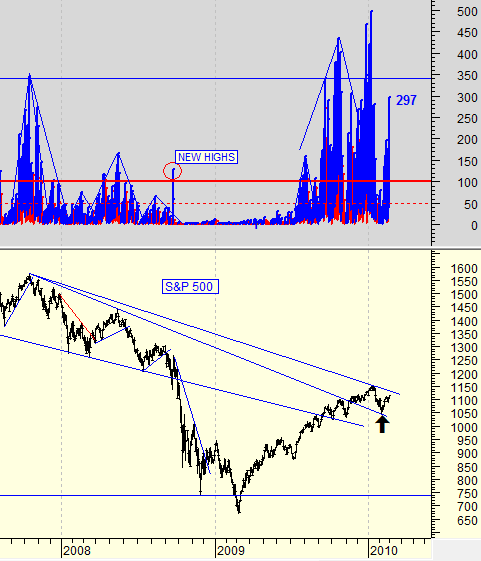

MACD: Trend-following momentum indicator. New High/New Low: Tracks stocks that are making new highs or new lows. RSI or Stochastics: Helps traders determine if a stock or market is overbought or oversold. Arms Index (TRIN): Helps traders identify overbought or oversold conditions.

What are the 5 key economic indicators?

There are five leading indicators that are the most useful to follow. They are the yield curve, durable goods orders, the stock market, manufacturing orders, and building permits.

Which is the best trading indicator?

Best trading indicatorsStochastic oscillator.Moving average convergence divergence (MACD)Bollinger bands.Relative strength index (RSI)Fibonacci retracement.Ichimoku cloud.Standard deviation.Average directional index.More items...

What are three types of indicators?

Indicators can be described as three types—outcome, process or structure - as first proposed by Avedis Donabedian (1966).

What are the types of indicators?

Type of indicatorsInput indicators. These indicators refer to the resources needed for the implementation of an activity or intervention. ... Process and output indicators. Process indicators refer to indicators to measure whether planned activities took place. ... Outcome indicators. ... Impact indicators.

How many types of stock indicators are there?

The infographic differentiates between four different types, including trend, momentum, volatility, and volume indicators. These technical indicators measure the direction and strength of a trend by comparing prices to an established baseline.

What is the best trend indicator?

The average directional index (ADX) is used to determine when the price is trending strongly. In many cases, it is the ultimate trend indicator.

How do you tell if a stock is a good buy?

Here are nine things to consider.Price. The first and most obvious thing to look at with a stock is the price. ... Revenue Growth. Share prices generally only go up if a company is growing. ... Earnings Per Share. ... Dividend and Dividend Yield. ... Market Capitalization. ... Historical Prices. ... Analyst Reports. ... The Industry.More items...

How do you know if the stock will go up or down?

Stock prices go up and down based on supply and demand. When people want to buy a stock versus sell it, the price goes up. If people want to sell a stock versus buying it, the price goes down. Forecasting whether there will be more buyers or sellers of a certain stock requires additional research, however.

How many types of stock indicators are there?

The infographic differentiates between four different types, including trend, momentum, volatility, and volume indicators. These technical indicators measure the direction and strength of a trend by comparing prices to an established baseline.

What are the 4 economic indicators?

For investors in the financial services sector, these four economic indicators can act as a sign of overall health or potential trouble.Interest Rates. Interest rates are the most significant indicators for banks and other lenders. ... Gross Domestic Product (GDP) ... Government Regulation and Fiscal Policy. ... Existing Home Sales.

What are examples of leading indicators?

The index of consumer confidence, purchasing managers' index, initial jobless claims, and average hours worked are examples of leading indicators.

Why do traders use indicators?

Many traders swear by them to help with the timing of their trades or to alert them of trends. But, even for an investor more focused on the underlying fundamentals of companies, learning how these indicators work can provide added conviction on new or existing trades.

Why are brands so unpopular?

Brands can become unpopular over time because of scandals, a decline in quality, or countless other reasons. When this happens, a name change can be a way of getting customers to shed those old, negative connotations.

