5 Things You Have to Do to Start Stock Trading as a Beginner

- Consult Your Watchlist. If you’ve already got some potential plays on watch, you’ll be ready when they make a run. ...

- Use Your Stock Screener. There are a lot of scans you can do to find potential trades. ...

- Check for Signs. ...

- Write Down Your Trading Plan. ...

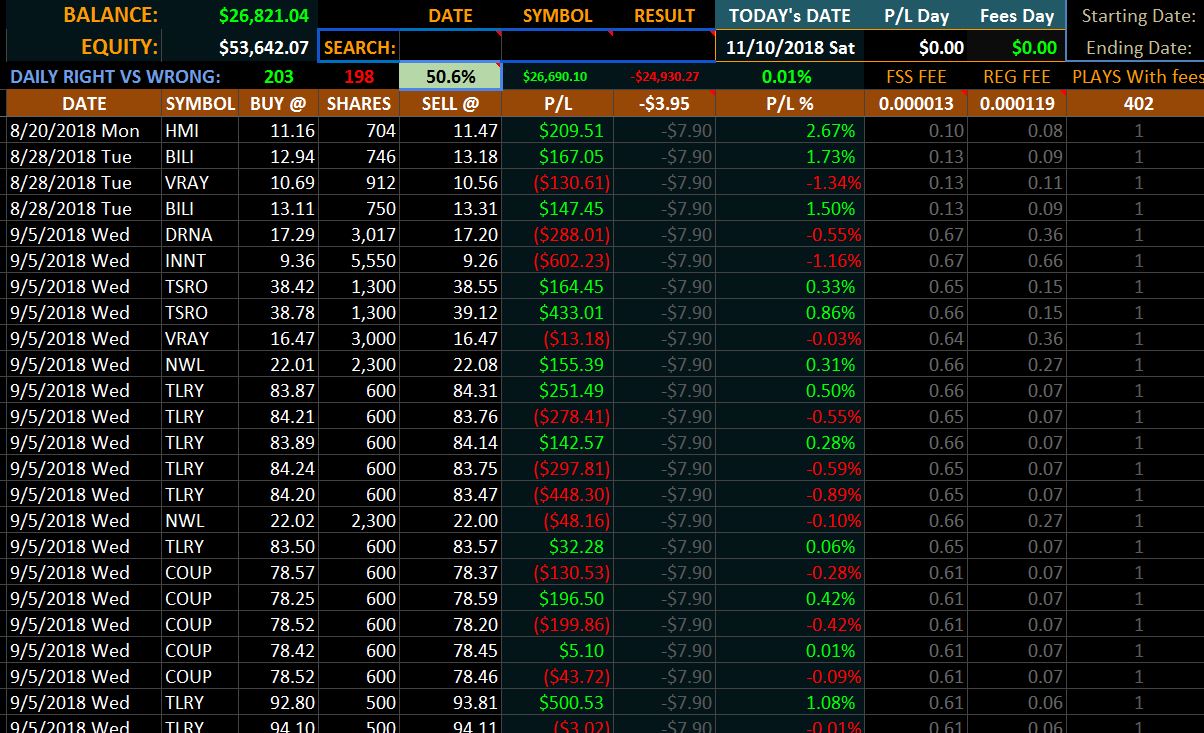

- Track Your Trade. ...

- Open a brokerage account.

- Set a stock trading budget.

- Learn to use market orders and limit orders.

- Practice with a paper trading account.

- Measure your returns against an appropriate benchmark.

- Keep your perspective.

- Lower risk by building positions gradually.

- Ignore 'hot tips'

How to start trading stocks in 5 steps?

How to Start Trading Stocks in 5 Steps

- Choose the Right Time. In order to achieve significant stock market success, you’ll need to have a good amount of freedom, free time and headspace.

- Select Your Strategies. ...

- Find the Best Site, Platform or Broker. ...

- Do Your Research. ...

How to invest in stocks for beginners?

eToro is the best platform for how to invest in stocks for beginners. Here’s how to buy shares with low fees in 2022. 1. Sign Up The first step involves visiting the eToro website and tapping on "Join Now". Enter your username and email, verify your details. 2. Verify Your Identity

What is the best trading platform for beginners?

- eToro – Overall Best Trading Platform

- Capital.com – New Online Broker with AI Trading Platform

- Libertex – CFD Trading Platform with Tight Spreads

- VantageFX – Global Trading Platform with Zero Commission

- Robinhood – Best Trading Platform for Buying US Stocks

- TD Ameritrade – Best Trading Plating for Asset Diversity

How do you start a stock market?

