Compounding frequency refers to how frequently you're adding interest to the principal. Using the example of 7% interest, if we were to use annual compounding, you would simply add 7% to the principal once per year. On the other hand, semi-annual compounding would involve applying half of that amount (3.5%) twice a year.

Which do stocks earn compound interest?

“How do stocks earn compound interest?” (Common) stocks don’t earn interest. They earn capital gains and dividends. Capital gains compound if the stock keeps increasing in price every year. Dividends compound if they are reinvested. “How does compound interest work when investing in stocks?” As earnings increase, the stock price will (generally) increase.

How do you calculate investment compound interest?

Here is how you determine how much interest you will pay over the life of the loan:

- Change the interest rate to decimal form. Divide 5% by 100 to get .05.

- Determine how many compounding periods there are. ...

- Fill in the formula. ...

- Solve the innermost parenthesis. ...

- Solve the exponent. ...

- Solve the remaining parenthesis. ...

- Solve the remaining equation. ...

- Determine how much you will pay in total. ...

How does compound interest make you money?

- How compound interest makes your money grow

- Here’s how compound interest works

- The first law of compound returns: start early!

- The second law of compound returns is: s mall differences in the rate of return matter. A lot!

Which type of investment gives compound interest?

Top 7 Picks

- CDs. Considered a safe investment, certificates of deposit are issued by banks and generally offer higher interest than savings.

- High-Interest Saving Accounts. A high-interest, or high-yield savings account is a good investment for those who need cash quickly.

- Rental Homes. ...

- Bonds. ...

- Stocks. ...

- Treasury Securities. ...

- REITs. ...

How do I invest in compound interest?

To take advantage of the magic of compound interest, here are some of the best investments below:Certificates of deposit (CDs) ... High-yield savings accounts. ... Bonds and bond funds. ... Money market accounts. ... Dividend stocks. ... Real estate investment trusts (REITs) ... Learn more:

How do you maximize compound interest in stocks?

Invest early – the longer your money is invested, the more time it has to grow. When it comes to compounding returns, time is an advantage. Contribute regularly – regardless of the amount – the important thing is to start and be consistent. Even small contributions made each month will grow.

Can compound interest make you rich?

Compounding has the potential to grow your savings at a phenomenal pace, making you wealthy over time.

Do stocks earn compound interest?

Dividend stocks: Stocks that pay dividends generate compound interest if you reinvest the dividends. You can instruct your brokerage to automatically reinvest all dividend payments you receive and buy more shares.

What Is Compound Interest?

The easiest way to understand compound interest is to think of the process required to make a snowman. Imagine yourself going outside on a snowy day. As you begin packing a large ball of snow to make your snowman you begin to roll the snowball along the ground.

How does compound interest work against you?

How Compound Interest Can Work Against You. On the other side of the coin, compound interest can be your enemy. Consider the credit card in your wallet. The debt on that credit card can compound in the same way that you can earn compound interest.

What happens when you earn compound interest?

As you continue to allow your money to grow, the compounding effect becomes greater and greater and the growth rate accelerates.

What is the difference between compound interest and simple interest?

With simple interest, you earn the same rate of interest every single year. With compound interest, you are able to earn interest on your interest. Compound interest allows you to earn a greater return every single year. While this change seems insignificant, the growth takes place over time.

Why did the early investors start investing their money?

It is simply because they started investing their money and allowing that money to grow into more money over time. They understood the power of compound interest early on and they had the patience to see it through.

How often does compound interest double?

At a 10% return, you would double your money every 7.2 years. This is why compound interest is referred to as the time value of money. A young person would be able to experience more of these doubling cycles than an older person. This is why it is imperative that you get started early.

Why is compound interest important?

For some, compound interest is the reason why they never have to worry about having enough money. For others, it is the reason why they will never get out of debt.

How does compound interest work?

At its core, compounding is the concept of earning interest on interest.

What are the benefits of compound interest?

The upside of compounding? It can grow your money. Interest means you earn money without needing to do any extra work. Then, the money you earned continues earning even more -- that's compounding. Your money continues to grow, whether you continue to add to it or not.

How often do savings accounts compound?