What is stock market indicator?

But while stock market indicators are a subset of technical indicators, they are primarily concerned with analyzing data points for multiple stocks (securities) instead of simply interpreting one specific stock. This helps analysts draw conclusions based on the overall market conditions instead of the performance of a single stock.

What is the purpose of indicators in the stock market?

These common indicators are quantitative analysis tools used by market analysts to interpret stocks or current status and future trends in the stock market . They are mathematical formulas and ratios used to predict how the market will move based on past patterns.

What is the breadth of the market?

Market breadth indicators analyze the relative trend of the overall market based on how many securities are on the rise versus how many are falling. If more stocks/securities have an upward trajectory, then the overall market breadth is positive, and we can say that the market is on a bullish run. If the majority of stocks/securities are declining, then the market breadth is negative and bearish.

What is volatility indicator?

Volatility indicators are typically based on a difference in the highest and lowest historical prices. The more volatile the market is, the higher the unpredictability and risk. But it can also point out likely points for price changes/corrections.

What is trend indicator?

A stock trend indicator measures both the strength and direction (up/down) of a trend. A trend indicator typically uses some form of price averaging to establish a baseline. A trend moving up from baseline is bullish, while a trend moving down is bearish. Moving averages are the most common trend indicator used to determine support and resistance levels for a market movement.

Why is the VIX a fear index?

The CBOE Volatility Index (VIX) indicator is often seen as the ‘fear index’ because it spikes when investors purchase a significant amount of put options—signaling the belief that the underlying stock will fall.

Why do traders use indicators?

Traders typically use individual indicators to make conclusions about the market’s trend, momentum, volatility, and volume of the market. Based on these conclusions, predictions can then be made about how the market will continue to develop.

What does it mean when a stock is above its moving average?

When a stock is trading above its moving average, it is generally on an upward trend. As the stock reaches resistance and reverses, it will come closer to its moving average, with the major moving averages — 30-day, 50-day, 90-day, and 120-day moving averages — acting as key points of support.

How to find the resistance of a stock?

To find resistance, simply find the highest point the stock has reached on the stock chart. A more accurate point of resistance can be found using moving averages, but paying attention to the highest point of resistance over the past 30 to 90 days will prove helpful for both the buy-and-hold investor and the trader.

What does it mean when the MACD line crosses above the signal line?

As is the case with the simple moving average crossover or the exponential moving average crossover, when the MACD line crosses above the signal line, it’s a bullish crossover or a signal that the stock is likely to move up ahead. Conversely, when the MACD line moves under the signal line, the move is considered a bearish crossover, and prices are expected to fall.

What do the two lines on a stock oscillator mean?

The two lines create what’s known in the trading industry as an oscillator, which is generally used to show if a stock is overbought or oversold. When these lines move away from each other, close to each other, or cross one another, they provide distinct signals.

What is relative strength index?

Relative strength index — often abbreviated RSI — is a momentum indicator commonly used by traders to determine the strength of price changes in the market. The indicator is an oscillator, meaning that it’s plotted on the stock chart as two lines that move toward or away from each other.

What does it mean when a stock is overbought?

The Stock Is Overbought. An RSI above 70 suggests that the stock is overbought, or overvalued. In general, this means that the stock is primed for a reversal from recent gains and likely to head into a losing streak. The higher above 70 the RSI goes, the stronger the chances of a reversal. Moreover, high RSIs suggest that momentum of the pullback will be intense.

What is the MA on a stock chart?

Price data in the stock market is volatile, leaving jagged up and down points on stock charts. Moving averages — often abbreviated MA and also known as simple moving averages — are used to smooth these edges and provide an easier-to-read trendline based on the average price of the stock over a predetermined period of time.

What are indicators in stock market?

Indicators can help you assess the value of a stock and its growth potential. But there are many other factors affecting stock prices that can’t be easily measured.

What are the indicators used to assess stocks?

Here are some key indicators used by investors. 1. Earnings per share (EPS) This is the amount each share. Share A piece of ownership in a company. A share does not give you direct control over ...

