How To Transfer Stock Between Brokerage Accounts.

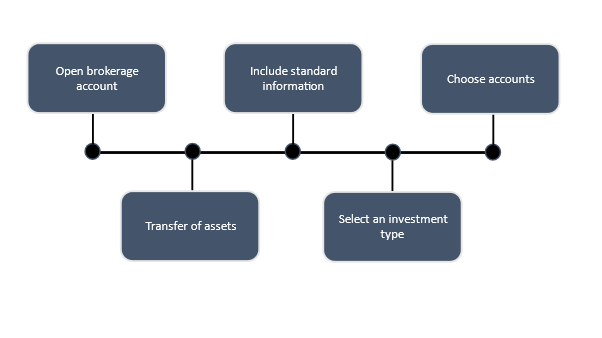

- 1. Choose a New Broker. The first thing you should do before moving your stocks to a new broker is choose the broker you want to work with. You should ...

- 2. Submit a Transfer Initiation Form.

- 3. Wait for the Receiving Firm to Contact Your Current Broker.

- 4. Work With Your New Broker to Make Sure it Accepts All Your Assets.

- 5. Wait for the Transfer To Be Completed.

- Choose a New Broker. ...

- Submit a Transfer Initiation Form. ...

- Wait for the Receiving Firm to Contact Your Current Broker. ...

- Work With Your New Broker to Make Sure it Accepts All Your Assets. ...

- Wait for the Transfer To Be Completed.

How to transfer stocks from one brokerage account to another?

These securities include:

- securities sold exclusively by your old firm;

- mutual funds or money market funds not available at the new firm;

- limited partnerships that are private placements;

- annuities; or

- bankrupt securities.

Can I transfer shares between brokers?

You can transfer an entire brokerage account or particular securities from one brokerage to another. Generally you can transfer an entire account using a system called the Automated Customer Account Transfer Service, or ACATS.

How to transfer stocks between brokers?

So lean on its customer support as you go through these five steps:

- Get your most recent statement from your existing account. Your new broker will need the information on this statement, such as your account number, account type and current investments.

- Open an account at the new broker. Most accounts at most brokers can be opened online. ...

- Initiate the funding process through the new broker. ...

- Watch and wait. ...

How can I buy stocks without a stock broker?

Know how DSPPs work.

- DSPPs are generally available from large, well-established companies.

- You can agree to automatic monthly withdrawals from your checking or savings account to purchase more stocks.

- A transfer agent is a third party that represents the company. It may be a bank, a trust company or a similar organization. ...

How are common stock shares transferred?

Common stock shares are most often transferred from one broker to another by a software-based system known as the Automated Customer Account Transfer Service (ACATS). 2 Prior to ACATS, a manual transfer system was used, which took far longer and was prone to human error. 3

How long does it take for a stock to be transferred to a new firm?

5 Experts also recommend that customers maintain proper records and make their own calculations to double-check that all assets are properly transferred. Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. 4

How long does it take to transfer stock in ACATS?

Once Firm B has submitted the transfer request with instructions, Firm A must either validate the instructions or reject or amend the request within three business days. If there is no exception, then the transfer will settle within six business days. 1 2

Can annuities be transferred?

Annuities can be transferred via a 1035 exchange, which is an Internal Revenue Service (IRS) provision that allows the tax-free transfer of insurance products. However, there are requirements that need to be met, such as the transfer might need to involve the same insurance product or annuity. 6 Also, the original provider can charge fees called surrender charges, although there are cases whereby those fees can be waived. 7

Can you transfer an annuity to another plan?

Congress in 2019. The new ruling makes annuities more portable, meaning if you leave your job, then your 401 (k) annuity can be rolled over into another plan at your new job. 8

Can annuities be transferred through the ACATS system?

There are several types of securities that cannot go through the ACATS system. Annuities bought through insurance companies cannot transfer through the system. 2 1 To transfer the agent of record on an annuity, the client must fill out the correct form to make the change and initiate the process.

How long does it take to get stocks transferred?

The companies will coordinate back and forth through ACATS to match your accounts and get your stocks transferred over, generally within about a week. Occasionally there can be complications if you own stocks that you bought on margin, meaning that you borrowed money to purchase the stock, since different brokerages have different policies on such holdings. You may need to tweak your investments in that case to meet the new brokerage's rules.

What is an automated account transfer?

You can use the Automated Customer Account Transfer Service, or ACATS, to transfer stock between different brokerage accounts.

Can you transfer stocks from one brokerage to another?

