What is the relationship between stocks and interest rates?

Feb 15, 2017 · Any impact on the stock market to a change in the interest rate changes is generally experienced immediately, while, for the rest of the economy, it may take about a year to see any widespread...

What happens to the stock market when interest rates rise?

Jan 24, 2022 · How do stocks perform when interest rates rise? Historically, when rates increase it's actually good for stocks overall. Again, the implications are that rates are …

How do interest rates affect the U.S. markets?

Apr 14, 2022 · We’ve all heard that when interest rates go up, stocks go down—that is the general rule of thumb, and that is what has usually occurred …

What happens when the Fed raises interest rates?

Jun 01, 2020 · Bank stocks: When interest rates rise, banks tend to make more in earnings from the higher rates that they can charge on loans, so their stock prices may rise in anticipation.

Will stocks go down when interest rates rise?

When interest rates rise, the discount rate may increase, which in turn could cause the price of the stock to fall. However, it is also possible that when interest rates change, expectations about future cash flows expected from holding a stock also change.

Why are rising interest rates bad for stocks?

When interest rates are rising, both businesses and consumers will cut back on spending. This will cause earnings to fall and stock prices to drop. On the other hand, when interest rates have fallen significantly, consumers and businesses will increase spending, causing stock prices to rise.

What stocks go up when interest rates go up?

Financials benefit from higher rates through increased profit margins. Brokerages often see an uptick in trading activity when the economy improves and higher interest income when rates move higher. Industrials, consumer names, and retailers can also outperform when the economy improves and interest rates move higher.

How do you make money when interest rates rise?

Hedge your bets by investing in inflation-proof investments and those with credit-based yields.Invest in Banks and Brokerage Firms. ... Invest in Cash-Rich Companies. ... Lock in Low Rates. ... Buy With Financing. ... Invest in Technology, Health Care. ... Embrace Short-Term or Floating Rate Bonds. ... Invest in Payroll Processing Companies.More items...

Do banks do better when interest rates rise?

Key Takeaways. Interest rates and bank profitability are connected, with banks benefiting from higher interest rates. When interest rates are higher, banks make more money, by taking advantage of the difference between the interest banks pay to customers and the interest the bank can earn by investing.

What is the relationship between stock prices and interest rates?

Based on historical observation, stock prices and interest rates have generally had an inverse relationship. Said plainly, as interest rates move higher, stock prices tend to move lower.

What stocks go up with inflation?

Hartford Funds strategist Sean Markowicz recently found that five sectors tend to produce positive returns in inflationary times: utilities, real estate investment trusts, energy, consumer staples, and healthcare.Jan 12, 2022

Where should I invest in inflation?

Here are some of the top ways to hedge against inflation:Gold. Gold has often been considered a hedge against inflation. ... Commodities. ... A 60/40 Stock/Bond Portfolio. ... Real Estate Investment Trusts (REITs) ... The S&P 500. ... Real Estate Income. ... The Bloomberg Aggregate Bond Index. ... Leveraged Loans.More items...

Interest rates are going up

Super-easy pandemic monetary policy gave strong support to asset prices. The prices of bonds in the secondary markets increased as new bonds could be issued at lower rates (and thus lower current yields - see example on how interest rates affect bonds).

How do stocks perform when interest rates rise?

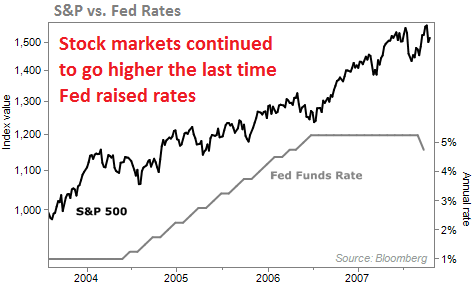

Historically, when rates increase it's actually good for stocks overall. Again, the implications are that rates are going up to slow (not stop) the rate of economic growth. A strong economy can be very good for companies.

Diversification, my old friend

The purpose of diversification is because like broad-based market moves, there’s no way to know when certain sectors, styles, or factors are going to outperform or underperform, for how long, and to what extent.

What happens to stock prices when interest rates decrease?

When interest rates decrease, it’s cheaper for companies to borrow capital with the aim of achieving growth, and this may encourage stock prices to rise. 2.

How are stocks affected by interest rates?

There are two main ways in which stocks are affected by interest rates: directly and indirectly. Here is a summary of how businesses, and therefore stocks, are affected by changes to interest rates: 1. Businesses are directly affected by bank rates because they affect the amount a company can afford to borrow. ...

Why are stocks attractive when interest rates fall?

It may seem easier to find attractive stocks when interest rates fall because lower rates can lead to higher disposable income in an economy, along with potentially lower borrowing costs for companies. Some stocks that may embark on an bullish theme around these scenarios include:

Why is volatility important?

Remember that volatility creates opportunity, but it also heightens risk, so it’s important that traders adhere closely to their risk management strategies and trading plan. This may help in the effort of mitigating losses when trading interest rate sensitive stocks, or volatile markets, around rate decisions.

Why do central banks have volatility?

When central banks are due to announce changes in interest rates, this in and of itself can cause volatility around the markets. As mentioned previously, the stock market is quick to react to changes in interest rates, so traders will often be making their projections ahead of major central bank announcements.

Why is borrowing more expensive?

Borrowing becomes more expensive and there is more incentive to save money, so people may be encouraged to spend less. Lower interest rates may boost economic growth. Borrowing becomes cheaper and there is less incentive to save money, so people may be encouraged to spend or invest.

How long does it take for the stock market to catch up to interest rate changes?

The stock market often reacts quickly to interest rate changes – certainly more quickly than many other areas of the economy, which may take up to 12 months to catch up. This can mean many opportunities for traders who analyze stock markets, both when buying and holding or employing a shorter-term speculative approach.

What happens if the 10-year yield is 2.5%?

If the 10-year yield does indeed breach 2.5% for a sustainable period of time, it’s logical to conclude that a pullback in stocks or larger than normal volatility may ensue as the stock market tries to adjust to what higher rates mean for earnings.

Is the stock market recovering from the 2009 crash?

Further, the stock market has recovered so far since the 2009 crash. As we come out of the pandemic, demand for everything is surging in the economy. Therefore, inflation is also rising. It is an inevitability interest rates will rise.