What does a 12 month price target mean?

When setting a stock's price target, an analyst is trying to determine what the stock is worth and where the price will be in 12 or 18 months. Ultimately, price targets depend on the valuation of the company that's issuing the stock.

What does 1 year target mean in stocks?

One year target is an estimate of a stock price for a point in time equal to a year from the current date. The price level most often reflects the collective opinion of different analysts on where the stock will be trading a year from now.

How do you calculate 12 month target price?

Price Target Formula It is calculated as the proportion of the current price per share to the earnings per share. read more uses the earnings for the past twelve months. Thus, the current market price is divided by the average earnings of the last twelve months.

How often are stock price targets correct?

Based on their 2012 study of more than 11,000 analysts from 41 countries, the overall accuracy of target prices is not very high, averaging around 18% for a three-month horizon and 30% for a 12-month horizon.

When should you sell a stock?

Investors might sell a stock if it's determined that other opportunities can earn a greater return. If an investor holds onto an underperforming stock or is lagging the overall market, it may be time to sell that stock and put the money to work in another investment.

What is the difference between target price and market price?

The current or market price is what the stock is currently trading at on the open market. It is a reflection of the current supply and demand for that stock. The target stock price is an estimate that an analyst believes will be the current price at some point in the future, generally 12 months from now.

How to estimate target stock price?

Multiply the company's projected earnings by your estimated multiple. The earnings-per-share estimate times your adjusted multiple will equal your stock target price. For example, if a company is estimated to earn $2 per share and you estimate its earnings multiple at 20, then your stock target price is $40 per share.

How do you calculate target price?

The formula to calculate the target price is: (Price / Estimated EPS) = Trailing PE where Price is the variable we are solving for.

Are stock analysts ever right?

2. Analysts Are Highly Inaccurate. You would think financial professionals who spend their lives analyzing opportunities in the stock market would be pretty good at what they do. You might be surprised to learn that the average stock market analyst isn't nearly as accurate as you may think.

Why are analyst price targets so high?

Price targets typically increase over time. If an analyst used a P/E ratio to set a price target, the price target would increase each year, assuming the company is growing earnings. Occasionally, company fundamentals or other factors deteriorate, causing an analyst to lower high price targets.

What is Amazon's target price?

Stock Price Target AMZNHigh$210.00Median$170.00Low$104.00Average$166.99Current Price$118.46

Is Target a good long term investment?

Sales growth has continued in 2022. However, Target's profit margin is crashing back to earth. As a result, Target stock has plunged more than 40% from its November 2021 high, with most of the drop coming in the last month. This has created a good entry point for long-term investors.

Is Yahoo Finance 1 year target accurate?

1 year target estimate is simply the price that analysts have predicted the stock will be one year from now. The reliability behind these estimates are the true question here. The way I see it, the accuracy of an estimate has the same chance as any other estimate.

Is Target a good stock buy?

Target's stock is cheap enough to buy The same-day services are immensely popular with consumers, increasing 9% in the first quarter on top of 90% growth in 2021. Fortunately for shareholders, both newer options are cheaper for Target than the free shipping to customers' homes for online orders.

What is a price target for a stock?

A target price is an estimate of the future price of a stock. Target prices are based on earnings forecasts and assumed valuation multiples. Target prices can be used to evaluate stocks and may be even more useful than an equity analyst's rating.

Is Target a good long term investment?

Sales growth has continued in 2022. However, Target's profit margin is crashing back to earth. As a result, Target stock has plunged more than 40% from its November 2021 high, with most of the drop coming in the last month. This has created a good entry point for long-term investors.

How do traders use price targets?

Traders may use price targets to help in the decision process of buying stocks or in determination of a holding period. Some traders may use price...

What are the risks of following price targets?

The primary risk of using price targets is their inconsistency. Markets and economic conditions change frequently and the randomness of the stock m...

Where do investors find price targets?

Price targets and analyst ratings can be found on many financial news websites. Stock analysts may also publish their price targets for specific co...

Why do we use target prices?

Target prices can be used to evaluate stocks and may be even more useful than an equity analyst’s rating. While opinion-based ratings have limited value, target prices can help investors evaluate the potential risk/reward profile of the stock.

Why are target prices better than ratings?

Why Target Prices Are Better Than Ratings for Investors. First and foremost, ratings have limited value, because they are opinion based. While one analyst may rate a stock as a “sell,” another may recommend it as a “buy.”. More importantly, a rating may not equally apply to every investor, because people have different investment goals ...

Why do ratings have limited value?

First and foremost, ratings have limited value, because they are opinion based. While one analyst may rate a stock as a “sell,” another may recommend it as a “buy.” More importantly, a rating may not equally apply to every investor, because people have different investment goals and risk tolerance levels, which is why target prices can be so essential to rounding out research.