Key Takeaways

- Investing is defined as the act of committing money or capital to an endeavor with the expectation of obtaining an additional income or profit.

- Unlike consuming, investing earmarks money for the future, hoping that it will grow over time.

- Investing, however, also comes with the risk for losses.

How do Beginners start trading stocks?

One of the best ways for beginners to get started investing in the stock market is to put money in an online investment account, which can then be used to invest in shares of stock or stock mutual funds. With many brokerage accounts, you can start investing for the price of a single share.

How much money do you need to start the stock market?

Stocks typically trade in round lots, or orders of at least 100 shares. 1 To buy a stock priced at $60 per share, you will need $6,000 in your account. A broker may let you borrow half of that money, but you still need to produce the other $3,000.

Which trading is best for beginners in stock market?

Best Trading Platforms for Beginners 2022Fidelity - Best overall for beginners.TD Ameritrade - Excellent education.E*TRADE - Best for ease of use.Merrill Edge - Best client experience.Webull - Best investor community.

How do beginners trade?

10 Day Trading Strategies for BeginnersKnowledge Is Power. ... Set Aside Funds. ... Set Aside Time. ... Start Small. ... Avoid Penny Stocks. ... Time Those Trades. ... Cut Losses With Limit Orders. ... Be Realistic About Profits.More items...

Can you get rich of stocks?

Investing in the stock market is one of the world's best ways to generate wealth. One of the major strengths of the stock market is that there are so many ways that you can profit from it. But with great potential reward also comes great risk, especially if you're looking to get rich quick.

Is trading a good career?

If you are one of these people who like working alone, or at your own pace, trading is the perfect career for you. Everything you do – from the trades you take to the money you earn – stays under your control if you're a trader.

Can I invest 100 RS in share market?

The answer to this question is “Definitely, Yes”. You can invest Rs 100 in share market. There are many shares in India whose share price is trading below Rs 100. The minimum number of quantity of shares that you need to buy is one.

Why do most traders lose money?

But that's not all, the biggest reason day-traders lose money is the risk they take on. Day traders are more likely to make risky investments to reach for those higher potential returns, and as you can probably guess, high risk = high potential loss. You make a 15% return in 1 year (which is a great return by the way!)

Which is the best trading app?

BEST Trading App In India: Top 12 Online Stock Market AppsComparing Top Online Stock Market Apps.#1) Upstox Pro App.#2) Zerodha Kite.#3) Angel Broking.#4) Groww.#5) 5paisa Online Trading App.#6) Sharekhan App.#7) Motilal Oswal MO Investor App.More items...•

Which trade is most profitable?

The safest and most profitable form of financial market trades is trading in companies stocks. Making trades in stocks tho comes with fewer downsides.

What is the safest type of trading?

Options trading is regarded as one of the safest forms of investments given the fact that you are given the freedom to control the stock or capitalize any other asset on its movement of price without actually owning it.

Is trading is a gambling?

Unlike gambling, trading has no ultimate win or loss. Companies compete with others to innovate their products and provide better services, thus leading their stock prices to rise. This, in turn, leads the stockholders of that firm to earn greater profits. Hence, trading is not gambling.

How to trade stocks?

While there's no right or wrong way to trade, there are risks and rewards to different approaches. Common approaches include: 1 Day trading: Day traders buy and sell stocks throughout the day. The Securities and Exchange Commission (SEC) defines pattern day traders as those who execute four or more day trades within five business days. Day traders often use borrowed money, which can lead to debt if the day trading isn't profitable. It has the potential for quick returns. 7 2 Swing trading: This is a longer-term approach than day trading. Swing traders take trades that last from a day to several weeks. This practice offers relatively quick rewards and less potential for loss than day trading, but it's still a labor-intensive approach. 8 3 Investing: This is the buying and holding of stocks for the long term, which could be months or even years. 9

Why is trading stocks so exciting?

Trading stocks is exciting, because it involves risk and reward. Starting to trade is the easy part, though. Be prepared for losses, and don't trade more than you can afford to lose. Over time, you'll learn what works for you, your goals, and your financial situation.

How to test drive potential brokers?