How to calculate dividend yield?

Dividend yield A ratio that shows annual dividend rate expressed as a percentage of the current market price of a stock. To calculate, you divide the total dividends you get in a year by the price of each share that you own. + read full definition

What is stock investment?

Stock An investment that gives you part ownership or shares in a company. Often provides voting rights in some business decisions. + read full definition. price. It’s calculated by dividing the current price per share of a company’s stock by the company’s earnings per share.

What does a peg tell you?

The PEG can tell you whether a stock may or may not be a good value. The lower the number, the less you have to pay to get in on the company’s expected future earnings growth.

How to calculate book value?

It’s calculated by dividing the current price per share by the book value per share. The book value is the current equity of a company, as listed in the annual report.

How to calculate EPS?

EPS is calculated by dividing the company’s total profit by the number of shares. Example – If a company’s profit is $200 million and there are 10 million shares, the EPS is $20. EPS can tell you how companies in the same industry compare. Companies that show steady, consistent earnings.

What are technical indicators for stock market in 2021?

20 technical indicators you can trust while stock trading in 2021. Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading ...

Why is the trend indicator important?

This indicator is important as it tells the traders both the trend and value of a stock.

What is channel commodity index?

Channel Commodity Index (CCI) is one of the technical indicators which measures the difference between the current prices and historical prices.

What is relative strength indicator?

Relative Strength Indicator is a momentum oscillator which measures the magnitude of change in the recent prices. It has a reading from 0 to 100.

What is a stochastic oscillator?

Stochastic Oscillator is a momentum oscillator which looks at the most recent closing prices as a percentage of the price range .

What is StockEdge application?

StockEdge application helps in filtering the stocks based on these technical indicators.

When the price moves above the moving average, is the trend considered to be an uptrend?

When the prices move above the Moving Average then the ongoing trend is considered to be an uptrend whereas when the prices move below the Moving Average then the ongoing trend is considered to be the downtrend.

Moving Averages

Moving Average Convergence Divergence

- The moving average convergence divergence (MACD) is a kind of oscillating indicator. An oscillating indicator is a technical analysis indicator that varies over time within a band (above and below a centerline; the MACD fluctuates above and below zero). It is both a trend-following and momentumindicator. One basic MACD strategy is to look at which side of zero the MACD lin…

Relative Strength Index

- The relative strength index (RSI) is another oscillating indicator but its movement is contained between zero and 100 so it provides different information than the MACD. One way to interpret the RSI is by viewing the price as "overbought"—and due for a correction—when the indicator in the histogram is above 70, and viewing the price as oversold—and due for a bounce—when the indic…

On-Balance Volume

- Volume itself is a valuable indicator, and on-balance volume (OBV) takes a significant amount of volume information and compiles it into a single one-line indicator. The indicator measures cumulative buying and selling pressure by adding the volume on "up" days and subtracting volume on "down" days.4 Ideally, the volume should confirm trends. A rising price should be accompanie…

Types of Stock Market Indicators

Most Popular Stock Market Indicators

Benefits of Stock Market Indicators

Conclusion

The Use of Indicators in Technical Analysis

List of 12 Must-Know Indicators For Technical Analysis

- 1. Moving Average

The moving averages are of different types. Here we will talk about the most basic type of moving averages indicator known as Moving Average (MA) or Simple Moving Average (SMA). The MA or SMA takes into account price movement over a specific period. The most common is 50 DMA ( … - 2. Moving Average Convergence Divergence

The moving average convergence divergence is more commonly known as MACD. The technical indicator takes into account the price momentum over some time by comparing two moving average indicators. When two MA data come close two one another, convergence occurs. On th…

Points to Remember

- There is no chart which is the best and can be treated that way. In different market conditions, different charts perform well. But a trader should remember that trader’s emotion or instinct should not override chart signals. Technical analysis charts are logical tools that help the trader to make money in the long run if the trader can use these tools judiciously. Hence, a rational appro…