If you' re only transferring some stock s from one brokerage to another, they may not use the ACATS system, and the process can sometimes take longer. Not all brokerages support non-ACATS transfers. Fees may still apply. The procedure, though, is generally the same.

Do brokerages charge fees to transfer accounts?

Some brokerages will charge fees to transfer accounts in and out of their systems, but many will waive fees for incoming accounts and even compensate you for what your old brokerage charges. Naturally, it's a good idea to see what fees are involved and how you're expected to pay them before the transfer begins.

What is the fee to transfer stocks out of Robinhood?

It varies among brokerage firms. For example, Robinhood charges a fee of $75 to do a partial or complete transfer of your account to another broker. 5 At Vanguard, no fee is charged to receive assets from another brokerage. 6

What Is an Automated Customer Account Transfer Service (ACATS)?

ACATS is designed to make transfers easier, especially for simple accounts that mostly hold basic assets like stocks, bonds, and cash.

Can I Transfer Stock From One Brokerage to Another?

Yes, it is possible to transfer stocks and other investments from one brokerage account to another.

How are accounts transferred between broker-dealers?

Most customer accounts are transferred between broker-dealers through an automated process. The National Securities Clearing Corporation (NSCC) operates the Automated Customer Account Transfer Service (ACATS) to facilitate the transfer of a customer account from one broker-dealer to another. Transfers involving the most common assets, for example, cash, stocks and bonds of domestic companies, and listed options, are readily transferable through ACATS.

Why would a new firm not accept a transfer of an account?

For example, the new firm may decide not to accept the account due to the quality of securities supporting a margin loan, or because the account does not meet its minimum equity requirements.

What must a customer do to start the account transfer process?

The firm a customer is transferring the account to can provide the form to facilitate the transfer. The new firm is called the "receiving firm." Once the receiving firm receives the TIF, it begins the process by communicating with the current or "delivering firm," via ACATS.

How long does it take to transfer a customer account to a new firm?

Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. This is called the delivery process. In total, the validation process and delivery process generally take about six days to complete.

How to become familiar with account transfer process?

In addition, investors can become familiar with the account transfer process by discussing it with the new firm. Ask questions, like the anticipated length of the transfer process given the specific type of account (such as cash, margin, IRA, custodial) and the assets held (such as stocks, bonds, options, limited partnership interests). Inquire about anything that may cause a delay during the account transfer process. Ask how the firm informs customers that the transfer process is complete?

How long does it take to transfer an account?

Even with today’s technology, a successful account transfer from the customer’s former firm to the new firm will usually take about a week although it is best to plan ahead for any potential delays.

Does a transfer require a custodian?

Generally, transfers where the delivering entity is not a broker-dealer (for example a bank, mutual fund, or credit union) will take more time. In addition, transfers of accounts requiring a custodian, like an Individual Retirement Account or a Custodial Account for a minor child, may take additional time.

How long does it take to transfer assets to a new broker?

Once all the due processes are carried out, the delivering firm can take three days to move the assets to the new security brokers.

Why do people transfer stocks?

One of the main reasons why investors want to transfer shares is because they want to change brokers . Just like the functioning of a bank, where loans and credit can be transferred, people can transfer shares from one account to another. Depending on their requirements, investors might change their mind on who they want to do business with. This can be due to rising costs, redundant technology, bad customer care or the firm simply going out of business. However, many might be intimidated by the procedure to do so, given the volatility of markets but this is into the case anymore. Here’s how to transfer stock between brokers.

How to transfer stocks via acst?

The brokerage account receiving the stocks will have to contact the firm in possession of the stocks and request for a transfer with instructions. Post this the former firm will have to accept the instructions received or reject or amend them within three business days. Here, validation will include corroborating the customers’ details. After this process, the current firm must cancel any open orders and cannot accept fresh requests from the client. They must also transfer the instructions to the new firm with particulars on the account balance and list of securities positions. Post the transfer, the new stock brokerage firm will be responsible and answerable to the customer regarding stock reporters.

Can you transfer shares between brokers?

Now, with a software-based programme called Automated Customer Account Transfer (ACATS) shares can be transferred between brokers without much hassle. Customers need to have online broking accounts to be eligible for this. If they are not in possession of one they need to open a broking account online with their DP.

How to transfer stock?

Specify the name of the stock you want to transfer. To avoid confusion, spell out the full name and include the stock symbol. Write down the number of shares you want to transfer or “ALL,” if you're moving all stocks.

How long does it take to transfer stocks between accounts?

Transferring stocks between accounts can take from three to six weeks or longer.

Can dividends be delayed?

