In the moment of the dilution, you may see a dip in the stock price, and thus a dip in the value of your holdings. This would happen just due to the number of shares increasing. However, it’s just a small part of the bigger picture of what determines a stock’s price.

What does it mean when a stock is diluted?

Dilution occurs when a corporate action, like a secondary offering, increases the number of shares outstanding. Exercising stock options is dilutive to shareholders when it results in an increase in the number of shares outstanding.

How do you calculate stock dilution?

Market capitalization reflects a stock's market value, by multiplying its current stock price by its number of shares.) Stock dilution happens when a company issues more shares of its stock, or when more shares materialize, such as when employees exercise stock options or grants.

Are you aware of diluted shares and what can you do?

Yet most traders aren’t aware of diluted shares and what they can do. Printing money devalues existing currency — and companies creating new shares devalues existing shares.

What happens when your stock is diluted?

Share dilution is when a company issues additional stock, reducing the ownership proportion of a current shareholder. Shares can be diluted through a conversion by holders of optionable securities, secondary offerings to raise additional capital, or offering new shares in exchange for acquisitions or services.

Do you lose money when shares are diluted?

How does dilution affect stock prices? Dilution usually corresponds with a decrease in stock price. The greater the dilution, the more potential there is for the stock price to drop. Dilution can keep stock prices lower even if a company's market capitalization (the total value of its outstanding shares) increases.

What causes stock dilution?

Stock dilution happens when a company issues more shares of its stock, or when more shares materialize, such as when employees exercise stock options or grants. Remember that a company first issues stock to the public via an initial public offering (IPO). After that, other issuances are called secondary offerings.

How do you prevent a stock from being diluted?

How to avoid share dilutionIssuing options over a specific individual's shares. ... Issuing options over treasury shares. ... Issuing unapproved options. ... Creating bespoke Articles of Association.

How do you determine dilution?

1:268:54How To Tell If A Stock Is Being Diluted - YouTubeYouTubeStart of suggested clipEnd of suggested clipYou down to kind of a net income here then it shows you an earnings per share here. On this line.MoreYou down to kind of a net income here then it shows you an earnings per share here. On this line. And most more importantly shows you the number of shares that it's using to calculate.

What happens if I buy all the shares of a company?

Originally Answered: What happens if I buy all the shares of a company? If you buy all shares of a company then control of the company totally in the hands of you. For publicly listed company, compay have to share part of the holding to the public . A promotor can hold maximum 75% part in this case.

Do stock warrants dilute existing shareholders?

When someone exercises a warrant, however, the company issues more shares and then sells them to the warrant holder for the strike price. As the strike price is less than the market price of the stock, this dilutes the interest of the existing shareholders.

What happens when a company increases number of shares?

As the company's earnings are divided by the new, larger number of shares to determine the company's earnings per share (EPS), the company's diluted EPS figure will drop.

Do founder shares get diluted?

When VCs agree to pump money into a startup, they receive equity shares in return. As a result, the founders dilute their ownership in the company in exchange for capital to grow their business.

Do seed investors get diluted?

We discuss the maths behind the 25,000 shares here (in the context of preemption), but the good news is that the SeedLegals platform takes care of all the maths for you! In this funding round, each founder has been diluted by 10% each = 20% overall. And that's all there is to dilution in early stage funding rounds!

How does dilution affect stock?

Stock dilution also impacts more than just the value of shares held by the stockholder. It also curbs the value of the stock in other ways, including the stock’s earnings per share, the voting rights of the shareholder, and the stock’s market value. Where stock dilutions can have a positive impact on company shares is in ...

What is stock dilution?

Stock dilution is basically a decline in the percentage of share ownership by investors owning a particular stock, mostly due to the company issuing new shares of stock, which “dilutes” the value of existing stock owned by shareholders. The brand new stock issued by the company boosts the total number of shares available, ...

What is a primary issue of stock?

A primary issue of company stock occurs well beforehand, with the company’s initial public offering of stock. Companies will issue secondary shares of stock for myriad reasons. They may want to reward employees for valued work or offer new shares of stock to raise capital, for example.

Does a Grinch exist in the stock market?

But a year-end Grinch actually does exist in the stock market, in the form of stock dilutions ...

What does it mean when a stock float is thick?

When a stock float is thick, it indicates heavy supply and liquidity but also makes for sluggish price appreciation. Thinner floats indicate smaller supply which can result in faster price movements but also carry more slippages with wider bid and ask spreads.

