- Determine the type of brokerage account you need.

- Compare the costs and incentives.

- Consider the services and conveniences offered.

- Decide on a brokerage firm.

- Fill out the new account application.

- Fund the account.

- Start researching investments.

How do you open a stock trading account?

Steps to open a trading account

- Choose a broker

- Select your membership level

- Provide ID

- Link bank account

- Submit application

- Start trading

What are the best trading accounts for beginners?

eToro is the world’s leading social trading and investing platform and is a great choice for those who are new to trading stocks. Their platform is very user-friendly, perfect for someone making their first trade!

How do I start trading stocks?

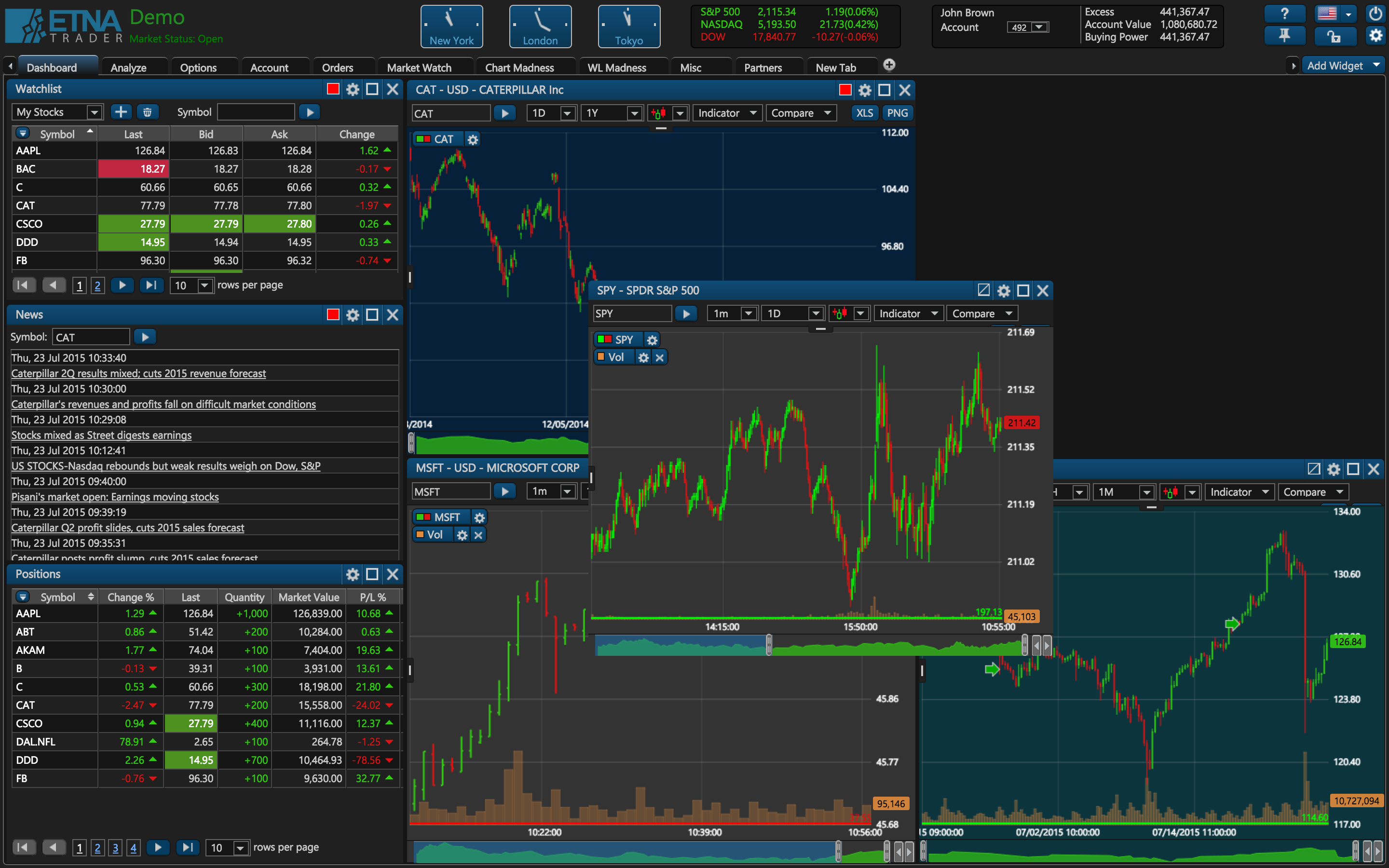

Stock Trading for Beginners: Finding a Stock Trading Platform

- A Wide-Ranging News Scanner. News catalysts can come from anywhere — press releases, SEC filings, Twitter. ...

- Awesome Charting Capabilities. Most traders base their ideas on chart patterns. ...

- A Ton of Customizable Features. Need Level 2 quotes? ...

- SteadyTrade Team Tie-Ins. Want to do the same stock scans we do on the SteadyTrade Team? ...

How to open a stock market account?

- One-stop storage for all your financial assets.

- Quick settlement of trade. ...

- There is no longer any storage, misplacement or risk of theft associated with physical shares.

- Demat accounts have also eliminated bad or vanda trades from the market.

What is the best online stock trading site for a beginner?

Best Brokerage Accounts and Trading Platforms for Beginners: Best Broker for Beginners: TD Ameritrade. Best Broker for Investor Education: TD Ameritrade. Best Broker for Ease of Trading Experience: E*TRADE. Best Broker for Customer Service: TD Ameritrade.

How much money do you need to open an online trading account?

Some brokerage firms will set a minimum at $1,000, $2,000, or more. Others may allow you to open an account with a smaller amount of money as long as you agree to have money deposited regularly, often on a monthly basis, from a linked checking or savings account. Increasingly, many require no minimum deposit at all.

How do I set up a stock trading account?

Fill out the online application or visit a local branch to open the account in-person, if available. Fund the account with a bank transfer, check or transfer of assets from another brokerage firm. Choose the investments you'll use, such as mutual funds or ETFs.