Dividends, interest or transaction proceeds might be delayed during this time. If you buy or sell the transferred stock, you may complicate. Some companies may freeze your accounts during transfers just to prevent problems.

Do you have to sign and date a transfer form?

Sign and date the form. If you are not the owner of the other account, that owner must also sign and date the form, and state that the transfer is authorized.

How long does it take to transfer brokerage accounts?

If your transfer goes smoothly, count on the whole process taking two to three weeks. But this time frame may vary depending upon such factors as the assets involved, the types of accounts, and the institutions between which the transfer occurs.

What to do if your brokerage account has not been transferred?

If you feel like your account has not been transferred in a timely fashion, ask to speak to the compliance director at your old or new firm. If you are not satisfied, contact the New York Stock Exchange or the FINRA, depending on where your brokerage firm is a member.

How to transfer IRA to IRA?

The easiest way to transfer your account is to keep the type of accounts the same (joint account transfers to joint account; IRA to IRA) and account owner the same . You can change account type or ownership at the time of the transfer, but this may delay the transfer. You may need to provide documents proving changes to ownership, such as a marriage certificate, divorce decree, or death certificate.

Why are my transfers delayed?

Transfers may be delayed if: the wrong transfer form is used; the transfer form has been incorrectly completed; the transfer involves a request to liquidate some or all of your assets; the transfer includes a margin account; the transfer is from one type of account into a different type of account; a change in the account owner is made; or.

What is transfer of account?

the transfer is from one type of account into a different type of account; a change in the account owner is made; or. the transfer involves a retirement account. This document walks you through the transfer process and provides tips on how to avoid problems.

What happens if a transfer request is not resolved?

If the old firm takes no action on the request or a problem is not resolved within six business days, the transfer request is purged (or deleted) from ACATS. If that happens, the new firm must start over by again inputting the transfer request into ACATS.

How long does it take to transfer a company?

If the transfer is made through ACATS, and there are no problems, the transfer should take no more than six business days to complete from the time your new firm enters your form into ACATS.

What to do before initiating a transfer?

An expert tip: "Before initiating a transfer, make sure your new broker has an agreement in place to accept all of your holdings, especially mutual funds ," Cyr says.

What are the mistakes to avoid when switching brokers?

When you're making a broker switch, mistakes to avoid include neglecting to complete an in-kind transfer and making trades while the transfer is in process.

How long does it take to transfer a TIF?

This automated process can take a week or more to complete, but depending on the broker-dealer, the time frame can vary.

What is the importance of switching brokers?

The brokerage you use is crucial to your long-term investment success. So if you suspect that your existing provider is not serving you, switching brokers should be top of mind.

Why referencing accounts?

Referencing these account statements can help avoid delays and ensure that no snags, such as unsettled trades or debit balances, will hold up the process , he says.

Is it easier to transfer assets or sell them?

For investors who feel they are not getting the proper value with their current brokerage, Stein says, transferring your assets rather than selling them is much easier.

Is client advisor relationship just investment performance?

Brie Williams, head of practice management at State Street Global Advisors, says that for many investors, the client-advisor relationship is not just about investment performance.

How much does it cost to transfer money out of a brokerage account?

There’s a good chance that a full transfer out of your account will come with a fee from your old broker, generally from $50 to $100. There’s no real way around it, but you may be reimbursed by your new broker, either formally via a program that reimburses transfer fees or informally via a new customer cash-back or free-trading bonus.

How long does it take to transfer money from a brokerage account to a new one?

5. Enjoy your new account. In most cases, the transfer is complete in three to six business days. Your broker may be able to give you a more specific time frame. Some even have online trackers so you can follow that money.

What is in-kind transfer?

An in-kind or ACAT transfer allows you to transfer your investments between brokers as is, meaning you don't have to sell investments and transfer the cash proceeds — you can simply move your existing investments to the new broker. Many brokers accept in-kind or ACAT transfers, which make it easier to switch accounts and allow you avoid any tax ...

How to get a new broker account?

1. Get your most recent statement from your existing account. Your new broker will need the information on this statement, such as your account number, account type and current investments. 2. Open an account at the new broker. Most accounts at most brokers can be opened online.

Does NerdWallet offer brokerage?

NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities. If you have an account at an online broker and you haven’t checked out the competition in a while, it would be worth your while to take a look.

Is it hard to transfer brokerage account?

Transferring your brokerage account isn't hard if you opt for an in-kind or ACAT transfer — and it may be worth your while.

Can you transfer in-kind investments?

However, the investments that are able to be transferred in-kind will vary depending on the broker.