Uses of pivot points

- Support or resistance levels. The pivot point indicator lines are known to act as potential price turning points, and the reason is not unconnected to the fact that the indicator ...

- Gauging price movements. ...

- Pivot points for placing stop losses. ...

- Pivot points for placing profit target. ...

- Identifying when the market is possibly in a range. ...

How to trade with pivot points the right way?

- Finding support and resistance levels.

- Pivot point breakout trading.

- Determine short-term market trends. The trend is bullish if we break above Resistance 1. ...

- Intraday trend reversals. ...

- As for the entry and profit targets: Buy and sell at S3 (R3) if the price is unable to move any further and close the trade by the end of ...

What is the formula for pivot points?

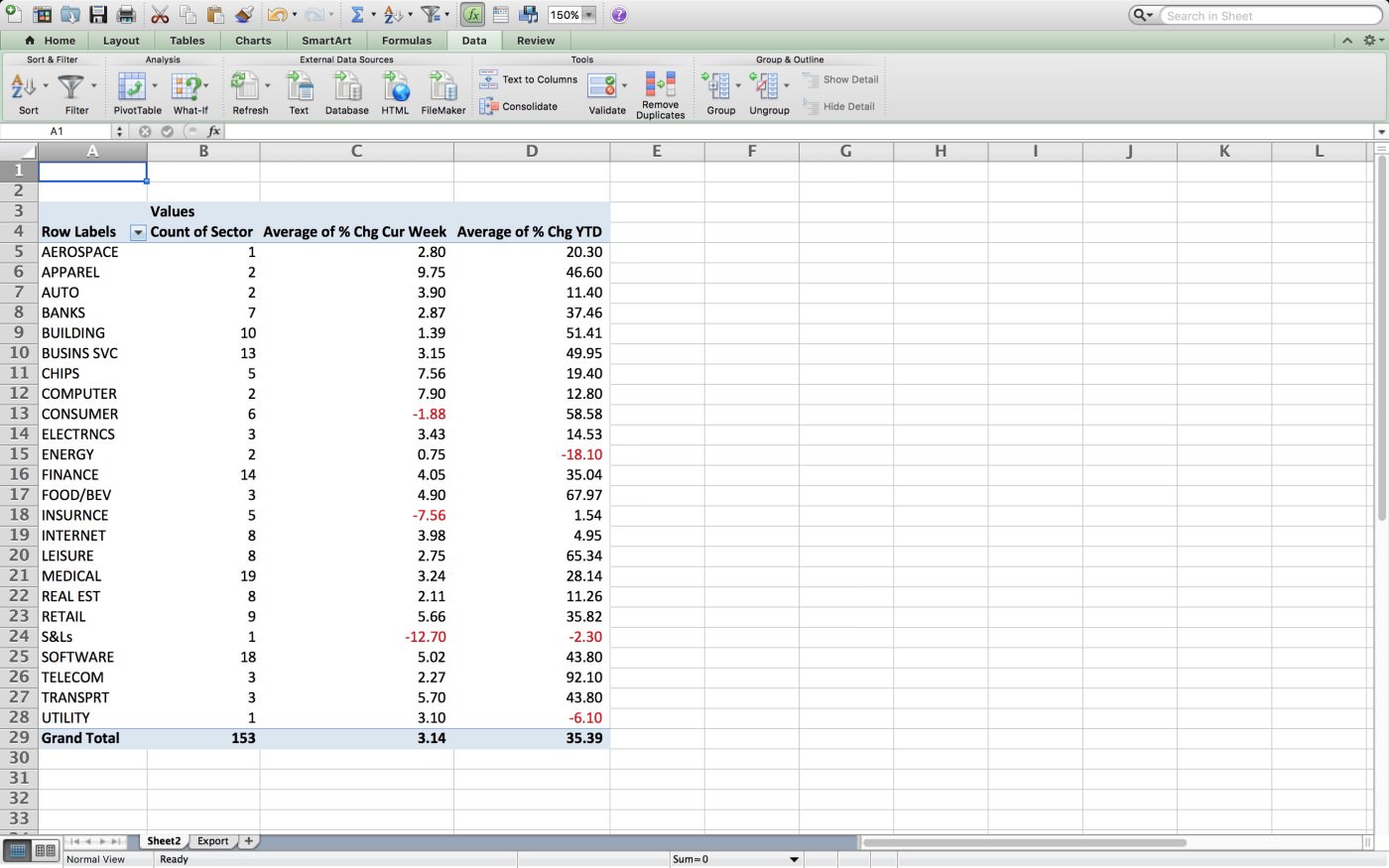

Pivot Table Formula in Excel

- Custom Field to Calculate Profit Amount. This is the most often used calculated field in the pivot table. ...

- Advanced Formula in Calculated Field. Whatever I have shown now is the basic stuff of Calculated Field. ...

