How to Transfer Your Stocks off Robinhood

- Pick a new broker. Before you can initiate a transfer, you need to decide where that transfer will go. ...

- Resolve Negative Balances or Account Restrictions. If you have a margin account with a negative balance or any account with account restrictions, you need to settle up with ...

- Read Up on Fees, Restrictions and Limitations. Robinhood charges a flat $75 fee, regardless of whether you’re doing a full or partial transfer (more on that later).

- Open an Account with Your New Broker. Once you’ve done your research and you’re confident in your decision, it’s time to open your new account.

- Request an Account Transfer. The last action required on your part is to make the official account transfer request. You’ll do this at your new broker.

- Wait 5-10 Business Days. In most cases, especially when you’re transferring from one online broker to another, you can complete the entire transfer process online in a matter ...

Full Answer

How to get a free share of stock from Robinhood?

- Commission-free trading of U.S. stocks, ETFs and cryptos.

- A free share of stock (up to $225 value) when you open a commission-free brokerage account.

- And more free stock (up to a $225 value) every time one of your friends opens a Robinhood account from your promotional link.

- That's up to $1,000 in free stock every year. ...

How to trade stocks using Robinhood?

Robinhood’s easy-to-use app and zero-commission trades are especially appealing ... stock soaring to the moon (or at least to $480) in early 2021, stock trading became one of the biggest trends on social media as well, making it cool to post memes ...

How does Robinhood Sell Your Stocks?

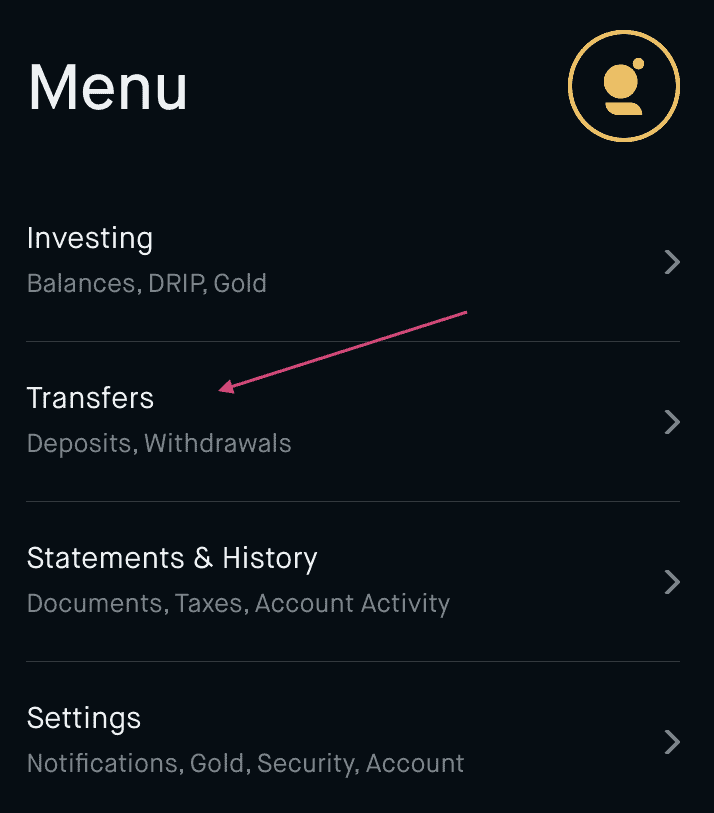

You can find this information in your mobile app:

- Tap the Account icon in the bottom right corner.

- Tap Investing.

- Your account number will be at the top of your screen.

Can I transfer stock from Robinhood to another brokerage?

You can transfer stocks and cash to other brokerages through ACATS (Automated Customer Account Transfer Service) transfer. If you want to keep your Robinhood account, you can initiate a partial transfer. Otherwise, you can initiate a full transfer, and we’ll close your account once the process is complete. Note that there is a $75 fee to ...

Can you transfer stocks from Robinhood?

You can transfer stocks and cash to other brokerages through ACATS (Automated Customer Account Transfer Service) transfer. If you want to keep your Robinhood account, you can initiate a partial transfer. Otherwise, you can initiate a full transfer, and we'll close your account once the process is complete.

How long does it take to transfer stocks from Robinhood?

Transfers will take 3–5 business days to complete.

How do I transfer stocks from Robinhood to Fidelity?

0:3410:08How To Transfer Stocks from Robinhood to Fidelity - YouTubeYouTubeStart of suggested clipEnd of suggested clipMain screen and so over here you can look at your accounts. And then over here is a transfer buttonMoreMain screen and so over here you can look at your accounts. And then over here is a transfer button so you just click onto this transfer button or tap on it and here.

How do I get my money out of Robinhood?

