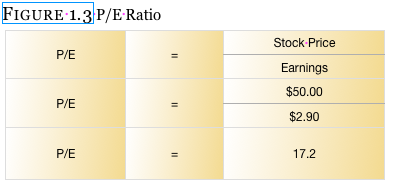

- Calculating The P/E Ratio. The P/E ratio is calculated by dividing the market value price per share by the company's earnings per share.

- Analyzing P/E Ratios. As stated earlier, to determine whether a stock is overvalued or undervalued, it should be compared to other stock in its sector or industry group.

- Limitations to the P/E Ratio. The first part of the P/E equation or price is straightforward as the current market price of the stock is easily obtained.

- PEG Ratio. A P/E ratio, even one calculated using a forward earnings estimate, does not always show whether or not the P/E is appropriate for the company's forecasted growth rate.

- Example of a PEG Ratio. An advantage of using the PEG ratio is that considering future growth expectations, we can compare the relative valuations of different industries that may have ...

- The Bottom Line. The price-to-earnings ratio (P/E) is one of the most common ratios used by investors to determine if a company's stock price is valued properly relative to its ...

How to find the historical PE ratio for any stock?

The price to equity ratio is the average market price per share divided by the average earnings per share. You mean the trailing 12 month PE. From their financial statements, take the EPS or earnings per share for the last four quarters, add them. Divide the current price by that number. That gives you TTM (Trailing Twelve Months) PE for the stock.

What does a PE ratio tell you?

What does the p/e ratio really tell you?

- The basic concept. The p/e's simplicity is also a pitfall. ...

- Variations on the theme. ...

- There's no 'magic number' If you could get rich using one number, we'd all be doing it. ...

- A useful alternative: EV/Ebitda. ...

What is the Best PE ratio?

Bank of America Corporation ( BAC) closed out the year 2021 with the following stats:

- Stock Price = $30.31

- Diluted EPS = $1.87

- P/E = 16.21x ($30.31 / $1.87) 4

How to value stocks using absolute PE model?

- For an average company, you will want to assign a value of 1.

- For a market leader, select a number less than 1. If you believe a market leader deserves a 10% premium, then use a value of 0.9. ...

- For a market lagger, select a number greater than 1. Poor companies should be discounted. A 20% discount requirement means a value of 1.2 will be used.

How do you value a stock using the PE ratio?

To determine the P/E value, one must simply divide the current stock price by the earnings per share (EPS).

Is a PE ratio of 30 good?

A P/E of 30 is high by historical stock market standards. This type of valuation is usually placed on only the fastest-growing companies by investors in the company's early stages of growth. Once a company becomes more mature, it will grow more slowly and the P/E tends to decline.

How much PE ratio is good for a company?

As far as Nifty is concerned, it has traded in a PE range of 10 to 30 historically. Average PE of Nifty in the last 20 years was around 20. * So PEs below 20 may provide good investment opportunities; lower the PE below 20, more attractive the investment potential.

Is a negative PE ratio good?

A high P/E typically means a stock's price is high relative to earnings. A low P/E indicates a stock's price is low compared to earnings and the company may be losing money. A consistently negative P/E ratio run the risk of bankruptcy.

What is Amazon PE ratio?

Amazon reported 50.38 in PE Price to Earnings for its fourth fiscal quarter of 2021.

Should I buy stocks with high PE ratio?

The popular opinion about stocks with high P/E ratios is that they are excellent investment options since investors are willing to pay more for a smaller share in the company's earnings. Hence, they presume this to be an indicator of an optimistic investor perception towards the stock.

Is PE ratio a good indicator?

To many investors, the price-earnings ratio is the single most indispensable indicator for any stock purchase.

Is a higher PE ratio better?

P/E ratio, or price-to-earnings ratio, is a quick way to see if a stock is undervalued or overvalued. And so generally speaking, the lower the P/E ratio is, the better it is for both the business and potential investors.

Price Earnings Ratio Formula

P/E = Stock Price Per Share / Earnings Per ShareorP/E = Market Capitalization / Total Net EarningsorJustified P/E = Dividend Payout Ratio / R – Gwh...

P/E Ratio Formula Explanation

The basic P/E formula takes current stock price and EPS to find the current P/E. EPS is found by taking earnings from the last twelve months divide...

Why Use The Price Earnings Ratio?

Investors want to buy financially sound companies that offer cheap shares. Among the many ratios, the P/E is part of the research process for selec...