Savings accounts typically compound daily or monthly -- so interest earned on your balance is swept into your balance to earn interest the very next day or every 30 days. Some investment accounts compound interest semi-annually or quarterly. The more frequent compounding happens in your account, the more you gain.

What is compounding effect?

The compounding effect makes these gains possible. Note that these calculations assume interest is compounded annually -- meaning the interest you earn is only added to your balance once each year. So, for a full year, you only earn interest on your principal investments. Accounts compound at different intervals.

What is the annual percentage yield?

That total rate of gain per year, with these compounding intervals taken into account, is called the annual percentage yield (APY). When you're charged interest, it's the annual percentage rate (APR).

What happens if you use compound interest to your benefit?

If you make a point to use compound interest to your benefit and don't let it work against you, you'll position yourself to make your money work for you throughout your life.

How much does the stock market return?

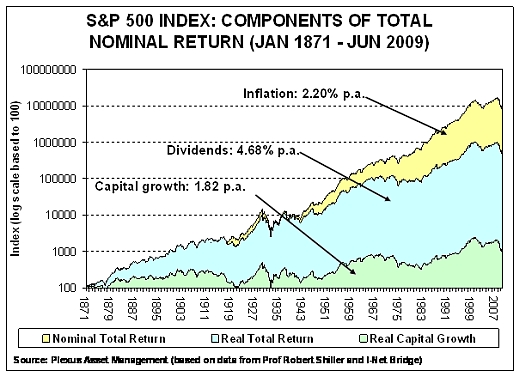

By contrast, investing in the stock market has historically delivered a 10% average yearly return -- though a return in any given year fluctuates quite a bit. To be conservative, we'll use a 7% return for our calculations.

What is compound interest?

Compound interest is the interest income that accrues on an initial sum of money and any accumulated interest over time. This might compare to what some call "simple interest," which is simply the interest that grows only on a principal amount.

What is the impact of compounding interest on savings?

The amount you see at the end of your saving or investing time frame can be massively impacted by compounding interest. Several factors influence the value of compounded returns, including the time period, the interest or rate of return, the original investment or savings amount, and if additional contributions are made. To illustrate, consider how changes to the example above impact the end amount (see chart below).

What is the snowball effect of compounding?

This snowball effect of compounding makes early saving or investing, particularly in tax-advantaged retirement accounts, that much more enticing since the earlier you start investing, the more compounded returns you can hope to make.

Does higher number of years of saving/investing lead to higher compounded returns?

Higher number of saving/investing years can lead to higher compounded returns.

Can savings accounts be consistent?

While most of these factors can be consistent for savings accounts, for example, many are not when it comes to investing. Annual rates of return can vary from year to year, for instance (see sidebar).

Do stocks have higher returns?

Stocks have historically provided higher returns than less volatile asset classes. But keep in mind that there may be a lot of ups and downs and there is a generally higher risk of loss in stocks than in investments like bonds. Over the short term, the stock market is unpredictable, but over the long term, it has historically trended up.

Is there a risk in investing?

Of course, investing involves risk, including the risk of loss of your original investment. This has the potential to nullify the benefits of compounding returns. Additionally, short-term investment windows may not realize the benefits of compounding returns. For example, suppose you bought a stock, mutual fund, or ETF for its relatively high dividend and intended on reinvesting that dividend. If, for some reason, you sell before receiving and reinvesting any dividends, there would be no compounding returns on this position.

When did the S&P 500 ETF start?

The same idea applies to dividends as well. The S&P 500 SDPR ETF (SPY) was introduced in 1993. In its first full year, the fund paid out a grand total of $1.10 in dividends per share. Based on the year-end price in 1993, that was a dividend yield of around 3.8%.

Do savings trump investment?

Your savings will trump your investment results for the first couple of decades. And then, all of the sudden, your investment returns take over once you’ve built up a decent-sized nest egg.

Is compound interest backloaded?

Compound interest is extremely back-loaded, which is something that’s hard to see unless you actually plot it out on a spreadsheet. Small gains can add up over time even though it may not feel like it in the moment. Further Reading: When Saving Trumps Investing.

What is the formula for calculating compound interest?

Future value = present value × (1 + interest rate) ^ number of periods

Why is compounding important?

Compounding helps investments grow at an ever-increasing rate.

What is compounding?

Capital gains, interest, or dividends that are reinvested to earn a higher return over time.