Is a target price model strong?

It should be stated that the quality of a target pricing model is only as strong as the factual analysis behind it. While a shoddy thesis behind a target price can lead investors astray, thoughtfully constructed target pricing models can legitimately help investors evaluate the potential risk/reward profile of the stock.

Why is knowing a stock's price target important?

Strategic: Knowing a stock's price target can help an investor analyze the risk/reward profile of investing in that company, which can help them make a more informed decision before transacting.

How to calculate price target?

One of the simplest price target formulas to understand is the use of a Price-to-Earnings (or P/E) multiple. The analyst will project Earnings Per Share (EPS) and then multiply that number by a P/E multiple. The result of this calculation will be a price target. For example, if an analyst uses an EPS estimate of $2.50 and a P/E multiple of 20x, they would reach a price target of $50.

What Is the Consensus Price Target?

The consensus price target is the average of analysts' individual price targets. This is the price target that investors will most often see quoted in the financial press.

What is a price target?

Put simply, a price target can be interpreted as an indication of how professional analysts collectively view fair value of a given stock. Price targets alone don't imply whether a stock is a Strong Buy, Buy, Hold, Sell, or Strong Sell, nor do they serve as an investment recommendation for any given investor. In some ways, a target price for a stock is similar to a weather forecast, in that it represents the expert opinion about the future, supported by currently available information. However, conditions impacting the data can change frequently, which means that forecasts may not turn out to be accurate.

What is the primary risk of using price targets?

The primary risk of using price targets is their inconsistency. Markets and economic conditions change frequently and the randomness of the stock market makes price movement difficult to predict.

Why do traders use price targets?

Traders may use price targets to help in the decision process of buying stocks or in determination of a holding period. Some traders may use price targets as guidance for setting a stop-loss order level, which is a specific trading price that triggers an order to sell an investment.

Do price targets change?

It's also important to keep in mind that price targets tend to change, which means that price targets also tend to be moving targets.

What is a price target in stock?

Stock Analysis: What Is a Price Target? The price target of a stock is the price at which the stock is fairly valued with respect to its historical and projected earnings. Investors can maximize their rates of return by buying and selling stocks when they are trading below and above their price targets, respectively.

When is the best time to buy a stock?

The ideal time to buy a stock is usually when it is trading at a substantial discount to its target price. This discount could be the result of weak market conditions or overreaction to recent company setbacks. The ideal time to sell a stock is usually when it is trading higher than its target price range or during overheated markets.

How to determine a stock's fair value?

This involves estimating future earnings potential by reviewing historical results, economic conditions and the competitive environment. A stock's price target can be a multiple of the price-to-earnings ratio, which is the market price divided by the trailing 12-month earnings. This multiple could be the industry multiple, the company's earnings growth rate or a combination. For example, if a company's annual earnings growth rate is 10 percent and the stock is currently trading at $20, then a possible one-year price target could be 1.10 multiplied by $20, or $22. Similarly, if the industry price-to-earnings multiple is 18 and the company expects to earn $1.10 over the next 12 months, then another possible price target would be 18 multiplied by $1.10, or $19.80.

What should investors use to do due diligence?

Investors should use these recommendations as one part of the due diligence process, which should include reviewing financial reports and regulatory filings on the investor relations sections of corporate websites.

Why should investors not try to time the market?

Investors should not try to time markets because it is impossible to predict the troughs and peaks consistently. Instead, they could set price alerts -- email reminders sent from brokerage accounts when certain price levels are reached -- or place limit or stop orders. Continuing with the earlier example, an $18 price alert would notify investors when the stock price might have become undervalued. Limit orders execute at specified limit prices, while stop orders become market orders at specified stop prices. Investors could use these orders to buy into a stock when it is about to break higher or sell before a sharp price drop.

Do analysts publish price targets?

Research analysts often publish stock price targets along with buy-sell recommendations. However, investors can and should determine their own price targets for entering and exiting stock positions.

What is the target price of a stock?

Most commonly, unless you read 'fair value target price,' an analyst's target price is a 12-month target price. Typically, there is a firm wide policy determining which time horizon to use.

How long does it take to get a price target?

You will find this information in the disclaimer, which is present on every research report. Usually it is 12 months, but some firms give 6 months price targets.

What does "I'm just boggled if it's" mean?

I'm just boggled if it's (2) because it means that firm's price targets are effectively useless for comparing one of their forecasts against another.

What is fair price?

If the time horizon is not indicated, this is just a "fair price". The price of the stock, which corresponds with the fair value of the whole company. The value, which the whole business is worth, taking into consideration its net income, current bonds yield, level of risk of the business, perspective of the business etc..