Limitations of Price Earnings Ratio

Finding the true value of a stock cannot just be calculated using current year earnings. The value depends on all expected future cash flows and ea...

What is justified P/E ratio?

The justified P/E ratio#N#Justified Price to Earnings Ratio The justified price to earnings ratio is the price to earnings ratio that is "justified" by using the Gordon Growth Model. This version of the popular P/E ratio uses a variety of underlying fundamental factors such as cost of equity and growth rate.#N#above is calculated independently of the standard P/E. In other words, the two ratios should produce two different results. If the P/E is lower than the justified P/E ratio, the company is undervalued, and purchasing the stock will result in profits if the alpha#N#Alpha Alpha is a measure of the performance of an investment relative to a suitable benchmark index such as the S&P 500. An alpha of one (the baseline value is zero) shows that the return on the investment during a specified time frame outperformed the overall market average by 1%.#N#is closed.

What does low P/E mean in stocks?

Companies with a low Price Earnings Ratio are often considered to be value stocks. It means they are undervalued because their stock price trade lower relative to its fundamentals. This mispricing will be a great bargain and will prompt investors to buy the stock before the market corrects it. And when it does, investors make a profit as a result of a higher stock price. Examples of low P/E stocks can be found in mature industries that pay a steady rate of dividends#N#Dividend A dividend is a share of profits and retained earnings that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend.#N#.

How to find current P/E?

The basic P/E formula takes the current stock price and EPS to find the current P/E. EPS is found by taking earnings from the last twelve months divided by the weighted average shares outstanding#N#Weighted Average Shares Outstanding Weighted average shares outstanding refers to the number of shares of a company calculated after adjusting for changes in the share capital over a reporting period. The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) on a company's financial statements#N#. Earnings can be normalized#N#Normalization Financial statements normalization involves adjusting non-recurring expenses or revenues in financial statements or metrics so that they only reflect the usual transactions of a company. Financial statements often contain expenses that do not constitute a company's normal business operations#N#for unusual or one-off items that can impact earnings#N#Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through#N#abnormally. Learn more about normalized EPS#N#Normalized EPS Normalized EPS refers to adjustments made to the income statement to reflect the up and down cycles of the economy.#N#.

What is the difference between EPS and fair value?

It is a popular ratio that gives investors a better sense of the value. Fair Value Fair value refers to the actual value of an asset - a product, stock, or security - that is agreed upon by both the seller and the buyer.

What is equity research analyst?

Equity Research Analyst An equity research analyst provides research coverage of public companies and distributes that research to clients.

What is it called when you own stock?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably. of different prices and earnings levels.

What is fair value in accounting?

Fair value is applicable to a product that is sold or traded in the market where it belongs or under normal conditions - and not to one that is being liquidated. of the company. The P/E ratio shows the expectations of the market and is the price you must pay per unit of current earnings. Net Income Net Income is a key line item, ...

What is the P/E ratio?

The price-to-earnings ratio (P/E) is one of the most common ratios used by investors to determine if a company's stock price is valued properly relative to its earnings. The P/E ratio is popular and easy to calculate, but it has shortcomings that investors should consider when using it to determine a stock's valuation.

When to use PEG ratio?

Since stock prices are typically based on investor expectations of future performance by a company, the PEG ratio can be helpful but is best used when comparing if a stock price is overvalued or undervalued based on the growth in the company's industry.

Why is the PEG ratio important?

Since the P/E ratio does not factor in future earnings growth, the PEG ratio provides more insight into a stock's valuation. By providing a forward-looking perspective, the PEG is a valuable tool for investors in calculating a stock's future prospects.

How to tell if a stock is overvalued or undervalued?

As stated earlier, to determine whether a stock is overvalued or undervalued, it should be compared to other stock in its sector or industry group. Sectors are made up of industry groups, and industry groups are made up of stocks with similar businesses such as banking or financial services.

Why do investors use P/E?

Investors not only use the P/E ratio to determine a stock's market value but also in determining future earnings growth. For example, if earnings are expected to rise, investors might expect the company to increase its dividends as a result. Higher earnings and rising dividends typically lead to a higher stock price.

What does a high P/E mean?

A high P/E could mean that a stock's price is high relative to earnings and possibly overvalued.

What is the first part of the P/E equation?

The first part of the P/E equation or price is straightforward as the current market price of the stock is easily obtained. On the other hand, determining an appropriate earnings number can be more difficult. Investors must determine how to define earnings and the factors that impact earnings. As a result, there are some limitations to the P/E ratio as certain factors can impact the P/E of a company. Those limitations include:

Tactics and considerations

Look at the P/E ratios of other companies in the same industry or sector as the company whose stock you’re considering.