How do I start trading stocks online?

Here are five steps to help you buy your first stock:Select an online stockbroker. The easiest way to buy stocks is through an online stockbroker. ... Research the stocks you want to buy. ... Decide how many shares to buy. ... Choose your stock order type. ... Optimize your stock portfolio.

Where should a beginner invest in stocks?

One of the best is stock mutual funds, which are an easy and low-cost way for beginners to invest in the stock market. These funds are available within your 401(k), IRA or any taxable brokerage account.

How do I buy stocks online without a broker?

Direct Stock Purchase Plans (DSPPs) allow investors to purchase shares of company stock directly from the company itself. Specifically, trades are completed through a transfer agent. That means you could buy stocks without a broker, full-service or online, to complete the transaction.

Is Robinhood safe?

YES–Robinhood is absolutely safe. Your funds on Robinhood are protected up to $500,000 for securities and $250,000 for cash claims because they are a member of the SIPC. Furthermore, Robinhood is a securities brokerage and as such, securities brokerages are regulated by the Securities and Exchange Commission (SEC).

Is Robinhood a brokerage account?

There are dozens of brokerage firms in the US where you can open a brokerage account, including Robinhood (of course), Charles Schwab, E-Trade, Interactive Brokers, and TD Ameritrade. They all vary in terms of services offered and commission rates charged.

Does opening a brokerage account affect credit score?

If you're curious what opening a brokerage account will do to your credit score, the answer is, for the most part, nothing. Investing money isn't considered a financially irresponsible move, so opening a brokerage account won't lower your score. It also won't raise your score.

How do beginners learn to trade?

Process of stock trading for beginners1) Open a demat account: ... 2) Understand stock quotes: ... 3) Bids and asks: ... 4) Fundamental and technical knowledge of stock: ... 5) Learn to stop the loss: ... 6) Ask an expert: ... 7) Start with safer stocks: ... Read More:

How can I buy and sell stocks on my own?

You can buy or sell stock on your own by opening a brokerage account with one of the many brokerage firms. After opening your account, connect it with your bank checking account to make deposits, which are then available for you to invest in.