Can I put too much stock in the guidance?

I wouldn't put too much stock in the guidance generically... it's more a measure of confidence in the company. When you listen to the earnings calls and start following a particular analyst, you'll understand where they come from when they kick out a number.

Can you assume a 12-month time horizon?

I don't think you can always assume a 12-month time horizon. Sometimes, the analyst's comments might provide some color on what kind of a time horizon they're thinking of, but it might be quite vague.

What happens if a stock hits its target within 12 months?

If the stock hits the target within the 12-month period, however, it doesn't necessarily mean the investor should sell. That's because the analyst may well have changed his or her price target in the interim. A good example is Apple Inc. ; analysts have been raising their price targets on the iPhone and iPad maker for years as ...

What is a price target?

Price targets are related to, but not the same as, "buy", "sell" and "hold" recommendations. For example, if a stock is trading for $50 and an analyst has a 12-month price target of $100, you can bet he or she will also have a "buy" recommendation on the company.

What are some exogenous factors that affect stock prices?

To be sure, all sorts of exogenous factors – the economy, interest rates and the prevailing mood of the market, for example – can play havoc with stock prices. That's one more reason to treat analyst price targets as the informed estimates that they are, not as the definitive word on where a stock is heading.

What is discounted cash flow?

Discounted cash flow analysis estimates what the company's future cash flows would theoretically be worth today. In Mr. Poirier's case, the price target is based on an average of all three methods.

Why are some investors suspicious of price targets?

Some investors are suspicious of price targets, seeing them as primarily a way for the brokerage industry to generate interest in a stock. Indeed, whether intentionally or not, some price targets have been badly off the mark.

Do analysts forecast earnings?

Analysts do exhibit skill in forecasting earnings, the researchers said, but "target price forecasts are overly optimistic on average, and … analysts demonstrate no abilities to persistently forecast target prices."

Do price targets change?

Price targets frequently change, depending on the outlook for a company's earnings.

What is the risk of relying on price targets when buying or selling stocks?

The risk of relying on price targets when buying or selling stocks is that a price target is somebody’s opinion as to what a stock could or should be worth, whereas the actual price is what investors are willing to pay for the stock based on all available information. Opinions are often wrong and can change with incoming data, and you never know the motivation behind an opinion.

What is the difference between actual price and target price?

Key Factors on Buying or Selling Stocks. "Actual price" is the price at which a stock is currently trading; "target price" is what somebody thinks the stock is worth or could sell for in the future. The larger the difference between the two, the more it motivates investors to act.

What are the two strongest motivators in the stock market?

Fear and greed are the two strongest motivators in the market. Anchoring stock prices helps trigger those emotions.

What is price anchoring?

Price anchoring is an excellent tool for manipulation. Suppose an institution has a sizable position in XYZ at an average cost of $20 and would like to realize a 50 percent profit by driving the price to $30. It needs high volume to sell its entire position, so it puts a $40 price target on the stock to motivate others to buy. When XYZ reaches $30, the institution quietly starts selling into the strength, while others are still buying.

When are stock price targets more likely to be met?

Stock price targets are more likely to be met when: (1) market returns over the 12-month forecast period are higher; (2) analysts have more experience; and, (3) analysts are employed by the largest brokerage houses.The higher the target relative to the current stock price, the less likely the stock price will reach the target.

How much of the time do stock prices reach analyst targets?

Stock prices reach analyst targets sometime during 12-month prediction periods only 35% of the time.

Do volatile stocks meet targets?

Surprisingly, volatile stocks are less likely to meet targets. Analysts do not show persistent differences in abilities to forecast target prices. They do exhibit persistent differences in forecasting earnings and in picking stocks.

Is a stock price target a good predictor?

In summary, analyst stock price targets are not good predictors of actual stock price potentials. Analysts exhibit this poor performance because they want to express optimism about the stocks they cover and have no compensation incentives or public accountability related to stock price targets.

