So to know if a stock is dividend paying, If you look at the analysis of a company and it has a positive percentage as dividend yield, then the company would (or would have to) pay dividend for that period. Most companies pay dividends quarterly, so you find/hear this after their meeting held post release of their quarterly report.

How to invest in dividend stocks for beginners?

... Terminology for Beginners on hand, there's no need for new investors to panic if they encounter an unknown term while researching a particular stock. Hamilton removes the guesswork from investing by explaining terms such as dividend and retained earnings.

What are the highest dividend paying stocks?

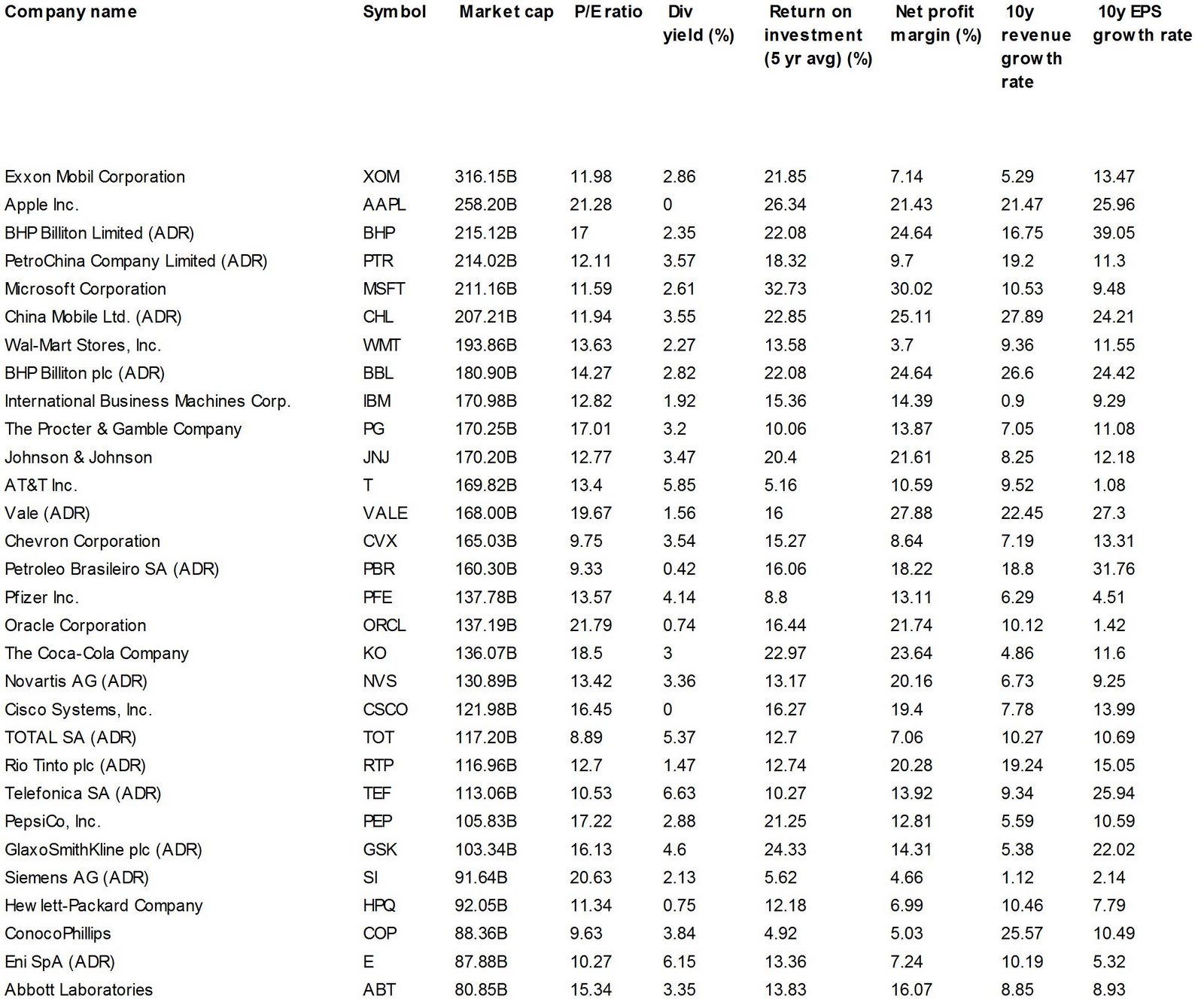

- Dividend yield greater than 3% (indicates high dividend payments),

- Dividend payout ratio less than 100% (indicates the Company isn’t paying more than 100% of its income in dividends),

- Marketcap over $200 million (more stable companies),

- EPS growth greater than 5% (continuing to grow operations),

What stocks pay dividends?

These high-yield, well-covered stocks are:

- China Petroleum & Chemical Corp (NYSE: SNP)

- Braskem (NYSE: BAK)

- Ternium (NYSE: TX)

- OneMain Holdings (NYSE: OMF)

- New York Community Bancorp (NYSE: NYCB)

- Sinopec Shanghai Petrochemical (NYSE: SHI)

- Vector Group (NYSE: VGR)

How do you buy dividend paying stocks?