- Things to Remember About Pivot Table Formula in Excel. We can delete, modify all the calculated fields. ...

How do you calculate pivot point?

They include:

- High accuracy The pivot point is considered one of the most accurate indicators in the market. ...

- Short time frames Unlike other trading tools that use long time frames, the pivot point indicator obtains data from a single day of trading. ...

- Easy to use

How to calculate pivot points?

These values are calculated as follows:

- Resistance 1 = (2 x Pivot Point) – Low (previous period)

- Support 1 = (2 x Pivot Point) – High (previous period)

- Resistance 2 = (Pivot Point – Support 1) + Resistance 1

- Support 2 = Pivot Point – (Resistance 1 – Support 1)

- Resistance 3 = (Pivot Point – Support 2) + Resistance 2

- Support 3 = Pivot Point – (Resistance 2 – Support 2)

Do pivot points work with stocks?

Pivot points are an intraday indicator for trading futures, commodities, and stocks. Unlike moving averages or oscillators, they are static and remain at the same prices throughout the day. This means traders can use the levels to help plan out their trading in advance.

How do you trade based on pivot points?

To enter a pivot point breakout trade, you should open a position using a stop limit order when the price breaks through a pivot point level. These breakouts will mostly occur in the morning. If the breakout is bearish, then you should initiate a short trade. If the breakout is bullish, then the trade should be long.

What indicator works best with pivot points?

As with other technical indicators, there is no single best Pivot Point that will work for all traders, all of the time. The best advice is to use your Pivot Point of choice with other technical analysis tools, including MACD, candlesticks and RSI.

What is R1 R2 R3 in share market?

The three levels of resistance are referred to as R1, R2, and R3 while the three levels of support are referred to as S1, S2, and S3. When the current price is trading above the daily pivot point, this serves as an indication to initiate long positions.

How do you analyze a pivot point?

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day. On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

How do you trade weekly pivots?

0:082:57WHY I LOVE WEEKLY PIVOTS - YouTubeYouTubeStart of suggested clipEnd of suggested clipYou'll see pivot points standard you click on pivot points standard and then all this mumbo-jumboMoreYou'll see pivot points standard you click on pivot points standard and then all this mumbo-jumbo pops up just double. Click on any one of those lines. And under pivots time frame choose weekly.

Do professional traders use Pivot Points?

Due to their high trading volume, forex price movements are often much more predictable than those in the stock market or other industries. The professional traders and the algorithms you see in the market use some sort of a pivot point strategy.

Are Pivot Points reliable?

High accuracy The pivot point is considered one of the most accurate indicators in the market. This explains why a majority of day traders like using it to determine trade entry or exit points.

What is golden pivot?

Golden Pivot indicator combines Central Pivot Range and Camarilla Pivots . 2. Pivot calculations are based on Secret of Pivot Boss book by Frank Ochoa. 3. One can also view tomorrow's pivots by today EOD .

Who invented Pivot Points?

I first remember hearing about pivot point analysis from the late Manning Stoller in the 1980s. He was the developer of the starc bands that I frequently use in my analysis. I have always felt it was important to give credit to those who originally developed or used a particular analytical tool.

What is Pivot formula?

Several methods exist for calculating the pivot point (P) of a market. Most commonly, it is the arithmetic average of the high (H), low (L), and closing (C) prices of the market in the prior trading period: P = (H + L + C) / 3.

How do you know if Nifty is bullish or bearish?

If the MACD is above 0 and crosses above the signal line it is considered to be a bullish signal. If the MACD is below 0 and crosses below the signal line it is considered to be a bearish signal.

What is pivot point in forex?

Pivot points are one of the best tools used to time entries and exits in any market. However, there is a lot of noise on when to buy with pivot points. To know what works from what does not work we’ll cover a few trade tactics that work in Forex day trading. We don’t need to overcomplicate technical indicators.

When is the best time to trade pivot points?

The best time to trade the pivot points strategy is around the London session open. However, it can be used for the New York session open with the same rate of success.

What is pivot point in trading?

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames. The pivot point itself is simply the average of the intraday high and low, and the closing price from the previous trading day.

What does it mean when the price is above the pivot point?

This means traders can use the levels to help plan out their trading in advance. For example, traders know that if the price falls below the pivot point they will likely be shorting early in the session. Conversely, if the price is above the pivot point, they will be buying.

Why do pivot points and Fibonacci extensions draw horizontal lines?

Pivot points and Fibonacci retracements or extensions both draw horizontal lines to mark potential support and resistance areas. The Fibonacci indicator is useful because it can be drawn between any two significant price points, such as a high and a low. It will then create the levels between those two points.

Do pivot points work?

Pivot points are based on a simple calculation, and while they work for some traders, others may not find them useful. There is no assurance the price will stop at, reverse at, or even reach the levels created on the chart. Other times the price will move back and forth through a level.

