Where do stockbrokers work?

Although the physical location of Wall Street is in New York City, and New York City is also widely considered the finance capital of the world, stockbrokers work from everywhere. There is likely a trading office in the city nearest to you.

What are the most common misconceptions about stockbrokers?

Other common misconceptions about stockbrokers are that they all live in New York City, all come from rich families, and all make random Las Vegas-style bets when trading stocks.

Who are Wall Street brokers and traders?

Wall Street stockbrokers and traders remain elusive for most people. In fact, they may as well be wizards behind curtains with special powers to influence the economy.

Why do stockbrokers wear suits and tie?

In addition, if you imagine a suit and tie when you think of a stockbroker, that's because the underlying assumption is that everyone who works on Wall Street is male. Although gender disparity is still a huge issue in the finance industry, years of research show that some female traders perform better than their male counterparts. 4.

Do stock brokers work on Wall Street?

Wall Street is home of the major U.S. stock markets and also home to a large number of stockbrokers. Some of these brokers work in offices – on Wall Street or anywhere in the world – recruiting investor clients and then placing orders to buy and sell stocks on their behalf.

How much does the average stock broker make on Wall Street?

Another employment website, GlassDoor, reported that the average Wall Street stockbroker salary, as of May 2021, was $63,365. The range of a Wall Street stockbroker salary was reported to be $31,000 to $129,000. Commissions and bonuses boost earnings to $150,000 to $200,000 or more.

What do stockbrokers do on Wall Street?

They buy and sell securities based on those clients' wishes. Some may even act as financial planners for their clients, shaping a retirement plan, dealing with portfolio diversification, and advising on insurance or real estate investments if their firm offers such financial and wealth management services.

How stock broker manipulate the stock market?

Market manipulation schemes use social media, telemarketing, high-speed trading, and other tactics to intentionally drive a stock price dramatically up or down. The manipulators then profit from the price movement.

How did Jordan Belfort get rich?

During the boiler room days, Belfort would promote penny stocks through intensive marketing which drove up the price of these stocks. Then, Belfort would instruct his team of investors to dump the stock making him millions of dollars over time.

Are Wall Street brokers rich?

Myth #1: All Stockbrokers Make Millions The average stockbroker doesn't make anything near the millions that we tend to imagine. In fact, some lose a lot of money through their trading activities. The majority of companies pay their employees a base salary plus commission on the trades they make.

How do Wall Street brokers make money?

Commission-based compensation -- Stockbrokers are generally compensated on commission, which means they earn money upfront when you buy or sell a specific type of investment. This contrasts with registered investment advisors, who generally charge clients a fee based on the amount they manage on the client's behalf.

Do stockbrokers make a lot of money?

Getting a job as a stockbroker is a good place to start. The top stockbrokers and other financial sales pros make more than $208,000 a year. You can make decent money as a stockbroker.

Why do Wall Street traders yell?

Open outcry is a method of communication between professionals on a stock exchange or futures exchange, typically on a trading floor. It involves shouting and the use of hand signals to transfer information primarily about buy and sell orders. The part of the trading floor where this takes place is called a pit.

Is it legal to manipulate the stock market?

Market manipulation is illegal in the United States under both securities and antitrust laws. Securities laws and related SEC rules broadly prohibit fraud in the purchase and sale of securities, and the Securities Exchange Act of 1934, Section 9, specifically makes it unlawful to manipulate security prices.

What is market abuse examples?

These include: Selling or buying at the close of the market with the purpose of misleading those who will act on closing prices (unless done legitimately). Wash trades. Selling and buying the same financial instruments to create a false impression of activity in the marketplace.

What are 4 forms of market manipulation?

A few examples of some well-known types of Securities Manipulation or Stock Market Manipulation schemes include:Churning.Spoofing.Wash Trades.Pump and Dumps.Painting the Tape / Marking the Close.Bear Raiding.Stock Bashing.

How much do stockbrokers make in 2019?

The median pay for stockbrokers and other sales agents who sell securities, commodities, and other financial services was $62,270 in 2019. 1 .

How long does a stockbroker work?

One thing to keep in mind is that the professional life of a stockbroker is long. Many tend to put in long hours—more than the traditional 40-hour workweeks. This means the may find themselves working well into the evenings and weekends, too. Hours may vary based on the clients they serve.

Where is Wall Street located?

Although the physical location of Wall Street is in New York City , and New York City is also widely considered the finance capital of the world, stockbrokers work from everywhere. There is likely a trading office in the city nearest to you.

Do stockbrokers work from home?

It's also true that many stockbrokers work from home—far from any trading floor or corporate office. In addition, if you imagine a suit and tie when you think of a stockbroker, that's because the underlying assumption is that everyone who works on Wall Street is male.

Is Wall Street like Las Vegas?

Wall Street is not like Las Vegas. It takes a great deal of knowledge about the workings of the domestic and international economy to be able to analyze and interpret the intricacies of the financial markets. Brokers and traders never make random bets.

Who is Claire Bradley?

Claire Bradley is a seasoned and well-respected journalist, whose stories have been published in multiple online publications. Whenever news about the stock market makes the headlines, a new wave of speculation arises about the people who work behind-the-scenes when these market movements occur. Wall Street stockbrokers ...

Can you predict if a stock is going up or down?