One way to test-drive potential brokers and practice your trading skills is to use a demo or virtual trading account. A virtual trading account simulates trading, but you're not actually spending any money. TD Ameritrade and TradeStation both offer virtual trading accounts. 12 13

What is a day trader?

Day trading: Day traders buy and sell stocks throughout the day. The Securities and Exchange Commission (SEC) defines pattern day traders as those who execute four or more day trades within five business days. Day traders often use borrowed money, which can lead to debt if the day trading isn't profitable.

What is trading outside of hours called?

Trading outside of hours is called "pre-market" or "after-hours trading.".

What are the key terms of stock?

Here are some key terms to know. Stocks: These are the format of ownership stakes in companies. Shares: These are units of stock. Stock price: The price reflects the value of a company and its outlook, as determined by those trading the stock (traders and investors). Stocks don't have set prices.

What time does the NYSE open?

Seventy of the biggest corporations in the world are traded on the NYSE, along with thousands of other stocks. 1 Its hours are 9:30 a.m. to 4:00 p.m. Eastern time, Monday through Friday. Nasdaq: The Nasdaq is another stock exchange.

What is a trade in stocks?

Remember, a trade is an order to purchase or sell shares in one company. If you want to purchase five different stocks at the same time, this is seen as five separate trades, and you will be charged for each one. Now, imagine that you decide to buy the stocks of those five companies with your $1,000.

What is the best way to reduce risk in investing?

Diversify and Reduce Risks. Diversification is considered to be the only free lunch in investing. In a nutshell, by investing in a range of assets, you reduce the risk of one investment's performance severely hurting the return of your overall investment.

What is mutual fund investment?

Mutual funds are professionally managed pools of investor funds that invest in a focused manner , such as large-cap U.S. stocks.

What does investing mean?

Investing is a means to a happier ending. Legendary investor Warren Buffett defines investing as "…the process of laying out money now to receive more money in the future.".

What is an online broker?

Online Brokers. Brokers are either full-service or discount. Full-service brokers, as the name implies, give the full range of traditional brokerage services, including financial advice for retirement, healthcare, and everything related to money.

How much can I invest in mutual funds?

Therefore, as long as you meet the minimum requirement to open an account, you can invest as little as $50 or $100 per month in a mutual fund. The term for this is called dollar cost averaging (DCA), and it can be a great way to start investing.

Is it bad to invest $1,000 in stocks?

As mentioned earlier, the costs of investing in a large number of stocks could be detrimental to the portfolio. With a $1,000 deposit, it is nearly impossible to have a well-diversified portfolio, so be aware that you may need to invest in one or two companies (at the most) to begin with. This will increase your risk.

How to start trading?

Start your trading journey with a deep education on the financial markets, and then read charts and watch price actions, building strategies based on your observations. Test these strategies with paper trading, while analyzing results and making continuous adjustments. Then complete the first leg of your journey with monetary risk that forces you to address trade management and market psychology issues.

What are the best books for trading?

Here are five must-read books for every new trader: 1 Stock Market Wizards by Jack D. Schwager 1 2 Trading for a Living by Dr. Alexander Elder 2 3 Technical Analysis of the Financial Markets by John Murphy 3 4 Winning on Wall Street by Martin Zweig 4 5 The Nature of Risk by Justin Mamus 5

What are the twin emotions of paper trading?

Traders need to co-exist peacefully with the twin emotions of greed and fear. Paper trading doesn’t engage these emotions, which can only be experienced by actual profit and loss. In fact, this psychological aspect forces more first-year players out of the game than bad decision-making.

Can securities go higher?

Theoretically, securities can only go higher or lower, encouraging a long-side trade or a short sale. In reality, prices can do many other things, including chopping sideways for weeks at a time or whipsawing violently in both directions, shaking out buyers and sellers.

How to trade stocks?

How to Trade Your First Stock. When you're ready to place your first trade, fund your brokerage account by transferring money to it from a bank account. It may take time for your funds to "settle," or become available.

Which companies have online trading platforms?

Big firms like Fidelity, Vanguard, and Charles Schwab have both online and app-based trading tools. They have been around for years, have low fees, and are well known. There are also new platforms that specialize in small trades and easy-to-use apps, such as Robinhood, WeBull, and SoFi.

Why do I pay less when I sell stocks?

You pay less when you hold a stock for more than a year. This tax structure is designed to encourage long-term investing. Selling stocks for a profit will increase your tax bill. But selling stocks for a loss will decrease your tax bill. To prevent you from taking advantage of this tax benefit, there's something known as ...