Can pivot points be added to a chart?

The pivot point indicator can be added to a chart , and the levels will automatically be calculated and shown. Here's how to calculate them yourself, keeping in mind that pivot points are predominantly used by day traders and are based on the high, low, and close from the prior trading day.

How to trade pivot points?

The following are the main trading strategies used with pivot points: 1. Pivot point bounces. If the price action hesitates and bounces back before reaching the pivot level, you should enter the trade in the direction of the bounce. If you are testing the trade with price above the pivot line, and the price moves close to ...

What is pivot point?

What are Pivot Points? Pivot points refer to technical indicators used by day traders. Day Trading The main attribute of day trading is that the purchasing and selling of securities occurs within the same trading day. to identify potential support and resistance price levels in a securities market.

Why is pivot point important?

This explains why a majority of day traders like using it to determine trade entry or exit points. It enables traders entering the market to follow the overall flow of the market since it uses the previous day’s trading action to predict the current day’s likely action.

What is pivot point indicator?

3. Easy to use. The pivot point indicator is an easy to use tool that’s been incorporated in most trading platforms.

Where is the stop loss on a pivot?

The stop-loss for the trade is located above the pivot line if the trade is short, and below the pivot line if the trade is long. 2. Pivot point breakout.

Should a bullish breakout trade be short?

If the breakout is bearish, the trade should be short, while for a bullish breakout, the trade should be long. A good place to implement a stop-loss order. Stop-Loss Order A stop-loss order is a tool used by traders and investors to limit losses and reduce risk exposure.

What is pivot point in trading?

Pivot points are also used by some traders to estimate the probability of a price move sustaining itself. Though it depends on the market, the following probabilities are generally reported in terms of how likely price is to close the trading day above or below the following levels:

Why are pivot points important?

Pivot points have the advantage of being a leading indicator, meaning traders can use the indicator to gauge potential turning points in the market ahead of time. They can either act as trade entry targets themselves by using them as support or resistance, or as levels for stop-losses and/or take-profit levels.

What is pivot point?

Pivot points are one of the most widely used indicators in day trading. The tool provides a specialized plot of seven support and resistance levels intended to find intraday turning points in the market.

Can you use daily pivot points as stop loss?

They can also be used as stop-loss or take-profit levels. While daily pivot points are the most common and most appropriate for day traders, some charting platforms will allow you to plot them for other timeframes as well (e.g., weekly, monthly).

Can swing traders use weekly pivot points?

Swing traders might use weekly pivot points would be best to apply the strategy on the four-hour to daily chart. Position traders would probably best be suited to use monthly pivot points on either the daily or weekly chart. But this is a fairly simple system that can be effective.

What is pivot point?

Pivots Points are significant levels chartists can use to determine directional movement and potential support/resistance levels. Pivot Points use the prior period's high, low and close to estimate future support and resistance levels. In this regard, Pivot Points are predictive or leading indicators. There are at least five different versions of ...

What is a standard pivot point?

Standard Pivot Points. Standard Pivot Points begin with a base Pivot Point. This is a simple average of the high, low and close. The middle Pivot Point is shown as a solid line between the support and resistance pivots. Keep in mind that the high, low and close are all from the prior period.

What is John Person's complete guide to technical trading?

John Person's A Complete Guide to Technical Trading Tactics has a complete chapter devoted to trading with Standard Pivot Points. Person shows chartists how to incorporate Pivot Point support and resistance levels with other aspects of technical analysis to generate buy and sell signals.

What does it mean to move above pivot point?

The converse is true on the downside. A move below the Pivot Point suggests weakness with a target to the first support level.

Do pivot points change?

Once Pivot Points are set, they do not change and remain in play throughout the day. Pivot Points for 30-, 60- and 120-minute charts use the prior week's high, low, and close. These calculations are based on calendar weeks. Once the week starts, the Pivot Points for 30-, 60- and 120-minute charts remain fixed for the entire week.

Can pivot points be used across timeframes?

While originally designed for floor traders, the concepts behind Pivot Points can be applied across various timeframes. As with all indicators, it is important to confirm Pivot Point signals with other aspects of technical analysis. A bearish candlestick reversal pattern could confirm a reversal at second resistance.

What color is the pivot line?

In contrast, the central pivot line is often plotted using a black color, and this line forms the basis of developing the system’s trading range. Practice This Strategy.

Why are prior short positions closed?

In other words, prior long positions can be closed so that new short positions can be established. Similarly, prior short positions can be closed in cases where new long positions should be established for the same financial market asset. Practice This Strategy.

Calculation Techniques

Day Trading with Pivot Points

Why Day Traders Prefer Pivot Points

Uses of Pivot Points

Related Readings

- When calculating pivot points, the point acts as the primary support or resistance level. High volume trading often occurs when price is at or near the pivot point. The following are the main trading strategies used with pivot points: