If the stock is delisted from option trading but still trades,usually, they do not add new series of options but trading continues in existing options out to the farthest month in which there is current open interest. If the stock is delisted from trading then it's worthless and puts are worth parity.

Will I Lose my shares if a company is delisted?

Apr 22, 2016 · Here's what happens when a stock is delisted. A company receives a warning from an exchange for being out of compliance. That warning comes with a deadline, and if the company has not remedied the...

What are the reasons for delisting a stock?

What happens when a class of options is "delisted"? If a stock fails to maintain the minimum exchange standards for being optionable, that class of options may be "delisted." In this case, no new option series will be added at expiration, but those series already listed will continue to trade until they expire.

What are the rules behind the delisting of a stock?

Apr 17, 2022 · What happens to put options when a company is delisted? If a stock fails to maintain minimum standards for price, trading volume and float as prescribed by the options exchange, option trading can cease even before its primary market delists the stock. If that occurs, the exchanges will not add any new series.

What to do when a stock delists?

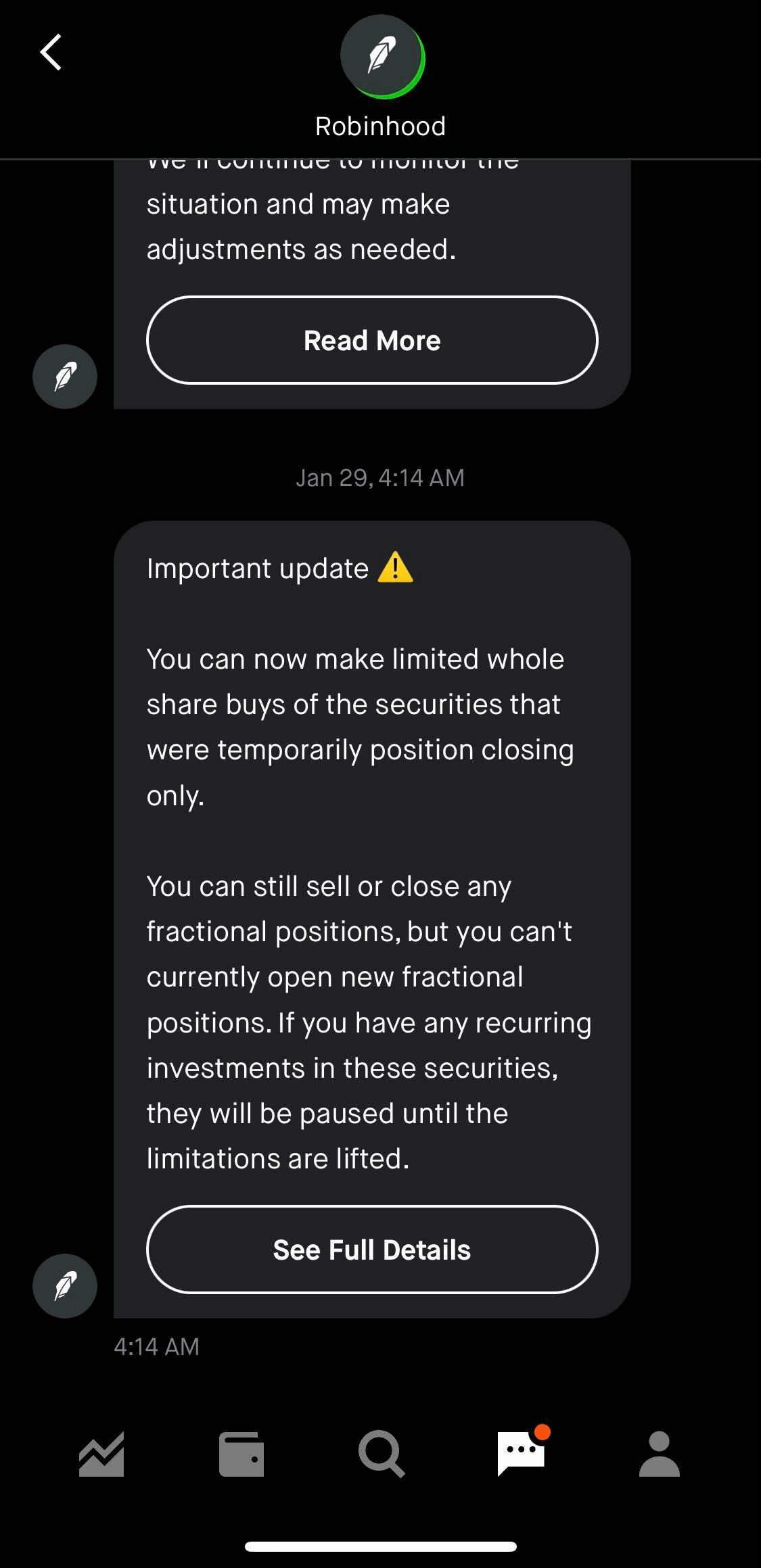

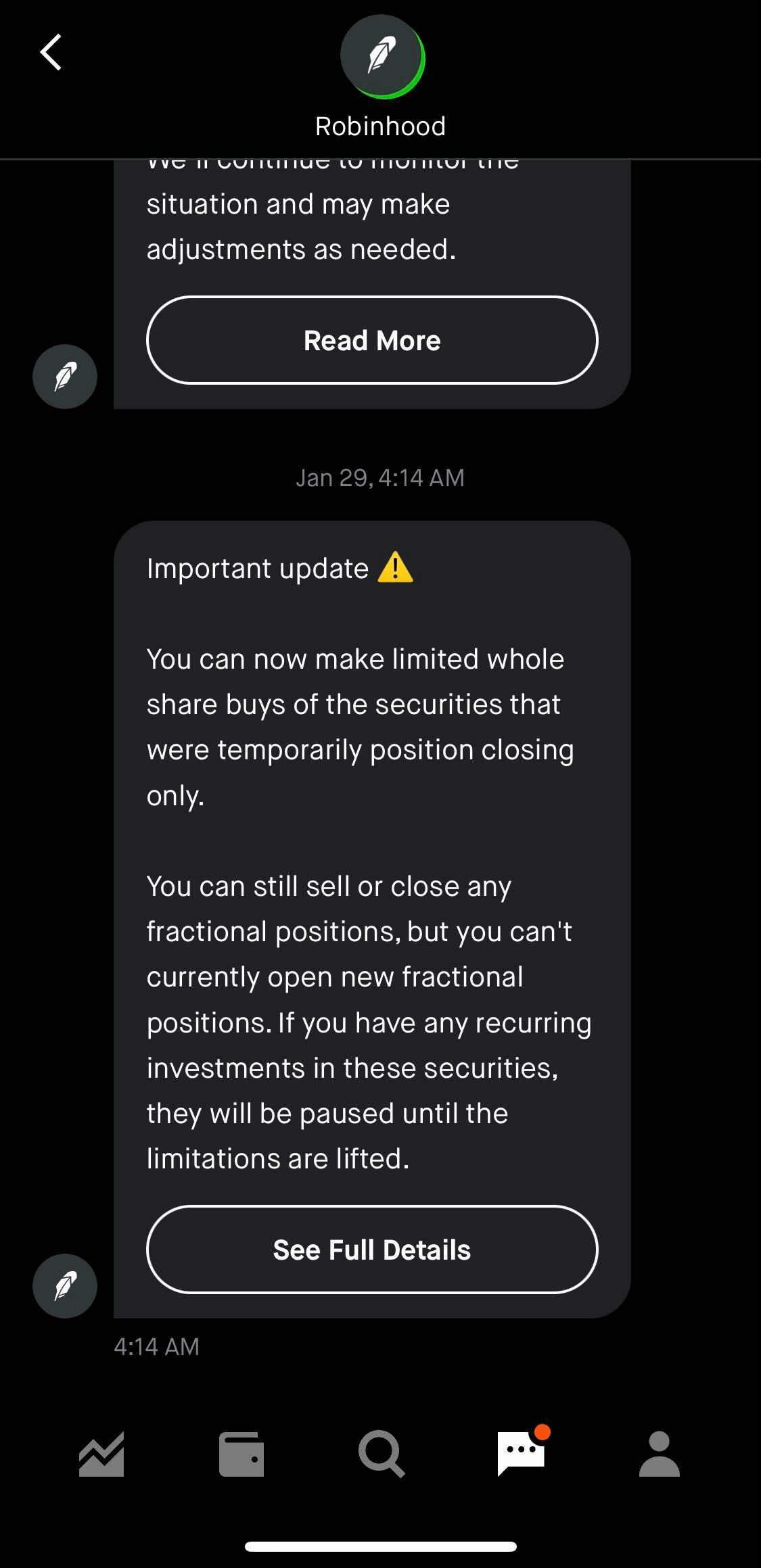

May 21, 2020 · Quite often, the shares begin trading on the Pink Sheets or over-the-counter if delisted from the national stock exchange where they are listed. When they do, the options exchanges usually announce that the options are eligible for closing only transactions and prohibit opening positions. Generally, there are no exercise restrictions.

What happens if a stock is delisted?

If a stock is delisted, the company may still trade over two different platforms, namely: the Over-the-Counter Bulletin Board (OTCBB) or the pink sheets system. Although both are significantly less regulated than the major exchanges, OTCBB is by far the stricter of the two.

Why do stocks drop off radar?

As a result, individual investors have less data on which to base their investment decisions, often causing such stocks to drop off their radar screens. Not surprisingly, a delisted company's liquidity and trading volume typically plummet as a result.

What are the requirements to sell stocks?

The mandates include share price minimums, certain shareholder thresholds, and fastidious documentation of a company's performance and operational data.

Political pressure on both sides

Amid rising tensions between the U.S. and China, former U.S. President Donald Trump took steps toward removing U.S. investment in Chinese companies, especially those deemed to have alleged ties to the Chinese military.

Delisting is not the end

Chinese stocks have been delisted from U.S. exchanges for reasons other than politics.