Withdraw money from RobinhoodTap the Account icon in the bottom right corner.Tap Transfers.Tap Transfer to Your Bank.Choose the bank account you'd like to transfer to.Enter the amount you'd like to transfer to your bank.Tap Submit.

Why can't I withdraw from Robinhood?

Remember that the Robinhood withdrawal limit is set at $50,000 or five withdrawal transactions each day. If you try to make more withdrawals than this, you may see an error when you try to withdraw your funds. Robinhood also requires the money in your account to settle before it can be withdrawn.

Does Robinhood charge fees to withdraw?

We have good news for you: basic withdrawal at Robinhood is free of charge.

Can you move stocks from one broker to another without selling?

An in-kind or ACAT transfer allows you to transfer your investments between brokers as is, meaning you don't have to sell investments and transfer the cash proceeds — you can simply move your existing investments to the new broker.

Is it better to trade on Fidelity or Robinhood?

Both brokers allow their customers to select certain tax lots when selling. Overall, Fidelity has the upper hand over Robinhood in this category as it offers a wider range of orders overall, even if not all of the orders are available on mobile.

How long does it take to transfer stocks from Robinhood to Fidelity?

If you are switching from Robinhood to Fidelity, it can take up to 2 weeks for your assets to be transferred over. Additionally, data from your stock portfolio, such as cost basis and profit/loss, will be missing or incorrect until the transfer has been completed.

Why can't I transfer money from Robinhood to my bank?

In most cases, the issue comes down to the settlement period. Following each sale, the money in your Robinhood account needs to “settle” before it can be transferred. This period includes the trade date plus two additional days; on or after the third, you'll be able to withdraw it.

How long does it take to cash out Robinhood?

two trading daysThe average time for this stage of the process is two trading days. Therefore, the funds from a Robinhood transaction are available for you to withdraw on the third day following a trade. Robinhood allows you to make up to five withdrawals per day, up to so long as they total $50,000 or less.

What happens when you sell a stock on Robinhood?

Q: What happens when you sell stock on Robinhood? A: After you sell stock, Robinhood sends your orders to market makers that execute your trades. After that, something known as “clearance and settlement” occurs. It takes 2 days for the clearinghouse to transfer your stock to you.

Step 1: Pick a new broker

Before you can initiate a transfer, you need to decide where that transfer will go. Otherwise, you’re just cashing out your account, which closes out your position in all of your stocks and, depending on the value of your portfolio, could lead to a hefty bill during tax season.

Step 2: Resolve Negative Balances or Account Restrictions

If you have a margin account with a negative balance or any account with account restrictions, you need to settle up with Robinhood before you can move to a new broker. You can do this by other depositing cash into the account or by selling off some shares to make up the balance owed.

Step 3: Read Up on Fees, Restrictions and Limitations

Robinhood charges a flat $75 fee, regardless of whether you’re doing a full or partial transfer (more on that later). However, some brokers might offer to cover that transfer fee for you, making it effectively free. To find out if a broker is willing to cover the fees, you’ll need to call directly and ask.

Step 4: Open an Account with Your New Broker

Once you’ve done your research and you’re confident in your decision, it’s time to open your new account. Even though you’re planning to transfer accounts, you don’t have to go through any special onboarding process to open an account. You can sign up and open the account as you normally would. The actual transfer will happen later.

Step 5: Request an Account Transfer

The last action required on your part is to make the official account transfer request. You’ll do this at your new broker. In some cases, the broker will ask during the onboarding process if you plan to transfer any accounts over to your new account.

Full Transfer vs. Partial Transfer

When you make the request, you can either request a full transfer or a partial transfer. As the name implies, a full transfer will completely move your entire portfolio over to your new broker and then close out your Robinhood account.

Step 6: Wait 5-10 Business Days

In most cases, especially when you’re transferring from one online broker to another, you can complete the entire transfer process online in a matter of minutes. Of course, if you have any account restrictions or a negative balance, the process might take longer.

How to transfer your stocks out of Robinhood

There's a $75 fee to transfer assets out of Robinhood, and this applies to both partial and full transfers. In other words, you'll have to pay $75 even if you don't move all of your assets out. If, however, you do transfer all of your assets, Robinhood will close your account for you.

Will all of your assets survive the transfer?

Robinhood says on its website that all full, settled shares of stocks and ETFs should transfer to your other brokerage. When it comes to fractional shares, though, Robinhood sells them and transfers them as cash during the brokerage change.

Transfer Fee

When you transfer stocks or cash from Robinhood to an outside brokerage such as E*TRADE, Robinhood will charge you a $75 fee (whether you are doing a full or partial transfer of your account).

Conclusion

If you’ve made the decision to move your money from Robinhood to E*TRADE, there are several steps, including settling any negative balances in your Robinhood account before you take action. It will end up costing you $75 as well, which is the transfer fee that Robinhood charges.