To stress-test by sector, Demmert suggests comparing your portfolio’s sector allocation to that of an index like the S&P 500 or, for global investors, the MSCI World Stock Index. Your portfolio's sector allocations shouldn't deviate dramatically from the index's, he says.

Full Answer

What is a bank stress test?

A bank stress test is one of the most common types of stress test because it is easy to implement and can also be used to gauge how well banks are doing.

How do I test my portfolio for bear market stress?

Stress-Test Your Portfolio With This Checklist 1 Check your asset mix. Portfolios with a heavier weighting of stocks don't hold up as well in... 2 Consider your sector exposure. Certain sectors fare better than others in a difficult market. 3 Look at liquidity. Bear markets are sometimes accompanied by recessions, which often lead to layoffs.

Is it time to stress-test your portfolio?

If those numbers seem daunting, maybe it’s time to stress-test your portfolio to determine how it would fare in a bear market. The practice can help identify potential trouble spots, such as overweighting a particular stock or sector.

How will the stress test affect dividends and capital in banks?

These changes will affect the distribution of dividends and how much capital is in the bank. However, in the long run, it will help the economy’s stability. U.S. authorities have created a direct and easily identifiable link between their stress test outcome and the consequences that investors can endure when a bank’s share price goes down.

How do you stress test a portfolio?

Stress test a portfolio against post-pandemic scenarios and 30+ other market events in 3 easy steps: 1) Upload a portfolio, 2) select the asset classes and market scenarios your clients are most interested in, and 3) run the analysis.

What is a stress test in stocks?

Key Takeaways Stress testing is a computer-simulated technique to analyze how banks and investment portfolios fare in drastic economic scenarios. Stress testing helps gauge investment risk and the adequacy of assets, as well as to help evaluate internal processes and controls.

How do you perform a stress test?

Process of Stress testing / how to perform stress testingStep1: Detect the testing environment. ... Step2: Find performance acceptance criteria. ... Step3: Plan and design stress tests. ... Step4: Configure the test environment. ... Step5: Implement test design. ... Step6: Execute tests. ... Step7: Analyze the results.

How do you stress test a trading strategy?

Testing a trading strategy for robustness is often referred to as sensitivity analysis, or more colloquially as stress testing. The basic idea is to see what happens when small changes are made to the strategy inputs, price data, or other elements of the strategy or the trading environment.

What is the example of stress testing?

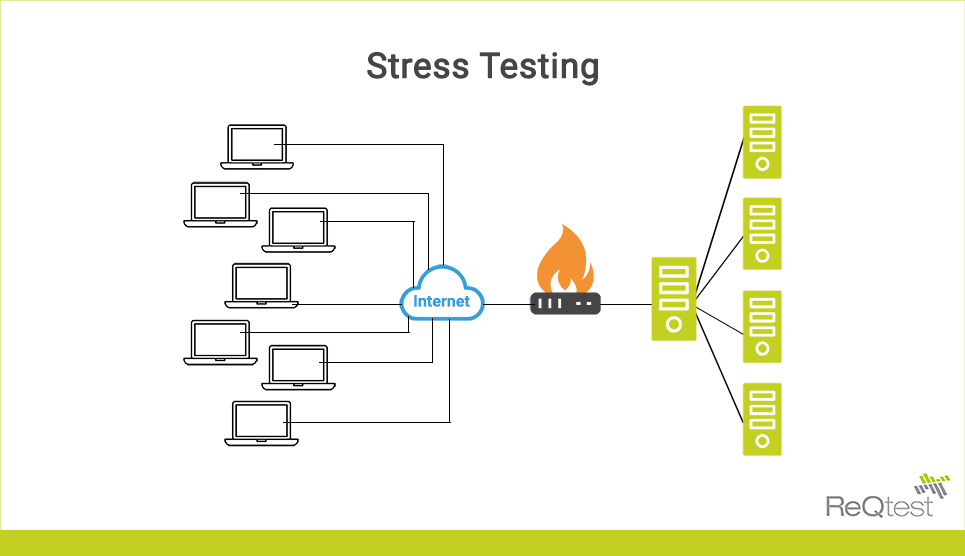

Few examples of Exploratory Stress Testing where such abnormal conditions are used: Extremely large numbers of concurrent users try to log into the application. Database linked to the website shuts down when the website tries to reach it from the front end. Data in added in extremely large quantity in the database.

How do I do a stress test in Excel?

2:025:27Sensitivity Analysis / Stress Testing on Excel - Financial Modeling - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo let's see how we can do that on excel the first thing you guys need to do is to go to um data andMoreSo let's see how we can do that on excel the first thing you guys need to do is to go to um data and then what-if analysis.

What is stress testing simple?

Stress testing is the process of determining the ability of a computer, network, program or device to maintain a certain level of effectiveness under unfavorable conditions. The process can involve quantitative tests done in a lab, such as measuring the frequency of errors or system crashes.

What is the main purpose of stress testing?

An exercise stress test is used to determine how well your heart responds during times when it's working its hardest. During the test, you'll be asked to exercise — typically on a treadmill — while you're hooked up to an electrocardiogram (EKG) machine. This allows your doctor to monitor your heart rate.

What is difference between load and stress testing?

The key difference is the goal of each: Load tests help you understand how a system behaves under an expected load. Stress tests help you understand the upper limits of a system's capacity using a load beyond the expected maximum.

Is backtesting a waste of time?

Backtesting works because you can falsify or confirm a trading idea, you can automate all your trading based on the backtests, exploit the law of large numbers, limit behavioral mistakes, and lastly you can save a lot of time in executions. Backtesting is definitely not a waste of time.

How do I find a good entry point for a stock?

Calculating Entry PointsPullbacks, Support, and Resistance. Looking at a stock's recent share price history gives you an idea of where it's trending. ... Trading Volume. ... Crossover with Two Moving Averages. ... Continuation Patterns. ... Limit Orders. ... Stop-Loss Orders.

How can I make 1 percent a day in the stock market?

The 1% rule for day traders limits the risk on any given trade to no more than 1% of a trader's total account value. Traders can risk 1% of their account by trading either large positions with tight stop-losses or small positions with stop-losses placed far away from the entry price.

1st Phase – Portfolio Stress Test

The last quote is essentially the stress test method. You need to really know why you bought your stocks.

2nd Phase – Portfolio Stress Test

You get recessions, you have stock market declines. If you don't understand that's going to happen, then you're not ready, you won't do well in the markets.

What is the key to stress testing a portfolio?

The key for stress testing your portfolio, however, is whether you will stick to your asset allocation plan when the market drops. 2. Cost. Investing costs are a key component of successful investing. Even small increases in cost, multiplied over a lifetime of investing, can erode a significant portion of a portfolio.

How does the allocation between stocks and bonds affect returns?

The allocation between stocks and bonds affects returns and risk more than any other asset allocation decision. As the chart below from Vanguard's Framework for Constructing Diversified Portfolios shows, both the volatility and returns increase as a portfolio increases its exposure to equities.