Example

Here’s what the price to earnings ratio formula looks like, as a mathematical equation:

Find out more

We break down the basics of investing in this short and informative learning guide. Not sure what the difference is between a stock, bond, or a fund? You’ve come to the right place!

Why use P/E ratio?

The most common use of the P/E ratio is to gauge the valuation of a stock or index. The higher the ratio, the more expensive a stock is relative to its earnings. The lower the ratio, the less expensive the stock. In this way, stocks and equity mutual funds can be classified as “growth” or “value” investments.

What is the Shiller P/E ratio?

A third approach is to use average earnings over a period of time. The most well known example of this approach is the Shiller P/E ratio, also known as the CAP/E ratio (cyclically adjusted price earnings ratio).

Is Shiller PE a good predictor of future returns?

A recent study found that the Shiller PE was a reliable predictor of market returns between 1995 and 2020. In contrast, a recent Vanguard study found that the Shiller PE and other P/E ratio measures “had little or no correlation with future stock returns.”.

What is the P/E ratio?

The price-to-earnings ratio or P/E is one of the most widely-used stock analysis tools used by investors and analysts for determining stock valuation. In addition to showing whether a company's stock price is overvalued or undervalued, the P/E can reveal how a stock's valuation compares to its industry group or a benchmark like the S&P 500 Index.

What is an individual company's P/E ratio?

An individual company’s P/E ratio is much more meaningful when taken alongside P/E ratios of other companies within the same sector. For example, an energy company may have a high P/E ratio, but this may reflect a trend within the sector rather than one merely within the individual company. An individual company’s high P/E ratio, for example, would be less cause for concern when the entire sector has high P/E ratios.

What is the inverse of the P/E ratio?

The inverse of the P/E ratio is the earnings yield (which can be thought of like the E/P ratio). The earnings yield is thus defined as EPS divided by the stock price, expressed as a percentage.

What does a high P/E mean?

A high P/E could mean that a stock's price is high relative to earnings and possibly overvalued.

Why is it better to buy shares with a lower P/E?

Many investors will say that it is better to buy shares in companies with a lower P/E, because this means you are paying less for every dollar of earnings that you receive. In that sense, a lower P/E is like a lower price tag, making it attractive to investors looking for a bargain.

What are the two types of P/E ratios?

These two types of EPS metrics factor into the most common types of P/E ratios: the forward P/E and the trailing P/E. A third and less common variation uses the sum of the last two actual quarters and the estimates of the next two quarters.

What does N/A mean in P/E?

A company can have a P/E ratio of N/A if it's newly listed on the stock exchange and has not yet reported earnings, such as in the case of an initial public offering (IPO), but it also means a company has zero or negative earnings, Investors can thus interpret seeing "N/A" as a company reporting a net loss.

What is a PE ratio?

A company’s price-to-earnings ratio, or PE ratio, is a single number that packs a lot of punch, and one of the most common ways to value a company’s stock shares.

How to find a company's PE ratio?

To arrive at a company’s PE ratio, you’ll need to first know its EPS, which is calculated by dividing the company’s net profits by the number of shares of common stock it has outstanding. Once you have that, you can divide the company’s current share price by its EPS.

Why is PE ratio low?

For businesses that are highly cyclical, a low PE ratio may signal an undervalued stock, when in reality, it’s been operating in a period of high earnings that’s about to end.

What does a low PE ratio mean?

A low PE ratio may signal that the stock price doesn’t accurately reflect the true value of the company based on its earnings. In this instance, the stock price may stay the same while the company’s earnings increase, which would send the PE ratio lower. Investors may see this as an opportunity to buy the stock with the expectation ...

Why is a stock's PE ratio higher than its historical ratio?

If a stock’s PE ratio is significantly higher than those of other similar companies — or even than the company’s own historical PE ratio — it could be due to growth prospects, but it’s also possible the stock is overvalued.

What happens if a company's stock price jumps?

If its stock price jumps but its earnings stay the same (and no earnings increases are expected), the company’s intrinsic value didn’t change; the market’s perception of the company did.

Do higher PE ratios mean higher growth?

According to Robert Johnson, a chartered financial analyst and CEO of Economic Index Associates in New York, higher PE ratios often go hand-in-hand with such growth stocks. “Typically, stocks selling at higher PE ratios have higher growth expectations than those selling at lower PE ratios,” Johnson says.