Which trading app is best for beginners?

What are the best stock trading apps for beginners?Webull.Betterment.SoFi Invest (iOS, Android, Desktop)Public.com.Acorns.M1 Finance.Stash.Vanguard.More items...

How to get started with trading?

To get started trading, you’ll need to put some cash into your account. You’ve got some options here, but by far the easiest way to go is to link a bank account to your brokerage account . You’ll need your bank’s nine-digit routing number and your account number, which is usually ten digits.

How long does it take to deposit money on a trading account?

Getting in the habit of making regular deposits is an ideal use of technology. There will be some time, one day to seven days, between the opening of your account and when you can start to trade, based on how you’ve chosen to deposit money.

How are free trades paid?

Free trades are generally paid for by routing to market makers, who pay the broker for the order flow, but who do not prioritize price improvement. So look for a broker who has research and education features that can help you grow as an investor, especially if you are new to investing.

How much does an online broker charge for options?

You will still pay per-contract commissions on most options trades, and you'll find fees that range from $0.10-$0.65 per contract at the majority of brokers.

How to invest money but not time?

For those who want to invest money but not time in building wealth, you should take a good look at a financial advisor or a robo-advisory service. Robo-advisors present you with a short survey of your time horizon and appetite for risk and ask you to state how much you plan to invest. If you’re investing for retirement, and that date is decades in the future, you might be more willing to invest in riskier asset classes than if you need to use your investments in three years.

Why do brokers need to collect information?

Brokers are required to collect some other information so they can keep up with a set of rules referred to as “ Know your client, ” which are intended to prevent money laundering and the funding of terrorism. They also need to make sure that you are who you say you are to avoid being involved in identity theft.

What are the types of assets that investors hold?

Most investors hold stock, exchange-traded funds (ETFs), and/or mutual funds. If you’re looking at trading options, there are a number of self-directed online brokers with a wide range of tools that can help you choose ...

How to create an online brokerage account?

Create an account with your preferred online brokerage by picking a user name and password. Your financial and personal details are also required. Be prepared to give your date of birth, Social Security number, bank account details, your address and citizenship information. U.S. brokerages restrict new accounts to U.S. citizens only.

How much does it cost to trade stocks?

While setting up a stock trading account is free, there are fees for trading stocks. The fees can range from $3 to $20 per trade and vary among brokerages.

Step 1

Compare the costs of trading at several online discount brokers. Scottrade, TD Ameritrade and E*Trade are three of the best known online brokers, but you can find many others. Compare the cost of each trade, including market orders, limit orders, option orders and short sales.

Step 2

Review the minimum balance requirements of each online discount broker you are considering. If you are just starting out, look for a firm with a low minimum balance requirement. Finding a firm that caters to new investors is a good idea as well. Also check the charges and expenses associated with each firm.

Step 3

Open an account online with the online trading firm that best meets your needs. Complete the application at the firm's website, and indicate how you want to fund your account. You can fund the account electronically by entering the account number and routing number for your bank, or you can send a check in with your printed application.

Step 4

Review the details of your account before submitting your application. The application lists the types of trading and accounts for which you are authorized, and which ones require additional authorization. For instance, many firms restrict margin trading and require a separate application to open a margin account.

What is a traditional brokerage account?

For this reason, a traditional, or standard brokerage account is often referred to as a taxable brokerage account.

How much does an option broker charge?

For example, many brokers charge a commission in the range of $0.50 to $0.75 per options contract, so even if the broker doesn't charge a base commission, options trading won't exactly be free.

What companies do brokers use to research stocks?

Access to research: Many brokers provide their own stock ratings, as well as access to third-party research from firms such as Standard & Poor's and Morningstar.

How long does it take for a wire transfer to post to your bank account?

Wire transfer: The quickest way to fund your account. Since a wire transfer is a direct bank-to-bank transfer of money, it often takes place within minutes.

Can you borrow money to buy stocks?