What are the two types of trade orders?

When you buy or sell a traded asset, such as a stock or ETF, there are different types of trade orders you can place. The two most basic types are market orders and limit orders . Market orders process, or "execute," immediately. The asset you are trading goes for the best price available at that moment.

Should I look for low fees when buying stocks?

If you buy individual stocks through a brokerage that doesn't charge commission fees, you might not have any expenses. However, when you start trading ETFs, mutual funds, and other investments, then you need to understand expense ratios .

Can mutual funds be traded?

Mutual funds, for example, don't trade like stocks or ETFs. Instead, they allow you to invest in many different sections of the market through a single fund. You can also use a robo adviser instead of trading on your own through a brokerage. Robo advisers are app-based investment services.

Do you pay capital gains tax on stocks?

In general, you pay more capital gains taxes when you hold a stock for less than a year before selling. You pay less when you hold a stock for more than a year.

What is the key to determining how the stock market moves?

Economics . This is another vital part of determining how stock markets move as generally speaking if the economy is doing well, then company’s will also be able to perform better, therefore helping to increase profitability and its stock price.

What is the purpose of stock trading?

The goal of stock trading is to, of course , make money by timing the market and capitalising on short term moves in the value of the shares you are trading.

What is stock investment?

A stock is a type of investment/security that represents a portion of ownership in a company, with each unit of stock called a ‘share/shares’. It means that you, as the stockholder, own a portion of the company’s assets and are entitled to a part of the company’s profits, “dividends,” equal to the amount of stock that you own.

Why is the stock market important?

Valued at an incredible $80 trillion, the stock market is an important part of the global economy. Not only is it an important source of capital for businesses, but it also provides investors with the opportunity to share in the profits of publicly-traded companies. When done right, investing in the stock market has the potential ...

What is value stock?

A value stock is a stock that is undervalued when compared to the underlying conditions of the company such as earnings, dividends, sales etc. With value stocks, the investor or trader is looking to capitalise on what they feel is the data not matching the current share price.

How many times can you trade stocks in a day?

If you are using a non-margin account, there is no limit to the number of times you can trade stocks in a day. However, if you trade with margin and have less than $25,000, you must comply with the ‘pattern day trading’ rule’.

How much are penny stocks?

Penny Stocks. Are common shares of small companies usually priced at under $1 per share but can be as large as $5 per share. You will find most penny stocks are traded over the counter (OTC), but some are on large exchanges. They can also be referred to as micro-cap or nano-cap stocks.

What is the stock market?

A stock market is a place where investors can buy and sell shares to make profits. Shares or stocks represent ownership in a company. When a company goes public, it issues shares. The investors who buy these shares are known as shareholders of the company.

How does trading in the stock market work?

In trading, two parties are involved. The buyer, having a positive view on the stock and the seller, carrying a negative view on the stock.

Why do share prices fluctuate?

Share prices fluctuate due to demand & supply factors. In the share market, there are individuals with two different mindsets, causing price fluctuation.

How to trade in the stock markets – Step-by-step guide for Beginners

To trade in the stock market, you need to open a Demat and trading account with a broker. A Demat account is similar to a bank account. A Demat account stores your shares electronically. A trading account is used to place buy and sell orders.

How to Trade in the Stock Market – Final Thoughts

For beginners, learning how to trade in the stock market can be time consuming. But once you understand the fundamental and technical aspects of a stock, you will be able to become a successful trader or investor.

What does it mean to invest in stocks?

Investing in stocks just means buying tiny shares of ownership in a public company. Those small shares are known as the company’s stock, and by investing in it, you’re hoping the company grows and performs well over time.

Is investing hard for beginners?

But if we had to pick one thing to tell every beginner investor, it would be this: Investing isn’t as hard — or complex — as it seems. That’s because there are plenty of tools available to help you. One of the best is stock mutual funds, which are an easy and low-cost way for beginners to invest in the stock market.

How do I start a trading business?

1. Get Educated. Just like in any other profession, you have to understand every piece of the job down to the microscopic details. Think about everything a doctor learns and goes through before their first surgery.

Is it hard to learn to trade stocks?

Learning to trade stocks is no different than learning any other profession. You must develop the same level of skill and expertise as a doctor or lawyer, and apply a high degree of commitment and attention to detail for every aspect of the job. Starting a trading business is a similar process to launching any business.