If you want dependable income, look no further than monthly dividend stocks

- Monthly Dividend Stocks: Realty Income (O)

- Stag Industrial (STAG)

- LTC Properties (LTC)

- EPR Properties (EPR)

- Vereit Series F Preferred Stock (VER-PF)

- Main Street Capital (MAIN)

- Prospect Capital (PSEC)

- Eaton Vance Limited Duration Income Fund (EVV)

- Cohen & Steers REIT and Preferred Income Fund, Inc. (RNP)

How do I know when a stock pays dividends?

On the declaration date, the Board of Directors announces the dividend, the size of the dividend, the record date, and the payment date. The record date is the day by which you must be on the company's books as a shareholder so as to receive the declared dividend.

How long do you have to hold a stock to get a dividend?

Briefly, in order to be eligible for payment of stock dividends, you must buy the stock (or already own it) at least two days before the date of record and still own the shares at the close of trading one business day before the ex-date.

What months do stocks pay dividends?

The Company normally pays dividends four times a year, usually April 1, July 1, October 1 and December 15. Shareowners of record can elect to receive their dividend payments electronically or by check in the currency of their choice.

What is the downside to dividend stocks?

While the disadvantages of cash dividends are: Tax inefficiency. Investment risk. Sector concentration. Dividend policy changes.

What stock pays the highest dividend?

9 highest dividend-paying stocks in the S&P 500:Williams Cos. Inc. (WMB)Devon Energy Corp. (DVN)Oneok Inc. (OKE)Simon Property Group Inc. (SPG)Kinder Morgan Inc. (KMI)Vornado Realty Trust (VNO)Altria Group Inc. (MO)Lumen Technologies Inc. (LUMN)More items...•

How many shares do you need to get a dividend?

Most dividend stocks pay out four times per year, or quarterly. To build a monthly dividend portfolio, you'll need to buy at least 3 different stocks so each month is covered.

Are dividends profitable?

Dividend is usually a part of the profit that the company shares with its shareholders. Description: After paying its creditors, a company can use part or whole of the residual profits to reward its shareholders as dividends.

How often are Apple dividends paid?

four times a yearHow Often Does Apple Stock Pay a Dividend? Apple stock pays a dividend four times a year. Its quarterly dividend has been payable during February, May, August, and November of each year.

What is a dividend?

Dividends, both current and historical, is the focus of attention for many investors when they consider which investments to buy.

Why consider stocks that pay dividends?

In a nutshell: dividend-paying companies can provide a little more certainty than growth stocks. They tend to be less volatile, so dividend stocks can also help diversify one’s portfolio and reduce risk.

When do dividends get paid out by corporations?

Paying dividends is serious business to a company and its directors. To ensure transparency, financial responsibility and optimal value to shareholders, a dividend process is utilized. We’ll highlight the most important dates below:

What is a Dividend Reinvestment Plan (DRIP) and a Dividend Purchase Plan (DDP)?

DRIPs, or dividend reinvestment plans, and DPPs, or dividend purchase plans, were specifically designed to help investors maximize the compound returns of dividend-paying stocks. To determine if you’re eligible or to enroll in the DRIP/ DPP program, call us at 1-888-872-3388 .

What is dividends?

Dividends are an integral part of your total return; Make sure you know how to get the right info and understand the dividend lingo. Reuben Gregg Brewer believes dividends are a window into a company's soul. He tries to invest in good souls. According to S&P Dow Jones Indices research, dividends made up around one third of the total return ...

When to use dividend dates?

You can also use dividend dates in a broad sense if you want to spread your distributions out, owning a portfolio of companies that ensures a payment occurs every month. Long-term investors, however, will probably want to pay attention to the timing of annual dividend hikes.

What is the first date of a dividend?

The first date is the Announcement Date, which is when the company tells the world that it's going to pay a dividend. Next up is the Record Date (or Date of Record), which is the date the company uses to determine who is a shareholder and, thus, has a right to the dividend. The third date to consider is the Payment Date -- which is ...

How long does it take to get a stock to show up on a record?

It takes a couple of days for a stock trade to be fully processed and for you to show up on a company's records. Thus, you'll need to execute a trade about two days before a Record Date to make the list.

Is dividends simple?

However, you'll quickly see that finding this information is only half the battle. In fact, dividends aren't nearly as simple as they first appear. First things first. Perhaps the most important thing about dividends is yield.

Do European companies pay dividends?

There's also an increasing number of companies that pay dividends monthly.

Where can I find dividend information?

Investors can also find dividend information on the Security and Exchange Commission's website, through specialty providers, and through the stock exchanges themselves.

Why are dividend stocks so attractive?

Dividend-paying stocks are attractive to investors because they distribute a portion of their earnings to shareholders in the form of cash payments or shares of stock. Investors can determine which stocks pay dividends by researching financial news sites, such as Investopedia's Markets Today page. Many stock brokerages offer their customers ...

What is dividend in accounting?

A dividend is a distribution of a portion of a company's earnings paid to its shareholders. Dividends can be issued as cash payments, as shares of stock, or other property.

What is a stock brokerage account?