Why is dilution a red flag?

Why Dilution can be a Red Flag. The fact that dilution minimizes the original ownership stake for existing shareholders is why selling tends to occur. Dilution reduces the value of positions held by current shareholders. When a company increases its share count, it causes the ownership stake for each share to shrink.

What does float mean in stock market?

The float is the total amount of free trading common shares that can change hands between buyers and sellers in the open market. Float represents the supply of trading shares and is a good measure of liquidity. When a stock float is thick, it indicates heavy supply and liquidity but also makes for sluggish price appreciation.

What is free trading stock?

Free trading shares are common shares that are bought and sold in the markets with no restrictions. Restricted stock must be converted to free trading shares by removal of restrictions. Restricted shares can’t be transferred or sold and are usually issued as compensation for employees, consultants and insiders.

What is common stock?

Stocks that freely trade on the U.S. stock exchanges are common shares. Common shares represent a piece of the underlying company. If you buy 100 shares of a company comprised of 10,000 shares, then you would theoretically own 1% of the company.

Why do companies price secondaries?

Companies tend to price secondaries after a sharp spike in share prices. The secondary offerings tend to be priced at a discount to the market, which accelerates price drops. Small cap stocks are notorious for this as well as companies that are burning through cash.

Why is it important to separate the actual business operations from the publicly traded stock?

While a stock’s price may reflect a company’s valuation and investor sentiment, it can also be influenced by its share structure and the events that impact it.

How does dilution affect shareholders?

After all, by adding more shareholders into the pool, their ownership of the company is being cut down. That may lead shareholders to believe their value in the company is decreasing.

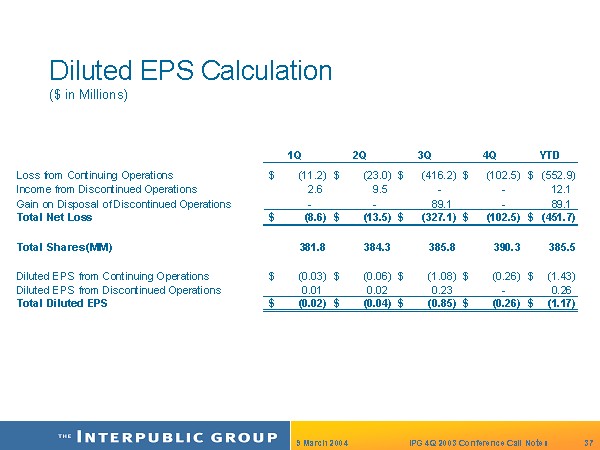

What is diluted earnings per share?

The value of earnings per share if all these convertible securities (executive stock options, equity warrants, and convertible bonds) were converted to common shares is called dilu ted earnings per share (EPS). It's calculated and reported in company financial statements.

What is Treasury stock method?

The Treasury stock method is used to calculate diluted EPS for potentially dilutive options or warrants. 3 The options or warrants are considered dilutive if their exercise price is below the average market price of the stock for the year.

How much would the share count increase after 6,000 shares are repurchased?

Share count would increase by 4,000 (10,000 - 6,000) because after the 6,000 shares are repurchased, there is still a 4,000 share shortfall that needs to be created. Securities can be anti-dilutive. This means that, if converted, EPS would be higher than the company's basic EPS.

What is a share dilution?

What Is Share Dilution? Share dilution happens when a company issues additional stock. 1 Therefore, shareholders' ownership in the company is reduced, or diluted when these new shares are issued. Assume a small business has 10 shareholders and that each shareholder owns one share, or 10%, of the company.

Why is dilution important for retail investors?

Because dilution can reduce the value of an individual investment, retail investors should be aware of warning signs that may precede potential share dilution, such as emerging capital needs or growth opportunities. There are many scenarios in which a firm could require an equity capital infusion.

Why is dilution negative?

Current shareholders sometimes view dilution as negative because it reduces their voting power.

What is dilution of stock?

Stock dilution happens when a company issues more shares of its stock, or when more shares materialize, such as when employees exercise stock options or grants. Remember that a company first issues stock to the public via an initial public offering (IPO). After that, other issuances are called secondary offerings.

Why do companies issue more stock?

They might, for example, need to raise money in order to grow their business in some way or maybe to buy another company. Or maybe they're just running low on funds needed to run the business.

What happens if new shares don't boost the value of the company?