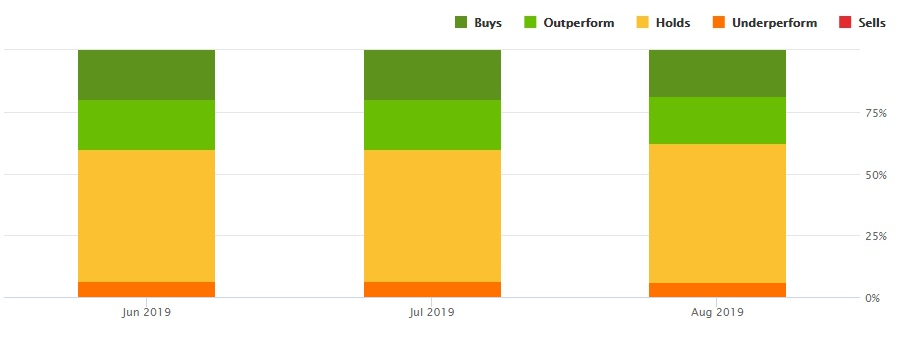

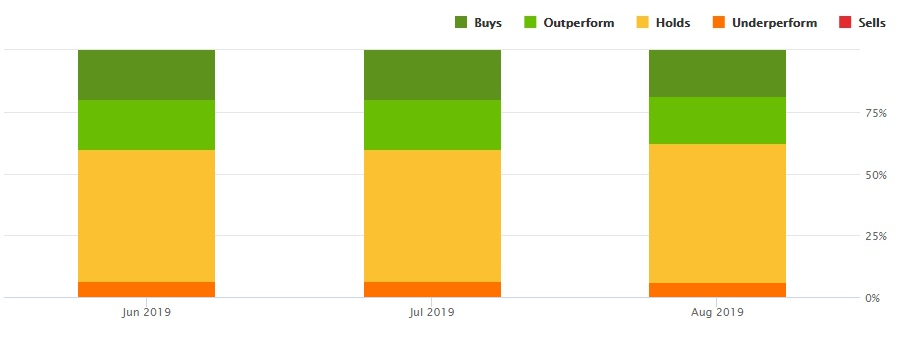

How does MarketBeat calculate stock ratings?

MarketBeat calculates consensus analyst ratings for stocks using the most recent rating from each Wall Street analyst that has rated a stock within the last twelve months. Each analyst's rating is normalized to a standardized rating score of 1 (sell), 2 (hold), 3 (buy) or 4 (strong buy). Analyst consensus ratings scores are calculated using the mean average of the number of normalized sell, hold, buy and strong buy ratings from Wall Street analysts. Each stock's consensus analyst rating is derived from its calculated consensus ratings score (0-1.5 = Sell, 1.5-2.5 = Hold, 2.5-3.5 = Buy, >3.5 = Strong Buy). MarketBeat's consensus price targets are a mean average of the most recent available price targets set by each analyst that has set a price target for the stock in the last twelve months. MarketBeat's consensus ratings and consensus price targets may differ from those calculated by other firms due to differences in methodology and available data.

What does the blue line on the chart below mean?

The chart below shows how a company's share price and consensus price target have changed over time. The dark blue line represents the company's actual price. The lighter blue line represents the stock's consensus price target. The even lighter blue range in the background of the two lines represents the low price target and the high price target for each stock.

Why is the value of a stock always imprecision?

The valuation will always carry a degree of imprecision because the future is uncertain. This is why value investors rely heavily on the margin of safety concept in investing.

When to sell Walmart shares?

Another more reasonable selling tool is to sell when a company's P/E ratio significantly exceeds its average P/E ratio over the past five or 10 years. For instance, at the height of the Internet boom in the late 1990s, shares of Walmart had a P/E of 60 times earnings as it opened up its first website with e-commerce. Despite Walmart's quality, any owner of shares should have considered selling and potential buyers should have considered looking elsewhere.

When Should You Sell?

In general, there are some intrinsic reasons to sell a stock—i.e., reasons that are related to the stock itself and/or the markets. In addition, the investor may also have extrinsic reasons to sell; by extrinsic, we mean reasons that are related to the investor’s finances or lifestyle. Occasionally, the sell decision may be triggered by a combination of intrinsic and extrinsic factors.

What happens if a company fails to meet short term earnings forecasts?

If a business fails to meet short-term earnings forecasts and the stock price goes down, don't overreact and immediately sell (assuming if the soundness of the business remains intact). But if you see the company losing market share to competitors, it could be a sign of a real long-term weakness in the company.

Why is margin of safety important in investing?

The value of any share of stock ultimately rests on the present value of the company's future cash flows. The valuation will always carry a degree of imprecision because the future is uncertain. This is why value investors rely heavily on the margin of safety concept in investing.

What does it mean when a company's revenue declines?

When a company's revenue declines, it’s usually a sign of reduced demand. First, look at the annual revenue numbers in order to see the big picture, but don’t rely solely on those numbers. It's also a good idea to look at the quarterly numbers. The annual revenue numbers for a major oil and gas company might be impressive annually, but what if energy prices have fallen in recent months?

What is the best rule of thumb for selling a company?

A good rule of thumb is to consider selling if the company's valuation becomes significantly higher than its peers. Of course, this is a rule with many exceptions. For example, suppose that Procter & Gamble ( PG) is trading for 15 times earnings, while Kimberly-Clark ( KMB) is trading for 13 times earnings.