However, very often it is impossible to predict if a stock is going to move up or down. And traders and brokers get it wrong all the time. Turbulence in the stock market leaves even the professionals scratching their heads sometimes. The elements that influence the valuation of any given stock are complex.

What is the biggest fraud in Wall Street history?

Before the fraud debacle that wiped Enron off the financial map, it was estimated to be one of the ten largest companies in the United States. Enron’s fraud was one of the biggest accounting frauds in Wall Street history.

What was the Enron stock fraud?

When the fraud was uncovered in 2001, Enron stock plummeted from around $90 a share to less than $1 a share.

How can a fraudster profit from price inflation?

The fraudster can profit from the price inflation by quickly selling the securities. ” strategy – buying a stock at a low price, broadly promoting it, and then selling out after a quick rise – was a perfectly legal trading tactic, as was insider trading.

What is penny stock?

Penny Stock A penny stock is a common share of a small public company that is traded at a low price. The specific definitions of penny stocks may vary among countries. For example, in the United States, the stocks that are traded at a price less than $5 are considered. investment into millions.

Is insider trading legal?

Many of the activities that are common ly considered fraud on Wall Street now – such as insider trading – were once perfectly legal. A lot of the biggest Wall Street frauds in recent years have involved major accounting scandals, where companies conspired to report inflated earnings or hide losses.

Is Wall Street regulated?

that Wall Street began to be significantly regulated in terms of what was and was not considered legal and legitimate practice. Among recent major Wall Street fraud cases, accounting fraud has been one of the most recurring violations, often committed by large corporations.

Was Scrushy convicted of fraud?

First, Scrushy was never convicted of any of the dozens of fraud charges leveled against him. What tripped him up instead and led to a conviction was his bribery scheme to get himself a seat on the hospital regulatory board.

How much did the FINRA fines drop in 2019?

Many of these crimes now seem like ancient history, and studies show FINRA’s enforcement “softening” over the years. The sum of FINRA’s total fines dropped 28% in 2019, down to $44 million from $61 million in 2018. This can partially be attributed to the bull market, at least pre-coronavirus. As the leader of the study Brian Rubin, a partner at Eversheds Sutherland, points out, investors tend not to complain about their brokers when their investments are doing well.

Who is Brain Scanlon?

14, Brain Scanlon, a broker so well-known for his smooth talking phone tactics that tapes of him selling stocks via cold calls were passed around in finance in the early 2000s. He worked at Stratton Oakmont in the early 90s, like Hannah, he was eventually fined $5 million and barred by FINRA while working at HGI 1998 for fraud.

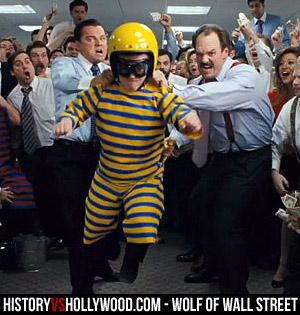

Does the Wolf of Wall Street Accurately Depict the Financial Sector?

The main areas this post will focus on are the more outlandish elements of the film, i.e. the drug taking, partying and excessive spending of its characters. However, the first thing we have to do is clarify what Stratton Oakmont actually was.

The Reality of Working in Wall Street

In reality, the above changes have caused a stark decline in the number of people who choose to get into the financial world. London Business School actually reported a decline in the number of students applying for finance internships. It went from 56 percent in 2008 to 31 percent in the most recent hiring cycle.

Does the Wolf of Wall Street Accurately Depict the Financial World?

In this post, we’ve discussed the more outlandish elements of the Wolf of Wall Street and compared it to the financial world then and now.

What is a stock broker?

A stockbroker is a broker who facilitates the process of buying and selling securities on a stock exchange on behalf of clients. The rise of the internet, however, has drastically changed the role of stock brokers. Online brokerages now allow investors to purchase their stocks from their computers, at much lower costs.

What are the different types of stock brokers?

There are two main types of brokers: traditional full service stock brokers or discount brokers. This is the question that will help you decide which direction to go. If you are able to pick stocks yourself, you have a huge advantage.

What to do if you have a huge amount of money to invest?

If you have a huge amount to invest, you may want to go with a combination of an advisor and a discount broker (assuming half your budget meets the minimal requirement for working with an advisor). By doing so, you effectively diversify your risk through professional advise and self-investments.

Why is choosing a broker important?

Choosing your broker is an important decision. It could be the start of a long-term relationship of which there is constant interaction. It is imperative that, like buying stocks, you do as much research as possible in order to be content with your broker.

Do discount brokerages require minimum deposits?

Discount brokerages may try to entice you with low trading fees but in-turn require minimum deposits as well. If you are part of a large bank, you can often go to your branch and ask to open a direct investing account, a seamless and easy way to begin investing.

Can an advisor buy stocks?

Some advisors may only have the ability to purchase stocks, bonds and mutual funds. Same goes with discount brokerages. It is important to think about more than just buying stocks. As you become a more advanced investor, you may want to begin using more advanced techniques such as trading options and short selling.

Can the wealthy afford a stock broker?

It the past, only the wealthy could afford hiring a broker and get access to the many great companies available on the stock market. However, advances in technology and the rise of discount brokerages has forced full service stock brokers to adapt their roles and become more of an advisor to their clients.