If the new shares don't boost the value of the company, though, then stock dilution has happened. A lot of dilution happened in the late 1990s, before the Internet bubble burst, when many young companies without much excess cash yet were rewarding employees with pieces of the business in the form of stock options.

Why is it good to issue more shares?

This is good for shareholders -- usually -- because it boosts the proportional claim of remaining shares.

How much of a company does a 10 share represent?

If a company has 100 shares and you own 10, you own 10% of the company. But if it issues 20 more shares, then your 10 shares represent 8.33% of the company. A rising share count can dilute the value of your shares.

Is a rising share count bad?

A rising share count can dilute the value of your shares. Good or bad. Many assume that the issuance of more shares is unfailingly bad news, causing dilution. It actually can be not so bad, if the funds raised by selling the new shares are spent in a very productive way.

Is P/E ratio bad?

That's too bad, because stock dilution can matter a lot.

What is fully diluted stock?

What are Fully Diluted Shares? Fully diluted shares outstanding is the total number of shares a company would theoretically have if all dilutive securities were exercised and converted into shares. Dilutive securities include options, warrants, convertible debt, and anything else that can be converted into shares.

How to calculate diluted earnings per share?

Diluted earnings per share#N#Diluted EPS Formula and Calculation The Diluted EPS Formula is a calculation of earnings per share after adjusting the number of shares outstanding for dilutive securities, options, warrants. Diluted EPS Formula = (net income - preferred dividends) / (basic shares + conversion of any in-the-money options, warrants, and other dilutions)#N#is derived by taking net income during the period and dividing by the average fully diluted shares outstanding in the period. The diluted shares are calculated by taking into account the effect of employee stock awards, options, convertible securities, etc.

Do employees quit before their shares vest?

Since some employees will quit before their shares vest, companies typically make an estimate, based on judgment, about forfeitures and the total number that will actually vest. This category is often one of the biggest causes of dilution to shares outstanding.

Why do diluted shares have less value?

That’s because the company’s market cap stays the same, but there are more shares trading. The new shares lower the value of existing shareholders’ positions.

What is a dilutive stock offering?

A dilutive stock offering is when a company introduces new shares into the market. I’m going to be talking about secondary offerings here … Those are offerings that happen after an IPO, when the stock is actually trading on the market.

What is a basic stock?

Basic shares are the shares that are already issued. They are a part of the stock’s outstanding shares. Diluted shares are the shares that would be added if warrants, convertible bonds, and new shares issued through stock offerings were exercised.

Can a stock shake off dilution?

A stock can sometimes shake off dilutions like they’re nothing, especially in a hot sector . Sometimes an offering will be at a higher price than where a stock is trading, leading to a rally. When bigger companies dilute their shares, it can be a positive catalyst ….

Why do companies dilute their stock?

Why Companies Dilute Stock. There are several reasons why companies may opt to issue more shares. However. raising money is one of the most common motivators. When a company goes public for the first time, it does so through an initial public offering or IPO.

What does dilution mean in stocks?

What Stock Dilution Means for Investors. Stock dilution can be worrying for investors since it means that your shares are now worth less money. Keeping a dilution event in perspective can help you gauge the impact it may potentially have on the value of your holdings going forward.

What happens when companies issue stock options to employees?

For some companies, this option might make more sense than taking on debt or selling off assets to raise capital. Dilution can also happen when companies issue stock optionsto employees and those employees then exercise their options. Companies can also issue new shares to a select group of investors.

What happens when you have more shares of stock?

When more shares of stock are issued or options are exercised, your ownership share in the company shrinks. In other words, it dilutes your stake. A good analogy is to think of it in terms of slicing a cake or pie. When the pie is split four ways, you can claim a 25% ownership share.

Is dilution the same as a stock split?

That’s especially true if a company is acquiring or merging with another company. However, dilution isn’t the same thing as a stock split. With a split, the number of shares increases while the price of each share decreases.

Can a company issue more shares to the market?

Essentially, the company can just issue more shares to the market as a secondary offering to attract investors. Investors buy those new shares. That allows the company to raise money and dilute ownership shares of existing investors in the process.

Can dilution be permanent?

It’s important to keep in mind that dilution doesn’t have to be permanent, however. Companies can pursue stock buybacks, in which they buy back shares of stock to reduce the number being traded on the market. This can essentially reverse the effects of dilution since your ownership share in the company would increase.