Brokerage Accounts. Many individual stock brokerage accounts provide online research and pricing information to their customers. Similar to the news sites, investors can easily find information on dividend amounts and payout dates, as well as other types of peer comparisons and screeners.

Do I need to report dividends on 1099?

All publicly-traded companies are required by law to report on Form 1099 all dividends they have paid to investors during the previous tax year on a quarterly and annual basis. As a result, you can research these filings on the U.S. Securities and Exchange Commission's website using their EDGAR system.

Can dividends be cash?

Dividends can be issued as cash payments, as shares of stock, or other property. There are several accessible sources to help investors identify dividend-paying stocks. Below we've listed a number of resources that can help you determine which stocks pay dividends.

What does it mean when a company pays dividends over time?

If a company has increased the amount of its dividend over time, this is also a good sign that suggests future distributions will persist and potentially grow.

What is cash dividend?

A cash dividend is the part of a company’s profits that are distributed to its shareholders. These distributions most commonly occur quarterly but can happen less frequently or not all. Many companies, such as early-stage technology companies, prefer to reinvest all their earnings in various growth opportunities.

Why are dividends important?

Many investors consider dividends to be an attractive feature of owning a stock. They offer and an added element of direct participation in a company’s profits. Dividends boost the return on a stock and can enhance the long-term growth potential of the investment.

What is a stock screener?

A stock screener allows you to find only the companies that you are interested in based on various criteria. There are usually multiple fields related to dividends that give you the ability to generate a list of stocks that pay dividends and meet whatever other measures fit your investment style. Yahoo!

What is investor relations?

The investor relations section of a company’s website is an excellent resource for both beginner and experienced investors. It contains press releases, quarterly financial results, regulatory filings, presentations, and other valuable information about a company.

What does IPO stand for in stock market?

Thank you for reaching out to us. First off, an IPO stands for Initial Public Offering. It means the very first time a company’s shares are sold to members of the public on a stock exchange.

Do stocks pay dividends?

Generally, there are stocks that always pay dividends and there are others that do not pay. Dividend in simple term is just the profit that a company gives to its shareholders from the company's profit.

How to look up quarterly reports?

You can search these filing using the U.S. Securities and Exchange Commission website with 2 simple steps. Click on the ‘filing’ section. Then do a quick search of each company you are interested in.

Do publicly traded companies report dividends?

All publicly traded companies are required by law to report all dividend paid to their shareholders. These companies will report how much dividend is paid for the previous year during their annual report. You can look up their reports to find quarterly report or a annual report.

Does the stock exchange keep data on dividends?

Some stock exchange even keep a historical data on all the ex-dividend dates and how much dividend is paid to their shareholders during each period.

Do financial news sites have stock screeners?

Most financial news sites do have a stock screener to help you find dividend paying stocks. Some sites may require you to be a member to access the tool, while other sites provide this service for free.

What is dividends?

A dividend is how a firm returns profits directly to its shareholders. 1 Companies aren't required to issue dividends, so there isn't a set rule about which will and which ones won't. Even if a company has issued dividends in the past, it may stop at any time.

Why do dividend stocks decrease in value?

During a recession or other times of hardship, dividend-paying stocks can quickly decrease in value, because there is a risk that the firm will reduce payouts in the future. If a company says that it's cutting its dividend, the stock price will react right away.

What does dividend yield mean?

A stock's dividend yield tells you how much dividend income you receive, compared to the current price of the stock. Buying stocks with a high dividend yield can provide a good source of income, but there are other factors to take into account.

What to do if you don't want to study stocks?

If you don't want to study and purchase individual stocks, you can invest in a dividend income fund instead. These funds allow you to diversify your portfolio while letting experts make the hard choices about which stocks to buy and when to buy them.

Is a company required to pay dividends to the people who own its stock?

4 On the other hand, a company is not required to pay a dividend to the people who own its stock.

Financial News Sites and Apps

Brokerage Accounts

- Many individual stock brokerage accounts provide online research and pricing information to their customers. Similar to the news sites, investors can easily find information on dividend amounts and payout dates, as well as other types of peer comparisons and screeners. An additional benefit for users of online accounts provided by a broker is the ability to tie into any current (or past) hol…

Securities and Exchange Commission

- All publicly-traded companies are required by law to report on Form 1099 all dividends they have paid to investors during the previous tax year on a quarterly and annual basis.1 As a result, you can research these filings on the U.S. Securities and Exchange Commission's website using their EDGAR system. You can also quickly research a company’s fin...

Specialty Providers

- There are a number of dividend-focused specialty resources available online for getting comprehensive information on dividends. Some of these sites are free, some have paid subscription content, and some have a combination of free and paid content. With these specialty providers, you might have access to a calendar of upcoming ex-dividend dates, as well as scree…

The Stock Exchanges

- Tools and resources are also provided from the stock exchanges themselves to keep investors up-to-date with dividend data for the companies they list. The NASDAQ provides a dividend calendar, history tool, and screeners on the highest-yielding stocks.4 Meanwhile, the New York Stock Exchange (NYSE) provides a historical database to research ex-dividend dates by a select…