If you choose a traditional brokerage account, your broker will likely ask if you want a cash account or margin account. If you choose to apply for margin privileges, this basically means that you can borrow money to buy stocks, with the stocks in your portfolio serving as collateral. You'll pay interest on the borrowed money, and there are some inherent risks involved with investing on margin that you should be aware of.

Do discount brokers offer commission free trading?

These days, virtually all of the major discount brokers offer commission-free trading. They may also offer you a discount to reward you for certain actions, such as transferring a large investment account from another broker.

Brokerage Account

Enjoy $0 commissions for online US-listed stock, ETF, and options trades. 1 Get easy access to your cash with a free debit card, checking, or Bill Pay. 2

Investing doesn't need to be confusing

Not sure where to begin? We can help you learn the ins and outs of investing with in-depth tutorials, articles, videos, and more.

Have questions? Get jargon-free answers

We're always here if you need help or want to bounce ideas off us. Our team leaves confusing financial jargon at the door, and instead talks to you like a human.

How to fund a brokerage account?

Fund the account with a bank transfer, check or transfer of assets from another brokerage firm.

What is the first step in investing?

Opening a brokerage account is the first big step to jump-starting your investing journey. Whether you are a hands-on investor or one who prefers your assets to be managed for you, consider these steps in your investment approach:

How to choose a brokerage firm?

Before you can choose a brokerage firm, you need to decide what type and level of services you're looking for. Decide whether you want to be more hands-on as a DIY investor or if you prefer to take a passive approach by using a full-service brokerage to manage your investment account for you. A full-service broker may be suited for an investor who is not familiar with what they should be investing in, doesn't want to spend the time to research or manage their investments or has a large amount of wealth that requires more complex financial management.

How to choose a broker?

When choosing a brokerage firm, it's important to consider the following: 1 The types of services offered and level of guidance you want: Do-it-yourself investors may prefer a more hands-off broker with an extensive trading platform, while investors looking for guidance may want a brokerage that provides easy access to financial advisors. 2 The costs: DIY investors who don't want any bells and whistles may focus on lower-cost options, while investors interested in full-service brokers will need to weigh costs in relation to the services provided. 3 Account minimums: Most online brokerages have waived their account minimums, but some firms may charge fees if your balance falls below a certain threshold. 4 Location: If you want access to an in-person advisor, look for a brokerage that has branch offices in your area. 5 Before you can choose a brokerage firm, you need to decide what type and level of services you're looking for. Decide whether you want to be more hands-on as a DIY investor or if you prefer to take a passive approach by using a full-service brokerage to manage your investment account for you. A full-service broker may be suited for an investor who is not familiar with what they should be investing in, doesn't want to spend the time to research or manage their investments or has a large amount of wealth that requires more complex financial management.

What is a broker?

Brokers are individuals or firms who charge a fee or commission for executing trades on behalf of their investors. An investor typically opens an account with a brokerage and receives assistance from a broker who works there.

How much does a robo advisor cost?

So if an investor has $10,000 of assets under management with an annual fee of 0.25%, the cost would be $25 per year for the robo advisor to manage your account.

How do mutual funds and ETFs help you diversify?

As for the investments you use, mutual funds and ETFs typically offer more diversification than individual stocks by letting you hold a basket of securities as opposed to just one company. Once you've chosen your investments, make sure to rebalance your portfolio periodically according to your target asset allocation by selling inflated assets and buying those that are cheap. Most importantly of all: Don't let day-to-day fluctuations in the stock market affect your long-term investment plan.

How to open Wellstrade account?

To open a WellsTrade account or ask questions, call 1-877-573-7997. For existing brokerage accounts, call 1-800-TRADERS ( 1-800-872-3377) 1. $0 per trade is applicable to commissions for online and automated telephone trading of stocks (excluding penny stocks) and exchange-traded funds (ETFs). For stock and ETF trades placed with an agent over ...

Does Wells Fargo have a brokerage account?

With a single sign-on for your Wells Fargo Advisors WellsTrade brokerage accounts and your Wells Fargo bank accounts, everything is connected. Move money easily between accounts with our Brokerage Cash Services, included with your account.