What if there are more than 1 compounding periods in a year?

As the frequency of compounding increases the future value increases. Even at the same rate of return.

What happens to compounding frequency?

As the frequency of compounding increases the future value increases. Even at the same rate of return.

How are earnings generated?

Earnings are generated from the initial investment and earnings are generated from previous periods’ earning. You earn “interest on interest.” The more earnings that have been compounded, the more earnings you are going to make every period. The “snowball” gets bigger and bigger.

What happens when interest accrues on a credit card?

Interest accumulates on unpaid principal, e.g. credit card. As you accrue interest on interest the amount you owe can grow faster than you can reduce principal.

What is 10% interest on $100?

E.g. 10% interest on $100 would net you $10—which means your account is now at $110 and your next 10% interest is $11 instead of $10. Note this doesn’t happen if the interest is taken out of the account (and in some cases, interest wouldn’t be able to join the rest of the account at all, so you would not experience compound interest at all).

How does stock gain?

The gains in stock investing come from the growth of the underlying companies, and the reflection of that growth in their stock prices. So if a company grows at 10% per year, their stock price (all else being equal) should grow at that rate as well.

What happens if a company grows 10% per year?

So if a company grows at 10% per year, their stock price (all else being equal) should grow at that rate as well. Also, in bank accounts and similar investments, interest is guaranteed, but stock returns aren't. Stocks can (and often do) lose value.

Do stocks pay interest?

Well, to clear up terminology, stocks do not pay interest. Many pay dividends, which you can sometimes choose to either take as cash or to reinvest (meaning either take the dividend in stock or buy more stock with the dividend), which then works much like compounding interest. However, the price of the stock drops by the same amount as the dividend, so it is a wash from an investment standpoint.

Do stocks have compound growth?

So to answer the question, yes, investing in stocks can lead to compound growth like interest on average, but only over long periods of time, and there will be years of growth above and below that average .

Do dividends have to be invested in stocks?

It’s correct for things that actually earn interest, more or less, but not for stocks. For stocks, dividends have to be invested if you want to “compound” them, and moreover, stocks involve risk and so nothing with them is “automatic.”. You might accumulate money—or you might lose it.

Do common stocks pay dividends?

Most common stocks pay dividends. Some preferred stocks pay a combination of interest and dividends. If it's a non sheltered account, both are usually taxable.

What is compound interest?

Here is a simple definition of compound interest: Compound interest – meaning that the interest you earn each year is added to your principal, so that the balance doesn’t merely grow, it grows at an increasing rate – is one of the most useful concepts in finance. – moneychimp.com.

Which market has the highest potential for wealth accumulation?

The Cryptocurrency Market is proving to be the wealth accumulation activity with the highest profit potential. Excellent, explosive gains trading this market and compound interest can result in some explosive wealth growth.

How much profit would you make if you invested $1,000?

If you invest $1,000 and get a 10% yearly return on your investment. That would be $100 profit at the end of the year.

What is the second factor in a bank account?

The second factor is how much money you have to start with and if you are going to systematically add to your accounts.

How can I achieve my financial goals in a relatively short time period?

By investing, adding regularly to my investments and beating other investment opportunities, and taking advantage of the power of compound interest… I can achieve my financial goals in a relatively short time period.

What is Compound Interest Investing?

Compound interest investing is the process of investing in assets that routinely pay you and grow exponentially.

What is Compound Interest?

Before going into the details of which compound interest investments are better than others, you must first understand what exactly compound interest is.

How Much Money Can Compound Interest Make?

Depending on your initial investment, you can generate thousands of dollars each month in compound interest.

What is the goal of investing?

As an investor, your goal is to find investments that maximize your returns while limiting risk.

What does it mean to combine safe and volatile investments?

When investing, this means using a variety of investments in the case that one specific investment fails, your others will be there to prop up your entire portfolio. By combining safe and volatile investments, you’ll get the best of both worlds.

Why are money market accounts good?

Money market accounts are perfect for those with a small risk tolerance because of how safe they are.

What is real estate investment trust?

Real estate investment trusts are a simpler option to get started in the world of real estate investing. In short, real estate investment trusts act similar to stocks. Instead of having to manage property, collect rent, etc, this is all completed for you.